Saudi Arabia Refrigerated Trucks Market Size, Share, Trends and Forecast by Type, Tonnage Capacity, Application, and Region, 2026-2034

Saudi Arabia Refrigerated Trucks Market Summary:

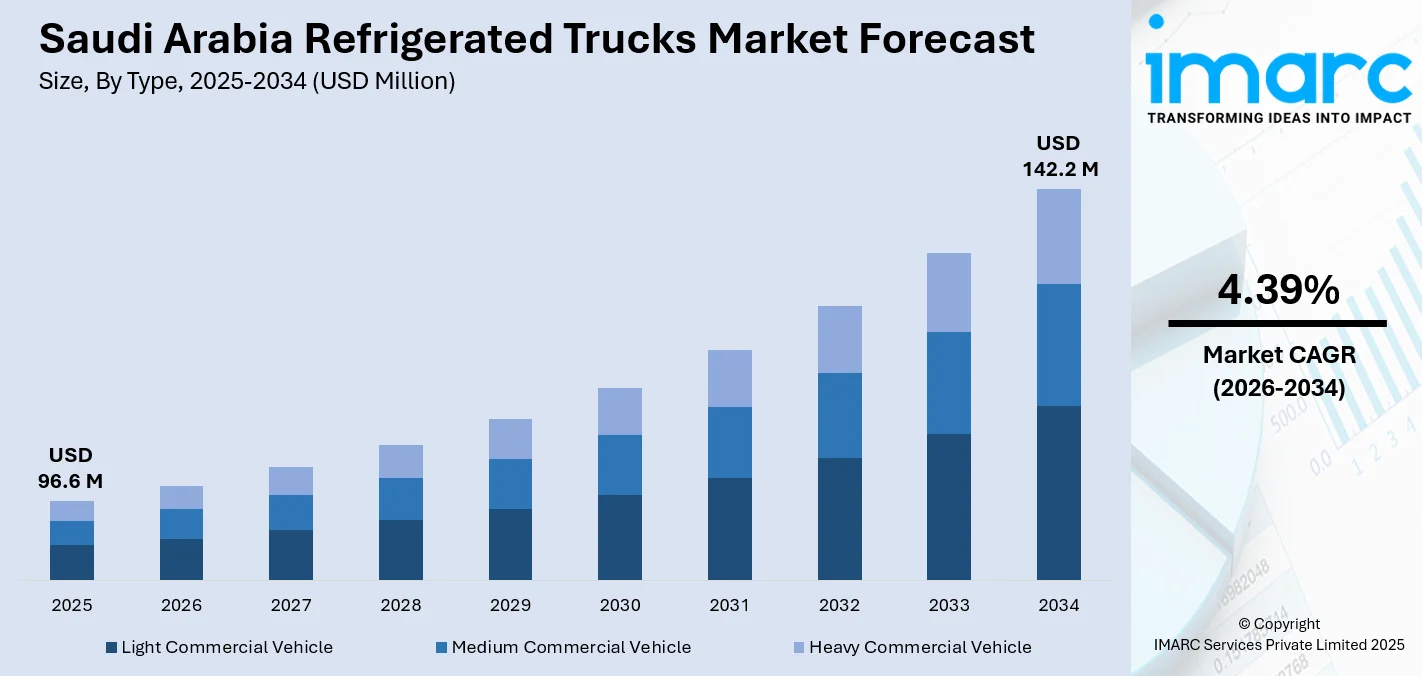

The Saudi Arabia refrigerated trucks market size was valued at USD 96.6 Million in 2025 and is projected to reach USD 142.2 Million by 2034, growing at a compound annual growth rate of 4.39% from 2026-2034.

The Saudi Arabia refrigerated trucks market is experiencing robust expansion driven by the Kingdom's strategic economic diversification initiatives under Vision 2030. The growing emphasis on food security, coupled with stringent regulations governing perishable goods transportation, is accelerating demand for temperature-controlled logistics solutions. Advancements in refrigeration technology, rising pharmaceutical distribution requirements, and the rapid expansion of e-commerce and food delivery platforms are collectively reshaping the cold chain landscape, positioning the market for sustained growth and expanding the Saudi Arabia refrigerated trucks market share.

