Saudi Arabia Precast Concrete Market Size, Share, Trends and Forecast by Type, Product, End Use, and Region, 2026-2034

Saudi Arabia Precast Concrete Market Summary:

The Saudi Arabia precast concrete market size was valued at USD 1.33 Billion in 2025 and is projected to reach USD 2.52 Billion by 2034, growing at a compound annual growth rate of 7.30% from 2026-2034.

The market expansion is driven by Saudi Arabia's transformative Vision 2030 initiative, which emphasizes large-scale infrastructure development, sustainable urban planning, and modernization of construction practices. The Kingdom's commitment to building smart cities, expanding residential housing capacity, and developing world-class transportation networks has created sustained demand for efficient, high-quality construction materials. Precast concrete solutions have emerged as the preferred choice for developers and contractors seeking to meet ambitious project timelines while maintaining stringent quality standards and cost efficiency.

Key Takeaways and Insights:

- By Type: Floors and roofs dominate the market with a share of 39% in 2025, driven by widespread adoption in residential and commercial construction projects requiring rapid installation and superior load-bearing capabilities for multi-story structures.

- By Product: Structural building components lead the market with a share of 46% in 2025, owing to their critical role in mega infrastructure projects and high-rise developments where durability, precision engineering, and rapid assembly are essential requirements.

- By End Use: Residential represents the largest segment with a market share of 61% in 2025, reflecting the Kingdom's ambitious housing programs targeting homeownership expansion and the construction of over 1.5 million new residential units by 2030.

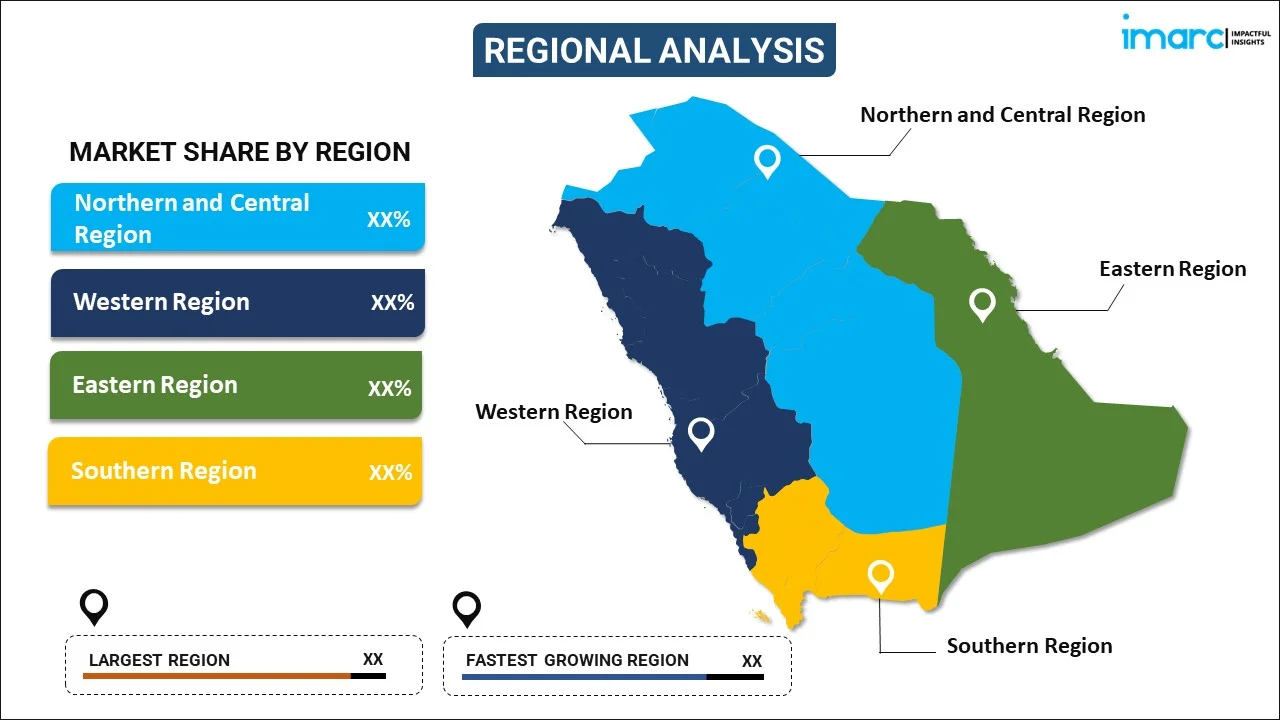

- By Region: Northern and Central Region dominates the market with a share of 35% in 2025, driving ongoing infrastructure projects, urban expansion, and industrial growth.

