Saudi Arabia Rooftop Solar Market Size, Share, Trends and Forecast by Grid Type, End User, and Region, 2026-2034

Saudi Arabia Rooftop Solar Market Overview:

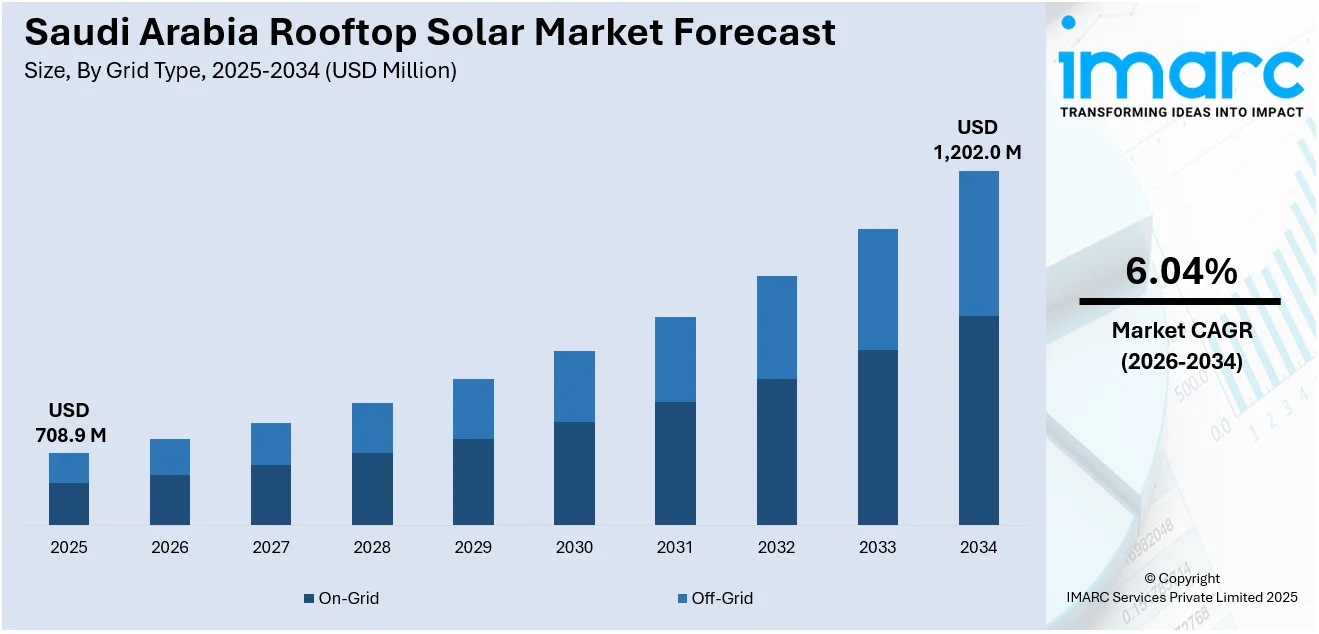

The Saudi Arabia rooftop solar market size reached USD 708.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,202.0 Million by 2034, exhibiting a growth rate (CAGR) of 6.04% during 2026-2034. The government of Saudi Arabia is encouraging the use of renewable energy sources, such as solar panels, by implementing supportive policies and incentives. Besides this, the decreasing cost of solar panels is contributing to the market growth. This trend, along with the rising environmental consciousness among the masses is expanding the Saudi Arabia rooftop solar market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 708.9 Million |

| Market Forecast in 2034 | USD 1,202.0 Million |

| Market Growth Rate 2026-2034 | 6.04% |

Saudi Arabia Rooftop Solar Market Trends:

Falling Solar Panel Costs

The decreasing cost of solar panels is contributing to the market growth. Technological improvements in solar energy production are resulting in more efficient manufacturing and lower production costs, and hence solar panels are becoming more affordable for customers. The growing availability of lower-cost raw materials and better supply chain efficiency are facilitating this price decline, making rooftop solar installations more economically competitive with traditional sources of energy. With declining prices for solar panels, the residential and commercial markets are increasingly looking to solar energy as a cost-competitive and reliable substitute for traditional electricity. This reduction in price is also creating a better investment climate, as people and companies are seeing quicker payback periods on their solar installations, again fueling the growth of the market.

To get more information on this market Request Sample

Growing Environmental Awareness

The growing environmental awareness among Saudi citizens is increasingly driving the market for rooftop solar solutions. As growing concern regarding climate change and the green footprint of fossil rises, people and organizations alike are turning towards cleaner energy options such as solar power. Public awareness programs and community outreach programs are emphasizing the green advantages of solar energy, including lower carbon emissions and energy autonomy. Also, the younger generation that is more aware about the environment is leading the charge for green technologies and environment friendly living practices. The increased focus on sustainability, combined with the kingdom's initiatives to decrease its carbon footprint, is making the transition towards renewable energy sources such as solar power. This shift is improving the long-term sustainability of rooftop solar as an integral part of the country's energy future. In 2025, the Tarshid National Energy Services Company and the Qassim University launched a huge project of solar panel installation whose main aim is to enhance energy efficiency in the university's every building and facility. The project, which has a capacity of 5,137 kW power generation, is expected to save energy by 8.6 million kWh per annum.

