Saudi Arabia Quinoa Market Size, Share, Trends and Forecast by Source, Product Type, Application, Distribution Channel, End Use, and Region, 2026-2034

Saudi Arabia Quinoa Market Summary:

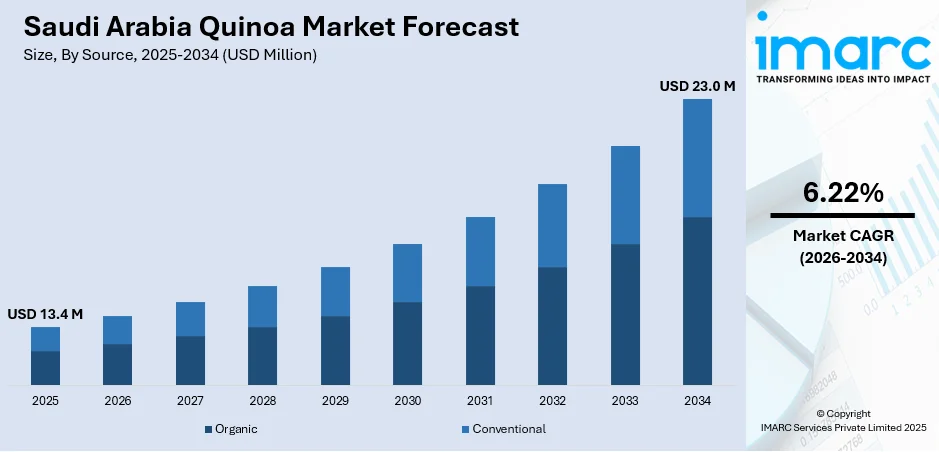

The Saudi Arabia quinoa market size was valued at USD 13.38 Million in 2025 and is projected to reach USD 23.03 Million by 2034, growing at a compound annual growth rate of 6.22% from 2026-2034.

The Saudi Arabia quinoa market is witnessing robust expansion driven by escalating health consciousness among consumers seeking nutrient-dense, gluten-free alternatives to traditional grains. The Kingdom's strategic Vision 2030 initiatives supporting food security and sustainable agriculture are accelerating market penetration. Growing prevalence of lifestyle diseases coupled with rising demand for plant-based protein sources continues bolstering the Saudi Arabia quinoa market share.

Key Takeaways and Insights:

- By Source: Conventional dominates the market with a share of 56% in 2025, attributed to its widespread availability, competitive pricing structures, and established supply chain networks. Consumer familiarity with conventional quinoa products continues driving mainstream adoption across retail channels.

- By Product Type: White quinoa leads the market with a share of 40% in 2025, owing to its mild flavor profile, versatile culinary applications, and consumer preference for lighter-colored grains in traditional Saudi cuisine preparations.

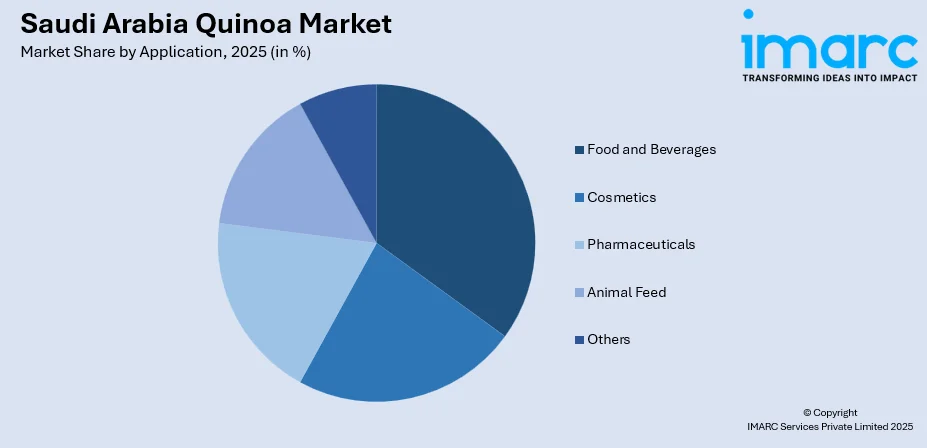

- By Application: Food and beverages represent the biggest segment with a market share of 51% in 2025, reflecting quinoa's primary utilization in healthy food products, breakfast cereals, bakery items, and ready-to-eat meal solutions across the Kingdom.

