Saudi Arabia Rainwater Harvesting Market Size, Share, Trends and Forecast by Harvesting Method, End User, and Region, 2026-2034

Saudi Arabia Rainwater Harvesting Market Overview:

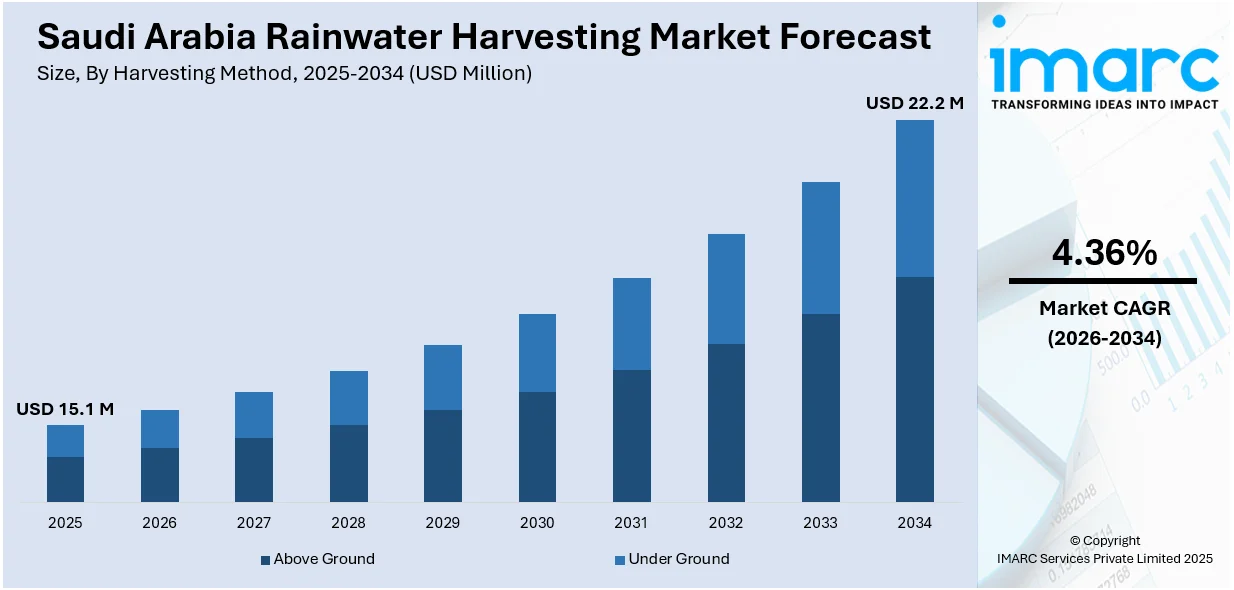

The Saudi Arabia rainwater harvesting market size reached USD 15.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 22.2 Million by 2034, exhibiting a growth rate (CAGR) of 4.36% during 2026-2034. The market is fueled by the nation's water shortage, dependence on desalination, and demand for sustainable water sources. Increased awareness about environmental protection, government policies for water management, and the use of green building techniques further drive demand for rainwater harvesting systems in urban and rural communities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 15.1 Million |

| Market Forecast in 2034 | USD 22.2 Million |

| Market Growth Rate 2026-2034 | 4.36% |

Saudi Arabia Rainwater Harvesting Market Trends:

Integration with Smart Water Management Systems

The Saudi Arabia rainwater harvesting market outlook is witnessing the growing trend of adopting harvesting systems while incorporating smart water management technologies. The increasing lack of water is popularizing the application of Internet of Things (IoT) devices and smart sensors in rainwater harvesting systems. These intelligent technologies assist in the monitoring of water levels, optimizing water consumption, and sensing issues like leaks or overflows, improving the general efficiency of rainwater harvesting and distribution. The smart systems also have the capability to automatically change between harvested rainwater and municipal supplies depending on availability, thus providing a consistent water source all the time. This trend complements Saudi Arabia's drive toward technological innovation within its Vision 2030 initiative, which places emphasis on sustainability and resource maximization. Increased uptake of IoT-capable rainwater harvesting technologies is likely to continue as organizations and consumers demand smarter, more efficient means to manage water within an environment with water scarcity.

To get more information on this market Request Sample

Focus on Residential and Commercial Buildings

Rainwater harvesting is being more commonly incorporated into both residential and commercial structures in Saudi Arabia as a component of sustainable water management techniques. With high rates of urbanization and increased residential and commercial areas, especially in cities such as Riyadh and Jeddah, there has been an enhanced demand for supplementary water sources. In residential complexes, rainwater harvesting systems are being fitted to augment water for non-potable purposes like irrigation, landscaping, and toilet flushing, thereby decreasing dependence on the municipal water supply. Likewise, commercial buildings, including hotels, malls, and office complexes, are implementing rainwater harvesting systems to increase sustainability measures and lower water bills. Government policies are also promoting the installation of rainwater harvesting systems in new constructions as part of larger sustainability and green building programs. This trend is likely to spur the Saudi Arabia rainwater harvesting market growth, owing to the significance of environmental stewardship and resource conservation in the urban development of the Kingdom.