- Key Players: The Saudi Arabia precast concrete market exhibits a moderately competitive landscape characterized by established domestic manufacturers and growing international partnerships. Major players focus on technological innovation, production capacity expansion, and strategic collaborations to address the substantial demand generated by Vision 2030 mega projects. Some of the major players include Al Kifah Precast Company, Bina Holding Co., Gulf Precast Concrete Co. L.L.C, Prainsa Saudi Arabia (Eastern Province Cement), and Rabiah-Nassar & Zamil Concrete Industries Co. Ltd.

The Saudi Arabia precast concrete market represents a dynamic sector integral to the Kingdom's construction transformation. Precast concrete manufactured in controlled factory environments offers distinct advantages including superior quality control, accelerated construction timelines, reduced on-site labor requirements, and enhanced structural durability. These characteristics align precisely with the scale and pace demanded by giga-projects such as NEOM, The Red Sea Project, Qiddiya, and Diriyah. The government's allocation of SAR 150 billion for infrastructure development in 2025 underscores the substantial investment driving market expansion. Local manufacturers are scaling production capacity while forming strategic partnerships with international technology providers to meet rising demand across residential, commercial, and infrastructure applications. The integration of advanced manufacturing technologies including automation, robotics, and Building Information Modeling, has enhanced production efficiency and product quality throughout the industry.

Saudi Arabia Precast Concrete Market Trends:

Integration of Smart Technologies and Digital Manufacturing

The Saudi construction industry is embracing digital transformation with strong emphasis on smart technologies in precast concrete manufacturing. This trend involves widespread adoption of Building Information Modeling for precise design coordination and Internet of Things sensors for quality monitoring throughout production processes. In July 2025, Al Rashid Abetong Co. partnered with Progress Group to implement fully automated precast manufacturing systems featuring smart robotics and real-time tracking solutions. The upgrade increased daily wall panel production to 700 units while reducing manual labor dependency by nearly 80 percent, demonstrating the operational efficiencies achievable through advanced digital integration.

Sustainable and Low-Carbon Construction Practices

Sustainability has become a central focus in Saudi Arabia’s construction sector, aligned with Vision 2030 environmental goals. Government regulations now require minimum green building certifications for public projects, boosting demand for eco-friendly precast materials. The industry is increasingly adopting low-carbon alternatives and supplementary cementitious materials to reduce emissions and support environmentally responsible construction practices. These initiatives contribute to the Kingdom’s broader green development objectives, promoting ultra-low carbon concrete use in large-scale projects and reinforcing the shift toward sustainable infrastructure and environmentally conscious urban growth across the country. For instance, in November 2024, Saudi Readymix (SRMCC) and Betolar collaborated to develop innovative low-carbon concrete solutions, meeting growing demand for sustainable construction. This partnership aligns with Saudi Arabia’s Vision 2030 and the Saudi Green Initiative, demonstrating a shared commitment to advancing eco-friendly practices and transforming the nation’s construction sector.

Rise of Modular and Hybrid Precast Construction Systems

The rapid pace of development in Saudi Arabia is accelerating the adoption of modular and hybrid precast construction methods. Modular precast involves producing large volumetric units off-site, including entire room modules and facade sections, which are then assembled on-site. In cities like Riyadh and Jeddah, modular precast units accounted for 30 percent of new housing projects in 2024, significantly reducing construction timelines. Hybrid systems combining precast concrete elements with structural steel are gaining traction for complex high-rise structures, offering enhanced structural performance and design flexibility crucial for iconic projects shaping the Kingdom's evolving skyline.

