Saudi Arabia Refrigerated Transport Market Size, Share, Trends and Forecast by Mode of Transportation, Technology, Temperature, Application, and Region, 2026-2034

Saudi Arabia Refrigerated Transport Market Summary:

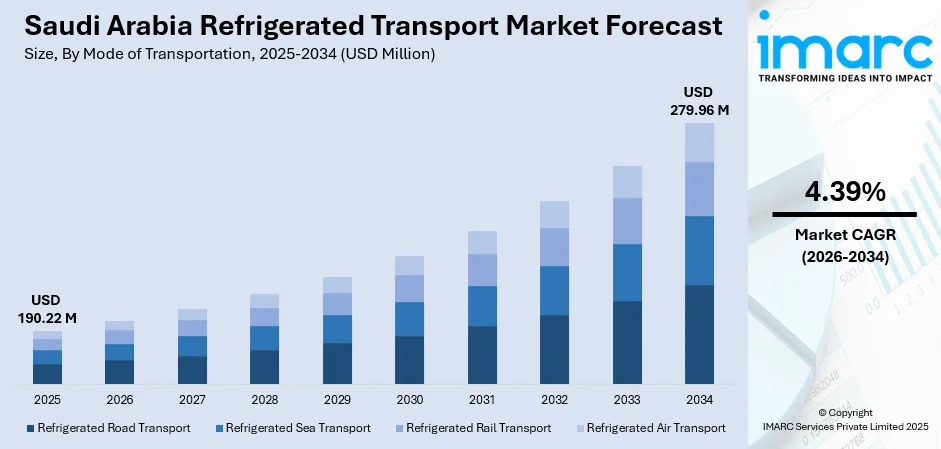

The Saudi Arabia refrigerated transport market size was valued at USD 190.22 Million in 2025 and is projected to reach USD 279.96 Million by 2034, growing at a compound annual growth rate of 4.39% from 2026-2034.

The Saudi Arabia refrigerated transport market is experiencing robust expansion driven by the Kingdom's ambitious Vision 2030 infrastructure development initiatives, rapid growth of e-commerce and online grocery platforms, and increasing investments in cold chain logistics by major domestic and international players. The convergence of rising consumer demand for fresh and frozen food products, expanding pharmaceutical distribution requirements, and government-led food security programs is fundamentally reshaping temperature-controlled logistics capabilities.

Key Takeaways and Insights:

- By Mode of Transportation: Refrigerated road transport dominates the market with a share of 39.62% in 2025, driven by the Kingdom's extensive road network, flexibility for last-mile deliveries, and suitability for diverse geographic terrains across urban and rural distribution points.

- By Technology: Air-blown evaporators lead the market with a share of 43.14% in 2025, owing to their cost-effectiveness, ease of maintenance, reliability in extreme desert temperatures, and widespread adoption across light and medium commercial refrigerated vehicles.

- By Temperature: Single-temperature represents the largest segment with a market share of 58.25% in 2025, reflecting the predominant demand for standardized temperature control solutions suitable for transporting chilled dairy, fresh produce, and pharmaceutical products requiring consistent cooling environments.

