Saudi Arabia Ready Mix Concrete Market Size, Share, Trends and Forecast by Product, End Use Sector, and Region, 2026-2034

Saudi Arabia Ready Mix Concrete Market Overview:

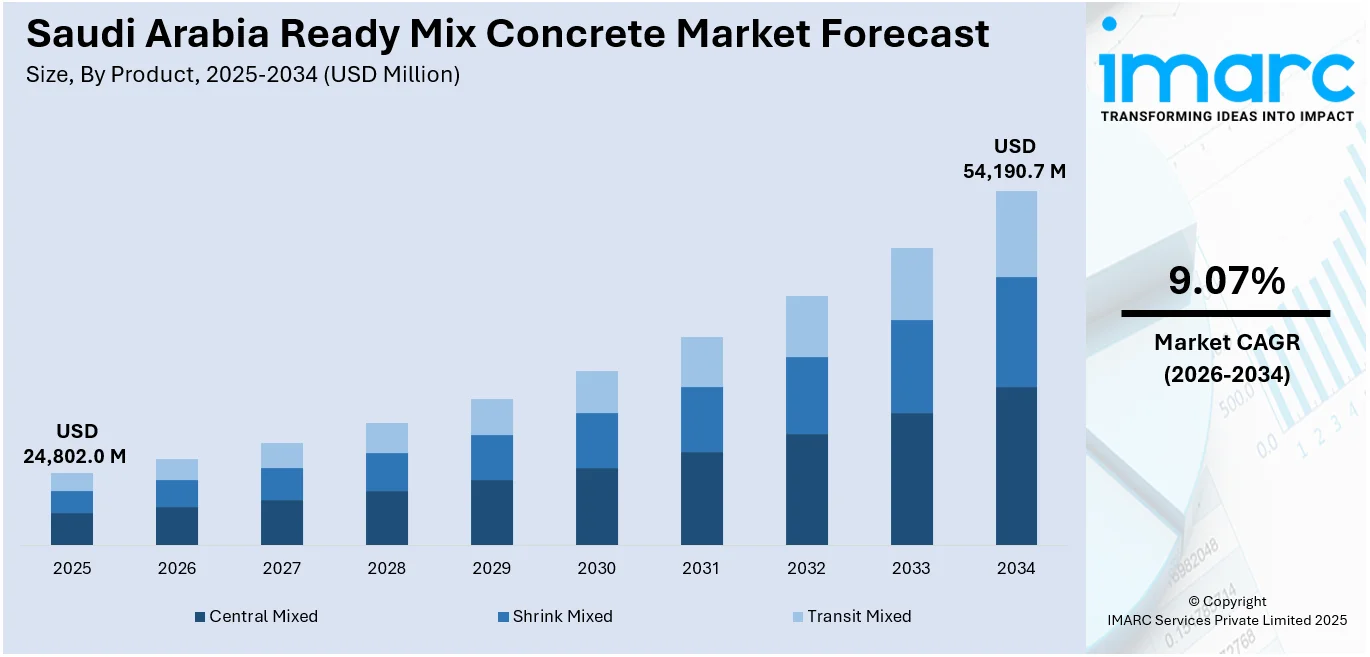

The Saudi Arabia ready mix concrete market size reached USD 24,802.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 54,190.7 Million by 2034, exhibiting a growth rate (CAGR) of 9.07% during 2026-2034. The market is fueled by swift urbanization, massive infrastructure developments under Vision 2030, growing need for green building materials, and heightened government investment in housing and transport. All these factors are anticipated to have a positive impact on the Saudi Arabia ready mix concrete market share in the next few years.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 24,802.0 Million |

|

Market Forecast in 2034

|

USD 54,190.7 Million |

| Market Growth Rate 2026-2034 | 9.07% |

Saudi Arabia Ready Mix Concrete Market Trends:

Integration of Smart Construction Technologies

The Saudi Arabia ready mix concrete market is witnessing a significant shift towards the integration of smart construction technologies. The adoption of automation in batching plants, coupled with real-time monitoring systems, ensures precise control over concrete mix proportions and quality. This technological advancement not only enhances operational efficiency but also reduces human error, leading to consistent product quality. Furthermore, the implementation of Internet of Things (IoT) sensors in transit mixers allows for tracking and managing concrete delivery, optimizing logistics, and minimizing delays. These innovations align with the Kingdom's Vision 2030 objectives by promoting efficiency and sustainability in the construction sector, thereby contributing to the overall Saudi Arabia ready mix concrete market growth. For instance, in November 2024, Saudi Readymix and Finland’s Betolar jointly launched two new low-CO₂ concrete products in Saudi Arabia, using ground granulated blast furnace slag and natural pozzolans via Betolar’s Geoprime technology. One mix is cement-free; the other has ultra-low cement content (2.5%).

To get more information on this market Request Sample

Emphasis on Sustainable and Green Building Practices

Sustainability has emerged as a pillar in the Saudi Arabia ready mix concrete industry, prompted by regulatory measures as well as market forces. The use of recycled materials like fly ash, slag, and recycled aggregates in concrete mixes is becoming increasingly popular. These activities not only decrease the use of virgin resources but also reduce the carbon intensity of construction processes. The Saudi Green Building Code requires the use of sustainable materials and energy-efficient processes, further encouraging the use of sustainable concrete solutions. Consequently, ready mix concrete manufacturers are increasingly making investments in technology and processes that meet environmental standards, becoming leaders in sustainable construction. For instance, in November 2024, Saudi Readymix and Aramco partnered to develop a lower-carbon concrete alternative, aiming to reduce emissions in Saudi Arabia’s construction sector. The collaboration focuses on optimizing AL-ECC, a cost-effective cementitious composite made from local materials. A successful pavement demonstration highlights the potential for sustainable, jointless, thinner concrete with lower environmental impact.

