Saudi Arabia Power Rental Market Size, Share, Trends and Forecast by Fuel Type, Equipment Type, Power Rating, Application, End Use Industry, and Region, 2026-2034

Saudi Arabia Power Rental Market Summary:

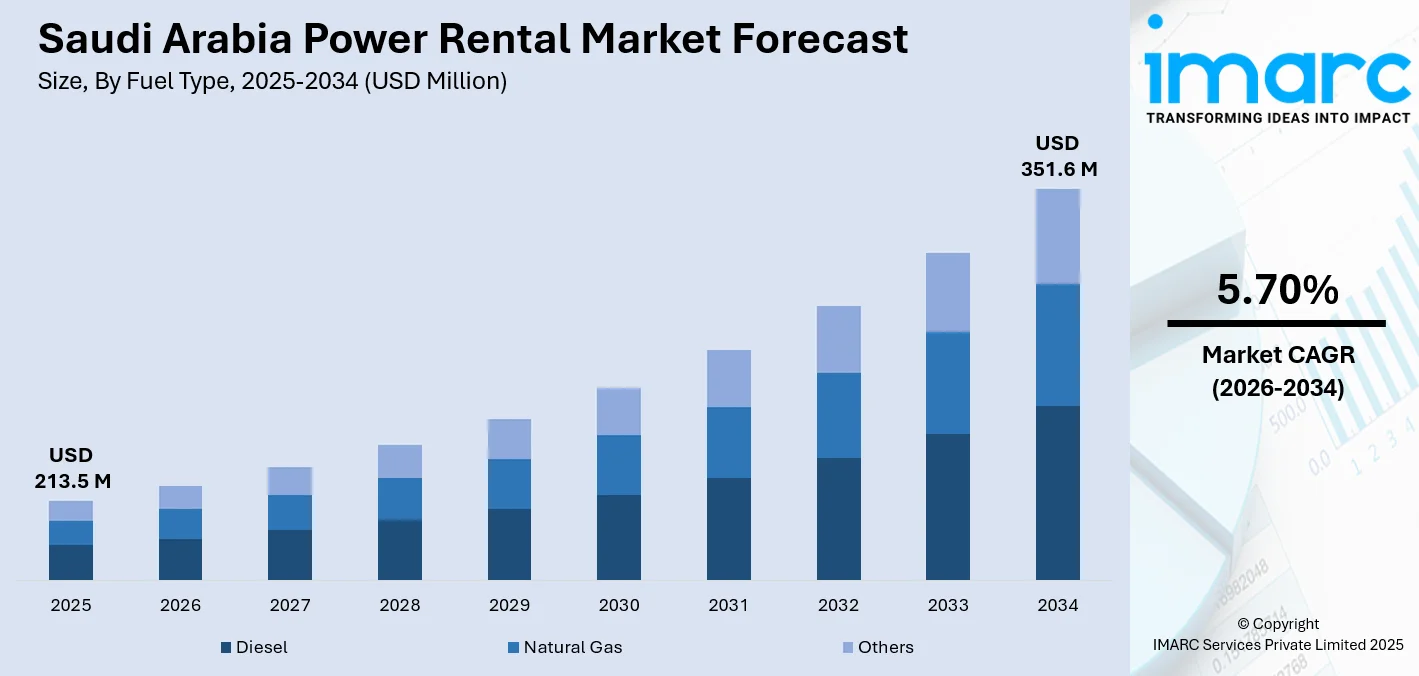

The Saudi Arabia power rental market size was valued at USD 213.5 Million in 2025 and is projected to reach USD 351.6 Million by 2034, growing at a compound annual growth rate of 5.70% from 2026-2034.

The Saudi Arabia power rental market is witnessing robust expansion, driven by the Kingdom's ambitious Vision 2030 initiatives and unprecedented infrastructure development programs. Large-scale mega-projects spanning construction, tourism, and entertainment sectors are generating substantial demand for flexible and scalable temporary power solutions. The oil and gas industry continues to rely heavily on rental power for remote drilling operations and processing facilities, while the expanding events sector requires reliable short-term power for international sporting championships and cultural festivals. Moreover, growing investments in data center infrastructure and the telecommunications sector are further contributing to the Saudi Arabia power rental market share.