Government Support and Regulations

The government of Saudi Arabia is playing a critical role in driving the development of the rainwater harvesting market with policy backing and regulations. The government, under the Kingdom's Vision 2030, is focusing heavily on sustainability and water conservation to cushion the impacts of water scarcity. This encompasses offering financial incentives, grants, and subsidies for the installation of rainwater harvesting systems in residential and commercial buildings. In addition to this, the government is implementing regulations that mandate new developments to include water-conserving technologies, such as rainwater harvesting, in their environmental impact statements. All these initiatives are aimed at encouraging water security, breaking the reliance on desalinated water, and ensuring the long-term sustainable use of water resources.

For example, recently, in February 2024, the National Center for Vegetation Development and Combating Desertification (NCVC) initiated a significant project aimed at restoring 620,000 hectares of degraded land in Saudi Arabia. The initiative will implement rainwater collection methods to enhance plant growth in nine areas throughout the nation. It will entail analyzing the practicality of executing rehabilitation initiatives in three primary climatic zones: continental, coastal, and mountainous. This includes pinpointing target locations, suitable rainwater collection methods, and the actions to be undertaken in each area. NCVC will gather climate and hydrological information, examine topographic and survey maps, and evaluate satellite images. Field visits will be undertaken to gather soil and water samples, perform field measurements and laboratory analyses, and map out the drainage network of the primary basins in the research areas. Various technological developments with the aid of the government is likely to support the expansion of the Saudi Arabia rainwater harvesting market share further in the coming years.

Saudi Arabia Rainwater Harvesting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on harvesting method and end user.

Harvesting Method Insights:

- Above Ground

- Under Ground

The report has provided a detailed breakup and analysis of the market based on the harvesting method. This includes above ground and under ground.

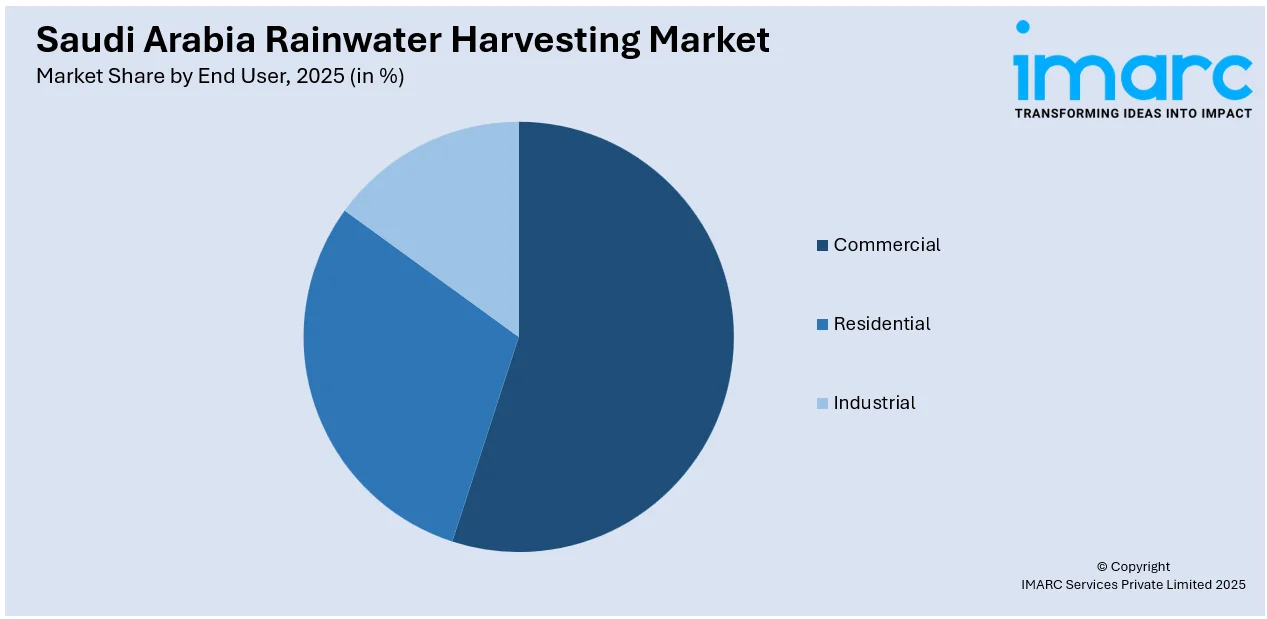

End User Insights:

Access the comprehensive market breakdown Request Sample

- Commercial

- Residential

- Industrial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes commercial, residential, and industrial.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Rainwater Harvesting Market News:

- In February 2024, a significant initiative to restore 620,000 hectares of damaged land has been initiated by the National Center for Vegetation Development and Combating Desertification (NCVC) In Saudi Arabia. The project would increase the amount of vegetation cover in nine different regions of the nation by using rainwater harvesting techniques.

Saudi Arabia Rainwater Harvesting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Harvesting Methods Covered | Above Ground, Under Ground |

| End Users Covered | Commercial, Residential, Industrial |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia rainwater harvesting market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia rainwater harvesting market on the basis of harvesting method?

- What is the breakup of the Saudi Arabia rainwater harvesting market on the basis of end user?

- What is the breakup of the Saudi Arabia rainwater harvesting market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia rainwater harvesting market?

- What are the key driving factors and challenges in the Saudi Arabia rainwater harvesting market?

- What is the structure of the Saudi Arabia rainwater harvesting market and who are the key players?

- What is the degree of competition in the Saudi Arabia rainwater harvesting market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia rainwater harvesting market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia rainwater harvesting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia rainwater harvesting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)