Saudi Arabia Railway System Market Size, Share, Trends and Forecast by Transit Type, System Type, Application, and Region, 2026-2034

Saudi Arabia Railway System Market Overview:

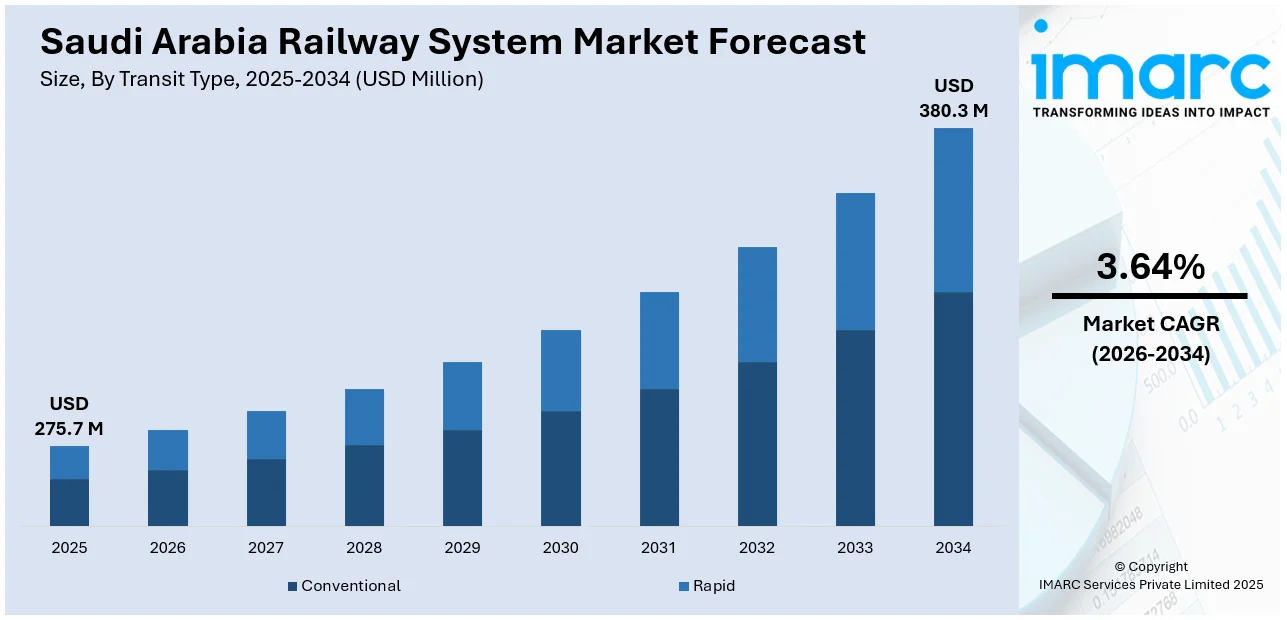

The Saudi Arabia railway system market size reached USD 275.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 380.3 Million by 2034, exhibiting a growth rate (CAGR) of 3.64% during 2026-2034. The growing investments in infrastructure development, rising urbanization, implementation of government initiatives, increasing demand for efficient public transport, expansion of freight networks, and adoption of advanced rail technologies are expanding the Saudi Arabia railway system market share and improving connectivity, supporting economic diversification, and reducing dependency on oil-based transportation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 275.7 Million |

| Market Forecast in 2034 | USD 380.3 Million |

| Market Growth Rate 2026-2034 | 3.64% |

Saudi Arabia Railway System Market Trends:

Rising Urbanization and Demand for Mass Transit Solutions

Rapid urbanization in Saudi Arabia, particularly in major cities such as Riyadh, Jeddah, Mecca, and Dammam, is driving substantial demand for efficient, high-capacity public transportation systems. As urban centers expand both in population and spatial footprint, there is growing pressure on existing road networks, which are increasingly unable to support the growing volume of daily commuters and commercial traffic. According to an industry report, urban populations across the Gulf Cooperation Council (GCC) region are projected to grow by 30 percent between 2020 and 2030. This trend is especially pronounced in Saudi Arabia due to its ongoing urban development programs and population growth. This shift is accelerating investment in modern rail infrastructure as a long-term solution to mitigate congestion, reduce vehicular emissions, and offer reliable alternatives to car-based travel. In response, the government is expanding urban rail systems, such as the Riyadh Metro and Jeddah Metro, to offer accessible alternatives for transport, which is positively impacting Saudi Arabia railway system market outlook. These metro systems are designed to serve millions of passengers daily and are structured to integrate with buses, ride-sharing services, and last-mile mobility platforms. Apart from this, urban rail projects are also implemented with a focus on comfort, safety, and digital ticketing to improve user experience and encourage public transport adoption. Moreover, increased focus on transit-oriented development is also influencing city planning and infrastructure design in major metropolitan areas.

To get more information on this market Request Sample

Government-Led Infrastructure Investments and Vision 2030 Projects

Saudi Arabia’s railway development is significantly influenced by large-scale public investments and the Kingdom’s national transformation plan. The kingdom is prioritizing rail connectivity as part of its strategy to diversify the economy, reduce dependence on oil revenues, and improve national logistics performance. For instance, on November 22, 2024, Saudi Arabia's Ministry of Transport and Logistic Services announced a USD 4 Billion investment to strengthen the domestic rail industry and promote economic diversification. This aims to raise the percentage of local content in SAR activities to 60% by 2025. This initiative is expected to create up to 3,000 jobs, enhance operational efficiency, and develop local human capital. The announcement underscores the Kingdom's commitment to advancing its rail infrastructure, which now spans over 5,500 kilometers, including key routes like the North Network and the East Network. Additionally, public agencies such as the Saudi Railway Company (SAR) and the Royal Commission for Riyadh City are managing multi-billion-dollar railway initiatives. The projects are supported through public-private partnerships (PPPs), foreign direct investment, and sovereign funding via the Public Investment Fund (PIF). The scale and coordination of infrastructure expansion under government supervision are driving consistent Saudi Arabia railway system market growth, which is also generating employment, attracting international players, and improving intermodal logistics capabilities across the Kingdom.

Saudi Arabia Railway System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on transit type, system type, and application.

Transit Type Insights:

- Conventional

- Diesel Locomotive

- Electric Locomotive

- Electro-Diesel Locomotive

- Coaches

- Rapid

- Diesel Multiple Unit (DMU)

- Electric Multiple Unit (EMU)

- Light Rail/ Tram

The report has provided a detailed breakup and analysis of the market based on the transit type. This includes conventional (diesel locomotive, electric locomotive, electro-diesel locomotive, and coaches) and rapid (diesel multiple unit (DMU), electric multiple unit (EMU), and light rail/tram).

System Type Insights:

- Auxiliary Power System

- Train Information System

- Propulsion System

- Train Safety System

- HVAC System

- On-Board Vehicle Control

A detailed breakup and analysis of the market based on the system type have also been provided in the report. This includes auxiliary power system, train information system, propulsion system, train safety system, HVAC system, and on-board vehicle control.