Key Takeaways and Insights:

- By Fuel Type: Diesel dominates the market with a share of 59% in 2025, driven by its proven reliability, high energy output, and widespread availability across remote construction sites and industrial facilities throughout the Kingdom.

- By Equipment Type: Generator leads the market with a share of 54% in 2025, owing to their versatility in providing both primary and backup power solutions across diverse industrial, commercial, and event applications.

- By Power Rating: 501–2,500 kW represents the largest segment with a market share of 40% in 2025, preferred for medium to large-scale construction projects and industrial operations requiring substantial power capacity.

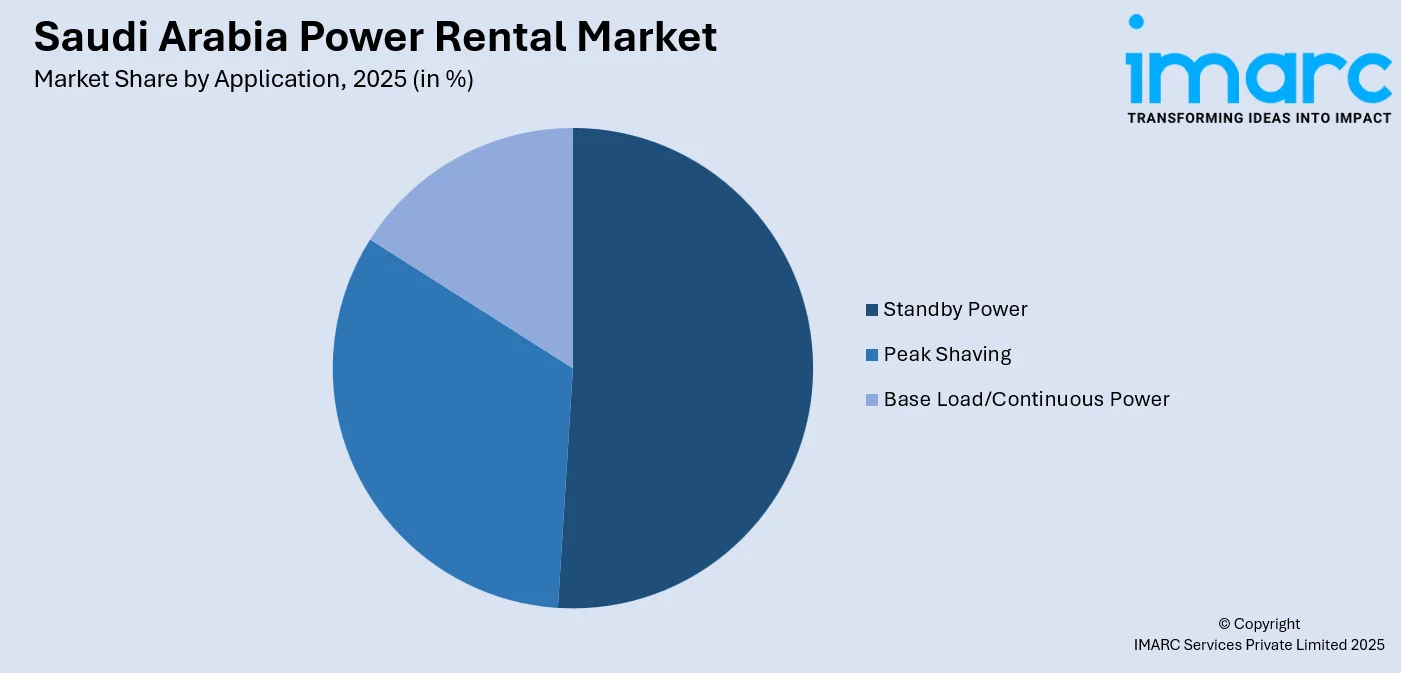

- By Application: Standby power leads the market with a share of 51% in 2025, reflecting the critical importance of backup power systems across healthcare, telecommunications, and commercial establishments.

