Saudi Arabia Power Tool Accessories Market Size, Share, Trends and Forecast by Type, Application, End-Use Sector, and Region, 2026-2034

Saudi Arabia Power Tool Accessories Market Overview:

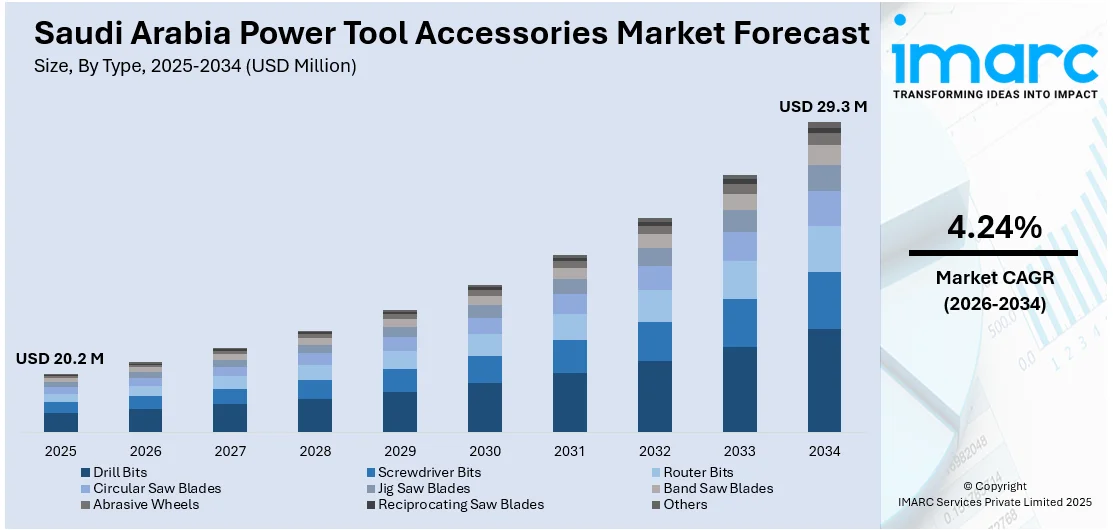

The Saudi Arabia power tool accessories market size reached USD 20.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 29.3 Million by 2034, exhibiting a growth rate (CAGR) of 4.24% during 2026-2034. The market is seeing strong growth, driven by rising construction activities, industrial expansion, and home improvement trends. Demand is supported by ongoing infrastructure development and the growing use of cordless and precision tools in various sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 20.2 Million |

| Market Forecast in 2034 | USD 29.3 Million |

| Market Growth Rate 2026-2034 | 4.24% |

Saudi Arabia Power Tool Accessories Market Trends:

Construction Growth Driving Demand

The power tool accessories market in Saudi Arabia is steadily expanding due to increasing demand from construction and infrastructure projects. Ongoing urban development in cities like Riyadh, Jeddah, and NEOM is contributing to the rising use of tools and attachments that support efficiency and precision. Alongside commercial and residential expansion, the Kingdom's emphasis on large-scale projects under Vision 2030 is encouraging steady procurement of durable, high-performance accessories that complement modern power tools. Contractors and tradespeople are looking for longer-lasting bits, blades, and attachments, which are influencing product innovation and material upgrades. Midway through this shift, brands are focusing more on carbide-tipped and diamond-coated variants to extend tool life and performance. By the later part of the decade, the development of modular accessory systems is expected to rise, aimed at simplifying tasks across trades. The introduction of accessories compatible with universal systems is further gaining attention from professionals who seek versatility and efficiency without switching between tool types. Demand is also being shaped by the need for reduced downtime and faster tool changes, reflecting a clear preference for ease of use across job sites.

To get more information on this market Request Sample

Cordless Tools Fueling Innovation

An increasing shift towards cordless power tools is shaping the direction of accessory development in Saudi Arabia. Professionals and DIY users alike are choosing compact and battery-powered tools for their convenience, particularly in tight or mobile work environments. This change in preference is leading to a surge in demand for accessories designed specifically for lighter, faster, and more energy-efficient usage. Accessories that reduce energy loss or improve cutting speed are becoming more popular as users aim to get the most out of each charge. Later in the supply chain, manufacturers are beginning to introduce accessories tailored for brushless tools, reflecting the industry's gradual move towards higher-efficiency motors. In the lower price segment, development is also underway for value-oriented products that don't compromise on performance. Battery-saving attachments, lightweight extension kits, and low-vibration designs are examples of ongoing innovation driven by user needs. As cordless tools continue to gain market share, brands are expected to launch broader compatible accessory lines to keep pace with tool upgrades, offering greater flexibility to both professional and casual users.

