Saudi Arabia Residential Battery Storage Market Size, Share, Trends and Forecast by Battery Type, Capacity, Ownership Model, Sales Channel, Application, and Region, 2026-2034

Saudi Arabia Residential Battery Storage Market Overview:

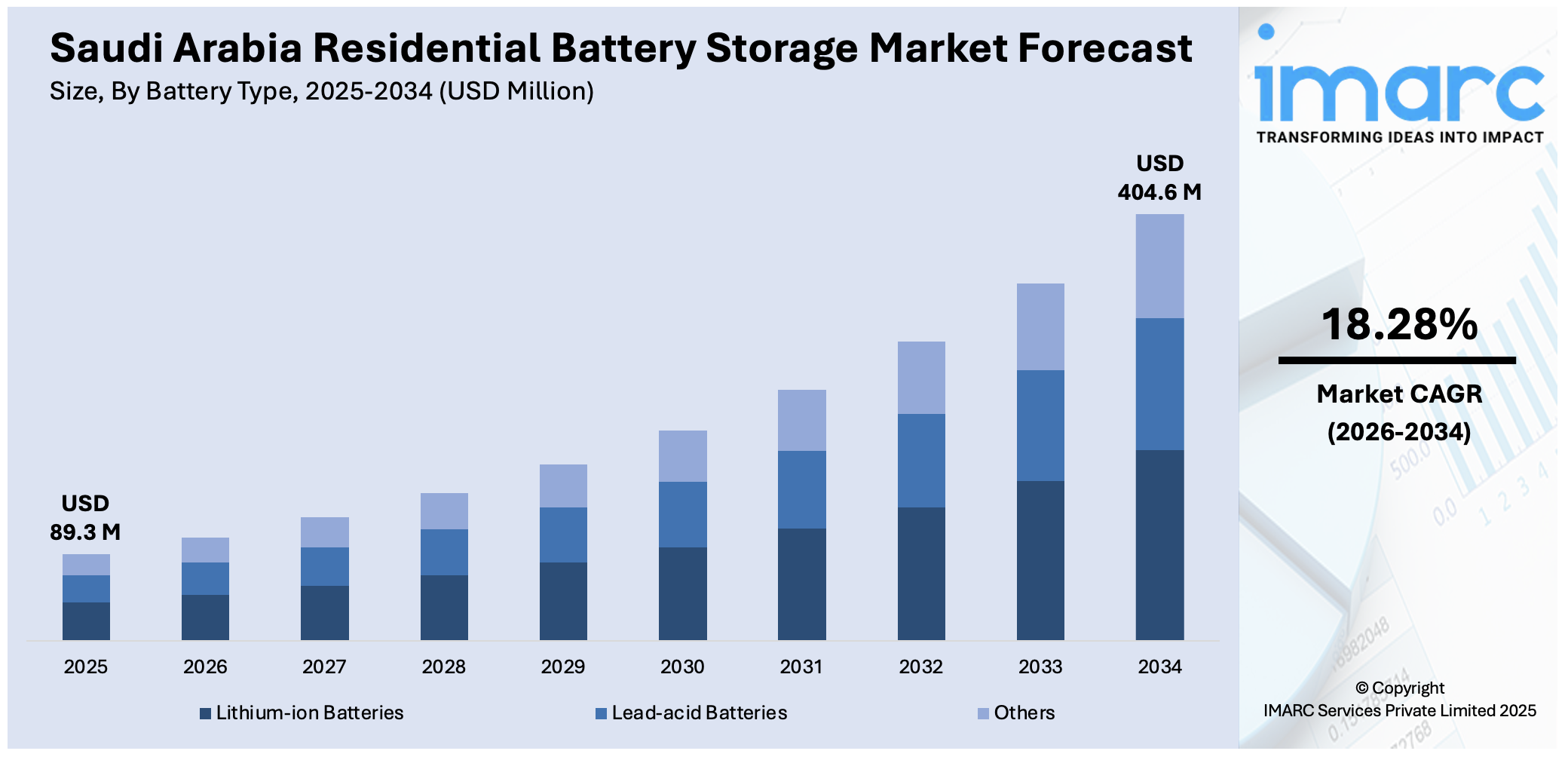

The Saudi Arabia residential battery storage market size reached USD 89.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 404.6 Million by 2034, exhibiting a growth rate (CAGR) of 18.28% during 2026-2034. The market is driven by rising household energy use and the need for efficiency amid subsidy cuts. Also, government-led reforms and residential energy regulations are fueling the product adoption. Additionally, high cooling demand and grid strain are increasing consumer reliance on storage. Climatic stress, energy policy changes, and urban consumption patterns are some of the other factors positively impacting the Saudi Arabia residential battery storage market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 89.3 Million |

|

Market Forecast in 2034

|

USD 404.6 Million |

| Market Growth Rate 2026-2034 | 18.28% |

Saudi Arabia Residential Battery Storage Market Trends:

Government Strategy and Regulatory Alignment with Vision 2030

Saudi Arabia's Vision 2030 initiative has placed a strong emphasis on sustainability, energy diversification, and private sector participation. While large-scale projects like NEOM and the Green Riyadh Program receive significant global attention, there is also a notable effort to promote decentralized energy solutions within residential communities. Regulatory entities such as the Water and Electricity Regulatory Authority (WERA) and the Ministry of Energy are working to implement clear technical standards and interconnection rules for distributed energy systems, including battery storage. These measures are gradually increasing confidence among suppliers, installers, and consumers. In tandem, the government’s removal of electricity subsidies has exposed the true cost of energy to consumers, motivating households to adopt technologies that mitigate monthly bills. While utility-scale storage dominates headlines, pilot residential battery programs supported by entities such as the King Abdullah City for Atomic and Renewable Energy (K.A.CARE) reflect growing institutional interest in small-scale applications.

To get more information on this market Request Sample

Streamlined licensing, support for solar-plus-storage setups, and expanding access to financing options are fostering a market environment where residential systems are no longer considered niche but rather viable complements to broader energy reforms. On April 17, 2025, Saudi Arabia’s Ministry of Energy and Saudi Electricity Company launched construction of a 2.5 GW / 10 GWh grid-scale battery storage project across five regions, backed by an investment exceeding SAR 6.73 billion (USD 1.79 billion). Each site: Riyadh, Qaisumah, Dawadmi, Aljouf, and Rabigh, will host a 500 MW / 2,000 MWh system, with contracts awarded to BYD and Alfanar Projects. The project is a core component of the Kingdom’s Vision 2030 plan, which includes a target of 48 GWh of storage by 2030, creating potential collaboration opportunities for Australian suppliers in utility-scale storage, battery materials, and EPC services. This is a core factor driving Saudi Arabia residential battery storage market growth, especially in urban areas.

Grid Reliability Constraints and Extreme Climate Conditions

Saudi Arabia’s harsh climate places immense stress on the national grid, particularly during extended heatwaves when residential cooling demands skyrocket. This leads to voltage instability and occasional service interruptions, especially in remote or high-density urban districts. Residential battery systems offer a practical response to these challenges, enabling households to maintain uninterrupted power even during grid failures or load-shedding events. On January 20, 2025, Saudi Arabia commissioned its largest battery energy storage system, a 500 MW / 2 GWh facility in Bisha, marking a major milestone in the country’s renewable energy rollout. The site uses 122 prefabricated LFP-based units to ensure reliability under extreme desert conditions. This project contributes to Saudi Arabia’s Vision 2030 target of deriving 50% of electricity from renewables and offers a key reference point for Australian suppliers seeking partnerships in large-scale, climate-adapted BESS solutions. The capability to operate independently during blackouts is increasingly valued, especially in homes with elderly residents or those running energy-intensive appliances. Furthermore, the unpredictability of solar output in desert environments, where sandstorms and dust reduce panel efficiency, adds another layer of complexity. Batteries help smooth out this variability, making solar systems more effective by balancing supply throughout the day. In newer residential developments built under sustainability guidelines, energy storage is already being integrated into the design phase, aligning with architectural trends and smart infrastructure planning.

Saudi Arabia Residential Battery Storage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on battery type, capacity, ownership model, sales channel, and application.

Battery Type Insights:

- Lithium-ion Batteries

- Lead-acid Batteries

- Others

The report has provided a detailed breakup and analysis of the market based on the battery type. This includes lithium-ion batteries, lead-acid batteries, and others.

Capacity Insights:

- Below 5 kWh

- 5–10 kWh

- 10–20 kWh

- Above 20 kWh

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes below 5 kWh, 5–10 kWh, 10–20 kWh, and above 20 kWh.

Ownership Model Insights:

- Customer-owned Systems

- Third-party Owned/Leasing Models

The report has provided a detailed breakup and analysis of the market based on the ownership model. This includes customer-owned systems and third-party owned/leasing models.