How Vision 2030 is Transforming the Saudi Arabia Precast Concrete Market:

Saudi Arabia’s Vision 2030 is profoundly reshaping the precast concrete market by driving large-scale urban development and infrastructure modernization. Mega projects, including smart cities, transport networks, and industrial zones, are creating sustained demand for high-quality, durable, and efficient construction materials. Precast concrete is increasingly preferred for its speed of installation, cost-effectiveness, and ability to meet stringent quality standards, aligning with the government’s emphasis on sustainable and resilient construction. Investments in residential, commercial, and public infrastructure are encouraging local manufacturers to expand production capacities and adopt advanced precast technologies. Consequently, Vision 2030 is positioning precast concrete as a cornerstone of Saudi Arabia’s construction transformation.

Market Outlook 2026-2034:

The Saudi Arabia precast concrete market outlook remains strongly positive through the forecast period, supported by continued government investment in mega infrastructure projects and housing development programs. The Ministry of Housing's target to increase homeownership to 70 percent by 2030 requires the construction of over a million new residential units, many utilizing precast solutions for speed and cost efficiency. Ongoing developments across NEOM, The Red Sea Project, Qiddiya, and urban expansion initiatives in Riyadh and Jeddah will sustain robust demand for structural and architectural precast components. The market generated a revenue of USD 1.33 Billion in 2025 and is projected to reach a revenue of USD 2.52 Billion by 2034, growing at a compound annual growth rate of 7.30% from 2026-2034.

Saudi Arabia Precast Concrete Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Floors and Roofs |

39% |

|

Product |

Structural Building Components |

46% |

|

End Use |

Residential |

61% |

|

Region |

Northern and Central Region |

35% |

Type Insights:

To get detailed segment analysis of this market, Request Sample

- Floors and Roofs

- Columns and Beams

- Stairs and Landing

- Walls

Floors and roofs dominate with a market share of 39% of the total Saudi Arabia precast concrete market in 2025.

Precast floor and roof systems have become the preferred choice for Saudi Arabia's construction sector due to their exceptional load-bearing capabilities and rapid installation characteristics. Hollow core slabs and prestressed floor panels enable efficient construction of multi-story residential complexes, commercial buildings, and industrial facilities while reducing overall project timelines. The controlled factory production environment ensures consistent quality and precise dimensional accuracy, critical factors for large-scale housing developments under government programs like Sakani and ROSHN.

The demand for precast flooring solutions is further strengthened by their superior thermal and acoustic insulation properties, particularly relevant in Saudi Arabia's extreme climate conditions. Developers across Riyadh, Jeddah, and Dammam increasingly specify precast floor systems for high-rise residential towers and mixed-use developments to meet stringent building code requirements while maintaining competitive construction schedules. The ongoing expansion of urban centers and new satellite cities continues to drive substantial orders for floor and roof components across the Kingdom.

Product Insights:

- Structural Building Components

- Architectural Building Components

- Transportation Products

- Water and Waste Handling Products

- Others

Structural building components lead with a share of 46% of the total Saudi Arabia precast concrete market in 2025.

Structural building components including beams, columns, wall panels, and foundation elements, form the backbone of Saudi Arabia's precast concrete market. These components are essential for mega infrastructure projects requiring high-strength, durable construction solutions delivered with precise engineering specifications. The substantial investment in giga-projects under Vision 2030 has generated continuous demand for prefabricated structural elements that enable rapid assembly while meeting international quality standards.

The growth of structural components is supported by technological advancements in prestressed and reinforced concrete manufacturing. In September 2024, Japanese specialist Aizawa High Pressure Concrete Company formed a joint venture with Al Saedan for Development to establish a pre-stressed concrete structural components factory at the Modon Industrial Complex near Riyadh. The venture includes technology transfer initiatives and plans to train 100 Saudi engineers, exemplifying the knowledge development accompanying market expansion. These partnerships strengthen domestic manufacturing capabilities while addressing the Kingdom's substantial requirements for structural precast solutions.

End Use Insights:

- Residential

- Non-Residential

Residential exhibits a clear dominance with a 61% share of the total Saudi Arabia precast concrete market in 2025.

Residential construction is the main driver of precast concrete demand in Saudi Arabia, fueled by government housing initiatives and rapid urban growth. Precast concrete enables the delivery of large-scale, cost-effective housing while shortening construction timelines, making it an ideal solution for programs aimed at expanding homeownership and providing efficient, high-quality housing for middle-income families across the Kingdom. Its use supports streamlined project execution and consistent quality, aligning with national objectives to meet growing residential demand in urban and suburban areas.