- By Distribution Channel: Supermarkets and hypermarkets hold the largest share at 38% in 2025, driven by extensive retail footprint, organized product assortments, and convenient accessibility for health-conscious urban consumers.

- By End Use: Ingredient exhibits a clear dominance with 60% share in 2025, reflecting strong demand from food manufacturers incorporating quinoa into processed food formulations, bakery products, and nutritional supplements.

- By Region: Northern and Central Region is the largest region with 30% share in 2025, driven by Riyadh's concentration of health-conscious consumers, premium retail outlets, and higher disposable incomes enabling organic food purchases.

- Key Players: Key players drive the Saudi Arabia quinoa market by expanding organic product portfolios, strengthening distribution partnerships with major retailers, and investing in marketing campaigns to build consumer awareness about quinoa's nutritional benefits and versatile culinary applications.

To get more information on this market, Request Sample

As Saudi Arabian consumers adopt healthier eating habits in line with global wellness trends, the country's quinoa market is seeing revolutionary expansion. The increased prevalence of diabetes and lifestyle-related health issues has created enormous demand for low-glycemic, nutrient-dense alternatives like quinoa among health-conscious people. The grain's entire protein profile, which includes all nine essential amino acids, makes it appealing to consumers who are health-conscious, fitness enthusiasts, and vegetarians or vegans. Through programs encouraging sustainable agriculture, food security, and domestic production capabilities, Saudi Arabia's Vision 2030 framework continues to encourage market expansion. The Organic Food Day 2024 public awareness campaign was started by the Ministry of Environment, Water, and Agriculture to demonstrate the government's dedication to promoting organic food consumption throughout Saudi society. Expanding retail infrastructure, increased e-commerce penetration, and increasing product availability in specialty health food stores are jointly strengthening Saudi Arabia quinoa market growth across varied consumer categories. Consumer acceptance of nutrient-dense food substitutes is further supported by government-backed health programs and legal frameworks requiring clear nutritional labeling.

Saudi Arabia Quinoa Market Trends:

Rising Demand for Gluten-Free Specialty Foods

The demand for naturally gluten-free substitutes like quinoa is rising due to the rising incidence of diabetes, celiac disease, and gluten sensitivity among Saudi consumers. Health-conscious metropolitan populations in Riyadh, Jeddah, and Dammam are actively exploring dietary replacements for traditional wheat-based items. The Saudi Food and Drug Authority's revised food labeling requirements demanding clear nutritional information have boosted customer understanding. Specialty health food shops are extending quinoa product assortments to benefit on this burgeoning wellness-oriented consumer sector seeking premium nutritional solutions.

Expansion of Organic and Sustainable Food Offerings

Saudi Arabia's organic food industry is growing significantly as consumers favor clean-label goods devoid of artificial additives and pesticides. Consumer trust in organic quinoa products has increased as a result of the Kingdom's legal structure requiring organic certification through the Saudi Organic Certification Authority. Retailers are committing more shelf space to organic goods, while e-commerce platforms promote fast access to unique organic quinoa variants. This sustainability-driven purchase pattern reflects larger environmental consciousness among younger Saudi demographics seeking responsibly sourced food options.

Integration of Quinoa in Functional Food Formulations

Food makers are increasingly adding quinoa into functional food products targeting health-conscious consumers seeking greater nutritional advantages. Because of its adaptability, the ingredient can be used into ready-to-eat meal solutions, energy bars, breakfast cereals, and baked goods. Local food producers are creating innovative quinoa-based products that cater to Saudi consumers' palates. Demand for high-protein, high-fiber food formulations including quinoa as a significant functional ingredient in sports nutrition and dietary supplement categories is being driven by the expanding fitness culture and wellness-oriented lifestyle trends.