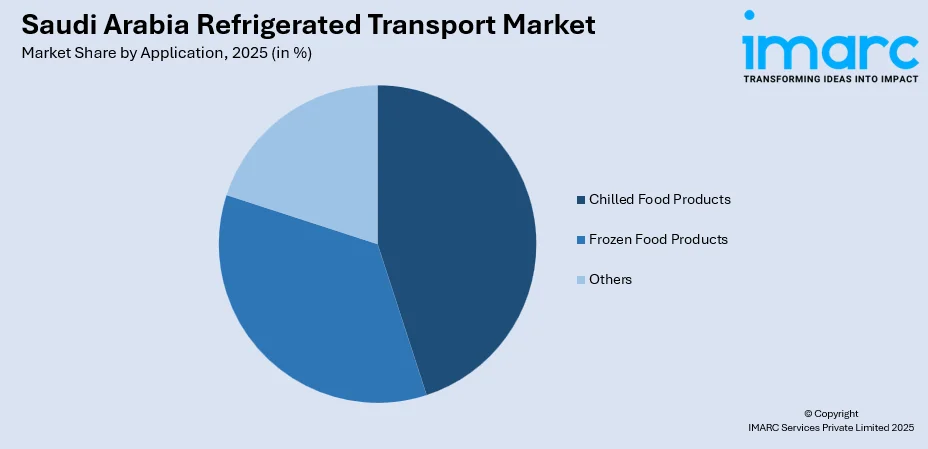

- By Application: Chilled food products dominates the market with a share of 32.66% in 2025, propelled by rising consumer preferences for fresh dairy, produce, and ready-to-eat meals, combined with expanding organized retail and quick-service restaurant networks.

- Key Players: The Saudi Arabia refrigerated transport market exhibits moderate competitive intensity, with global refrigeration technology providers competing alongside regional logistics operators and local fleet management companies across diverse temperature-controlled transportation segments.

To get more information on this market Request Sample

The Saudi Arabia refrigerated transport market is growing owing to the rising demand for dependable temperature-controlled logistics across food and beverage, pharmaceutical, and agricultural supply chains. Individuals expect steady access to fresh and premium perishable products, which encourages retailers and distributors to rely on vehicles that maintain stable cooling throughout long and short-haul routes. Hospitals, clinics, and laboratories also depend on controlled transport for sensitive medical items that require strict handling conditions. This growing demand for dependable temperature-controlled logistics is being significantly supported by infrastructure developments, as demonstrated by the 2024 partnership between Port Development Company (PDC) and MEDLOG Saudi to establish a 60,000-square-meter cold storage facility at King Abdullah Port, representing an SR 300 million investment. Furthermore, companies are adopting better monitoring tools to track temperature and reduce spoilage, while businesses across hospitality, catering, and e-commerce increasingly require frequent chilled deliveries.

Saudi Arabia Refrigerated Transport Market Trends:

Shift Toward Sustainable Transport Solutions

The rising interest in cleaner fuel alternatives for refrigerated fleets, as operators seek to reduce emissions and meet sustainability expectations is positively influencing the market. Biofuel-powered and low-carbon vehicles are gaining traction, offering more efficient operation without compromising cooling performance. Companies are integrating greener technologies into long-term fleet strategies, improving environmental compliance and aligning with national sustainability objectives. For instance, in 2024, Red Sea Global (RSG) became the first Saudi company to use only sustainable biofuels in all its supply chain vehicles. This initiative powers RSG's fleet, including refrigerated trucks, with biofuel produced from used cooking oil, significantly reducing carbon emissions. RSG aimed to transition to green hydrogen by 2030, further enhancing sustainability.

Expansion of Specialized Refrigerated Vehicle Offerings

The increasing availability of purpose-built refrigerated trucks and vans equipped with advanced cooling capabilities is impelling the market growth. These vehicles are designed to maintain consistent temperatures, enhance cargo protection, and meet rising standards for perishable transport. Manufacturers are offering extended service packages and improved technical reliability, encouraging businesses to upgrade fleets with confidence. For instance, on the occasion of Ramadan 2024, Victory Saudi Motors introduced new refrigerated trucks and vans designed to meet the high demand for food transportation in the holy month. These vehicles featured advanced cooling technology, ensuring safe and efficient transportation, with temperatures as low as -15°C.

