Saudi Arabia Power Tools Market Size, Share, Trends and Forecast by Product Type and Region, 2026-2034

Saudi Arabia Power Tools Market Overview:

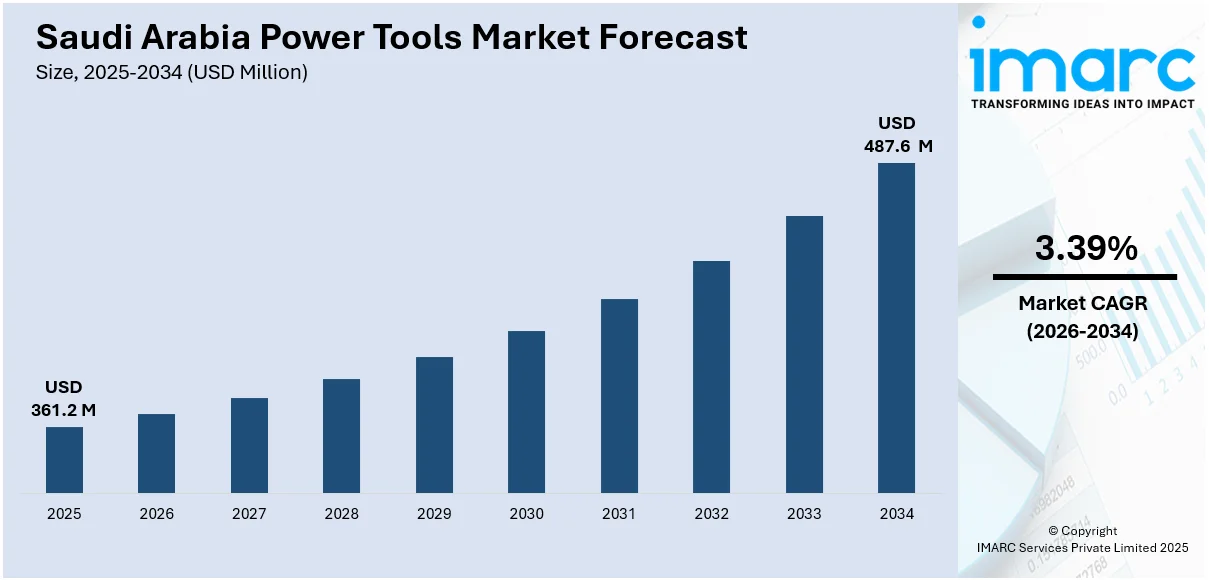

The Saudi Arabia power tools market size reached USD 361.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 487.6 Million by 2034, exhibiting a growth rate (CAGR) of 3.39% during 2026-2034. The market is expanding due to large-scale infrastructure investment, the growing demand across construction and utilities, and the shift to electric and battery-operated tools for efficiency. Furthermore, international manufacturers are forming local partnerships to improve tool availability, service, and responsiveness. These collaborations support faster delivery, better alignment with local conditions, and broader tool adoption. Together, infrastructure growth and localized distribution strategies are contributing to the Saudi Arabia power tools market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 361.2 Million |

| Market Forecast in 2034 | USD 487.6 Million |

| Market Growth Rate 2026-2034 | 3.39% |

Saudi Arabia Power Tools Market Trends:

Infrastructure-Led Industrial Growth

Saudi Arabia's multibillion-dollar investment in infrastructure as part of Vision 2030 is a crucial factor in the growth of the market, creating the demand in construction, manufacturing, and utilities. The vast scale and intricacy of projects demand reliable, long-lasting tools that facilitate high-volume activities, ranging from assembling structures to installing machinery. In 2024, the governing body announced that it had initiated $1.3 trillion in real estate and infrastructure projects during the last eight years, featuring major developments, such as Neom, The Line, and Qiddiya. These mega projects are turning regions like Riyadh and the western coastline into vibrant construction centers, with more than $54 billion designated for new urban areas, entertainment districts, and transportation networks. This process is speeding up the shift from hand-operated techniques to electric and battery-operated equipment that allow for quicker completion and greater precision. Contractors and developers working under stringent deadlines and performance metrics are progressively investing in sophisticated tool systems that alleviate labor pressure and enhance production consistency. As construction cycles become shorter and complexity increases, the demand for dependable, high-performance tools is rising not only in heavy civil projects but also in finishing trades, utility installations, and equipment integration. The Vision 2030 initiative is attracting international developers and subcontractors who introduce rigorous safety and efficiency standards, ultimately accelerating the shift toward modernized tools.