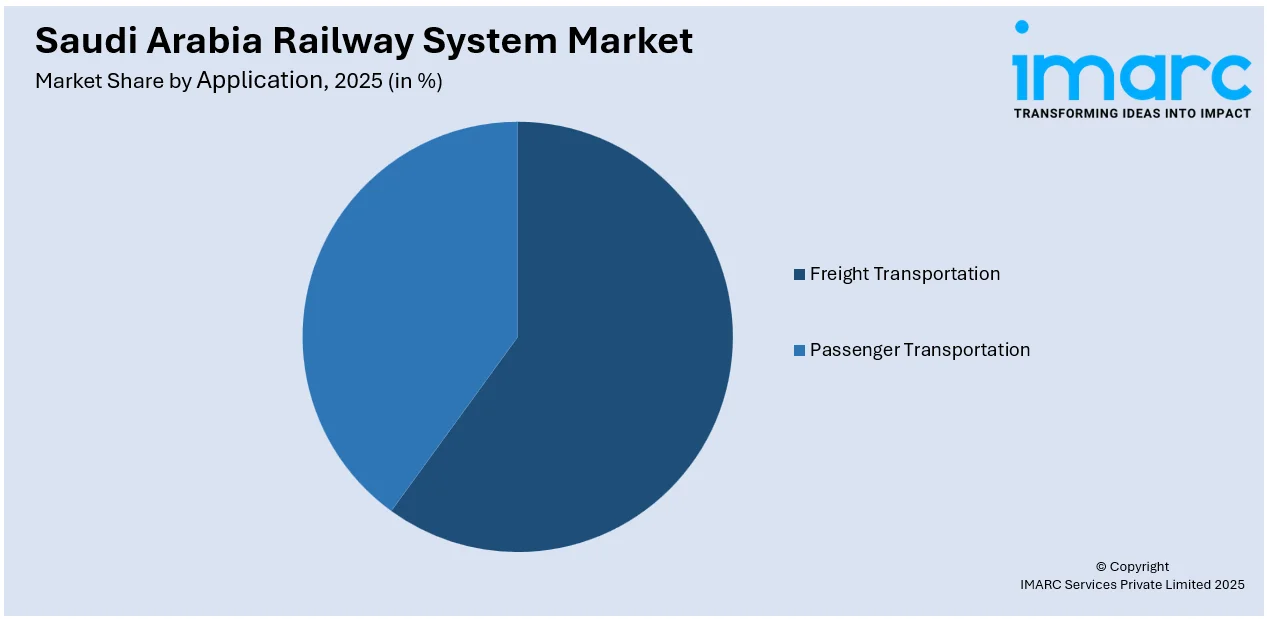

Application Insights:

Access the comprehensive market breakdown Request Sample

- Freight Transportation

- Passenger Transportation

The report has provided a detailed breakup and analysis of the market based on the application. This includes freight transportation and passenger transportation.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Railway System Market News:

- On October 2, 2024, the Saudi Arabia Railways (SAR) announced plans to expand and modernize its North-South passenger rail fleet by issuing an Expression of Interest to global rail manufacturers. The initiative includes acquiring 15 new train sets, each comprising two power cars and five passenger coaches, capable of speeds up to 200 km/h, along with eight additional power cars in reserve. These trains will be designed to withstand Saudi Arabia's extreme heat and offer amenities such as Wi-Fi connectivity and advanced passenger information systems. A mandatory 10-year maintenance agreement is also part of the procurement to ensure long-term reliability.

- On April 6, 2025, the Saudi Railway Company (SAR) issued a public tender inviting bids for Lead Design Consultancy Services for the Saudi Landbridge Railway Network. The selected consultant will be responsible for the Concept Design Stage, with options to extend to Preliminary and Issued for Construction (IFC) Design Stages. The project aims to establish a passenger and logistics network exceeding 2,000 kilometers, connecting the Red Sea to the east coast, thereby linking the Port of Dammam with Jeddah. This initiative is part of Saudi Arabia's broader strategy to enhance its transportation infrastructure and facilitate economic diversification.

Saudi Arabia Railway System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Transit Types Covered |

|

| System Types Covered | Auxiliary Power System, Train Information System, Propulsion System, Train Safety System, HVAC System, On-Board Vehicle Control |

| Applications Covered | Freight Transportation, Passenger Transportation |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia railway system market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia railway system market on the basis of transit type?

- What is the breakup of the Saudi Arabia railway system market on the basis of system type?

- What is the breakup of the Saudi Arabia railway system market on the basis of application?

- What is the breakup of the Saudi Arabia railway system market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia railway system market?

- What are the key driving factors and challenges in the Saudi Arabia railway system market?

- What is the structure of the Saudi Arabia railway system market and who are the key players?

- What is the degree of competition in the Saudi Arabia railway system market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia railway system market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia railway system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia railway system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)