Digital Integration Strengthening Cold Chain Accessibility

The growing use of digital platforms that improve access to temperature-controlled logistics services is propelling the market growth. Companies are adopting online tools to manage bookings, monitor shipments, and coordinate warehousing and distribution with greater accuracy. These systems enhance transparency, reduce delays, and simplify communication between service providers and clients. As more logistics operators integrate technology into their service models, refrigerated transport becomes easier to manage, encouraging broader adoption across sectors that depend on reliable cold chain networks. In line with this trend, in 2024, Duroub Integrated Logistics launched a new website to streamline access to its temperature-controlled logistics services, offering businesses efficient warehousing, transportation, and distribution solutions. The platform supported end-to-end cold chain logistics, including cross-border transport and custom warehousing across Saudi Arabia.

Market Outlook 2026-2034:

The Saudi Arabia refrigerated transport market is positioned for notable growth over the forecast period, supported by continued infrastructure upgrades and rising demand for reliable temperature-controlled logistics. Growth is further influenced by increasing movement of perishable goods, stricter quality requirements, and broader adoption of cold chain standards across industries. The market generated a revenue of USD 190.22 Million in 2025 and is projected to reach a revenue of USD 279.96 Million by 2034, growing at a compound annual growth rate of 4.39% from 2026-2034.

Saudi Arabia Refrigerated Transport Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Mode of Transportation | Refrigerated Road Transport | 39.62% |

| Technology | Air-Blown Evaporators | 43.14% |

| Temperature | Single-Temperature | 58.25% |

| Application | Chilled Food Products | 32.66% |

Mode of Transportation Insights:

- Refrigerated Road Transport

- Refrigerated Sea Transport

- Refrigerated Rail Transport

- Refrigerated Air Transport

Refrigerated road transport dominates with a market share of 39.62% of the total Saudi Arabia refrigerated transport market in 2025.

Refrigerated road transport represents the largest segment, as it offers flexible routing, wide geographic reach, and reliable delivery schedules suited to the Kingdom’s distribution patterns. Its adaptability supports efficient movement of temperature-sensitive goods across major urban and industrial centers.

Its strong position is also supported by ongoing improvements in vehicle technology, better temperature-control systems, and rising demand for timely deliveries. For instance, in, 2024, ISUZU launched its advanced freezer trucks in Saudi Arabia, enhancing temperature-controlled logistics for food, pharmaceuticals, and chemicals. The trucks was designed with cutting-edge cooling technology, ensuring precise temperature control even in extreme desert heat.

Technology Insights:

- Vapor Compression Systems

- Air-Blown Evaporators

- Eutectic Devices

- Cryogenic Systems

Air-blown evaporators lead with a market share of 43.14% of the total Saudi Arabia refrigerated transport market in 2025.

Air-blown evaporators dominate the market owing to their ability to provide steady air circulation, uniform temperature distribution, and reliable cooling performance across varied cargo conditions. Their efficiency supports consistent protection of temperature-sensitive goods during long hauls and frequent loading cycles.

Their widespread use is further driven by lower maintenance needs, strong compatibility with different vehicle types, and the ability to maintain stable conditions in high-heat environments. These features make air-blown systems a preferred choice for operators seeking dependable, cost-effective refrigeration technology.

Temperature Insights:

- Single-Temperature

- Multi-Temperature

Single-temperature exhibits a clear dominance with a 58.25% share of the total Saudi Arabia refrigerated transport market in 2025.

Single-temperature dominates the market because it suits the bulk movement of goods requiring a consistent thermal setting, allowing operators to maintain stable conditions with simpler equipment. Its straightforward operation lowers handling complexity and supports predictable performance across long routes.

Its popularity is also linked to reduced maintenance needs, lower operational costs, and strong compatibility with common cargo types. As many shipments fall within a single thermal range, operators prefer this unit for reliability, easier monitoring, and efficient fuel usage throughout regular transport cycles.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Chilled Food Products

- Dairy Products

- Bakery and Confectionery Products

- Fresh Fruits and Vegetables

- Others

- Frozen Food Products

- Frozen Dairy Products

- Processed Meat Products

- Fish and Seafood Products

- Others

- Others

Chilled food products segment accounts for the highest revenue share of 32.66% in 2025, driven by rising consumer demand for fresh dairy, produce, and convenience foods.

