Saudi Arabia Programmable Logic Controller (PLC) Market Size, Share, Trends and Forecast by Type, End Use Industry, and Region, 2026-2034

Saudi Arabia Programmable Logic Controller (PLC) Market Overview:

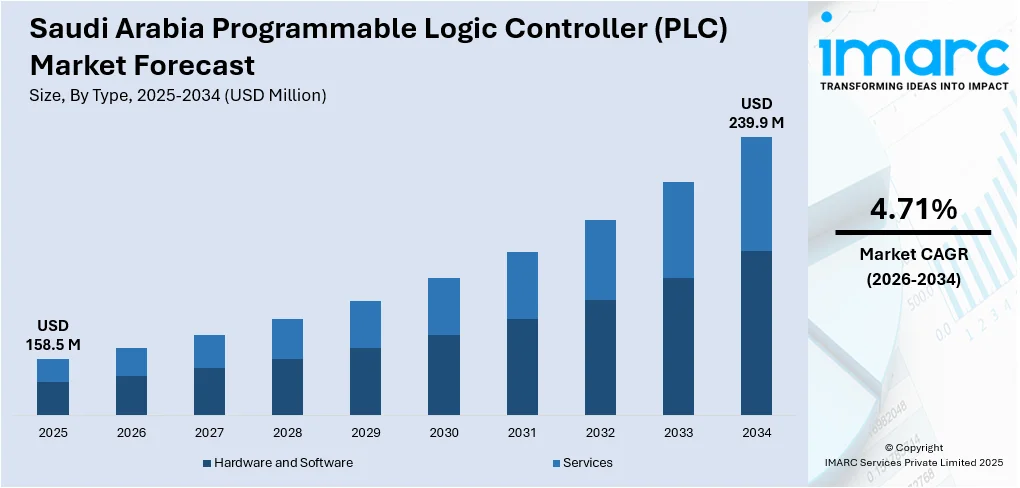

The Saudi Arabia programmable logic controller (PLC) market size reached USD 158.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 239.9 Million by 2034, exhibiting a growth rate (CAGR) of 4.71% during 2026-2034. The market is expanding with increasing automation in the manufacturing, construction, and biotech industries, bolstered by technology upgrades and training programs emphasizing skills. Demand for accurate, integrated control systems is driving the implementation of advanced PLC platforms across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 158.5 Million |

| Market Forecast in 2034 | USD 239.9 Million |

| Market Growth Rate 2026-2034 | 4.71% |

Saudi Arabia Programmable Logic Controller (PLC) Market Trends:

Increased Demand for Smart Control Solutions

Saudi Arabia's move towards industrial automation is speeding up the uptake of smart control systems in strategic industries like manufacturing, biotechnology, and construction. As industries aim to make operations more streamlined and minimize human error, there is a growing demand for programmable logic controllers that provide high-speed, flexible, and reliable automation solutions. There is a widespread preference for technologies that are able to combine motion control, sensor information, and application-specific features in one framework, minimizing downtime and improving the quality of production. This applies particularly in industries with high precision where consistency and speed are vital. In June 2024, ABB launched its OmniCore robotics control platform, introducing a system that combines motion, sensors, and application components under one scalable setup. This development enhanced the capabilities of PLCs in Saudi Arabia by offering quicker response times, high precision, and simpler integration. The platform’s adaptability allows it to support a wide range of industrial applications, further encouraging its uptake. As businesses prioritize efficiency and intelligent control, the move toward such advanced systems is reshaping the local PLC market. The resulting increase in smart automation adoption is driving the replacement of outdated systems and expanding the role of PLCs as essential components in Saudi Arabia’s industrial upgrade efforts.

To get more information on this market, Request Sample

Strengthening Technical Skills and Workforce Readiness

The rapid adoption of automation technologies in Saudi Arabia has highlighted the importance of a technically skilled workforce. As companies implement more sophisticated PLC systems, they require personnel trained in PLC programming, system integration, and control logic. Without adequate technical expertise, the pace of automation adoption can slow down, especially in sectors where downtime or programming errors could lead to costly disruptions. Bridging this skill gap is becoming a priority for industry players, educational institutions, and training providers alike. In March 2024, NobleProg introduced a structured industrial automation training initiative in Saudi Arabia. The program offered both online and onsite formats, making it accessible to a broad range of professionals and students. It focused on key areas like PLC programming and industrial control systems, with an emphasis on practical knowledge. This effort not only supported individual career growth but also addressed a national need by equipping the workforce with the competencies required to manage and maintain automation setups effectively. By building local expertise, the initiative contributed to stronger operational independence and reduced reliance on foreign technical support. These workforce development programs are playing a direct role in expanding the country’s PLC market, as companies now have access to a trained talent pool ready to support their automation goals.

