Saudi Arabia Q-Commerce Market Size, Share, Trends and Forecast by Product Type, Platform, and Region, 2026-2034

Saudi Arabia Q-Commerce Market Summary:

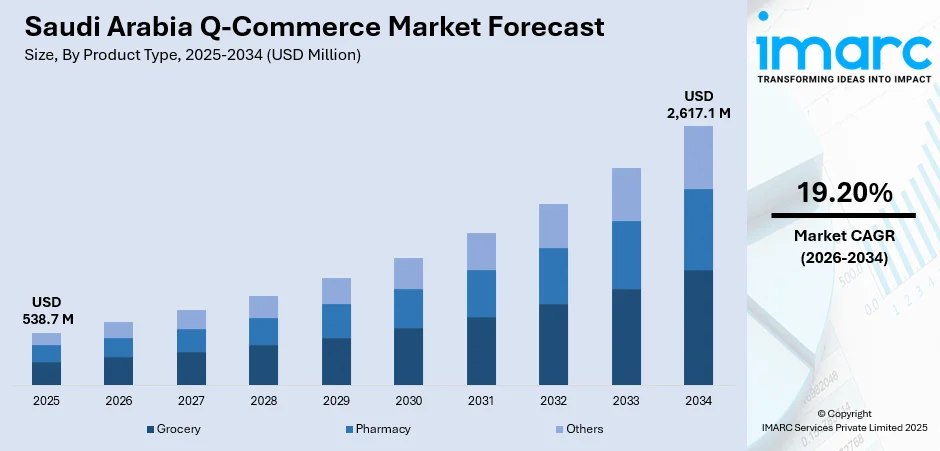

The Saudi Arabia q-commerce market size was valued at USD 538.7 Million in 2025 and is projected to reach USD 2,617.1 Million by 2034, growing at a compound annual growth rate of 19.20% from 2026-2034.

The Saudi Arabia q-commerce market is experiencing robust expansion, driven by the Kingdom's digital transformation initiatives and rising consumer expectations for ultra-fast delivery services. Increasing smartphone penetration, a young tech-savvy population, and supportive government policies under Vision 2030 are accelerating market adoption. The proliferation of dark stores, advancements in last-mile logistics technology, and seamless digital payment integration are strengthening operational capabilities.

Key Takeaways and Insights:

- By Product Type: Grocery dominates the market with a share of 59.96% in 2025, owing to the high frequency of grocery purchases, growing consumer preferences for home delivery of daily essentials, and the expansion of dark store networks enabling rapid fulfillment of fresh produce and staples across urban centers.