How Vision 2030 is Transforming the Saudi Arabia Quinoa Market:

Through extensive measures that prioritize food security, sustainable agriculture, and public health improvement, Saudi Arabia's Vision 2030 framework is radically changing the quinoa market. The national transformation program urges Saudi citizens to switch from traditional grain intake to nutrient-dense substitutes that promote better lifestyles. Government-backed programs supporting organic farming practices and sustainable agricultural development create good conditions for specialized food industry expansion. The vision's emphasis on minimizing import dependency promotes interest in developing climate-resilient crops suited to arid environments, promoting quinoa as a strategically relevant agricultural commodity. The market for superfoods like quinoa is indirectly increased by health-focused regulatory reforms that require transparent nutritional labeling, enabling customers to make educated dietary decisions. Together, these interrelated governmental actions create favorable ecosystems that allow the Kingdom's quinoa market to grow steadily.

Market Outlook 2026-2034:

The Saudi Arabia quinoa market outlook remains optimistic as the Kingdom accelerates its food security initiatives and embraces sustainable agricultural practices under Vision 2030. Consumer preferences are progressively shifting toward nutrient-dense superfoods that support healthy lifestyles and address growing health concerns related to obesity, diabetes, and cardiovascular conditions. The market generated a revenue of USD 13.38 Million in 2025 and is projected to reach a revenue of USD 23.03 Million by 2034, growing at a compound annual growth rate of 6.22% from 2026-2034. The expansion of modern retail formats, rising e-commerce adoption, and strengthening distribution networks are enhancing product accessibility nationwide. Government-led initiatives promoting organic farming practices and domestic agricultural development are creating supportive conditions for sustained market expansion throughout the forecast period.

Saudi Arabia Quinoa Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Source |

Conventional |

56% |

|

Product Type |

White Quinoa |

40% |

|

Application |

Food and Beverages |

51% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

38% |

|

End Use |

Ingredient |

60% |

|

Region |

Northern and Central Region |

30% |

Source Insights:

- Organic

- Conventional

Conventional dominates with a market share of 56% of the total Saudi Arabia quinoa market in 2025.

The conventional quinoa segment maintains its leading position in Saudi Arabia due to established import channels from major producing countries in South America. Price accessibility compared to organic variants makes conventional quinoa the preferred choice for mainstream consumers and food service establishments seeking cost-effective nutritional alternatives. The segment benefits from consistent supply availability through well-developed distribution networks serving supermarkets, hypermarkets, and institutional buyers across urban and suburban markets. Peru, the world's largest quinoa producer of global output with 106,756 Tons annually, serves as the primary supply source for Saudi Arabia's conventional quinoa imports. Conventional quinoa's widespread acceptance stems from its seamless integration into diverse food applications spanning household cooking, restaurant preparations, and industrial food manufacturing operations throughout the Kingdom.

Cost-conscious consumers looking for significant nutritional benefits without the premium pricing usually associated with organic certification standards are efficiently served by this category. In order to satisfy a wide range of consumer tastes and culinary needs, major stores in Saudi Arabia keep significant assortments of typical quinoa products. Growing consumer awareness about quinoa's remarkable health advantages, including its full protein profile and critical nutritional content, continues expanding the conventional segment's addressable market. As health-conscious purchasing behaviors spread throughout various Saudi demographic categories, the segment is well-positioned for long-term growth thanks to its well-established supply chains and competitive price structures.

Product Type Insights:

- Red Quinoa

- Black Quinoa

- White Quinoa

- Others

White quinoa leads with a share of 40% of the total Saudi Arabia quinoa market in 2025.

Due to its moderate, neutral flavor profile that enhances a variety of culinary preparations without overpowering other ingredients in both traditional and modern recipes, white quinoa controls the biggest product type share. The variety's brighter color and particularly fluffy texture appeal strongly to Saudi consumers seeking healthful rice alternatives that integrate effortlessly into traditional Middle Eastern recipes and current fusion cuisines. White quinoa is continuously used by food manufacturers for processed food formulations, breakfast cereals, and bakery goods because of its neutral flavor profile, adaptable processing qualities, and widespread consumer acceptance across a variety of demographic segments within the Kingdom.