Key Takeaways and Insights:

- By Type: Medium commercial vehicle dominates the market with a share of 42% in 2025, driven by their optimal balance between payload capacity and maneuverability for regional food and pharmaceutical distribution across urban and semi-urban areas.

- By Tonnage Capacity: 10-20 tons lead the market with a 47% share in 2025, owing to its versatility in handling medium-scale shipments for supermarkets, restaurants, and healthcare facilities requiring consistent temperature control.

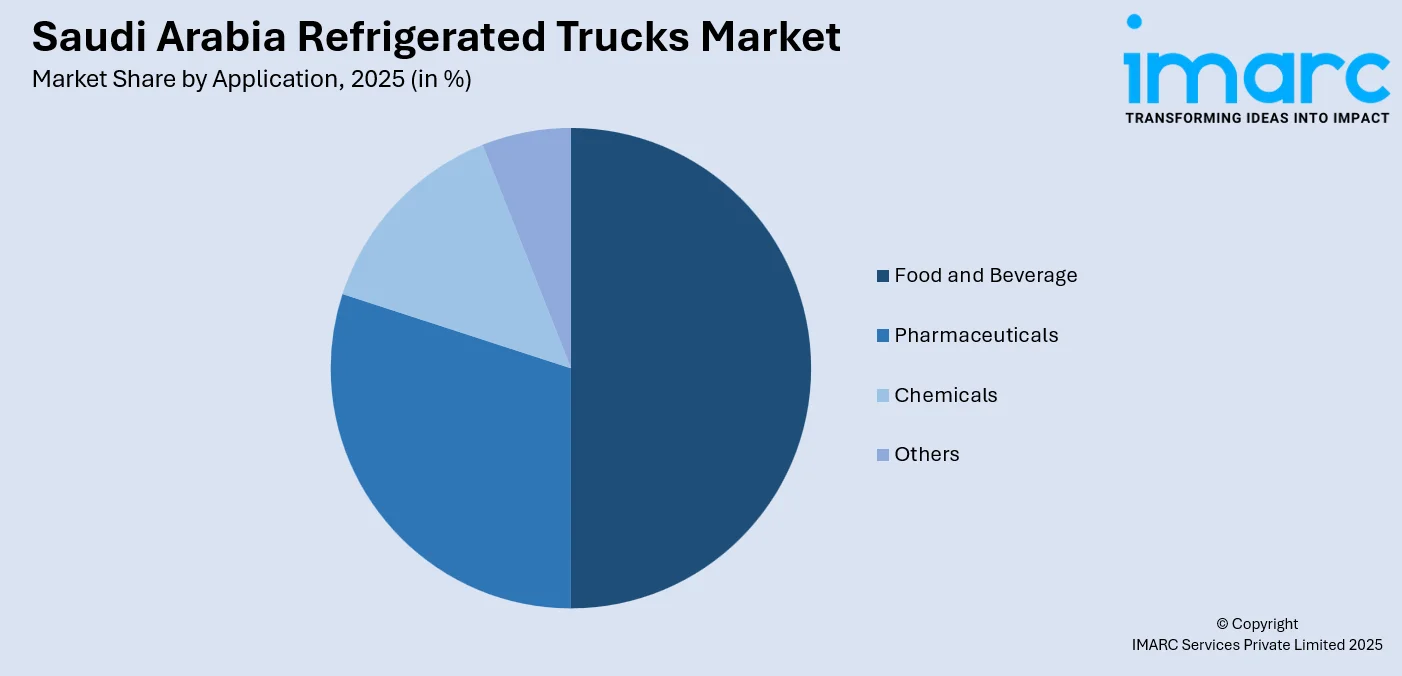

- By Application: Food and beverage hold the largest market share at 50% in 2025, reflecting the Kingdom's massive food import dependency and expanding retail and hospitality sectors demanding reliable cold chain logistics.

- By Region: Northern and Central Region accounts for 30% of the market in 2025, anchored by Riyadh's position as the economic hub with extensive cold storage infrastructure and high concentration of food processing facilities.

- Key Players: The Saudi Arabia refrigerated trucks market exhibits a moderately consolidated competitive landscape, with global manufacturers and regional players competing through technological innovations, strategic partnerships, and localized service networks to capture market share.