Chilled food products lead the market because they represent a major portion of daily consumer demand and require dependable temperature-controlled transport from production facilities to retail outlets. The Saudi Arabia frozen foods market is projected to reach USD 3.35 Billion by 2033, reflecting rising demand for perishable items. Their limited shelf life further increases the need for frequent, well-managed distribution cycles that maintain consistent quality throughout the supply chain.

Their leading position is further supported by steady growth in organized retail, expanding foodservice operations, and rising preference for fresh items. These factors intensify the need for reliable chilled transport capacity, driving continued investment in fleets that maintain consistent conditions during regular distribution.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region holds strong activity in refrigerated transport due to major population centers, extensive distribution hubs, and significant food retail presence. Its logistical connectivity supports frequent movement of chilled and frozen goods across long routes serving commercial, institutional, and residential markets.

Refrigerated transport demand in this Western Region is supported by high commercial activity, dense urban markets, and strong hospitality-related consumption. Its ports and trade links also encourage frequent movement of chilled and frozen products, strengthening regional logistics requirements.

The Eastern Region benefits from active industrial zones and strong import-related flows, requiring consistent cold chain capacity. Its logistics infrastructure supports large-scale transport of perishable goods to inland markets, enhancing demand for reliable refrigerated fleets.

Southern Region shows growing refrigerated transport needs linked to expanding retail activity, rising population centers, and gradual improvements in road connectivity. Demand is shaped by the movement of perishable goods across challenging terrain, requiring dependable cooling systems and coordinated delivery schedules.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Refrigerated Transport Market Growing?

Increasing Investments in Cold Chain Capacity Expansion

Companies in distribution, food processing, pharmaceuticals, and retail are increasing capital allocation to expand temperature-controlled storage, improve fleet capabilities, and adopt advanced cooling technologies, reinforcing the national cold chain. This direction was further highlighted in 2025 when Starlinks introduced Polaris, a 40,000-square-meter cold-chain facility with 44,000 multi-temperature pallets in Riyadh’s 2nd Industrial City. Such investments strengthen end-to-end logistics by improving consistency across storage, transit corridors, and delivery points. As infrastructure modernizes, refrigerated transport becomes essential for ensuring product integrity, regulatory compliance, and dependable coverage across a rapidly growing cold logistics network.

Expansion of E-Commerce and Last-Mile Cold Delivery

The rise in online retail is reshaping logistics needs for temperature-sensitive goods, as people seek quicker delivery of fresh groceries and chilled products. This shift is catalyzing the demand for cold last-mile capacity, including smaller refrigerated vehicles and insulated solutions suited to dense urban areas. The International Trade Administration projected that 33.6 million internet users in Saudi Arabia would engage in e-commerce by 2024, underscoring the rising influence of digital purchasing. As platforms expand perishable offerings, reliable refrigerated transport becomes crucial for maintaining product quality, minimizing temperature deviation, and supporting consistent customer satisfaction across rapidly growing delivery networks.

Growth of Healthcare Supply Networks Requiring Cold Transport

The growing reliance of the healthcare sector on temperature-controlled logistics is influencing the market, as medical products require stable conditions to retain their effectiveness. This need is increasing alongside the Kingdom’s shifting demographic profile, which is highlighted by the Elderly Survey 2025. It reported that around 1.7 million people in Saudi Arabia were aged 60 years and above, representing 4.8% of the total population, reflecting rising demand for medicines and sensitive therapies. Hospitals, laboratories, and distributors depend on vehicles with accurate temperature control and monitoring to meet safety standards. As medical networks widen, transport operators invest in specialized fleets, making cold logistics an essential pillar of national healthcare delivery.

Market Restraints:

What Challenges the Saudi Arabia Refrigerated Transport Market is Facing?