- By End Use Industry: Utilities represent the largest segment with a market share of 25% in 2025, driven by growing electricity demand and grid support requirements during peak consumption periods.

- By Region: Northern and Central Region leads the market with a share of 32% in 2025, attributed to the concentration of major construction activities in Riyadh and surrounding development zones.

- Key Players: The Saudi Arabia power rental market exhibits a competitive landscape characterized by the presence of both international corporations and regional specialists, with providers continuously expanding their fleets and service capabilities to meet diverse industrial requirements.

To get more information on this market Request Sample

The Saudi Arabia power rental market is experiencing transformative growth as the Kingdom advances its economic diversification agenda through large-scale infrastructure investments. The convergence of mega-project development, industrial expansion, and the evolving events landscape is creating unprecedented demand for temporary power solutions. Power rental providers are strategically positioned to support construction activities at landmark developments including NEOM, the Red Sea Project, and Qiddiya, where grid infrastructure has yet to reach operational sites. In January 2024, Teksan supplied 90 MW of prime power through 60 diesel generator sets, including transformers and synchronization units, to a major construction project in Saudi Arabia, highlighting the essential role of rental equipment in supporting large-scale infrastructure development. The market is further propelled by the oil and gas sector's continued reliance on mobile power for upstream and downstream operations, alongside the growing need for backup power across commercial, healthcare, and telecommunications facilities. The emergence of smart telematics and remote monitoring capabilities is enabling more efficient fleet management and predictive maintenance, while environmental regulations are encouraging the adoption of cleaner fuel alternatives and hybrid power systems.

Saudi Arabia Power Rental Market Trends:

Integration of Digital Telematics and Smart Monitoring Systems

Power rental providers are increasingly deploying Internet of Things (IoT)-enabled generators equipped with cloud-based dashboards that track fuel consumption, engine performance, and emissions in real time. These digital solutions enable predictive maintenance to minimize downtime and optimize operational efficiency across remote sites. Advanced monitoring capabilities facilitate compliance reporting for environmental regulations while supporting seamless integration with on-site renewable energy installations. Rental companies are leveraging data analytics to enhance fleet utilization and provide customers with actionable insights for improved power management decisions. In 2024, Saudi Arabia announced to automate 40% of its electricity distribution network by the end of 2025, having accomplished 32 percent of this goal, as stated by the energy minister. Automating an electricity distribution system utilizes technologies such as smart meters and real-time tracking to enhance efficiency and supports the incorporation of renewable energy, aligning with Vision 2030 objectives of generating 50 percent of the Kingdom’s electricity from renewable sources.

Transition Toward Cleaner Fuel Alternatives and Hybrid Solutions

Environmental regulations and corporate sustainability mandates are driving the adoption of natural gas generators and hybrid power systems within the Saudi Arabia power rental market. Rental providers are expanding their fleets to include bio-diesel compatible units and solar-battery hybrid configurations that leverage the Kingdom's abundant renewable resources. These integrated systems ensure reliable power supply while reducing lifecycle emissions compared with diesel-only units. The shift toward cleaner technologies aligns with national sustainability goals and positions rental companies to meet evolving customer requirements for environmentally responsible power solutions. In 2025, Saudi Arabia announced its plans of investing petrodollars to become a major player in the clean energy transition.

Expansion of Customized and Efficient Power Solutions

Power rental providers are increasingly offering comprehensive turnkey solutions that extend beyond equipment provision to include installation, commissioning, operation, and maintenance services. This trend reflects growing customer preference for end-to-end power management that minimizes administrative burden and ensures optimal system performance. Rental companies are developing specialized packages tailored to specific industry requirements, from oil and gas operations to large-scale entertainment events. The emphasis on service quality and technical expertise is differentiating market leaders and strengthening long-term customer relationships. In 2024, the Saudi Electricity Company (SEC) announced a number of major projects and investments in Makkah, Medina, and the sacred sites ahead of the 1445 Hajj season. These measures aim to improve the electricity network's infrastructure and guarantee a dependable power supply for both pilgrims and residents, ultimately elevating the quality of electrical services, crucial for the comfort of pilgrims during Hajj.