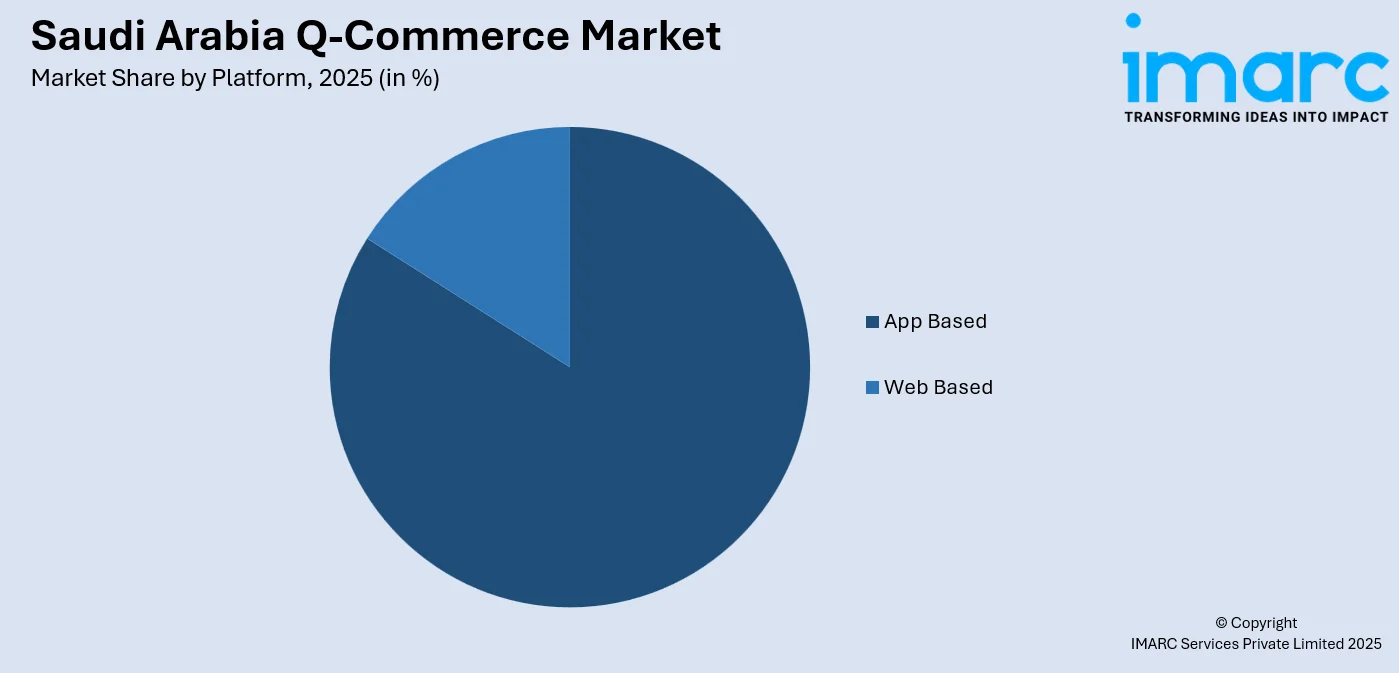

- By Platform: App based leads the market with a share of 83.94% in 2025. This dominance is driven by widespread smartphone adoption, user-friendly interfaces with real-time tracking capabilities, personalized recommendations through artificial intelligence (AI) algorithms, and integrated digital payment options, enhancing the overall shopping experience.

- By Region: Northern and Central Region represents the largest region with 27% share in 2025, driven by the concentration of population in Riyadh, superior digital infrastructure development, high concentration of dual-income households, and presence of major platform headquarters and distribution centers.

- Key Players: Key players drive the Saudi Arabia q-commerce market by expanding dark store networks, investing in autonomous delivery technologies, enhancing mobile application features, and forming strategic partnerships to strengthen nationwide coverage and accelerate adoption across diverse consumer segments.

To get more information on this market Request Sample

The Saudi Arabia q-commerce market is advancing rapidly, as platforms leverage technology innovations and logistics infrastructure investments to meet growing consumer demand for instant delivery. The Kingdom's exceptional digital connectivity, with 98% smartphone adoption rate in 2024, creates a robust foundation for on-demand services. Urban population centers, including Riyadh, Jeddah, and Dammam, exhibit strong mobile shopping trends supported by 5G networks covering approximately 78% of the population. Platforms are increasingly diversifying beyond food delivery into grocery, pharmacy, personal care, and electronics categories, enabling the ‘everything in 30 minutes’ model to become a viable consumer expectation. The government's Vision 2030 initiative continues to channel substantial investments into fostering digital economy infrastructure, accelerating market development and attracting international players seeking growth opportunities in the Gulf region.

Saudi Arabia Q-Commerce Market Trends:

Expansion of Dark Store Networks and Micro-Fulfillment Infrastructure

The proliferation of dark stores and micro-fulfillment centers is transforming q-commerce operations across Saudi Arabia, enabling platforms to achieve delivery windows under 30 minutes. These strategically located facilities position inventory closer to consumers, reducing last-mile distances and improving order accuracy. Major retailers are investing heavily in hub infrastructure that merges store and dark-store inventory, shortening delivery radii and raising pick-rate productivity. Saudi grocery retailer, BinDawood Holding, committed USD 390 Million to robotics and delivery hub development. These funds would be allocated to improve the company's automated dark stores and the necessary infrastructure to back them.

Integration of Advanced Digital Payment Solutions

Digital payment innovation is elevating conversion rates and customer satisfaction across q-commerce platforms. Real-time payment rails and wallet integrations enable friction-free transactions that reduce cart abandonment significantly. Google Pay and Google Wallet were launched in Saudi Arabia in September 2025, assisting users in making quick, easy, and secure payments using their Android devices. These advancements are encouraging greater adoption of q-commerce services among tech-savvy consumers, supporting higher order frequency and overall market growth.