To get more information on this market Request Sample

The Saudi Arabia refrigerated trucks market is being reshaped by transformative investments in logistics infrastructure and regulatory frameworks prioritizing food safety standards. The Kingdom's ambitious tourism expansion, particularly through mega-projects like The Red Sea and NEOM, is creating unprecedented demand for temperature-controlled transportation serving hospitality operations across remote coastal and desert locations. The growing pharmaceutical sector, with diabetes affecting 23.1% of the adult population according to the International Diabetes Federation, necessitates reliable cold chain logistics for insulin and medication distribution to healthcare facilities nationwide. E-commerce penetration has reached remarkable levels, intensifying requirements for last-mile refrigerated capabilities. In January 2024, Red Sea Global became the first Saudi company to operate its entire delivery fleet of nine refrigerated trucks on low-carbon biofuel produced from recycled cooking oil, demonstrating the market's pivot toward sustainable cold chain solutions while maintaining operational efficiency across the Kingdom's challenging desert climate conditions.

Saudi Arabia Refrigerated Trucks Market Trends:

Adoption of IoT-Enabled Fleet Management Systems

The integration of Internet of Things (IoT) technology and artificial intelligence is revolutionizing refrigerated truck operations across Saudi Arabia. Fleet operators are increasingly deploying real-time temperature monitoring sensors, global positioning system (GPS) tracking systems, and predictive maintenance algorithms to optimize route efficiency and ensure cargo integrity. These advanced telematics solutions enable precise temperature control and reduce product spoilage rates significantly, supporting the Saudi Arabia refrigerated trucks market growth. Moreover, Saudi Arabia has made a significant move in enhancing its digital infrastructure by initiating a large-scale data centre project in Riyadh, aimed at empowering national data services and advancing future logistics and supply chain innovations. The new facility, built to meet Tier IV reliability standards, the highest international classification, will provide up to 480 megawatts of power capacity across an area larger than 30 million square feet, establishing it as one of the largest centers of its kind globally.

Transition Toward Sustainable Refrigeration Solutions

Environmental sustainability is becoming a defining factor in refrigerated truck procurement decisions as operators align with Saudi Arabia's carbon neutrality goals. The adoption of low-global warming potential refrigerants, biofuel-powered vehicles, and hybrid electric systems is gaining momentum across the Kingdom. Compliance with Kigali Amendment timelines is driving fleet upgrades toward eco-friendly alternatives that reduce emissions while maintaining cooling performance. The Biofuel Company's expansion plans to triple refining capacity to 36 million liters annually by 2025 across Jeddah and Riyadh facilities reflects this sustainability-driven market transformation. Since commencing operations in November 2022, the company has executed three capacity expansions to accommodate rising demand. The current facility in Jubail, the largest biofuel refinery in the Gulf, processes 12 million litres of B100 [100 percent biofuel] each year.

Expansion of Last-Mile Cold Chain Infrastructure

The rapid growth of e-commerce and quick-commerce platforms is reshaping last-mile refrigerated transportation requirements across Saudi Arabia. Dark stores, micro-fulfillment centers, and urban distribution hubs are proliferating in major cities to support same-day and under-30-minute delivery promises for perishable goods. Multi-temperature vehicles capable of segregating different product categories within single trips are becoming essential for optimizing delivery efficiency. In 2024, SAL, Saudi Arabia’s leading logistics and supply chain solutions provider, has announced the launch of its Fulfillment Business Unit, a one-stop-shop solution aimed at revolutionizing the logistics and supply chain industry in the Kingdom. The core of SAL’s Fulfillment Business Unit centers on its integrated strategy, merging a complete range of value-added services with proficiency in cold chain logistics and strong digital capabilities. By effortlessly merging fulfillment and logistics solutions, SAL today provides a cohesive service that spans from the first mile to the final destination.

How Vision 2030 is Transforming the Saudi Arabia Refrigerated Trucks Market:

Saudi Arabia's Vision 2030 is driving significant transformation across various sectors, including the refrigerated trucks market. As part of the plan to diversify the economy and reduce reliance on oil exports, Vision 2030 emphasizes the growth of non-oil industries, logistics, and infrastructure. The refrigerated trucks market is benefitting from increased demand for efficient cold chain logistics, especially in food, pharmaceuticals, and perishable goods sectors. The government’s push for modernization of transportation infrastructure, including the development of ports and railways, is facilitating smoother and faster distribution networks. Additionally, Vision 2030 encourages investments in sustainable technologies, leading to innovations in energy-efficient refrigerated trucks. This shift not only supports the growth of the domestic market but also positions Saudi Arabia as a key player in the regional cold chain logistics market, serving as a hub for international trade. The rise in e-commerce and consumer demand for fresh products further accelerates this market expansion.

