Saudi Arabia Reverse Logistics Market Size, Share, Trends and Forecast by Return Type, Service, End User, and Region, 2026-2034

Saudi Arabia Reverse Logistics Market Overview:

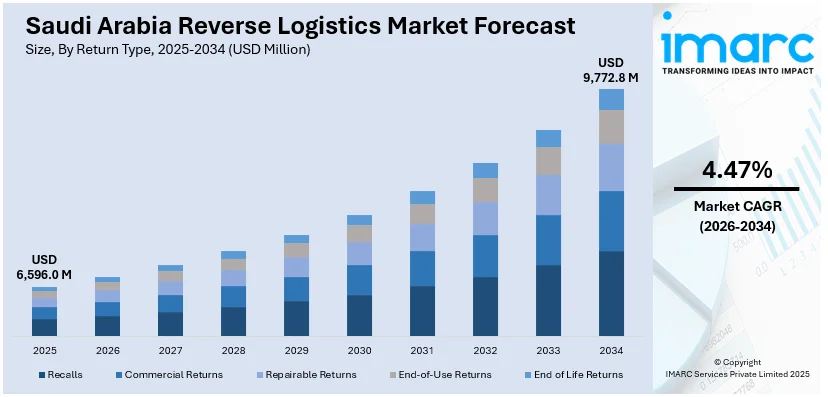

The Saudi Arabia reverse logistics market size reached USD 6,596.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 9,772.8 Million by 2034, exhibiting a growth rate (CAGR) of 4.47% during 2026-2034. The e-commerce growth, rising product returns, stricter environmental regulations, increased focus on sustainability, advancements in tracking technologies, expanding retail and automotive sectors, and government initiatives promoting circular economy practices for waste reduction and resource optimization are the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6,596.0 Million |

| Market Forecast in 2034 | USD 9,772.8 Million |

| Market Growth Rate 2026-2034 | 4.47% |

Saudi Arabia Reverse Logistics Market Trends:

Strengthening Logistics Infrastructure Supports Market Activity

The market is experiencing increased movement of goods through reverse channels, supported by ongoing enhancements in logistics infrastructure. Faster service capabilities, better connectivity, and modernized transport systems are contributing to more efficient handling of returned, surplus, or redistributed items. These improvements are encouraging greater reuse and secondary circulation of products, aligning with broader goals around operational efficiency and resource optimization. As logistics networks become more capable and responsive, there is growing potential for businesses to streamline reverse operations, reduce waste, and recover value more effectively. This shift indicates a steady rise in organized systems for managing goods beyond their initial delivery, paving the way for expanded reuse and resale opportunities. For example, in December 2024, Saudi Arabia's re-exports reached SAR 61 billion, marking a 23% growth compared to the previous year. This increase is attributed to strong infrastructure and the rapid development of logistics services in the Kingdom.

To get more information on this market, Request Sample

Increased Investment Driving Reverse Flow Capabilities

Saudi Arabia is witnessing a surge in agreements aimed at strengthening its logistics backbone, with recent deals supporting warehouse expansion and multimodal transport integration. This activity reflects a growing focus on building capacity for more efficient handling of returns, refurbishments, and redistribution. Planned warehousing enhancements will support higher volumes of product movement, while new partnerships with rail operators are expected to streamline inland connectivity and reduce turnaround times. These developments align with national goals to elevate the logistics sector and foster more organized systems for managing goods after their initial sale. As infrastructure continues to scale, the reverse flow of goods is becoming more agile, laying the groundwork for improved recovery, resale, and circular supply chain practices. For instance, in October 2024, during the Global Supply Chain and Logistics Forum, 65 agreements worth SAR 16 Billion were signed. Among them, Agility Logistics announced plans to expand its warehousing capacity in Saudi Arabia, supporting enhanced reverse logistics operations. A memorandum of understanding was also signed with Saudi Arabia Railways (SAR), aiming to improve integrated logistics solutions in line with the Kingdom’s logistics sector development goals.

Saudi Arabia Reverse Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on return type, service, and end user.

Return Type Insights:

- Recalls

- Commercial Returns

- Repairable Returns

- End-of-Use Returns

- End of Life Returns

The report has provided a detailed breakup and analysis of the market based on the return type. This includes recalls, commercial returns, repairable returns, end-of-use returns, and end of life returns.

Service Insights:

- Transportation

- Warehousing

- Reselling

- Replacement Management

- Refund Management Authorization

- Others

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes transportation, warehousing, reselling, replacement management, refund management authorization, and others.

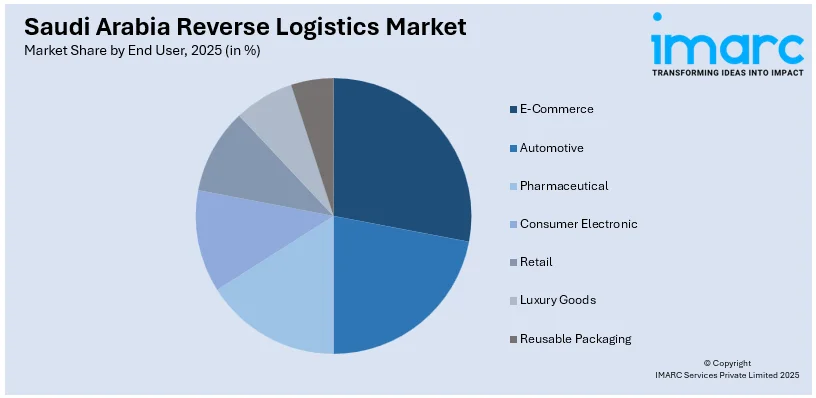

End User Insights:

Access the Comprehensive Market Breakdown, Request Sample

- E-Commerce

- Automotive

- Pharmaceutical

- Consumer Electronic

- Retail

- Luxury Goods

- Reusable Packaging

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes e-commerce, automotive, pharmaceutical, consumer electronic, retail, luxury goods, and reusable packaging.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Reverse Logistics Market News:

- In December 2024, French shipping and logistics company CMA CGM signed a memorandum of understanding with the Ministries of Transport and Investment of Saudi Arabia to develop key port and logistics projects within the Kingdom, supporting Saudi Arabia’s Vision 2030.

Saudi Arabia Reverse Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Return Types Covered | Recalls, Commercial Returns, Repairable Returns, End-of-Use Returns, End of Life Returns |

| Services Covered | Transportation, Warehousing, Reselling, Replacement Management, Refund Management Authorization, Others |

| End Users Covered | E-Commerce, Automotive, Pharmaceutical, Consumer Electronic, Retail, Luxury Goods, Reusable Packaging |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia reverse logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia reverse logistics market on the basis of return type?

- What is the breakup of the Saudi Arabia reverse logistics market on the basis of service?

- What is the breakup of the Saudi Arabia reverse logistics market on the basis of end user?

- What are the various stages in the value chain of the Saudi Arabia reverse logistics market?

- What are the key driving factors and challenges in the Saudi Arabia reverse logistics market?

- What is the structure of the Saudi Arabia reverse logistics market and who are the key players?

- What is the degree of competition in the Saudi Arabia reverse logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia reverse logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia reverse logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia reverse logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)