Adoption of Sustainable and Autonomous Delivery Technologies

The adoption of sustainable and autonomous delivery technologies is fueling the Saudi Arabia q-commerce market by improving efficiency, reliability, and customer satisfaction. Electric vehicles (EVs), autonomous robots, and AI-powered route optimization reduce operational costs and carbon emissions, supporting environmentally conscious operations. Faster, more accurate deliveries enhance user experience, encouraging repeat orders and higher platform engagement. Additionally, these technologies enable q-commerce providers to scale rapidly across urban and suburban areas, meeting growing consumer demand for convenient, on-demand delivery while aligning with sustainability goals.

How Vision 2030 is Transforming the Saudi Arabia Q-Commerce Market:

Vision 2030 is transforming the Saudi Arabia q-commerce market by accelerating digital adoption, urban development, and last-mile logistics modernization. The program’s focus on smart cities, digital payments, and e-government services has strengthened consumer comfort with app-based, on-demand platforms offering ultra-fast deliveries. Rapid expansion of urban hubs, mixed-use developments, and high-density residential projects is improving delivery feasibility within short time windows. Vision 2030 also supports logistics infrastructure upgrades, including fulfillment centers and cold chain facilities, enabling q-commerce players to scale operations efficiently. Rising participation of women in the workforce and changing lifestyles are increasing demand for convenience-driven grocery and essentials delivery. Additionally, entrepreneurship and startup-friendly policies are encouraging investments in local q-commerce platforms, intensifying competition, innovation, and service differentiation.

Market Outlook 2026-2034:

The Saudi Arabia q-commerce market is poised for substantial expansion, as digital infrastructure development accelerates and consumer adoption deepens across demographic segments. Rising urbanization rate will create increasingly dense demand zones favorable for rapid delivery economics. Platform investments in warehouse automation, AI-driven logistics optimization, and expanded dark store coverage will enhance service reliability while improving unit economics. The market generated a revenue of USD 538.7 Million in 2025 and is projected to reach a revenue of USD 2,617.1 Million by 2034, growing at a compound annual growth rate of 19.20% from 2026-2034. Government support through Vision 2030 initiatives will continue to foster innovations in logistics infrastructure, creating favorable conditions for sustained growth across product categories and geographic regions.

Saudi Arabia Q-Commerce Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Grocery |

59.96% |

|

Platform |

App Based |

83.94% |

|

Region |

Northern and Central Region |

27% |

Product Type Insights:

- Grocery

- Pharmacy

- Others

Grocery dominates with a market share of 59.96% of the total Saudi Arabia q-commerce market in 2025.

Grocery commands the largest share of the Saudi Arabia q-commerce market, driven by high purchase frequency and growing consumer preference for convenient home delivery of daily essentials. Urban consumers increasingly rely on q-commerce platforms for fresh produce, dairy, packaged foods, and household staples, seeking rapid fulfillment that traditional retail channels cannot match. The segment benefits from extensive dark store networks strategically positioned across metropolitan areas, enabling platforms to maintain product freshness while achieving delivery windows under 30 minutes.

Platforms are expanding grocery inventory breadth and depth to capture diverse consumer preferences, including premium products, organic selections, and local specialty items. Technology investments in inventory management systems and temperature-controlled storage facilities ensure product quality throughout the fulfillment process. The expanding digital payment ecosystem, with STC Pay growing to over 8 Million users in 2024, simplifies transaction completion and encourages repeat purchases. Strategic partnerships between q-commerce platforms and traditional grocery retailers are creating hybrid fulfillment models that leverage existing supply chain relationships while meeting evolving consumer expectations for speed and convenience.

Platform Insights:

Access the comprehensive market breakdown Request Sample

- App Based

- Web Based

App based leads with a share of 83.94% of the total Saudi Arabia q-commerce market in 2025.

