Saudi Arabia Recliner Chair Market Size, Share, Trends and Forecast by Product Type, Seating Arrangement, Material, Distribution Channel, End-User, and Region, 2026-2034

Saudi Arabia Recliner Chair Market Overview:

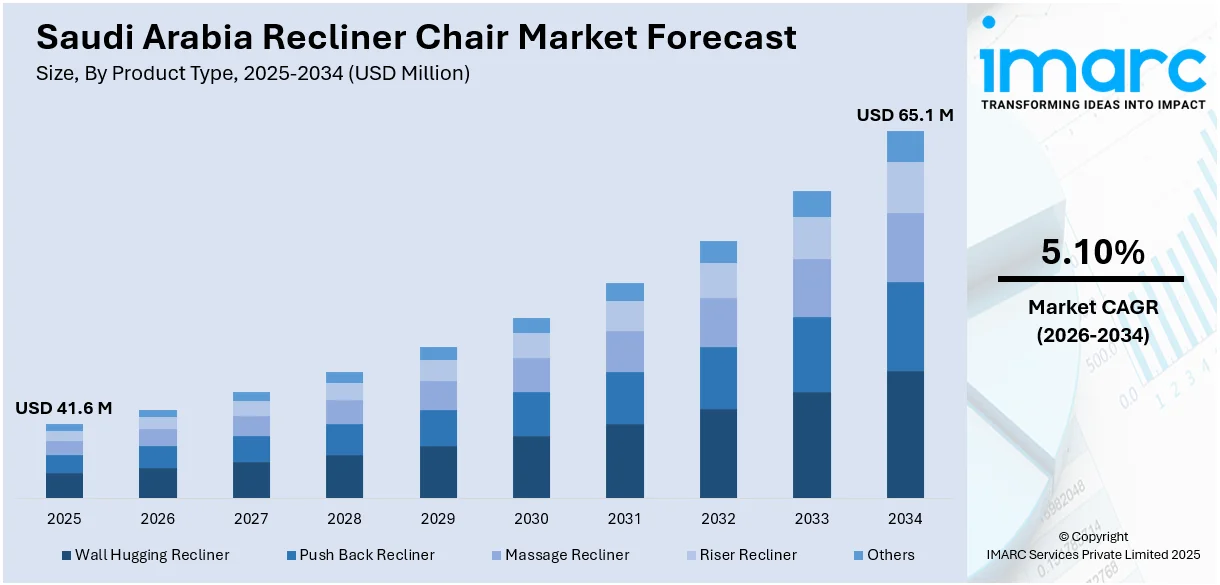

The Saudi Arabia recliner chair market size reached USD 41.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 65.1 Million by 2034, exhibiting a growth rate (CAGR) of 5.10% during 2026-2034. Rising disposable incomes, growing demand for comfort-driven furniture, increasing urbanization, and a shift toward modern living spaces are some of the factors propelling the growth of the market. Additionally, the popularity of home theaters and relaxation-focused lifestyles fuels market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 41.6 Million |

| Market Forecast in 2034 | USD 65.1 Million |

| Market Growth Rate 2026-2034 | 5.10% |

Saudi Arabia Recliner Chair Market Trends:

Growing Demand for Premium Seating in Entertainment Venues

The push toward upscale leisure experiences in Saudi Arabia is driving increased interest in high-comfort seating solutions. Luxury cinemas with plush interiors and enhanced viewing environments are becoming more common, reflecting changing consumer expectations. As entertainment spaces focus on delivering superior comfort, the demand for high-quality recliner chairs is seeing a noticeable rise, particularly in commercial settings. This aligns with broader lifestyle upgrades supported by Vision 2030, which is encouraging greater investment in hospitality and entertainment infrastructure with premium seating as a key differentiator. For example, in January 2023, Cinépolis launched its first luxury cinema in Saudi Arabia at Boulevard World, Riyadh. The theater features premium amenities and upscale interiors designed to offer a high-end viewing experience. This expansion reflects rising demand for luxury entertainment environments, potentially boosting commercial demand for recliner chairs in the country, especially in cinemas adopting comfort-focused seating to attract premium audiences in line with Vision 2030’s lifestyle and entertainment goals.

To get more information on this market Request Sample

Rising Interest in High-Comfort Seating across the Region

Premium seating solutions are gaining traction in Saudi Arabia’s furniture market, driven by evolving consumer preferences for greater comfort and design sophistication. Events attracting Gulf-based buyers highlight increasing attention on luxury recliner categories, particularly for residential and home entertainment use. Suppliers are actively engaging with regional buyers, signaling growing opportunities for high-end recliners in the Kingdom. This shift reflects broader lifestyle upgrades and heightened interest in personalized comfort-driven interiors across mid- to high-income households. For instance, in May 2024, Recliners India showcased its range of luxury seating solutions, including home theater and motorized recliners, at the Hive Furniture Show 2024 in Sharjah. The event drew strong interest from Gulf region buyers, highlighting growing demand for premium seating across the Middle East. This participation points to increased supplier engagement with Saudi Arabia’s furniture sector, supporting the expanding market for high-comfort recliner chairs in residential and entertainment settings.