Saudi Arabia Programmable Logic Controller (PLC) Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type and end use industry.

Type Insights:

- Hardware and Software

- Large PLC

- Nano PLC

- Small PLC

- Medium PLC

- Others

- Services

The report has provided a detailed breakup and analysis of the market based on the type. This includes hardware and software (large PLC, nano PLC, small PLC, medium PLC, and others) and services.

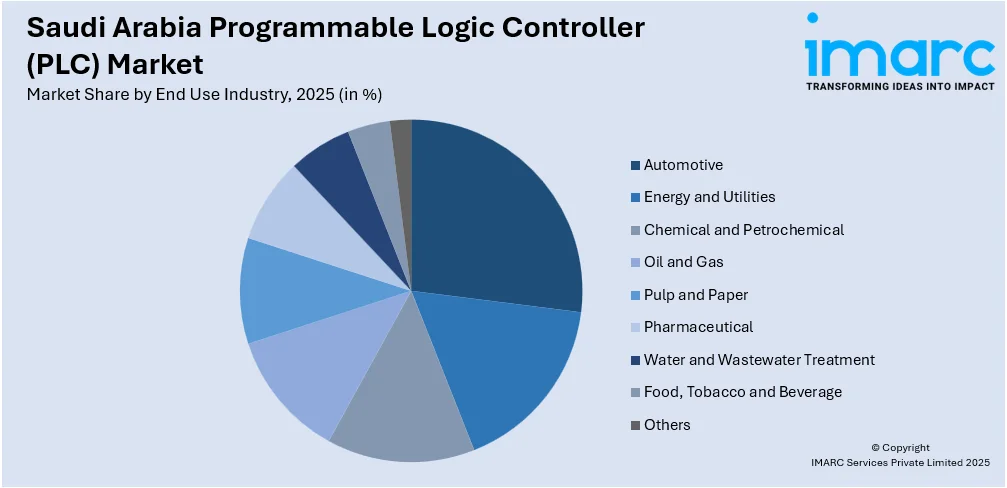

End Use Industry Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Automotive

- Energy and Utilities

- Chemical and Petrochemical

- Oil and Gas

- Pulp and Paper

- Pharmaceutical

- Water and Wastewater Treatment

- Food, Tobacco and Beverage

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive, energy and utilities, chemical and petrochemical, oil and gas, pulp and paper, pharmaceutical, water and wastewater treatment, food, tobacco and beverage, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central region, Western region, Eastern region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Programmable Logic Controller (PLC) Market News:

- February 2025: ABB partnered with Red Sea Global to deploy over 1,200 EV chargers across Saudi Arabia, integrating safety systems like MCBs and RCBs. This advancement boosted demand for PLCs, enhancing automation, safety, and control efficiency in Saudi Arabia’s expanding electric mobility infrastructure.

- May 2024: Honeywell launched its first building automation assembly line in Dhahran, Saudi Arabia, producing fire alarm and management systems. This development supported the local PLC market by boosting demand for automation controls, enhancing localization, and accelerating delivery of smart infrastructure solutions across the region.

Saudi Arabia Programmable Logic Controller (PLC) Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| End Use Industries Covered | Automotive, Energy and Utilities, Chemical and Petrochemical, Oil and Gas, Pulp and Paper, Pharmaceutical, Water and Wastewater Treatment, Food, Tobacco and Beverage, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia programmable logic controller (PLC) market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia programmable logic controller (PLC) market on the basis of the type?

- What is the breakup of the Saudi Arabia programmable logic controller (PLC) market on the basis of end use industry?

- What are the various stages in the value chain of the Saudi Arabia programmable logic controller (PLC) market?

- What are the key driving factors and challenges in the Saudi Arabia programmable logic controller (PLC) market?

- What is the structure of the Saudi Arabia programmable logic controller (PLC) market and who are the key players?

- What is the degree of competition in the Saudi Arabia programmable logic controller (PLC) market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia programmable logic controller (PLC) market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia programmable logic controller (PLC) market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia programmable logic controller (PLC) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)