Saudi Arabia Power Transformer Market Size, Share, Trends and Forecast by Core, Insulation, Phase, Rating, Application, and Region, 2026-2034

Saudi Arabia Power Transformer Market Overview:

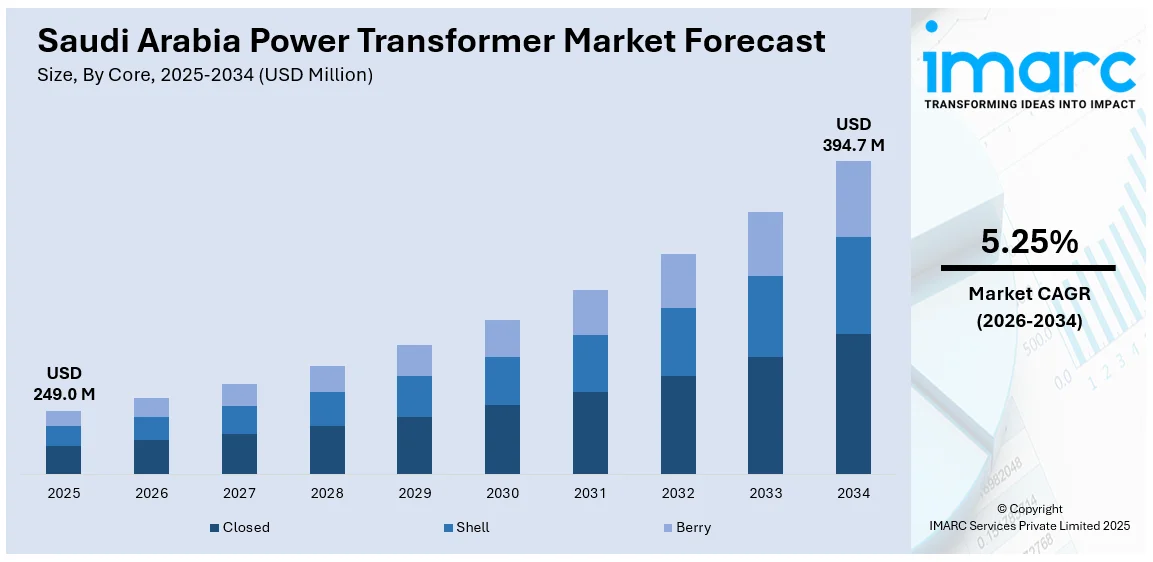

The Saudi Arabia power transformer market size reached USD 249.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 394.7 Million by 2034, exhibiting a growth rate (CAGR) of 5.25% during 2026-2034. The market is driven by increasing demand for electricity due to rapid urbanization, industrial growth, and government infrastructure projects. Investments in renewable energy, grid modernization, and the ongoing development of smart grids and electricity distribution networks also contribute significantly to the Saudi Arabia power transformer market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 249.0 Million |

| Market Forecast in 2034 | USD 394.7 Million |

| Market Growth Rate 2026-2034 | 5.25% |

Saudi Arabia Power Transformer Market Trends:

Investment in Renewable Energy Projects

Saudi Arabia's Vision 2030 is a major catalyst for the diversification of energy in the country, with a thrust towards incorporating renewable energy sources like solar and wind power. With the Kingdom targeting 50% renewable energy by 2030, the need for high-end power transformers is on the rise. These transformers are needed for effective incorporation of renewable energy in the national power grid, since they play a crucial role in stabilizing and maximizing the levels of voltage during the process of energy conversion and transmission from solar and wind farms. Power transformers facilitate efficient energy distribution, thus aiding Saudi Arabia's renewable energy drive and going hand-in-hand with its vision of cutting carbon emissions while ensuring energy reliability in the country. For instance, in April 2025, the Saudi Electricity Company (SEC) advanced its infrastructure with a USD 200 Million investment in a new 380 kV substation at Mawqaq, central Saudi Arabia. This project is vital for integrating large-scale renewable energy into the national grid. SEC has awarded contracts for the substation and overhead transmission line projects to enhance Saudi Arabia's renewable energy capacity as part of Vision 2030. The initiative reflects the country's continued investment in modernizing energy infrastructure and boosting cleaner energy production.