Saudi Arabia Ready Mix Concrete Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2026-2034. Our report has categorized the market based on product and end use sector.

Product Insights:

- Central Mixed

- Shrink Mixed

- Transit Mixed

The report has provided a detailed breakup and analysis of the market based on the product. This includes central mixed, shrink mixed, and transit mixed.

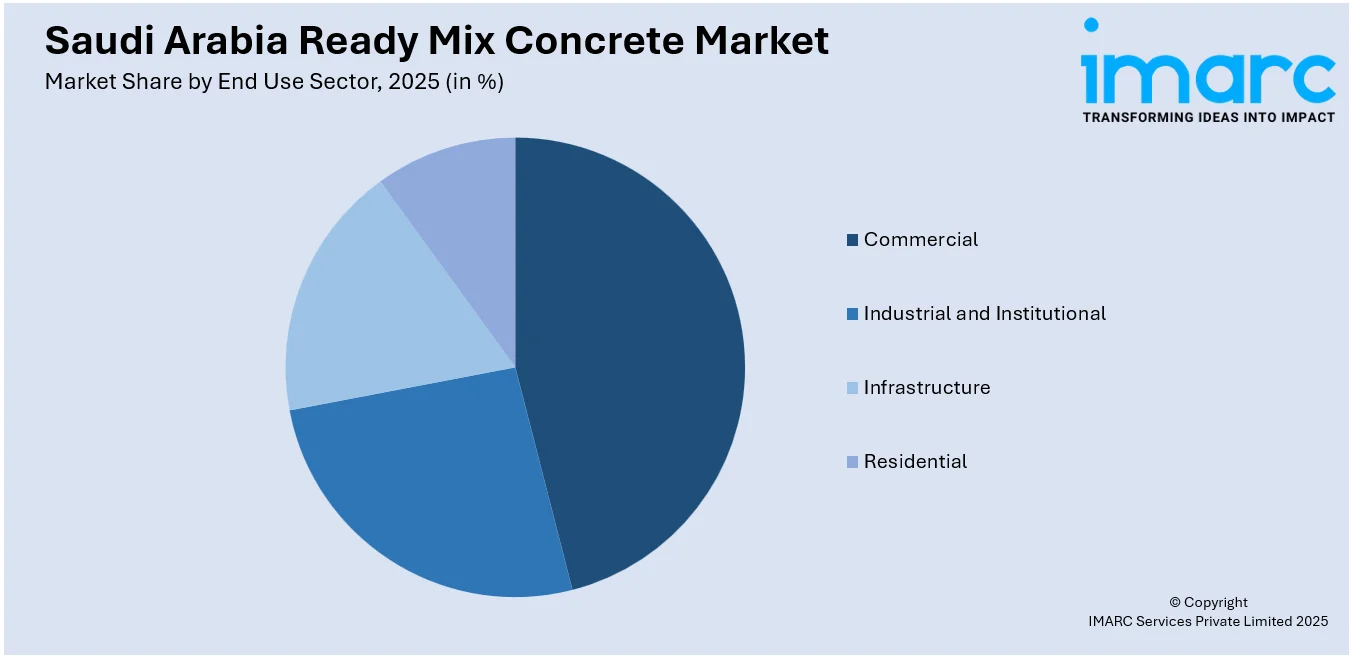

End Use Sector Insights:

Access the comprehensive market breakdown Request Sample

- Commercial

- Industrial and Institutional

- Infrastructure

- Residential

A detailed breakup and analysis of the market based on the end use sector have also been provided in the report. This includes commercial, industrial and institutional, infrastructure, and residential.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Ready Mix Concrete Market News:

- In December 2024, Abdullah Abdin Ready-Mix Concrete, based in Saudi Arabia, achieved the Concrete Sustainability Council (CSC) certification, becoming the first ready-mix concrete company in the MENA region to earn this recognition. The certification highlights their commitment to sustainability, supporting Saudi Arabia's Vision 2030 and setting a new standard for responsible construction in the region.

- In October 2024, NEOM partnered with Asas Al-Mohileb to establish a SAR 700 million ready-mix concrete factory for the construction of THE LINE, a linear city in Saudi Arabia. The facility will produce over 20,000 cubic meters of green concrete daily, supporting the project’s rapid progress. The factory incorporates carbon capture and energy-saving technologies, aligning with sustainable practices.

- In June 2024, Nuvoco Vistas launched Ecodure Thermal Insulated Concrete on World Environment Day. This eco-friendly concrete improves energy efficiency, reduces cooling needs, and lowers indoor temperatures by up to 3°C. It cuts energy use intensity by 5%, reduces cooling load by 6%, and construction costs with its lighter density, making it a sustainable solution for building efficiency and reduced carbon footprint.

Saudi Arabia Ready Mix Concrete Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Central Mixed, Shrink Mixed, Transit Mixed |

| End Use Sectors Covered | Commercial, Industrial and Institutional, Infrastructure, Residential |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia ready mix concrete market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia ready mix concrete market on the basis of product?

- What is the breakup of the Saudi Arabia ready mix concrete market on the basis of end use sector?

- What is the breakup of the Saudi Arabia ready mix concrete market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia ready mix concrete market?

- What are the key driving factors and challenges in the Saudi Arabia ready mix concrete market?

- What is the structure of the Saudi Arabia ready mix concrete market and who are the key players?

- What is the degree of competition in the Saudi Arabia ready mix concrete market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia ready mix concrete market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia ready mix concrete market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia ready mix concrete industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)