How Vision 2030 is Transforming the Saudi Arabia Power Rental Market:

Saudi Arabia's Vision 2030 is significantly transforming the power rental market by promoting diversification and sustainability. As part of its broader goals to reduce dependency on oil, the country is heavily investing in renewable energy projects such as solar and wind power. This shift increases demand for flexible power solutions, driving growth in the rental market. Temporary power needs in construction, industrial operations, and large events are creating opportunities for power rental companies to provide backup solutions, especially during peak demand periods. Moreover, Vision 2030 encourages infrastructure development across sectors, including smart cities and industrial zones, which require continuous, reliable power. This demand is further fueled by the government's push for energy efficiency, making rental power solutions more appealing for short-term and emergency needs. As a result, rental firms are increasingly adopting advanced technologies like hybrid and solar-powered generators, aligning with the nation's sustainability goals.

Market Outlook 2026-2034:

The Saudi Arabia power rental market is positioned for sustained expansion over the forecast period, underpinned by continued infrastructure development and economic diversification initiatives. Apart from this, the growing investments in data center infrastructure and telecommunications networks are expected to create additional opportunities for standby and backup power services. The market generated a revenue of USD 213.5 Million in 2025 and is projected to reach a revenue of USD 351.6 Million by 2034, growing at a compound annual growth rate of 5.70% from 2026-2034. Moreover, the Kingdom's preparation for major international events including the AFC Asian Cup 2027, Asian Winter Games 2029, and FIFA World Cup 2034 will generate substantial demand for temporary power solutions across venue construction and event operations.

Saudi Arabia Power Rental Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Fuel Type |

Diesel |

59% |

|

Equipment Type |

Generator |

54% |

|

Power Rating |

501–2,500 kW |

40% |

|

Application |

Standby Power |

51% |

|

End Use Industry |

Utilities |

25% |

|

Region |

Northern and Central Region |

32% |

Fuel Type Insights:

- Diesel

- Natural Gas

- Others

Diesel dominates with a market share of 59% of the total Saudi Arabia power rental market in 2025.

Diesel generators remain the predominant choice within the Saudi Arabia power rental market, valued for their durability, high energy output, and proven performance across demanding operational environments. The fuel type's widespread availability and established infrastructure for storage and transportation provide significant logistical advantages for contractors operating across remote sites. Diesel-powered equipment offers reliable performance in the Kingdom's harsh desert conditions, supporting construction activities, oil and gas operations, and industrial processes that require consistent and substantial power output.

The construction sector represents a major consumer of diesel rental generators, with large-scale projects requiring high-capacity units often exceeding 1,000 kVA to power heavy machinery, site facilities, and lighting systems. Oil and gas operations rely extensively on diesel generators for both baseload generation and critical backup at drilling sites and processing facilities located in remote areas lacking grid connectivity. The rental model provides contractors with flexibility to scale power capacity according to project phases while avoiding substantial capital expenditure on equipment ownership and maintenance.

Equipment Type Insights:

- Generator

- Transformer

- Load Bank

- Others

Generator leads with a share of 54% of the total Saudi Arabia power rental market in 2025.

Generators constitute the core equipment category within the Saudi Arabia power rental market, serving as the primary source of temporary and backup electricity across diverse industrial, commercial, and event applications throughout the Kingdom. The equipment's inherent versatility enables rapid deployment to construction sites, manufacturing facilities, mining operations, and outdoor venues where grid power is unavailable, insufficient, or unreliable for supporting critical operations. Rental providers maintain extensive generator fleets ranging from compact portable units rated below 50 kVA suitable for small commercial applications and residential backup to multi-megawatt installations capable of powering large industrial complexes, data centers, and major infrastructure projects requiring sustained high-capacity output. The generator segment benefits from continuous technological advancement that enhances fuel efficiency, reduces emissions, improves operational reliability under demanding conditions, and enables sophisticated remote monitoring and control capabilities.