Saudi Arabia Power Tool Accessories Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type, application, and end-use sector.

Type Insights:

- Drill Bits

- Screwdriver Bits

- Router Bits

- Circular Saw Blades

- Jig Saw Blades

- Band Saw Blades

- Abrasive Wheels

- Reciprocating Saw Blades

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes drill bits, screwdriver bits, router bits, circular saw blades, jig saw blades, band saw blades, abrasive wheels, reciprocating saw blades, and others.

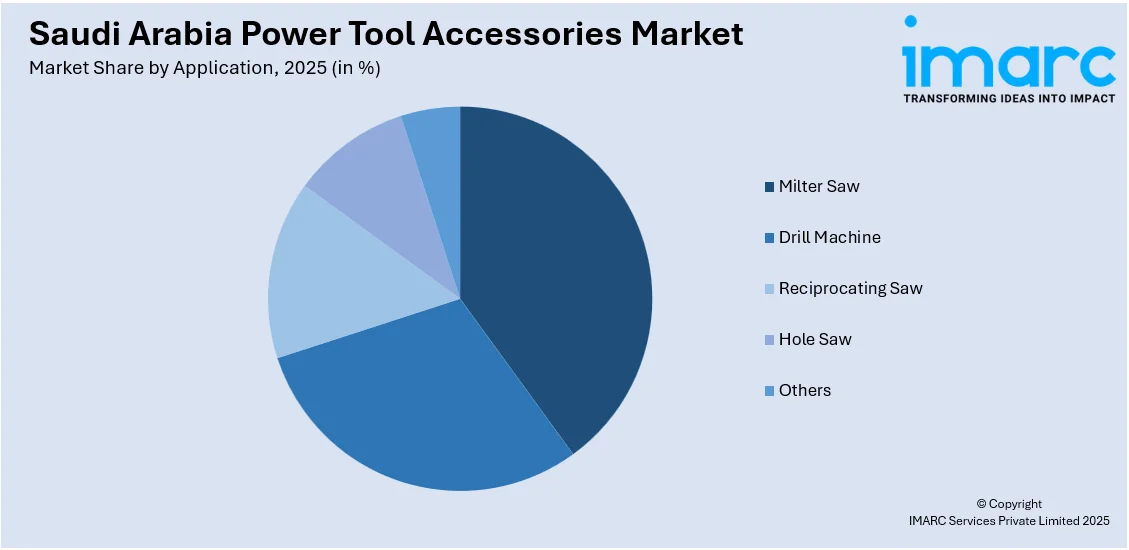

Application Insights:

Access the comprehensive market breakdown Request Sample

- Milter Saw

- Drill Machine

- Reciprocating Saw

- Hole Saw

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes milter saw, drill machine, reciprocating saw, hole saw, and others.

End-Use Sector Insights:

- Industrial

- Automotive

- Construction

- Aerospace and Defense

- Energy

- Marine

- Others

- Residential

A detailed breakup and analysis of the market based on the end-use sector have also been provided in the report. This includes industrial (automotive, construction, aerospace and defense, energy, marine, and others) and residential.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central region, Western region, Eastern region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Power Tool Accessories Market News:

- October 2024: Neo Oiltools appointed Saja Energy as the official distributor of its NeoTork vibration management tool in Saudi Arabia. The tool enhanced drilling efficiency and reduced equipment wear, supporting growth in power tool accessories by boosting demand for high-performance, durable downhole components.

- March 2024: Mach & Tools Saudi Arabia provided a key platform for showcasing power tool accessories, alongside machinery and spare parts. The event supported market expansion by attracting regional and global manufacturers, promoting dealership agreements, and increasing brand visibility within the Kingdom’s industrial sector.

Saudi Arabia Power Tool Accessories Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Drill Bits, Screwdriver Bits, Router Bits, Circular Saw Blades, Jig Saw Blades, Band Saw Blades, Abrasive Wheels, Reciprocating Saw Blades, Others |

| Applications Covered | Milter Saw, Drill Machine, Reciprocating Saw, Hole Saw, Others |

| End-Use Sectors Covered |

|

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia power tool accessories market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia power tool accessories market on the basis of the type?

- What is the breakup of the Saudi Arabia power tool accessories market on the basis of application?

- What is the breakup of the Saudi Arabia power tool accessories market on the basis of end-use sector?

- What are the various stages in the value chain of the Saudi Arabia power tool accessories market?

- What are the key driving factors and challenges in the Saudi Arabia power tool accessories market?

- What is the structure of the Saudi Arabia power tool accessories market and who are the key players?

- What is the degree of competition in the Saudi Arabia power tool accessories market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia power tool accessories market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia power tool accessories market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia power tool accessories industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)