Market Outlook 2026-2034:

The Saudi Arabia refrigerated trucks market is positioned for steady expansion as the Kingdom intensifies its focus on food security, healthcare accessibility, and sustainable logistics development. Government investments in logistics centers will substantially enhance cold chain distribution capabilities nationwide. The pharmaceutical sector's expansion, supported by Public Investment Fund-backed initiatives for localizing biologics manufacturing, is creating specialized requirements for refrigerated transportation of vaccines, insulin, and advanced therapies. The market generated a revenue of USD 96.6 Million in 2025 and is projected to reach a revenue of USD 142.2 Million by 2034, growing at a compound annual growth rate of 4.39% from 2026-2034. Additionally, the Kingdom's commitment to achieving domestic food production localization will drive sustained investment in cold chain infrastructure connecting agricultural zones with urban consumption centers.

Saudi Arabia Refrigerated Trucks Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Medium Commercial Vehicle |

42% |

|

Tonnage Capacity |

10-20 Tons |

47% |

|

Application |

Food and Beverage |

50% |

|

Region |

Northern and Central Region |

30% |

Type Insights:

- Light Commercial Vehicle

- Medium Commercial Vehicle

- Heavy Commercial Vehicle

Medium commercial vehicle dominates with a market share of 42% of the total Saudi Arabia refrigerated trucks market in 2025.

Medium commercial refrigerated vehicles have emerged as the backbone of Saudi Arabia's cold chain logistics network, offering the ideal combination of cargo capacity, fuel efficiency, and urban accessibility. These vehicles, typically ranging from 3.5 to 7.5 tons gross weight, serve as the primary workhorses for regional distribution networks connecting warehouses to retail outlets, restaurants, and healthcare facilities. Their versatility enables efficient navigation through congested city centers while carrying sufficient payload volumes to meet growing demand for temperature-controlled deliveries.

The dominance of medium commercial vehicles reflects the evolving structure of Saudi Arabia's food retail and pharmaceutical distribution landscape. In 2024, ISUZU introduced its new range of freezer trucks featuring advanced cooling technology designed specifically for the Kingdom's extreme desert climate conditions. These vehicles incorporate state-of-the-art refrigeration units capable of maintaining precise temperatures across diverse cargo requirements, from fresh produce to temperature-sensitive medications, making them indispensable for operators seeking reliability and operational efficiency.

Tonnage Capacity Insights:

- Less Than 10 Tons

- 10-20 Tons

- More Than 20 Tons

10-20 tons lead with a share of 47% of the total Saudi Arabia refrigerated trucks market in 2025.

Refrigerated trucks in the 10-20 tons capacity range represent the most sought-after segment due to their ability to balance substantial cargo volumes with operational flexibility across Saudi Arabia's diverse logistics requirements. These vehicles efficiently serve medium-scale distribution networks, including supermarket chains, hotel groups, and hospital supply operations that require consistent temperature-controlled deliveries without the constraints associated with larger heavy-duty trucks. Their payload capacity aligns perfectly with typical shipment sizes demanded by growing retail and foodservice sectors.

The segment's leadership position is reinforced by the Kingdom's expanding hospitality and tourism sectors, which generate significant demand for reliable food logistics. The Ministry of Hajj and Umrah's coordination of catering services for millions of pilgrims annually necessitates extensive refrigerated transportation within this tonnage range. Additionally, the Saudi Cold Chain Association reports substantial cold storage capacity expansion in major urban centers, creating corresponding demand for appropriately sized refrigerated trucks to optimize distribution between warehouses and consumption points.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverage

- Pharmaceuticals

- Chemicals

- Others

Food and beverage exhibit a clear dominance with a 50% share of the total Saudi Arabia refrigerated trucks market in 2025.

