Saudi Arabia Precision Agriculture Market Size, Share, Trends and Forecast by Technology, Type, Component, Application, and Region, 2026-2034

Saudi Arabia Precision Agriculture Market Overview:

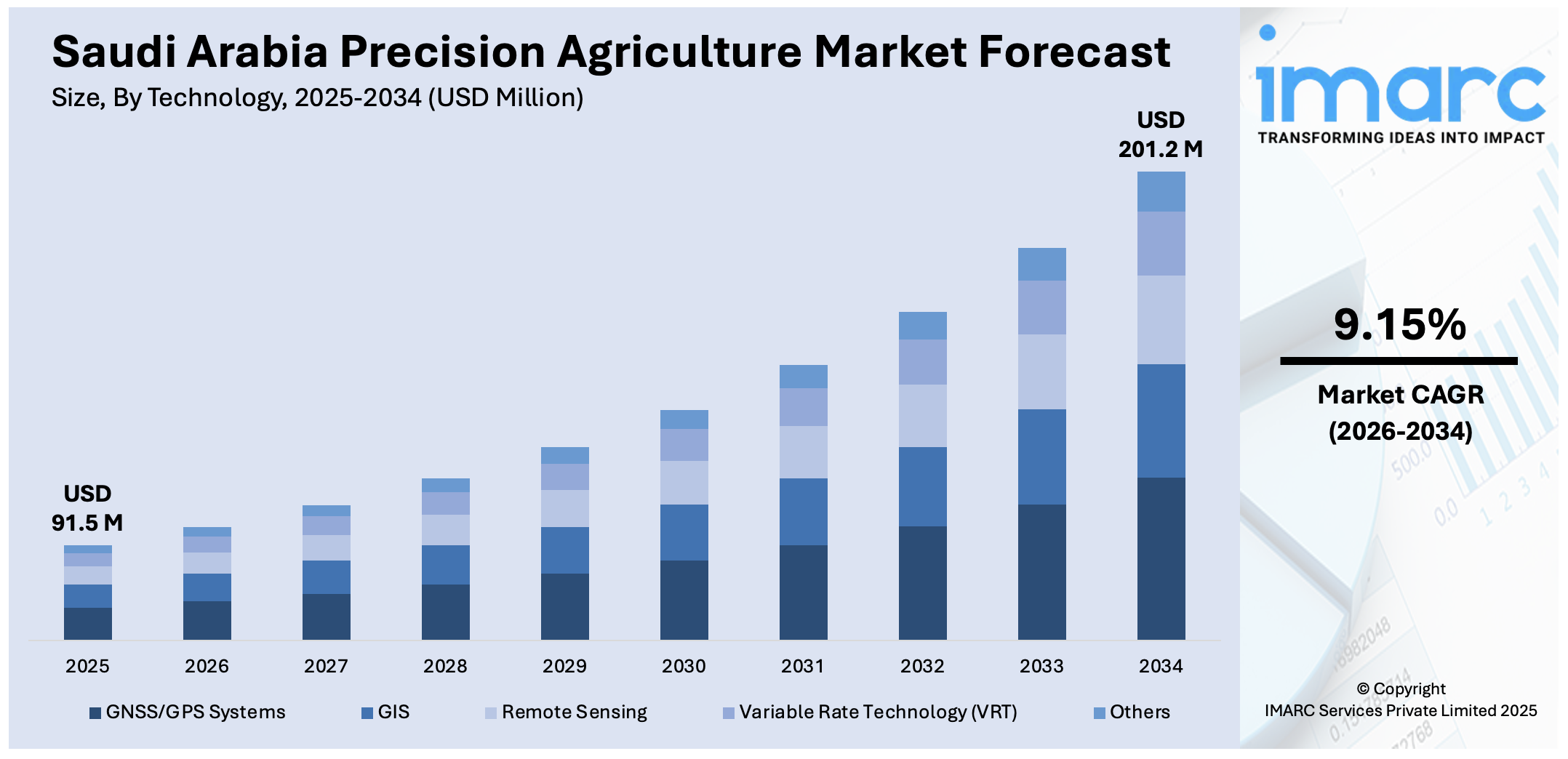

The Saudi Arabia precision agriculture market size reached USD 91.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 201.2 Million by 2034, exhibiting a growth rate (CAGR) of 9.15% during 2026-2034. The market is driven by water scarcity, rising food security needs, and government support through Vision 2030. Technological advancements like IoT, drones, and data analytics enhance crop yields and resource efficiency, making precision farming a viable solution for sustainable agriculture in arid conditions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 91.5 Million |

| Market Forecast in 2034 | USD 201.2 Million |

| Market Growth Rate 2026-2034 | 9.15% |

Saudi Arabia Precision Agriculture Market Trends:

