Saudi Arabia Refrigerant Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2026-2034

Saudi Arabia Refrigerant Market Overview:

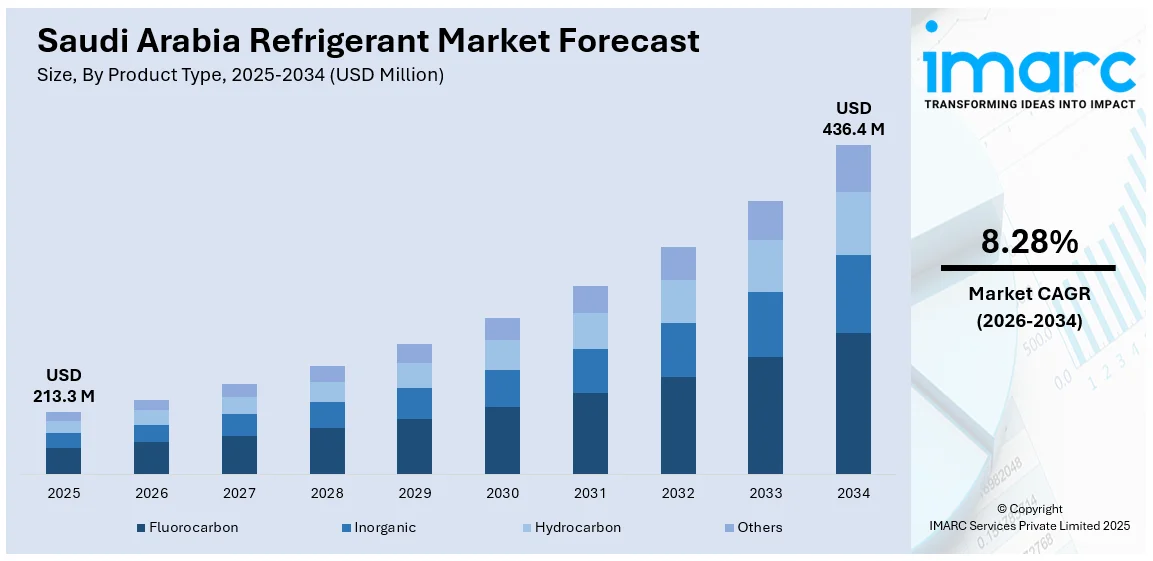

The Saudi Arabia refrigerant market size reached USD 213.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 436.4 Million by 2034, exhibiting a growth rate (CAGR) of 8.28% during 2026-2034. The market is driven by growing demand for air conditioning due to extreme climate conditions, rapid urbanization, and expansion in commercial and residential real estate. Rising investments in cold chain logistics, food processing, and industrial HVAC systems also contribute, alongside regulatory shifts toward sustainable, low-GWP refrigerant alternatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 213.3 Million |

| Market Forecast in 2034 | USD 436.4 Million |

| Market Growth Rate 2026-2034 | 8.28% |

Saudi Arabia Refrigerant Market Trends:

Transition Toward Low-GWP Refrigerants in Building HVAC

A notable trend in Saudi Arabia’s refrigerant market is the shift toward low-global warming potential (GWP) refrigerants in the building HVAC segment. The country's hot climate results in heavy reliance on centralized and split air conditioning systems in residential, commercial, and public infrastructure. With Saudi Arabia aligning its environmental policies to reduce carbon emissions under Vision 2030, building codes are increasingly favoring refrigerants like R-32 and R-290 over legacy options such as R-22 and R-410A. As developers adopt green building certifications and sustainable cooling systems, the market for low-GWP refrigerants is experiencing steady growth. Equipment manufacturers are also modifying their product lines to comply with these changes, reinforcing the long-term shift toward climate-resilient and energy-efficient refrigerant technologies in large-scale developments. For instance, in February 2025, Johnson Controls Arabia announced it has started exporting locally manufactured HVAC products to the United States, with nearly 100 Saudi-made chillers shipped for American public schools. Operating from King Abdullah Economic City, local production has surged to 90% from 30% in three years. The company now serves 26 countries, with 25–30% of 2025 output aimed at exports. It supports Saudi food security with refrigeration systems and expands into data center cooling, while advancing sustainability through its OpenBlue platform and Net Zero Center initiatives.