Saudi Arabia Recliner Chair Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type, seating arrangement, material, distribution channel, and end-user.

Product Type Insights:

- Wall Hugging Recliner

- Push Back Recliner

- Massage Recliner

- Riser Recliner

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes wall hugging recliner, push back recliner, massage recliner, riser reclin\r, and others.

Seating Arrangement Insights:

- Single Seater Recliner

- Multi Seater Recliner

A detailed breakup and analysis of the market based on the seating arrangement have also been provided in the report. This includes single seater recliner and multi seater recliner.

Material Insights:

- Leather

- Fabric

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes leather, fabric, and others.

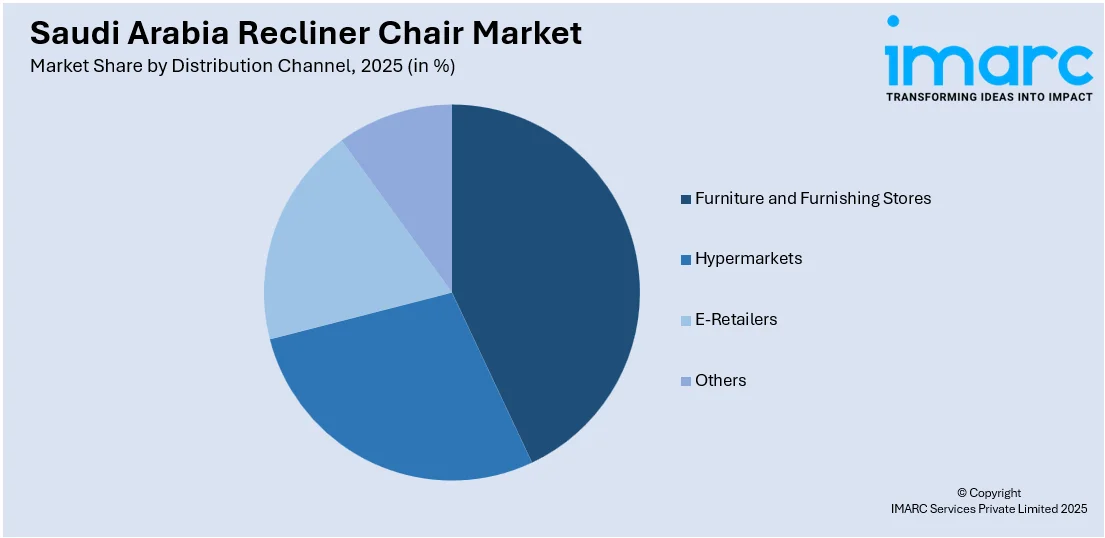

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Furniture and Furnishing Stores

- Hypermarkets

- E-Retailers

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes furniture and furnishing stores, hypermarkets, e-retailers, and others.

End-User Insights:

- Residential

- Commercial

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes residential, commercial, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Recliner Chair Market News:

- In May 2024, a multifunctional recliner chair with rocking and swivel features became available through online platforms in Saudi Arabia, signaling a growing demand for comfort-oriented furniture. The product’s presence on major e-commerce sites reflects rising consumer interest in ergonomic home seating. This aligns with broader market momentum driven by urban lifestyle upgrades and increasing preference for versatile, premium recliner chairs across the Kingdom’s expanding residential furniture segment.

Saudi Arabia Recliner Chair Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Wall Hugging Recliner, Push Back Recliner, Massage Recliner, Riser Recliner, Others |

| Seating Arrangements Covered | Single Seater Recliner, Multi Seater Recliner |

| Materials Covered | Leather, Fabric, Others |

| Distribution Channels Covered | Furniture and Furnishing Stores, Hypermarkets, E-Retailers, Others |

| End-Users Covered | Residential, Commercial, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia recliner chair market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia recliner chair market on the basis of product type?

- What is the breakup of the Saudi Arabia recliner chair market on the basis of seating arrangement?

- What is the breakup of the Saudi Arabia recliner chair market on the basis of material?

- What is the breakup of the Saudi Arabia recliner chair market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia recliner chair market on the basis of end-user?

- What are the various stages in the value chain of the Saudi Arabia recliner chair market?

- What are the key driving factors and challenges in the Saudi Arabia recliner chair?

- What is the structure of the Saudi Arabia recliner chair market and who are the key players?

- What is the degree of competition in the Saudi Arabia recliner chair market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia recliner chair market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia recliner chair market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia recliner chair industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)