Government Support and Vision 2030 Initiatives

Saudi Arabia’s Vision 2030 development plan emphasizes food security, sustainability, and technological innovation in agriculture. The government actively supports precision farming through subsidies, research funding, and partnerships with global agri-tech companies. Public-private collaborations have introduced smart farming solutions tailored to desert environments. Institutions like the Ministry of Environment, Water and Agriculture (MEWA) promote digital agriculture adoption, while pilot projects demonstrate effectiveness across various crop types. These initiatives aim to modernize the agricultural sector, reduce reliance on food imports, and encourage youth participation, thereby fueling Saudi Arabia precision agriculture market share. Government-backed infrastructure development and awareness campaigns have made policy support a powerful driver of precision agriculture growth. For instance, in July 2024, BGI Group declared its role as a founding member of the recently established Saudi AgriFood Tech Alliance. This significant occasion, organized by the Saudi Ministry of Environment, Water and Agriculture (MEWA) on July 3, represents an important achievement in BGI’s dedication to enhancing agri-food technology and fostering sustainable agricultural progress in Saudi Arabia and the larger Middle East. The partnership seeks to establish a holistic platform that combines scientific research and innovation, industrial application, and market growth, in line with Saudi Arabia's "Vision 2030" initiative to modernize agriculture and guarantee national food security. The initiative is aligned with Vision 2030, aiming at modernizing agriculture and enhancing food security, which is indirectly supporting precision agriculture industry in Saudi Arabia.

To get more information on this market Request Sample

Advancements in Technology and Agritech Adoption

The Saudi Arabia precision agriculture market growth is also influenced by rapid development of agricultural technologies, including drones, GPS-guided equipment, IoT-based sensors, and AI-powered data platforms, which have significantly lowered barriers to precision farming adoption in Saudi Arabia. These innovations enable farmers to monitor soil conditions, track crop health, automate machinery, and analyze data to make informed decisions. The Kingdom’s improving digital infrastructure and rising tech-savviness among younger farmers support the uptake of these tools. Additionally, training programs and international collaborations are helping bridge the skills gap, making advanced farming solutions more accessible, which is creating a positive impact on the Saudi Arabia precision agriculture market outlook. As tech becomes more affordable and scalable, it continues to be a crucial driver in the growth of precision agriculture. For instance, in July 2025, FarmERP, a worldwide frontrunner in innovative sustainable technology solutions, revealed a strategic alliance with Seiyaj Tech, a tech firm from Saudi Arabia that specializes in adapting green energy technologies from leading international firms. The Memorandum of Understanding (MoU), executed in Riyadh, seeks to enhance FarmERP's presence and effect in Saudi Arabia by utilizing Seiyaj Tech's vast business connections and regional knowledge.

Saudi Arabia Precision Agriculture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on technology, type, component, and application.

Technology Insights:

- GNSS/GPS Systems

- GIS

- Remote Sensing

- Variable Rate Technology (VRT)

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes GNSS/GPS systems, GIS, remote sensing, variable rate technology (VRT), and others.

Type Insights:

- Automation and Control Systems

- Sensing and Monitoring Devices

- Farm Management System

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes automation and control systems, sensing and monitoring devices, and farm management system.

Component Insights:

- Hardware

- Software

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware and software.