High Operational Costs and Fuel Price Volatility

Elevated operational costs associated with refrigerated transport operations present ongoing challenges for market participants. Fuel consumption for temperature-controlled vehicles significantly exceeds conventional trucks due to continuous refrigeration unit operation. Maintenance requirements for specialized cooling equipment add complexity to fleet management, while replacement costs for aging refrigeration systems strain operator margins. Fuel price fluctuations create planning uncertainty for logistics providers operating on fixed-rate contracts.

Extreme Climate Conditions Impacting Equipment Performance

Saudi Arabia's harsh desert climate places exceptional stress on refrigeration equipment, challenging operators to maintain cargo temperature integrity. Ambient temperatures exceeding forty-five degrees Celsius during summer months demand high-performance cooling systems capable of managing substantial temperature differentials. Equipment failure rates increase under extreme conditions, requiring enhanced maintenance protocols and backup systems. The demanding operating environment accelerates component wear, shortening equipment lifecycles compared to temperate climate operations.

Infrastructure Gaps in Remote and Underserved Areas

Limited cold chain infrastructure in remote and rural areas constrains market expansion beyond major urban corridors. Many secondary cities and agricultural regions lack adequate cold storage facilities for product consolidation and distribution. Road conditions in peripheral areas may limit access for heavy refrigerated vehicles. The concentration of cold chain investments in primary logistics hubs creates service gaps affecting food security and healthcare access in underserved communities across the Kingdom.

Competitive Landscape:

The Saudi Arabia refrigerated transport market exhibits moderate competitive intensity characterized by the presence of global refrigeration technology providers, multinational logistics corporations, and established regional operators competing across equipment supply and logistics service segments. Market dynamics reflect ongoing consolidation through strategic partnerships and joint ventures combining international expertise with local market knowledge. Competition intensifies around technological differentiation, fleet modernization, and geographic coverage expansion. Sustainability initiatives and digital capabilities are emerging as competitive differentiators as operators align with Vision 2030 objectives and evolving customer requirements for transparency and environmental responsibility.

Recent Developments:

- In June 2025, Tanmiah Food Company launched Saudi Arabia's first fully refrigerated electric truck for transporting fresh chicken. Powered by Quantron zero-emission technology, this initiative supports sustainability goals and Saudi Vision 2030, reducing 95 metric tons of CO₂ emissions annually. The trucks will operate within a 240 km range, using infrastructure built at Tanmiah's Riyadh operations.

Saudi Arabia Refrigerated Transport Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Mode of Transportations Covered | Refrigerated Road Transport, Refrigerated Sea Transport, Refrigerated Rail Transport, Refrigerated Air Transport |

| Technologies Covered | Vapor Compression Systems, Air-Blown Evaporators, Eutectic Devices, Cryogenic Systems |

| Temperatures Covered | Single-Temperature, Multi-Temperature |

| Applications Covered |

|

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia refrigerated transport market size was valued at USD 190.22 Million in 2025.

The Saudi Arabia refrigerated transport market is expected to grow at a compound annual growth rate of 4.39% from 2026-2034 to reach USD 279.96 Million by 2034.

Refrigerated road transport dominated the Saudi Arabia refrigerated transport market with a share of 39.62% in 2025, driven by the Kingdom's extensive road network, flexibility for diverse delivery requirements, and suitability for last-mile distribution across urban and rural areas.

Key factors driving the Saudi Arabia refrigerated transport market include a growing shift toward cleaner fuels, with operators adopting low-carbon fleets to reduce emissions and strengthen sustainability performance. In 2024, Red Sea Global supported this direction by powering its full supply chain fleet with biofuel and setting a 2030 green hydrogen target.

Major challenges include high operational costs from fuel consumption and specialized equipment maintenance, extreme climate conditions placing stress on refrigeration systems with ambient temperatures exceeding 45 degrees Celsius, infrastructure gaps in remote and rural areas limiting service coverage, and workforce requirements for skilled technicians and certified drivers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)