App based dominates the Saudi Arabia q-commerce market, reflecting the Kingdom's exceptional mobile connectivity and consumer preference for smartphone-enabled shopping experiences. With increasing smartphone penetration and rising internet usage occurring on mobile devices, apps have become the primary interface for instant delivery services. Leading platforms have adopted app-first strategies, with some operating entirely through mobile applications. These platforms offer features, including push notifications, loyalty programs, real-time order tracking, AI-driven personalized recommendations, and integrated digital payment solutions that enhance user engagement and satisfaction.

Mobile applications provide superior user experiences compared to web-based alternatives through faster load times, offline capabilities, and seamless hardware integration for location services and payment authentication. The app-based model enables platforms to collect valuable consumer behavior data that informs inventory optimization and targeted promotional strategies. In October 2025, Jahez and noon announced a strategic partnership integrating their services within respective applications, allowing customers to access noon Minutes quick delivery through the Jahez app while noon users can order from over 50,000 restaurant partners. This cross-platform collaboration demonstrates the strategic importance of mobile applications in capturing market share.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region exhibits a clear dominance with a 27% share of the total Saudi Arabia q-commerce market in 2025.

Northern and Central Region, anchored by Riyadh as the capital city, leads the Saudi Arabia q-commerce market due to its massive population base, high concentration of dual-income households, and superior digital infrastructure development. Major platforms have established their headquarters and primary distribution centers in Riyadh, creating operational efficiencies that translate to faster delivery times and broader product selection. The city's smart city initiatives under Vision 2030, including expansion of the Riyadh Metro and integrated logistics hubs, continue to strengthen its e-commerce and delivery ecosystem.

Major players are actively expanding warehouse automation and AI-driven delivery scheduling in the city to enhance operational efficiency. Growing consumer familiarity with app-based grocery and essentials ordering is further accelerating demand in the region. High-density residential communities support rapid last-mile fulfillment, enabling ultra-fast delivery commitments. Additionally, strong purchasing power and lifestyle-driven convenience preferences encourage frequent repeat orders, making the region a testing ground for new service models, product categories, and technology-driven innovations.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Q-Commerce Market Growing?

Rising Consumer Expectations for Speed and Convenience

Growing consumer demand for ultra-fast delivery is fundamentally reshaping retail expectations across Saudi Arabia. Influenced by digital convenience and on-demand lifestyles, particularly among younger consumers, traditional delivery models spanning multiple days are rapidly giving way to near-instant service standards. Urban populations increasingly expect access to groceries, pharmacy items, and personal care products within 30 minutes, driven by busy professional schedules and changing household dynamics. The success of established platforms like Jahez has normalized rapid delivery expectations, extending beyond food to encompass diverse product categories. This consumer behavior shift is particularly pronounced in metropolitan centers where dense population clusters and robust infrastructure support high-speed logistics operations. Youth prioritize time-saving solutions over traditional shopping experiences. Platforms are responding by optimizing delivery processes to ensure consumers receive orders within hours, enhancing customer satisfaction and building loyalty through consistent service excellence.

Exceptional Digital Infrastructure and Mobile Connectivity

Saudi Arabia's world-class digital infrastructure provides the foundation for q-commerce market expansion, enabling seamless connectivity between platforms, delivery networks, and consumers. The Kingdom had 36.84 Million internet users as of early 2024, creating an extensive digital consumer base ready for on-demand services. Smartphone adoption rate is high, with mobile devices serving as the primary interface for online transactions and delivery ordering. Continuous upgrades to 5G backbone networks support richer application experiences, including live order tracking, video customer support, and real-time inventory visibility. This robust connectivity enables q-commerce platforms to process high order volumes with minimal latency and improved reliability. Enhanced data speeds also support advanced features, such as AI-driven recommendations and dynamic pricing. Together, these digital strengths lower entry barriers for platforms and accelerate consumer adoption of ultra-fast delivery services across the Kingdom.