The residential segment's expansion is concentrated in major urban centers including Riyadh, Jeddah, and Dammam where population growth and urban migration continue to pressure housing supply. In February 2023, the National Housing Company launched the Al-Fursan suburb project in northeast Riyadh covering 35 million square meters with over 50,000 residential complexes utilizing precast construction methods. Developers prefer precast systems for their fire resistance, thermal efficiency, and structural durability characteristics essential in Saudi Arabia's demanding climate conditions. Regional production hubs near major cities are emerging to address logistics challenges and ensure timely delivery to construction sites.

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central Region represents the largest share at 35% of the total Saudi Arabia precast concrete market in 2025.

The Northern and Central Region, led by Riyadh, dominates the precast concrete market due to its concentration of major infrastructure projects, government institutions, and commercial developments. As the capital city, Riyadh serves as the primary hub for large-scale urban expansion initiatives including the King Salman Park project, Sports Boulevard, and numerous residential developments under Vision 2030. The region benefits from established manufacturing facilities and logistics networks supporting efficient precast component delivery to construction sites throughout the metropolitan area.

The region's continued growth is supported by substantial government investment in diversifying the capital's economic base and enhancing livability for residents. Smart city technologies, sustainable construction practices, and advanced infrastructure systems are being integrated into new developments requiring high-quality precast solutions. The Northern and Central Region also serves as a strategic base for precast manufacturers supplying projects across the Kingdom, with production capacity expanding to meet anticipated demand from ongoing and planned developments.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Precast Concrete Market Growing?

Vision 2030 Mega Projects and Infrastructure Investment

Saudi Arabia's Vision 2030 initiative represents the primary catalyst driving precast concrete market expansion, with the government committing unprecedented investment to infrastructure development and economic diversification. The Kingdom seeks to provide over one million residences, more than 362,000 hotel rooms, over 7.4 million square meters of retail space, and 7.7 million square meters of new office facilities by the end of this decade. The government’s focus on large-scale infrastructure projects is driving strong demand for efficient construction materials capable of meeting tight timelines. Mega-developments such as NEOM, The Red Sea Project, Qiddiya, and Diriyah require substantial volumes of precast components delivered with accuracy and speed. This has established precast concrete as the preferred construction method for developers undertaking these transformative projects, offering the precision, efficiency, and scalability needed to execute complex and high-profile developments across the Kingdom.

Labor Shortage Driving Automation and Prefabrication Adoption

The shortage of skilled labor in Saudi Arabia’s construction sector is encouraging companies to increasingly adopt precast concrete solutions, which reduce on-site workforce requirements while maintaining high quality standards. Precast manufacturing shifts much of the construction work to controlled factory environments, where automation and robotics can produce components with minimal manual intervention. This prefabrication process ensures consistent quality without relying on large numbers of skilled workers at construction sites, effectively addressing one of the industry’s persistent challenges. As construction activity accelerates across the Kingdom, the efficiency, speed, and labor-saving advantages of precast concrete are driving its growing adoption.

Rapid Urbanization and Housing Demand Expansion

Saudi Arabia is experiencing accelerated urbanization as increasing numbers of people relocate to urban centers seeking employment and improved living standards. This demographic shift is propelling demand for residential housing, commercial buildings, and supporting infrastructure across major cities. Precast concrete provides a faster construction turnaround essential for absorbing the rising population and urban expansion requirements. The constant development of high-rise residential complexes, schools, hospitals, and commercial centers creates sustained demand for prefabricated concrete elements that can be manufactured efficiently and installed rapidly. Cities including Riyadh, Jeddah, and the emerging Eastern Province urban areas continue driving market growth as developers implement precast solutions to meet accelerating housing and infrastructure needs.

Market Restraints:

What Challenges the Saudi Arabia Precast Concrete Market is Facing?