The market domination of this sector is a result of the segment's significant retail penetration in supermarkets and hypermarkets, where white quinoa is prominently displayed in health food sections that draw wellness-conscious consumers. White quinoa's convenience appeal for time-pressed households juggling busy lifestyles and nutritional concerns is further increased by its very short cooking time compared to colored quinoa variations. The variety's adaptability across sweet and savory uses enhances its culinary versatility, encouraging adoption among consumers investigating healthier grain options. In Saudi Arabia's changing quinoa product market, white quinoa's established consumer familiarity and consistent availability through mainstream distribution channels support its dominant market position.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverages

- Cosmetics

- Pharmaceuticals

- Animal Feed

- Others

Food and beverages dominate the market with a share of 51% of the total Saudi Arabia quinoa market in 2025.

The food and beverages segment leads quinoa applications driven by escalating consumer demand for nutritious, protein-rich food alternatives supporting healthy lifestyles and wellness objectives. Quinoa's classification as a complete protein containing all essential amino acids positions it exceptionally favorably within the Kingdom's rapidly growing health food category attracting diverse consumer demographics. Restaurant chains and food service operators increasingly feature quinoa-based menu items catering specifically to health-conscious diners seeking nutritious alternatives to conventional grain offerings. The segment encompasses diverse product categories including ready-to-eat meals, breakfast cereals, salads, soups, grain bowls, and innovative grain-based snack products appealing to wellness-oriented consumers. The Saudi Food Show 2025 held in May at Riyadh Front attracted over 1,300 exhibitors and facilitated food industry contracts exceeding SAR 600 Million, demonstrating robust commercial appetite for specialty food ingredients including quinoa-based products.

Saudi Arabia's food and beverages industry demonstrates growing innovation in quinoa-based product development targeting wellness-oriented consumers seeking clean-label, nutrient-dense food options. The Saudi Food and Drug Authority's regulatory framework supporting transparent nutritional labeling has enhanced consumer confidence in quinoa products and facilitated informed purchasing decisions. Manufacturers are actively developing quinoa-infused products tailored to regional taste preferences while expanding distribution across retail and food service channels. The segment's growth trajectory reflects broader dietary shifts toward plant-based proteins, gluten-free alternatives, and functional foods delivering measurable health benefits aligned with contemporary wellness priorities embraced by Saudi consumers.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Traditional Retail Stores

- Convenience Stores

- Online

- Others

Supermarkets and hypermarkets hold the largest share at 38% of the total Saudi Arabia quinoa market in 2025.

Supermarkets and hypermarkets dominate quinoa distribution through extensive retail footprints, organized merchandising strategies, and dedicated health food sections attracting wellness-conscious shoppers seeking convenient access to specialty nutritional products. Major retail chains across Saudi Arabia maintain comprehensive quinoa product assortments spanning conventional, organic, and specialty varieties addressing diverse consumer preferences and budgetary considerations. The channel benefits substantially from strong consumer trust, convenient geographic accessibility, and ability to offer competitive pricing through bulk purchasing advantages, supplier negotiations, and strategic promotional activities driving consumer trial and repeat purchases.

Saudi Arabia's continuously expanding modern retail infrastructure supports sustained channel growth as leading retailers invest significantly in store network expansions and enhanced shopping experiences incorporating dedicated wellness sections. The channel's market dominance reflects Saudi consumers' established preference for one-stop shopping destinations offering diverse product selections, consistent quality assurance, and value-oriented pricing structures supporting regular quinoa purchases for household consumption. Supermarkets and hypermarkets provide ideal environments for consumer education through in-store promotions, product demonstrations, and informative packaging highlighting quinoa's nutritional benefits. The channel's extensive reach across urban centers and expanding suburban communities positions it as the primary gateway for quinoa market penetration throughout the Kingdom.

End Use Insights:

- Ingredient

- Packaged Food

Ingredient represents the leading segment with 60% share of the total Saudi Arabia quinoa market in 2025.