The food and beverage sector's commanding market position reflects Saudi Arabia's substantial reliance on imported perishables and the expanding domestic food processing industry. With the Kingdom importing approximately 80% of its food requirements, maintaining product integrity during transportation from ports to distribution centers and retail locations is paramount. The Saudi Food and Drug Authority's stringent regulations governing temperature compliance during food transport have made refrigerated trucks essential infrastructure for importers, distributors, and retailers operating across the supply chain.

Vision 2030's emphasis on enhancing food security and reducing food waste is driving investments in advanced cold chain capabilities. The government allocated over SAR 3 billion toward agricultural and cold storage infrastructure development, directly supporting refrigerated transportation expansion. In 2024, Almarai, the largest dairy firm in the Middle East based in Saudi Arabia, intended to invest over 18 billion Saudi riyals ($4.8 billion) by 2028 to enhance its current operations and venture into new areas. The strategy encompassed 7 billion riyals for poultry development and 5 billion riyals for enhancing food sectors like dairy, juice, and bakery, the company stated in a filing to the Saudi stock exchange Tadawul, where its stocks are listed. The company also focussed on expanding promising operating areas like frozen food items, red meat, seafood, and ice cream. These operations intensified demand for reliable temperature-controlled logistics connecting production facilities with nationwide distribution networks.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region leads with a share of 30% of the total Saudi Arabia refrigerated trucks market in 2025.

The Northern and Central Regions of Saudi Arabia are the largest and most prominent areas in the refrigerated trucks market, driven by their strategic geographical location and high demand for cold chain logistics. Riyadh, the capital city, located in the central region, plays a crucial role as the economic and logistical hub of the country. With the rapid urbanization, industrial growth, and population expansion in these regions, there is a significant increase in the demand for refrigerated trucks, particularly for the transportation of perishable goods such as food, pharmaceuticals, and chemicals. The growth of sectors like retail, e-commerce, and hospitality in these regions further boosts the need for efficient cold chain solutions to ensure product quality and safety.

The Northern Region, with its proximity to key trade routes and the influence of Vision 2030 initiatives, has also seen significant investment in infrastructure development, improving road connectivity and transportation systems. This enhances the efficiency of refrigerated truck operations, facilitating smooth distribution across the country and even internationally. Both regions benefit from the government’s focus on economic diversification, which includes modernizing logistics and transportation networks. As a result, the refrigerated trucks market in these areas continues to grow, driven by the expanding demand for reliable and temperature-controlled transportation solutions.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Refrigerated Trucks Market Growing?

Vision 2030 Economic Diversification and Infrastructure Investments

Saudi Arabia's comprehensive Vision 2030 initiative is fundamentally reshaping the logistics landscape through unprecedented infrastructure investments targeting economic diversification beyond hydrocarbons. The logistics transformation in Saudi Arabia is speeding up under Vision 2030, with private companies anticipated to account for 80% of the sector's planned investments. The Ministry of Transport and Logistic Services forecasts that projects valued at SR240 billion ($63.95 billion) will be made available to the private sector, including privatized airports, ports, and cargo terminals. The National Transport and Logistics Strategy (NTLS) seeks to raise the sector’s GDP contribution to 10% by the year 2030. These strategic investments are creating extensive demand for refrigerated trucks to service the expanding network of temperature-controlled facilities connecting producers, distributors, and consumers across the Kingdom.

Rapid Expansion of E-Commerce and Food Delivery Services

The explosive growth of online grocery platforms and quick-commerce services is generating substantial demand for refrigerated last-mile delivery capabilities across Saudi Arabia. With a large number of Saudis shopping online and e-commerce revenues increasing in 2025, the infrastructure requirements for temperature-controlled transportation have intensified dramatically. In January 2025, Matternet became the first company approved by Saudi Arabia's General Authority of Civil Aviation to operate delivery drones, while Jahez launched the Kingdom's first electric delivery vehicle with plans to electrify majority of its fleet by 2026, demonstrating the sector's rapid evolution.