Expansion of Dark Stores and Micro-Fulfillment Centers

The rapid broadening of dark stores and micro-fulfillment centers is a critical trend driving the Saudi Arabia q-commerce market. These facilities, strategically located within residential clusters, allow platforms to stock fast-moving consumer goods closer to end users, enabling ultra-fast delivery commitments. Dark stores improve inventory accuracy, reduce picking times, and lower last-mile delivery costs compared to traditional retail fulfillment. Q-commerce operators are increasingly investing in automation, robotics, and AI-driven inventory management within these facilities to improve efficiency and scalability. This model also supports better demand forecasting and reduced wastage, particularly for fresh and perishable items. As cities expand and consumer expectations for speed intensify, micro-fulfillment infrastructure is becoming a competitive differentiator, allowing platforms to expand coverage, maintain service reliability, and support higher order volumes without compromising delivery timelines.

Market Restraints:

What Challenges the Saudi Arabia Q-Commerce Market is Facing?

High Operational and Last-Mile Delivery Costs

Maintaining profitability remains a major challenge for q-commerce platforms due to high operational expenses. Significant investment is required to build and operate dark stores, micro-fulfillment centers, and continuous delivery fleets. Rising fuel, labor, and vehicle maintenance costs further compress margins, especially during expansion phases. Many platforms struggle to balance speed expectations with cost efficiency, making scale, automation, and technology optimization essential for long-term sustainability and competitive viability.

Geographic Coverage Limitations and Infrastructure Gaps

Expanding q-commerce services beyond major cities is challenging due to Saudi Arabia’s wide geographic spread and uneven infrastructure development. Lower population density in non-urban areas reduces order frequency, increasing delivery costs and limiting economic viability. Addressing complexities, longer travel distances, and limited fulfillment infrastructure hinder consistent service quality. Platforms must explore alternative models, such as hybrid fulfillment, regional hubs, and localized partnerships, to gradually extend coverage while managing operational efficiency.

Intense Competition and Margin Pressures

The Saudi Arabia q-commerce market is highly competitive, with numerous domestic and international players vying for consumer attention. Aggressive pricing, frequent promotions, and customer acquisition spending are eroding profit margins across the sector. Well-funded players invest heavily in technology, marketing, and logistics, raising entry barriers for smaller operators. To survive, platforms must differentiate through service reliability, assortment quality, and operational efficiency rather than relying solely on price-based competition.

Competitive Landscape:

The Saudi Arabia q-commerce market exhibits moderate concentration with established domestic platforms and emerging international entrants competing for market leadership. Major players are differentiating through investments in technology infrastructure, dark store expansion, and strategic partnerships that enhance service capabilities and geographic reach. Competition increasingly centers on delivery speed, application user experience, product assortment breadth, and pricing strategies. Platforms are pursuing diversification beyond food delivery into grocery, pharmacy, and lifestyle categories to capture greater share of consumer spending. Strategic acquisitions and cross-platform integrations are consolidating market positions while expanding operational synergies.

Recent Developments:

- In November 2025, Doos, a prominent Saudi platform in the quick-commerce industry, revealed a strategic investment from Jahez, a top on-demand services ecosystem traded on the Saudi Exchange. The funding represented a significant milestone in Doos’s mission to transform the quick-commerce landscape in Saudi Arabia. Through the integration of Jahez’s strong technological framework with Doos’s carefully selected product range and rapid delivery system, both firms strived to provide a smooth experience in app usage, product exploration, and lightning-fast order completion for families in Saudi Arabia.

Saudi Arabia Q-Commerce Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Grocery, Pharmacy, Others |

| Platforms Covered | App Based, Web Based |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia q-commerce market size was valued at USD 538.7 Million in 2025.

The Saudi Arabia q-commerce market is expected to grow at a compound annual growth rate of 19.20% from 2026-2034 to reach USD 2,617.1 Million by 2034.

Grocery dominated the market with a share of 59.96%, driven by high purchase frequency, growing consumer preferences for home delivery of daily essentials, and expansion of dark store networks enabling rapid fulfillment of fresh products and staples.

Key factors driving the Saudi Arabia q-commerce market include rising consumer expectations for rapid delivery, government support through Vision 2030 initiatives, exceptional digital infrastructure, high smartphone penetration, and expanding dark store networks.

Major challenges include high operational and last-mile delivery costs, geographic coverage limitations in less populated regions, intense market competition affecting profit margins, infrastructure gaps outside major urban centers, and rising fuel and labor expenses.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)