The ingredient segment leads end-use applications as food manufacturers increasingly incorporate quinoa into processed food formulations targeting health-conscious consumer segments seeking enhanced nutritional profiles in everyday food products. Quinoa flour, flakes, and whole grain formats serve diverse manufacturing applications spanning bakery products, breakfast cereals, nutritional bars, pasta alternatives, and ready-to-eat meal solutions requiring protein fortification. The segment benefits substantially from quinoa's exceptional functional properties including high protein content, excellent binding characteristics, moisture retention capabilities, and gluten-free formulation compatibility supporting clean-label product development aligned with contemporary consumer preferences.

Industrial demand for quinoa ingredients continues expanding as manufacturers respond proactively to consumer preferences for nutrient-dense, naturally sourced food components delivering tangible health benefits. The Kingdom's food processing sector demonstrates growing investment in product innovation utilizing quinoa as a key functional ingredient enhancing nutritional profiles across diverse product categories. Local manufacturers are actively developing quinoa-based products tailored to regional taste preferences and culinary traditions while international brands introduce quinoa-containing product lines to capture Saudi Arabia's health food market growth opportunities. The segment's expansion reflects broader industry recognition of quinoa's versatility as a premium functional ingredient supporting product differentiation and nutritional enhancement strategies.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region exhibits a clear dominance with 30% share of the total Saudi Arabia quinoa market in 2025.

The Northern and Central Region leads Saudi Arabia's quinoa market driven by Riyadh's concentration of health-conscious urban consumers, premium retail infrastructure, and higher disposable income levels enabling specialty food purchases and wellness-oriented consumption patterns. The capital city's cosmopolitan population demonstrates strong awareness of global health food trends and notable willingness to incorporate superfoods like quinoa into regular dietary routines. Extensive modern retail development throughout Riyadh provides consumers convenient access to diverse quinoa product assortments across supermarkets, hypermarkets, specialty health food stores, and emerging organic retail concepts catering to discerning wellness-focused shoppers.

The region benefits from concentrated food service industry presence including upscale restaurants, international hotels, corporate catering operations, and health-focused cafes featuring quinoa-based menu offerings appealing to cosmopolitan consumers. Strong e-commerce infrastructure facilitates convenient online quinoa purchases for digitally-savvy consumers seeking efficient home delivery options complementing busy urban lifestyles. Government initiatives supporting healthy lifestyles and food security under Vision 2030 continue strengthening the region's position as the Kingdom's primary quinoa consumption hub. Ongoing retail expansion, consumer education campaigns promoting nutritious food alternatives, and growing fitness culture collectively reinforce the Northern and Central Region's market leadership within Saudi Arabia's evolving quinoa landscape.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Quinoa Market Growing?

Rising Health Consciousness and Demand for Nutritious Food Alternatives

The escalating health awareness among Saudi consumers represents a fundamental driver propelling quinoa market expansion. Growing prevalence of lifestyle-related health conditions including obesity, diabetes, and cardiovascular diseases has prompted consumers to seek healthier dietary alternatives supporting wellness objectives. Quinoa's exceptional nutritional profile featuring complete protein content, high fiber levels, and essential minerals positions it as an ideal substitute for refined grains. The Kingdom's younger demographic segments demonstrate particularly strong interest in superfoods and functional nutrition supporting active lifestyles. Fitness culture expansion across Saudi Arabia has created substantial demand for high-protein, low-glycemic foods aligning with athletic performance and weight management goals.

Government Initiatives Supporting Food Security and Sustainable Agriculture

Saudi Arabia's Vision 2030 framework encompasses comprehensive initiatives promoting food security, agricultural sustainability, and reduced import dependency driving favorable conditions for quinoa market development. Government programs supporting organic farming practices and sustainable agricultural development create supportive policy environments encouraging healthy food consumption. The Ministry of Environment, Water and Agriculture's active promotion of organic food awareness through initiatives including the Organic Food Day 2024 public awareness campaign demonstrates institutional commitment to encouraging healthier dietary choices. The Sustainable Agricultural Rural Development Program provides incentives for expanding organic and specialty food production projects, potentially supporting future domestic quinoa cultivation initiatives. Agricultural Development Fund financing programs assist farmers and food businesses in developing sustainable operations.