To get more information on this market Request Sample

Infrastructure Expansion and Urbanization

Technological growth, growing industrialization, and fast-paced urbanization coupled with consistent development of infrastructure, especially in bigger cities like Riyadh, Jeddah, and Dammam, are key drivers of the Saudi Arabia power transformer market growth. With an increasing population and new residential as well as business developments, a higher and expanded power distribution system becomes imperative. New substations and grid connections necessitate the addition of high-capacity power transformers to guarantee stable power supply and efficient energy transmission. This infrastructure expansion, fueled by government-sponsored mega-projects such as NEOM, Red Sea Project, and the Riyadh Metro, is likely to maintain the demand for sophisticated power transformers and ancillary equipment, driving the country's ambitious urban development plans. For instance, in January 2025, the Diriyah Company, in collaboration with Saudi Electricity Company, launched two substations: the 1707 MVA Bulk Substation and the 200 MVA Primary Substation in Saudi Arabia. These substations will support the development of Diriyah’s City of Earth and Wadi Safar projects. The 1707 MVA substation, valued at SAR 605 million, aids Diriyah’s first-phase development, while the 200 MVA substation supports Wadi Safar. These substations reflect the growing need for power transformers to support large-scale infrastructure projects.

Saudi Arabia Power Transformer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on core, insulation, phase, rating, and application.

Core Insights:

- Closed

- Shell

- Berry

The report has provided a detailed breakup and analysis of the market based on the core. This includes closed, shell, and berry.

Insulation Insights:

- Gas

- Oil

- Solid

- Air

- Others

The report has provided a detailed breakup and analysis of the market based on the insulation. This includes gas, oil, solid, air, and others.

Phase Insights:

- Single

- Three

The report has provided a detailed breakup and analysis of the market based on the phase. This includes single and three.

Rating Insights:

- 100 MVA to 500 MVA

- 501 MVA to 800 MVA

- 801 MVA to 1200 MVA

The report has provided a detailed breakup and analysis of the market based on the rating. This includes 100 MVA to 500 MVA, 501 MVA to 800 MVA, and 801 MVA to 1200 MVA.