The growing complexity of power requirements across Saudi Arabia's diverse economic sectors is driving demand for integrated solutions that combine generators with transformers, switchgear, distribution panels, and control systems to deliver complete power packages. Rental companies are expanding their offerings to address voltage transformation requirements between generator output and end-use equipment specifications, load management capabilities for optimizing power distribution across multiple consumption points, power quality considerations including harmonic filtering and voltage regulation, and synchronization needs for multiple generator installations operating in parallel configurations. This comprehensive approach enables customers to obtain turnkey solutions that minimize coordination challenges between multiple equipment suppliers, reduce installation timelines through pre-engineered system designs, and ensure optimal system performance across demanding operational scenarios where reliability and efficiency directly impact project economics.

Power Rating Insights:

- Up to 50 kW

- 51–500 kW

- 501–2,500 kW

- Above 2,500 kW

501–2,500 kW exhibits a clear dominance with a 40% share of the total Saudi Arabia power rental market in 2025.

The 501–2,500 kW power rating segment addresses the substantial electricity requirements of medium to large-scale construction projects, industrial facilities, commercial developments, and infrastructure initiatives throughout Saudi Arabia that demand significant power capacity while maintaining practical considerations for equipment transportation, installation, and operation. This capacity range provides sufficient output to power heavy construction equipment including tower cranes, concrete pumping systems, and batch plants, manufacturing processes requiring consistent high-quality electrical supply, large building systems encompassing HVAC, lighting, and elevator operations, and comprehensive site operations involving hundreds of simultaneous electrical loads.

The segment benefits from growing infrastructure development activities across major urban centers including Riyadh, Jeddah, and Dammam, as well as emerging development zones associated with Vision 2030 mega-projects that require reliable temporary power during extended construction phases spanning multiple years. Mega-projects are generating significant demand for high-capacity rental equipment capable of supporting extensive construction operations involving thousands of workers and hundreds of pieces of heavy machinery operating simultaneously across sprawling development sites. These developments require reliable temporary power during construction phases spanning multiple years before permanent grid infrastructure becomes operational and sufficient to meet ongoing requirements of completed facilities.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Peak Shaving

- Standby Power

- Base Load/Continuous Power

Standby power leads with a share of 51% of the total Saudi Arabia power rental market in 2025.

Standby power applications encompass backup electricity systems deployed across healthcare facilities, telecommunications infrastructure, commercial buildings, industrial operations, and critical government installations to ensure uninterrupted functionality during grid outages, equipment failures, or maintenance periods that would otherwise disrupt essential services and operations. The critical nature of operations in these sectors necessitates reliable backup power to prevent equipment damage from unexpected shutdowns, data loss from computing system interruptions, production disruptions from process upsets, and service interruptions that could result in significant financial, operational, and reputational consequences extending far beyond immediate power restoration costs.

Growing digitalization across Saudi Arabia's economy and increased reliance on electronic systems, computerized manufacturing processes, internet-connected services, and real-time data applications are amplifying the importance of standby power across commercial and industrial establishments throughout the Kingdom. The expanding data center sector in Saudi Arabia is driving substantial demand for standby power solutions to protect sensitive computing equipment from damage, maintain continuous operations supporting cloud services and digital applications, and ensure service availability commitments to customers whose businesses depend on uninterrupted access to hosted systems and stored data.

End Use Industry Insights:

- Utilities

- Oil and Gas

- Events

- Construction

- Mining

- Data Centers

- Others

Utilities exhibit a clear dominance with a 25% share of the total Saudi Arabia power rental market in 2025.

The utilities sector relies on power rental solutions to address peak demand periods when grid consumption exceeds installed generation capacity, support grid maintenance activities requiring temporary isolation of transmission and distribution equipment, provide emergency backup during outages or equipment failures affecting generation or transmission assets, and facilitate the commissioning of new generation and transmission facilities being added to meet growing electricity demand. The growing electricity consumption driven by population growth, rapid urban development’s demand in major metropolitan areas, industrial expansion establishing manufacturing facilities throughout the Kingdom, and the proliferation of air conditioning systems essential for comfort in Saudi Arabia's extreme climate is intensifying pressure on the national grid infrastructure, particularly during summer months when cooling loads reach maximum levels that can approach double typical baseline consumption.