Expansion of Modern Retail Infrastructure and Distribution Networks

The continuous expansion of supermarkets, hypermarkets, and specialty retail outlets across Saudi Arabia significantly enhances quinoa product accessibility driving market penetration. Major retail chains are investing substantially in store network expansion and enhanced health food sections accommodating growing consumer demand for nutritious alternatives. Modern retail formats provide organized merchandising environments enabling effective quinoa product positioning and consumer education through point-of-sale materials. The e-commerce channel demonstrates rapid growth as digital-savvy consumers embrace convenient online grocery shopping platforms offering expanded quinoa product selections. Strengthening cold chain logistics and last-mile delivery capabilities further support quinoa distribution efficiency across urban and suburban markets throughout the Kingdom.

Market Restraints:

What Challenges the Saudi Arabia Quinoa Market is Facing?

Heavy Reliance on Imports and Supply Chain Vulnerabilities

Saudi Arabia's quinoa market remains predominantly dependent on imports from South American producing countries, creating exposure to international supply chain disruptions and price volatility. The absence of significant domestic quinoa cultivation limits local supply control and creates vulnerability to global market fluctuations. Transportation costs and import logistics add complexity affecting product pricing competitiveness and availability consistency across distribution channels.

Premium Pricing Limiting Mass Market Penetration

Quinoa commands significantly higher prices compared to traditional grains like rice and wheat, constraining adoption among price-sensitive consumer segments. Organic quinoa variants carry additional premiums further limiting accessibility for mainstream households. The pricing differential poses challenges for manufacturers seeking to develop affordable quinoa-based products capable of competing with conventional grain alternatives in mass market retail channels.

Limited Consumer Awareness and Culinary Familiarity

Despite growing health consciousness, significant portions of Saudi consumers remain unfamiliar with quinoa's nutritional benefits and culinary preparation methods. Traditional dietary preferences favoring rice and wheat-based foods present adoption barriers requiring sustained consumer education efforts. The lack of established quinoa-based recipes within local cuisine limits integration into everyday meal planning for households unfamiliar with the ingredient.

Competitive Landscape:

The Saudi Arabia quinoa market exhibits a fragmented competitive landscape characterized by the presence of international quinoa brands, regional health food distributors, and local specialty retailers. Market participants compete primarily on product quality, organic certification credentials, pricing strategies, and distribution network reach. Companies are investing in brand building, consumer education initiatives, and retail partnerships to strengthen market positioning. Strategic collaborations between international suppliers and local distributors facilitate market entry and expansion. Players are diversifying product portfolios to include conventional, organic, and value-added quinoa formats addressing varied consumer preferences. The competitive environment continues intensifying as health food demand growth attracts new market entrants seeking opportunities within Saudi Arabia's expanding wellness-oriented consumer segment.

Saudi Arabia Quinoa Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Organic, Conventional |

| Product Types Covered | Red Quinoa, Black Quinoa, White Quinoa, Others |

| Applications Covered | Food and Beverages, Cosmetics, Pharmaceuticals, Animal Feed, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Traditional Retail Stores, Convenience Stores, Online, Others |

| End Uses Covered | Ingredient, Packaged Food |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia quinoa market size was valued at USD 13.38 Million in 2025.

The Saudi Arabia quinoa market is expected to grow at a compound annual growth rate of 6.22% from 2026-2034 to reach USD 23.03 Million by 2034.

Conventional dominated the market with a share of 56%, driven by established import channels, competitive pricing, and widespread availability across mainstream retail distribution networks serving diverse consumer segments.

Key factors driving the Saudi Arabia quinoa market include rising health consciousness, growing demand for gluten-free alternatives, government initiatives supporting food security, expanding modern retail infrastructure, and increasing consumer awareness about quinoa's nutritional benefits.

Major challenges include heavy reliance on imports creating supply chain vulnerabilities, premium pricing limiting mass market penetration, limited domestic production capabilities, and insufficient consumer awareness about quinoa preparation and culinary applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)