To get more information on this market Request Sample

Strengthening Local Distribution and Strategic Partnerships

Rising efforts to localize industrial capabilities are fostering the Saudi Arabia power tools market growth, with an increasing focus on creating strong regional distribution networks. International manufacturers are working with local partners to establish localized warehousing, assembly, and service operation, strategies that decrease reliance on imports and minimize lead times for tool access. These collaborations are essential for guaranteeing a steady supply of goods, prompt after-sales assistance, and convenient access to spare parts in key industrial areas. Organized distributor networks, which include specialized hardware retailers and business-to-business (B2B) platforms, are more capable of addressing the changing requirements of construction companies, energy providers, and infrastructure builders. The local presence also allows for immediate feedback, enabling brands to enhance tool features for local operating conditions, such as heat, dust, and ongoing use. In 2024, Neo Oiltools appointed Saja Energy as the official distributor of its neotork Vibration Management Tool in Saudi Arabia. The tool enhanced drilling efficiency by controlling torque and reducing vibration-related failures. Such kind of strategic partnership enhances commercial responsiveness and assists global brands in fostering stronger connections with industrial users. As the market evolves, these collaborations are facilitating wider tool usage by synchronizing distribution and service abilities with the performance and compliance benchmarks anticipated for extensive projects.

Saudi Arabia Power Tools Market Segmentation:

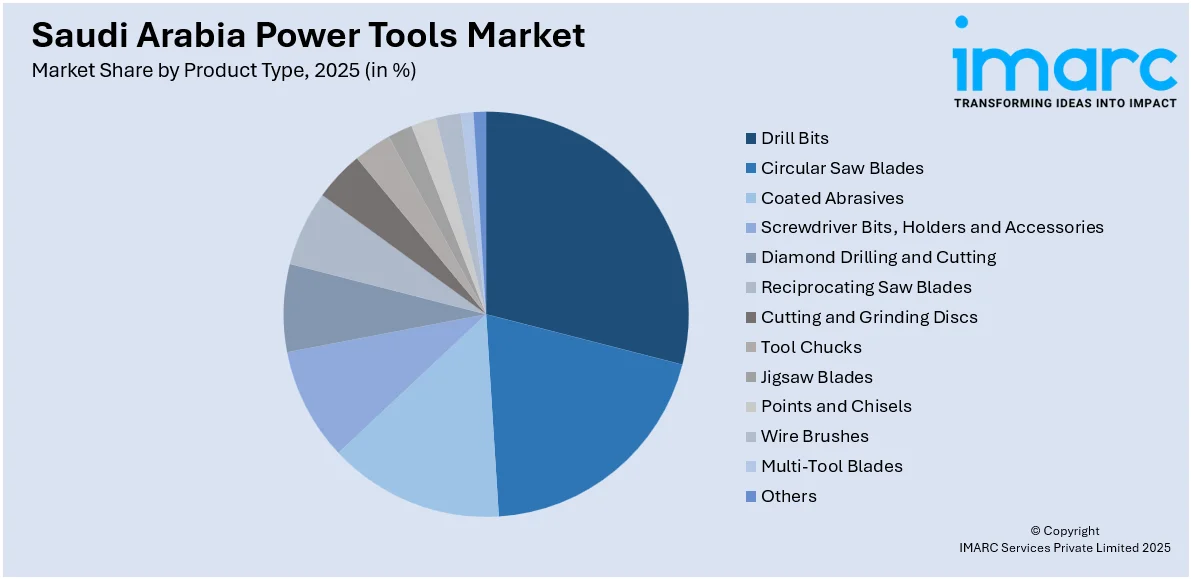

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type.

Product Type Insights:

Access the comprehensive market breakdown Request Sample

- Drill Bits

- Circular Saw Blades

- Coated Abrasives

- Screwdriver Bits, Holders and Accessories

- Diamond Drilling and Cutting

- Reciprocating Saw Blades

- Cutting and Grinding Discs

- Tool Chucks

- Jigsaw Blades

- Points and Chisels

- Wire Brushes

- Multi-Tool Blades

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes drill bits, circular saw blades, coated abrasives, screwdriver bits, holders and accessories,diamond drilling and cutting, reciprocating saw blades, cutting and grinding discs, tool chucks, jigsaw blades, points and chisels, wire brushes, multi-tool blades, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Power Tools Market News:

- In November 2024, the Mach & Tools Saudi 2024 & Gulf 4P expo was held at Dhahran International Exhibition Centre in Saudi Arabia. The event showcased advanced machinery, tools, and technologies across industrial and 4P sectors (plastics, printing, packaging, petrochemicals). It supported Saudi Vision 2030's diversification goals and rising demand for industrial solutions.

- In November 2024, Koelnmesse and dmg events announced the launch of the International Hardware Fair Saudi Arabia, which was scheduled to debut from June 16–18, 2025, at the Riyadh International Convention & Exhibition Center (RICEC). The event served as a comprehensive B2B platform for hardware and tools, bringing together global and local industry stakeholders.

Saudi Arabia Power Tools Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Drill Bits, Circular Saw Blades, Coated Abrasives, Screwdriver Bits, Holders and Accessories, Diamond Drilling and Cutting, Reciprocating Saw Blades, Cutting and Grinding Discs, Tool Chucks, Jigsaw Blades, Points and Chisels, Wire Brushes, Multi-Tool Blades, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia power tools market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia power tools market on the basis of product type?

- What is the breakup of the Saudi Arabia power tools market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia power tools market?

- What are the key driving factors and challenges in the Saudi Arabia power tools?

- What is the structure of the Saudi Arabia power tools market and who are the key players?

- What is the degree of competition in the Saudi Arabia power tools market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia power tools market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia power tools market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia power tools industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)