Rental power enables utilities to rapidly deploy additional generation capacity without the extended planning timelines spanning years for major projects, regulatory approvals requiring environmental assessments and interconnection studies, and capital expenditure associated with permanent generation facilities that must be justified through long-term demand forecasts. This flexibility proves particularly valuable for addressing seasonal demand variations that would otherwise require permanent capacity investments utilized only during peak periods, unexpected generation shortfalls from equipment failures or fuel supply disruptions, and emergency situations where rapid response prevents widespread service interruptions affecting residential, commercial, and industrial customers.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region leads with a share of 32% of the total Saudi Arabia power rental market in 2025.

The Northern and Central Region encompasses Riyadh, the Kingdom's capital and primary economic hub, where intensive construction activity, commercial development, and infrastructure expansion are generating substantial and sustained power rental demand across diverse project types and customer segments. Riyadh serves as the administrative center of Saudi Arabia, housing the headquarters of major government ministries, regulatory authorities, state-owned enterprises, and multinational corporations that collectively drive economic activity and infrastructure investment throughout the Kingdom.

The metropolitan area's population exceeds 8 million residents and continues growing rapidly as Vision 2030 initiatives attract domestic migration and international talent to the capital's expanding employment opportunities across technology, financial services, entertainment, and professional services sectors. This demographic growth intensifies demand for residential construction, commercial development, healthcare facilities, educational institutions, and supporting infrastructure that collectively require substantial temporary power during development phases. Major infrastructure projects transforming Riyadh's urban landscape include the Riyadh Metro expansion extending network coverage beyond the initial six-line system. These landmark developments represent multi-billion dollar investments requiring years of construction activity supported by temporary power installations sized to accommodate heavy machinery, concrete production, tower cranes, site lighting, worker facilities, and construction management operations.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Power Rental Market Growing?

Unprecedented Infrastructure Development Under Vision 2030

Saudi Arabia's Vision 2030 economic diversification program has catalyzed an extraordinary wave of infrastructure development that is fundamentally reshaping the Kingdom's construction landscape. Mega-projects spanning tourism, entertainment, residential, and commercial sectors are creating unprecedented demand for temporary power solutions across development sites where grid infrastructure has yet to reach operational capacity. NEOM represents one of the world's largest construction endeavors, with approximately 140,000 construction workers operating across multiple sites as of April 2024, projected to rise to 200,000 in 2025. The Red Sea Project, Qiddiya entertainment city, Diriyah historical development, and New Murabba urban district are among numerous landmark initiatives requiring substantial temporary power during construction phases. Power rental providers are strategically positioning their operations to serve these high-value contracts, expanding equipment fleets and establishing regional service capabilities to meet growing demand.

Expanding Oil and Gas Sector Power Requirements

Saudi Arabia's oil and gas industry continues to drive significant power rental demand through exploration, production, and refining operations that require reliable electricity in remote and challenging environments. Drilling sites, processing facilities, and pipeline installations frequently operate beyond the reach of grid infrastructure, necessitating mobile power solutions for both baseload generation and critical backup applications. The sector's operational intensity demands robust equipment capable of continuous performance in extreme desert conditions while maintaining the reliability standards essential for production continuity and safety compliance. Saudi Aramco's extensive upstream and downstream operations represent a major market segment, with contractors and service providers relying heavily on rental power to support project execution and maintenance activities. In 2024, the energy minister of Saudi Arabia revealed the finding of seven oil and gas reserves in the Eastern Province and the Empty Quarter, as reported by the Saudi Press Agency (SPA).