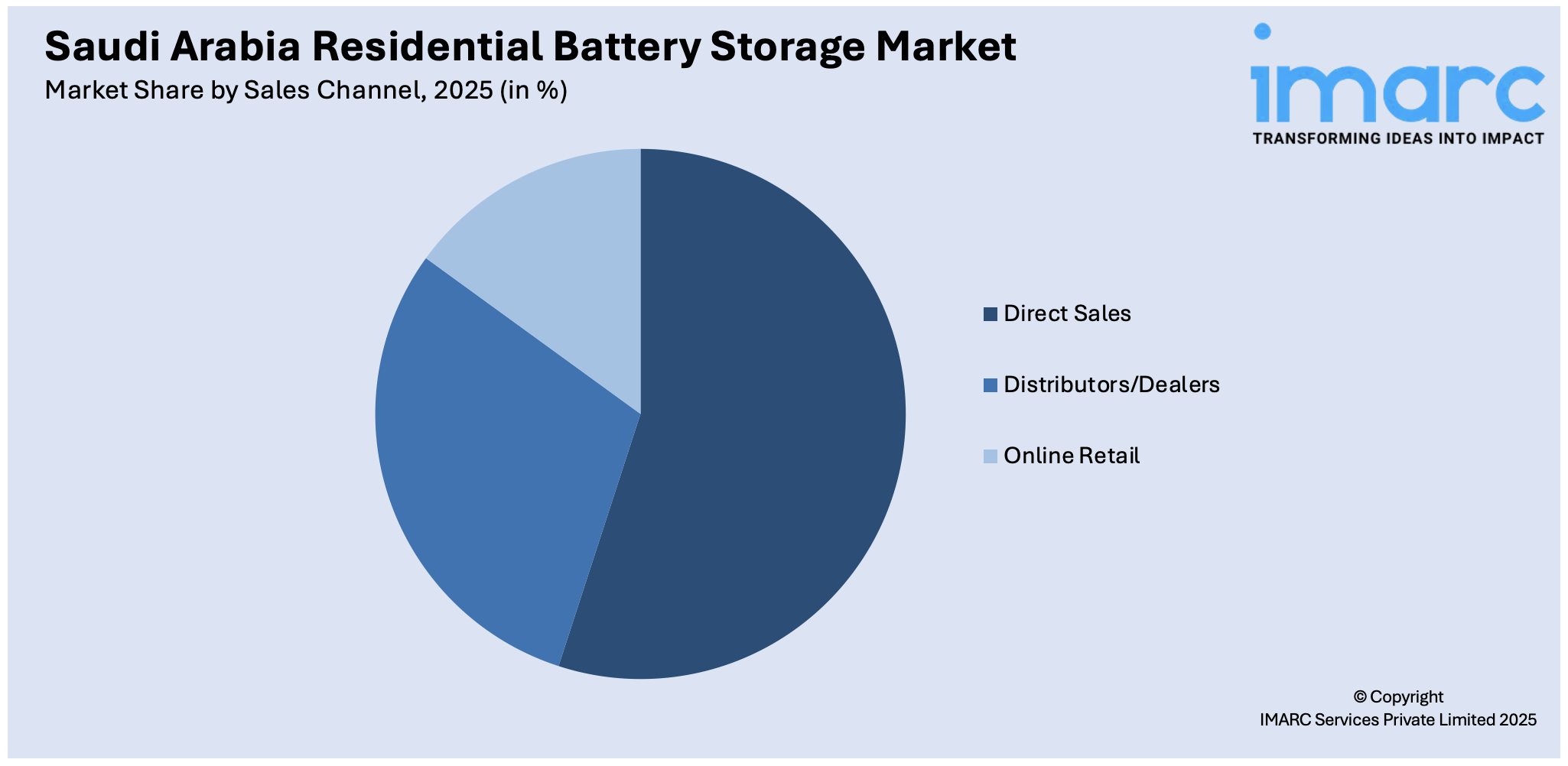

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Direct Sales

- Distributors/Dealers

- Online Retail

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes direct sales, distributors/dealers, and online retail.

Application Insights:

- Backup Power Supply

- Solar Energy Storage

- Off-grid Systems

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes backup power supply, solar energy storage, off-grid systems, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has provided a comprehensive analysis of all major regional markets. This includes Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Residential Battery Storage Market News:

- On October 16, 2024, Hithium and Saudi firm MANAT announced a joint venture to establish a battery energy storage system (BESS) manufacturing facility in Saudi Arabia with an annual production target of 5 GWh. The plant will support the deployment of desert-optimized storage systems featuring 12+ hour discharge cycles, temperature resilience, and sandstorm protection tailored for the Middle East and Africa. This move positions Saudi Arabia as a regional BESS manufacturing hub and creates potential downstream demand for Australian lithium and energy storage component exports.

Saudi Arabia Residential Battery Storage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Types Covered | Lithium-ion Batteries, Lead-acid Batteries, Others |

| Capacities Covered | Below 5 kWh, 5–10 kWh, 10–20 kWh, Above 20 kWh |

| Ownership Models Covered | Customer-owned Systems, Third-party Owned/Leasing Models |

| Sales Channels Covered | Direct Sales, Distributors/Dealers, Online Retail |

| Applications Covered | Backup Power Supply, Solar Energy Storage, Off-grid Systems, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia residential battery storage market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia residential battery storage market on the basis of battery type?

- What is the breakup of the Saudi Arabia residential battery storage market on the basis of capacity?

- What is the breakup of the Saudi Arabia residential battery storage market on the basis of ownership model?

- What is the breakup of the Saudi Arabia residential battery storage market on the basis of sales channel?

- What is the breakup of the Saudi Arabia residential battery storage market on the basis of application?

- What is the breakup of the Saudi Arabia residential battery storage market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia residential battery storage market?

- What are the key driving factors and challenges in the Saudi Arabia residential battery storage market?

- What is the structure of the Saudi Arabia residential battery storage market and who are the key players?

- What is the degree of competition in the Saudi Arabia residential battery storage market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia residential battery storage market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia residential battery storage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia residential battery storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)