To get more information on this market Request Sample

Cold Chain Modernization in Food and Pharmaceutical Sectors

The modernization of cold chain infrastructure, especially for food distribution and pharmaceutical storage, is shaping demand for advanced refrigerant solutions in Saudi Arabia. With rising consumption of perishable foods and increased pharmaceutical imports, refrigerated storage and transport systems are undergoing rapid upgrades. These systems require reliable, temperature-stable refrigerants suitable for varying load and ambient conditions. As a result, there is growing use of ammonia and CO₂-based refrigerants, known for their thermal performance and low environmental impact. Government-led initiatives to enhance food security and healthcare logistics are reinforcing this trend, while private investments in refrigerated warehouses, hypermarkets, and vaccine distribution facilities are creating long-term opportunities for specialized refrigerant technologies that meet both safety and efficiency benchmarks. For instance, at the Saudi Food Manufacturing Exhibition 2025, WP Refrigeration announced the company's plan to achieve 100% local manufacturing under the “Made in Saudi” initiative. WP Refrigeration, based in Jeddah and partnered with Germany’s Bitzer, aims to expand operations in logistics for the food industry, introducing new refrigeration solutions to strengthen Saudi Arabia’s supply chains.

Saudi Arabia Refrigerant Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2026-2034. Our report has categorized the market based on product type and application.

Product Type Insights:

- Fluorocarbon

- Inorganic

- Hydrocarbon

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes fluorocarbon, inorganic, hydrocarbon, and others.

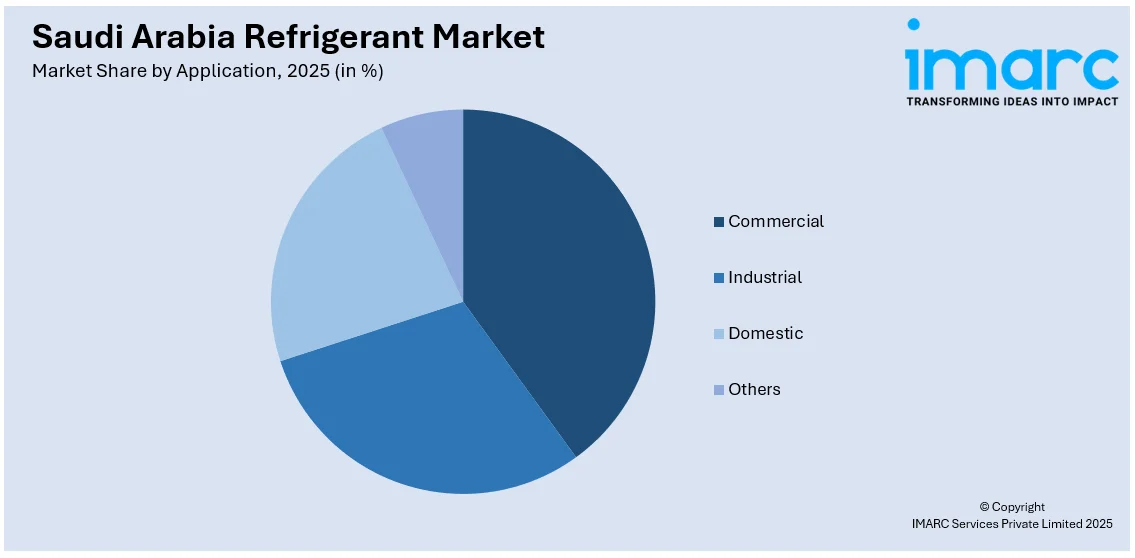

Application Insights:

Access the comprehensive market breakdown Request Sample

- Commercial

- Industrial

- Domestic

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial, industrial, domestic, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Refrigerant Market News:

- In February 2024, Carrier announced the construction of an advanced HVAC manufacturing and R&D facility in Saudi Arabia through a partnership with Alat, a new PIF company. The facility will produce VRF, chillers, AHUs, and rooftop units for the MENA region. This marks the first phase of their partnership, targeting the growing Middle East HVAC market, including the NEOM project.

- In February 2024, LG and its Saudi distributor, Shaker Group, are exploring the feasibility of manufacturing AC compressors in Saudi Arabia. They signed an MoU with the Ministry of Investment to conduct a local manufacturing feasibility study. This initiative aims to strengthen their existing joint venture in Riyadh, which produces AC units. The move aligns with Saudi Arabia's Vision 2030 to become an industrial leader in the air conditioning sector and its components, potentially making them pioneers in regional compressor manufacturing.

Saudi Arabia Refrigerant Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fluorocarbon, Inorganic, Hydrocarbon, Others |

| Applications Covered | Commercial, Industrial, Domestic, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia refrigerant market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia refrigerant market on the basis of product type?

- What is the breakup of the Saudi Arabia refrigerant market on the basis of application?

- What is the breakup of the Saudi Arabia refrigerant market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia refrigerant market?

- What are the key driving factors and challenges in the Saudi Arabia refrigerant market?

- What is the structure of the Saudi Arabia refrigerant market and who are the key players?

- What is the degree of competition in the Saudi Arabia refrigerant market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia refrigerant market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia refrigerant market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia refrigerant industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)