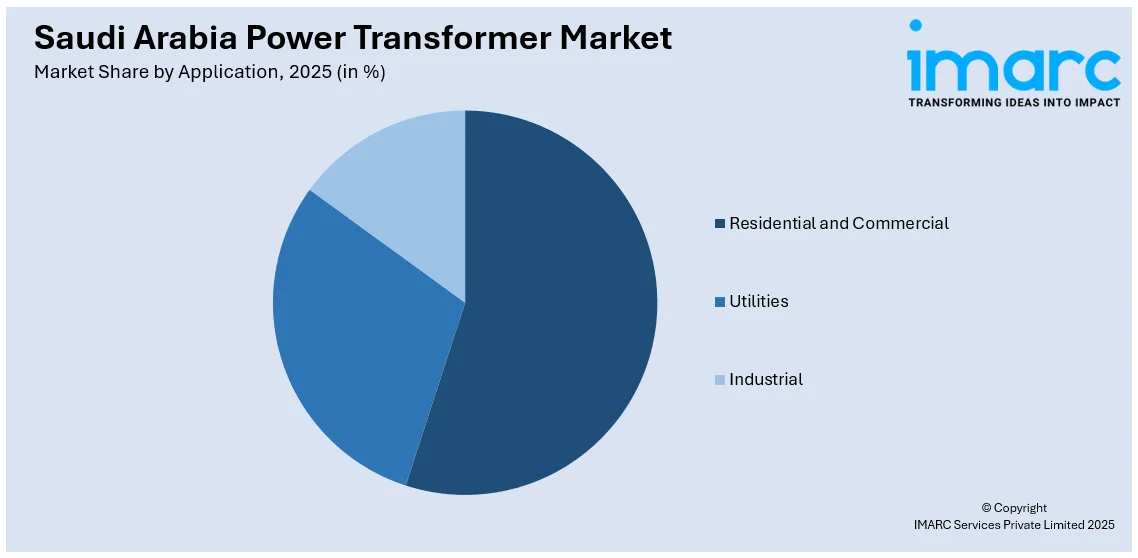

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential and Commercial

- Utilities

- Industrial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential and commercial, utilities, and industrial.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Power Transformer Market News:

- In February 2025, Hansa Meyer Global secured a significant logistics contract to transport six 200-ton power transformers for Saudi Electricity Company (SEC). The transformers will be delivered to substations in Dirab (Riyadh) and Rabie (Dammam). The project involves critical tasks such as customs clearance, accessory segregation, and precise placement using specialized techniques. This operation supports Saudi Arabia’s growing power infrastructure and enhances Hansa Meyer Global’s reputation in the heavy-lift logistics sector, emphasizing the importance of global coordination and expertise in project cargo handling.

- In February 2025, Hyundai Engineering & Construction secured USD 389 Million in projects for Saudi Electricity Company to build 380 kV transmission lines in the Medina and Jeddah regions. The transmission lines will connect planned solar power plants to the grid, supporting Saudi Arabia's renewable energy goals. The Medina project spans 311 km, while the Jeddah project covers 180 km. Both projects are set to be completed by November 2027, with Hyundai overseeing the design, procurement, and construction of the entire process.

- In May 2024, Saudi Electricity Company (SEC) approved a 192 million SAR ($51.20 million) expansion project for its subsidiary, Saudi Power Transformers Company, to manufacture high-voltage transformers and 380-kilovolt reactors. The expansion aims to increase the production capacity of high-voltage transformers. Construction is scheduled for the second half of 2024, with the project expected to complete by Q4 2026. The pilot production will begin in Q1 2027, with commercial production slated for Q3 2027, supporting Saudi Arabia's growing energy infrastructure.

- In February 2024, Oman's Voltamp Energy and Saudi Arabia's Al-Sharif Holding Group launched a joint venture, Saudi Voltamp, to establish a high-voltage power transformer manufacturing plant in Saudi Arabia. The $10 million investment aims to strengthen the region's power infrastructure. The factory, located near Jeddah, will produce 132 kV transformers initially, with plans for expansion by 2027 to include 380 kV transformers. This project aligns with both Oman's Vision 2040 and Saudi Arabia's Vision 2030, contributing to economic diversification and industrial growth.

Saudi Arabia Power Transformer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cores Covered | Closed, Shell, Berry |

| Insulations Covered | Gas, Oil, Solid, Air, Others |

| Phases Covered | Single, Three |

| Ratings Covered | 100 MVA To 500 MVA, 501 MVA To 800 MVA, 801 MVA To 1200 MVA |

| Applications Covered | Residential and Commercial, Utilities, Industrial |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia power transformer market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia power transformer market on the basis of core?

- What is the breakup of the Saudi Arabia power transformer market on the basis of insulation?

- What is the breakup of the Saudi Arabia power transformer market on the basis of phase?

- What is the breakup of the Saudi Arabia power transformer market on the basis of rating?

- What is the breakup of the Saudi Arabia power transformer market on the basis of application?

- What is the breakup of the Saudi Arabia power transformer market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia power transformer market?

- What are the key driving factors and challenges in the Saudi Arabia power transformer market?

- What is the structure of the Saudi Arabia power transformer market and who are the key players?

- What is the degree of competition in the Saudi Arabia power transformer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia power transformer market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia power transformer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia power transformer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)