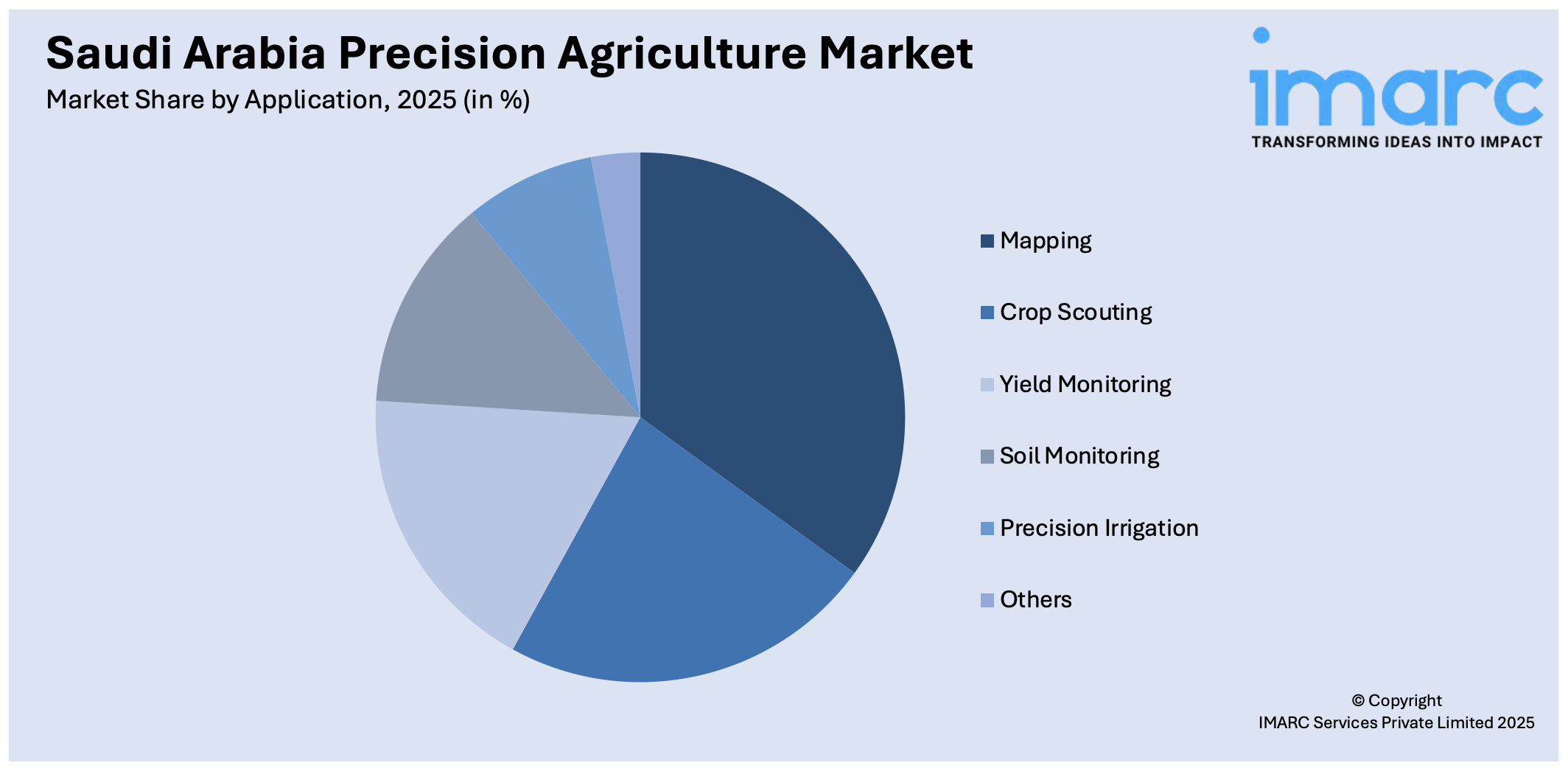

Application Insights:

Access the comprehensive market breakdown Request Sample

- Mapping

- Crop Scouting

- Yield Monitoring

- Soil Monitoring

- Precision Irrigation

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes mapping, crop scouting, yield monitoring, soil monitoring, precision irrigation, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include the Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Precision Agriculture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | GNSS/GPS Systems, GIS, Remote Sensing, Variable Rate Technology (VRT), Others |

| Types Covered | Automation and Control Systems, Sensing and Monitoring Devices, Farm Management System |

| Components Covered | Hardware, Software |

| Applications Covered | Mapping, Crop Scouting, Yield Monitoring, Soil Monitoring, Precision Irrigation, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia precision agriculture market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia precision agriculture market on the basis of technology?

- What is the breakup of the Saudi Arabia precision agriculture market on the basis of type?

- What is the breakup of the Saudi Arabia precision agriculture market on the basis of component?

- What is the breakup of the Saudi Arabia precision agriculture market on the basis of application?

- What is the breakup of the Saudi Arabia precision agriculture market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia precision agriculture market?

- What are the key driving factors and challenges in the Saudi Arabia precision agriculture market?

- What is the structure of the Saudi Arabia precision agriculture market and who are the key players?

- What is the degree of competition in the Saudi Arabia precision agriculture market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia precision agriculture market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia precision agriculture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia precision agriculture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)