Growth of International Events and Entertainment Industry

Saudi Arabia's emergence as a major destination for international sporting events and entertainment is generating significant demand for scalable, short-term power solutions. The Kingdom hosted innumerable international sporting events in 2024, including the Esports World Cup, Formula 1 Saudi Arabian Grand Prix, WTA Finals, and ATP Next Gen Finals, each requiring temporary power for lighting, audio-visual systems, broadcasting equipment, and climate control. Looking forward, Saudi Arabia's confirmed hosting of the AFC Asian Cup 2027, Asian Winter Games 2029, and FIFA World Cup 2034 will require extensive temporary power infrastructure across venue construction and event operations. The events sector demands rapid deployment capabilities and reliable performance to support high-profile international broadcasts and spectator experiences, driving rental providers to enhance their equipment portfolios and service responsiveness.

Market Restraints:

What Challenges the Saudi Arabia Power Rental Market is Facing?

Equipment Maintenance and Operational Cost Pressures

Power rental providers face ongoing challenges in managing equipment maintenance requirements and operational costs across their deployed fleets. The harsh desert environment accelerates wear on mechanical components and filtration systems, requiring more frequent servicing intervals and replacement parts. Rising fuel costs directly impact operational economics for both rental companies and their customers, influencing rental pricing structures and competitive positioning within the market.

Evolving Environmental Regulations and Emissions Compliance

Tightening environmental regulations are compelling power rental providers to invest in fleet upgrades and cleaner fuel alternatives to maintain regulatory compliance. The transition toward stricter emissions standards requires capital expenditure on newer equipment incorporating advanced exhaust treatment technologies. Rental companies must balance the costs of fleet modernization against competitive pricing pressures while meeting growing customer expectations for environmentally responsible power solutions.

Supply Chain Dependencies and Equipment Import Reliance

The Saudi Arabia power rental market remains dependent on imported equipment and spare parts, exposing providers to supply chain vulnerabilities and currency fluctuations. Limited domestic manufacturing capacity for generators and associated components necessitates reliance on international suppliers for fleet expansion and maintenance requirements. Lead times for equipment procurement can extend to several months, challenging providers' ability to rapidly scale capacity in response to large project awards or unexpected demand surges.

Competitive Landscape:

The Saudi Arabia power rental market features a competitive landscape comprising international corporations with global expertise alongside regional specialists possessing deep local market knowledge. Major players maintain substantial equipment fleets ranging from compact portable generators to multi-megawatt installations, enabling service delivery across the full spectrum of customer requirements. Competition centers on equipment availability, technical capabilities, service responsiveness, and geographic coverage across the Kingdom's expanding development zones. Providers are differentiating through value-added services including installation support, maintenance programs, remote monitoring capabilities, and customized power solutions tailored to specific industry applications. Strategic partnerships with equipment manufacturers and financial institutions are enabling fleet expansion and technological upgrades to meet evolving market demands.

Saudi Arabia Power Rental Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Diesel, Natural Gas, Others |

| Equipment Types Covered | Generator, Transformer, Load Bank, Others |

| Power Ratings Covered | Up to 50 kW, 51–500 kW, 501–2,500 kW, Above 2,500 kW |

| Applications Covered | Peak Shaving, Standby Power, Base Load/Continuous Power |

| End Use Industries Covered | Utilities, Oil and Gas, Events, Construction, Mining, Data Centers, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia power rental market size was valued at USD 213.5 Million in 2025.

The Saudi Arabia power rental market is expected to grow at a compound annual growth rate of 5.70% from 2026-2034 to reach USD 351.6 Million by 2034.

Diesel dominated the market with a 59% share in 2025, driven by its reliability and high energy output. Apart from this, the widespread availability across construction sites and industrial facilities throughout the Kingdom is supporting the market growth.

Key factors driving the Saudi Arabia power rental market include unprecedented infrastructure development under Vision 2030, expanding oil and gas sector power requirements, growth of international events and entertainment industry, and increasing demand for reliable backup power across commercial and industrial sectors.

Major challenges include equipment maintenance and operational cost pressures, evolving environmental regulations requiring fleet upgrades, supply chain dependencies for imported equipment, and competitive pricing pressures amid rising fuel costs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)