Growing Pharmaceutical and Healthcare Logistics Requirements

The expansion of Saudi Arabia's pharmaceutical and biotechnology sectors is creating specialized demand for refrigerated trucks capable of maintaining stringent temperature controls required for medicines, vaccines, and biological products. The Saudi Arabia cold chain pharmaceutical logistics market reached USD 131.04 million in 2024 and is projected to grow at 9.20% during 2025-2033 according to IMARC Group. The government plans to invest more than SAR 3 billion in cold chain infrastructure by 2025 specifically supporting pharmaceutical storage, transportation, and advanced monitoring systems. In February 2025, NUPCO secured SR2.5 billion to enhance the healthcare supply chain, highlighting the substantial investments driving refrigerated truck demand in this sector.

Market Restraints:

What Challenges the Saudi Arabia Refrigerated Trucks Market is Facing?

High Initial Investment and Operational Costs

The substantial capital expenditure required for acquiring refrigerated trucks, combined with ongoing maintenance, fuel, and insurance expenses, presents significant barriers for small and medium-sized logistics operators. Annual maintenance and insurance costs for specialized refrigerated vehicles can be considerably higher than conventional trucks, while fuel consumption for refrigeration units adds to operational expenses. These cost pressures limit market accessibility and constrain fleet expansion among price-sensitive operators.

Extreme Climate Conditions Impacting Equipment Performance

Saudi Arabia's harsh desert climate, with ambient temperatures regularly exceeding 45 degrees Celsius during summer months, places extraordinary stress on refrigeration systems and vehicle components. Maintaining precise temperature control within cargo compartments becomes increasingly challenging under extreme heat conditions, requiring more robust and energy-intensive cooling solutions. The accelerated wear on refrigeration units and associated components increases maintenance frequency and replacement costs for operators.

Limited Cold Chain Infrastructure in Remote Areas

Despite significant investments in major urban centers, cold chain infrastructure gaps persist in rural and semi-urban regions across Saudi Arabia. The uneven distribution of cold storage facilities, maintenance services, and charging stations for alternative-fuel vehicles creates operational challenges for refrigerated truck operators serving geographically dispersed customers. These infrastructure limitations constrain market penetration in underserved areas and increase logistics costs for reaching peripheral markets.

Competitive Landscape:

The Saudi Arabia refrigerated trucks market exhibits a moderately consolidated competitive structure characterized by the presence of established global manufacturers alongside regional players and specialized body builders. International refrigeration unit providers compete through technological differentiation, energy efficiency improvements, and after-sales service networks. Market participants are increasingly focusing on localized production capabilities, strategic partnerships with logistics operators, and development of sustainable refrigeration solutions aligned with the Kingdom's environmental objectives. Competition is intensifying as companies invest in advanced telematics integration, alternative fuel compatibility, and customized configurations tailored to Saudi Arabia's specific climate and regulatory requirements.

Recent Developments:

- In June 2025, Tanmiah Food Company, a top provider of fresh and processed poultry and other meat items, animal feed and health products, as well as a franchise operator for food brands, has revealed the launch of fully electric trucks that produce no pollutant gas emissions for its logistics and distribution processes. The new model line is regarded as the nation's first entirely refrigerated electric truck for transporting fresh local chicken, utilizing Quantron's zero-emission technology. These trucks are designed for sustainable, long-distance commercial use, in line with national and global climate goals.

Saudi Arabia Refrigerated Trucks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Light Commercial Vehicle, Medium Commercial Vehicle, Heavy Commercial Vehicle |

| Tonnage Capacities Covered | Less Than 10 Tons, 10-20 Tons, More Than 20 Tons |

| Applications Covered | Food and Beverage, Pharmaceuticals, Chemicals, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia refrigerated trucks market size was valued at USD 96.6 Million in 2025.

The Saudi Arabia refrigerated trucks market is expected to grow at a compound annual growth rate of 4.39% from 2026-2034 to reach USD 142.2 Million by 2034.

Medium commercial vehicle held the largest market share at 42% in 2025, driven by their optimal balance between cargo capacity and operational flexibility for regional food and pharmaceutical distribution networks.

Key factors driving the Saudi Arabia refrigerated trucks market include Vision 2030 infrastructure investments, expanding e-commerce and food delivery services, growing pharmaceutical logistics requirements, and increasing food safety regulations.

Major challenges include high initial vehicle acquisition and operational costs. Apart from this, extreme climate conditions stressing refrigeration equipment, limited cold chain infrastructure in remote areas, and skilled workforce shortages are some of the major challenges faced by the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)