High Transportation Costs for Large Precast Elements

The transportation of large precast concrete elements presents significant logistical challenges due to their substantial weight and dimensional requirements. Special equipment and careful planning are required for safe transport, increasing overall project costs, particularly for remote construction sites. Inadequate logistics infrastructure in certain regions can delay project timelines and limit precast adoption. To address these constraints, manufacturers are establishing regional production hubs near major urban centers to reduce transportation distances and associated costs.

Skilled Labor Shortage in Design and Installation

While precast concrete reduces on-site labor requirements, skilled personnel remain essential for component design, manufacturing supervision, and proper installation. The shortage of trained workers capable of managing sophisticated precast production processes and ensuring correct assembly can delay projects and compromise quality. Workforce development programs and technology transfer initiatives are necessary to build domestic capabilities and sustain market growth across the Kingdom's expanding construction sector.

Raw Material Price Volatility and Supply Chain Disruptions

Fluctuations in raw material prices including cement, aggregates, and steel reinforcement affect manufacturers' profit margins and project cost predictability. Global supply chain disruptions, geopolitical tensions, and trade policy changes can impact material availability and delivery schedules. Energy price volatility directly influences cement production costs, while steel prices remain subject to international market conditions. These factors require careful supply chain management and contingency planning to maintain production continuity and competitive pricing.

Competitive Landscape:

The Saudi Arabia precast concrete market shows moderate competition, with domestic manufacturers operating alongside regional and international technology partners. Companies differentiate themselves through technological innovation, capacity expansion, and collaborations with global precast specialists. Increasing partnerships aim to introduce advanced production systems and sustainable precast solutions. Competitive pressures are rising as construction demand from Vision 2030 initiatives accelerates, requiring enhanced manufacturing capabilities, faster delivery, and consistent quality. Firms focusing on efficiency, automation, and environmentally responsible practices are better positioned to capture opportunities within the Kingdom’s expanding precast concrete sector.

Some of the key players include:

- Al Kifah Precast Company

- Bina Holding Co.

- Gulf Precast Concrete Co. L.L.C

- Prainsa Saudi Arabia (Eastern Province Cement)

- Rabiah-Nassar & Zamil Concrete Industries Co. Ltd.

Recent Developments:

- May 2025: Windtechnic Engineering S.L. signed a Memorandum of Understanding with RDB-El Seif Company Ltd. to introduce precast concrete tower manufacturing for onshore wind projects in Saudi Arabia, combining international engineering expertise with established local manufacturing capabilities.

- October 2024: NEOM, the rapidly developing sustainable region in northwest Saudi Arabia, has revealed a partnership with Asas Al-Mohileb to set up and manage a SAR 700 million ready-mix concrete complex. This multi-plant facility will focus on producing concrete primarily for the construction of THE LINE, the ambitious linear city project underway in NEOM, supporting large-scale infrastructure and building requirements while enhancing production efficiency and supply reliability for the ongoing development.

Saudi Arabia Precast Concrete Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Floors and Roofs, Columns and Beams, Stairs and Landing, Walls |

| Products Covered | Structural Building Components, Architectural Building Components, Transportation Products, Water and Waste Handling Products, Others |

| End Uses Covered | Residential, Non-Residential |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Companies Covered | Al Kifah Precast Company, Bina Holding Co., Gulf Precast Concrete Co. L.L.C, Prainsa Saudi Arabia (Eastern Province Cement), Rabiah-Nassar & Zamil Concrete Industries Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia precast concrete market size was valued at USD 1.33 Billion in 2025.

The Saudi Arabia precast concrete market is expected to grow at a compound annual growth rate of 7.30% from 2026-2034 to reach USD 2.52 Billion by 2034.

Floors and roofs dominated with a 39% market share in 2025, driven by widespread adoption in residential and commercial construction requiring rapid installation, superior load-bearing capabilities, and thermal insulation properties essential for multi-story structures across the Kingdom.

Key factors driving the Saudi Arabia precast concrete market include Vision 2030 infrastructure investments and mega project development, labor shortage driving prefabrication adoption, rapid urbanization and housing demand expansion, growing emphasis on sustainable construction practices, and technological advancements in automated manufacturing.

Major challenges include high transportation costs for large precast elements requiring specialized logistics, skilled labor shortages in design and installation functions, raw material price volatility affecting production costs, supply chain disruptions impacting material availability, and the need for substantial capital investment in advanced manufacturing facilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)