Government Incentives and Policies

The government of Saudi Arabia is encouraging the use of renewable energy sources, such as rooftop solar, by implementing supportive policies and incentives, thereby impelling the Saudi Arabia rooftop solar market growth. The government is motivating the integration of solar technologies by providing financial incentives like subsidies, tax exemptions, and low-interest loans for commercial and residential solar installations. These actions are making solar energy available to a wider population, increasing the growth of the market. Moreover, the launch of the Vision 2030 program, that seeks to diversify the country's energy matrix and lower reliance on oil, is promoting the use of renewable energy sources like solar systems on rooftops. The government, in its bid to meet sustainability objectives, is also in the process of streamlining regulatory procedures, issuing transparent guidelines, and generating public awareness about solar energy advantages. These steps are fostering a steep rise in solar installations on rooftops throughout the kingdom. In 2024, the Saudi government planned to set the target to elevate the proportion of renewable energy in its energy mix to 50% by 2030 and reach net-zero greenhouse gas emissions by 2060, leading to the execution of a chain of policies and projects focused on sustainable development.

Saudi Arabia Rooftop Solar Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on grid type and end user.

Grid Type Insights:

- On-Grid

- Off-Grid

The report has provided a detailed breakup and analysis of the market based on the grid type. This includes on-grid and off-grid.

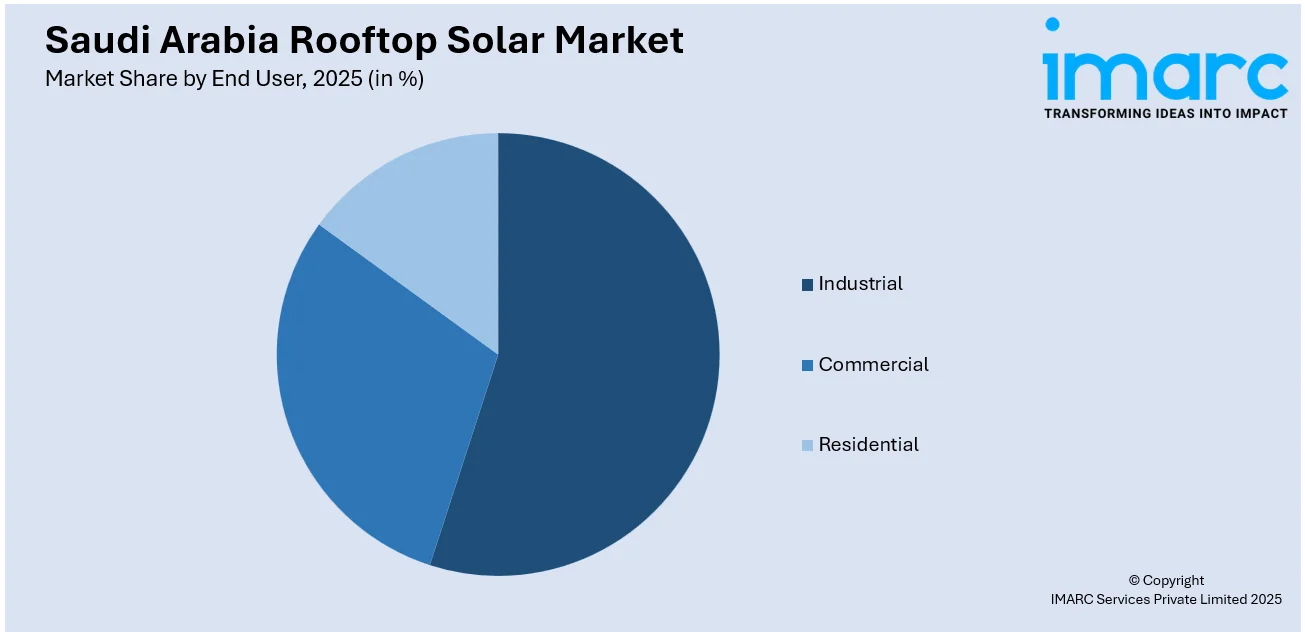

End User Insights:

Access the comprehensive market breakdown Request Sample

- Industrial

- Commercial

- Residential

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes industrial, commercial, and residential.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Rooftop Solar Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grid Types Covered | On-Grid, Off-Grid |

| End Users Covered | Industrial, Commercial, Residential |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia rooftop solar market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia rooftop solar market on the basis of grid type?

- What is the breakup of the Saudi Arabia rooftop solar market on the basis of end user?

- What is the breakup of the Saudi Arabia rooftop solar market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia rooftop solar market?

- What are the key driving factors and challenges in the Saudi Arabia rooftop solar market?

- What is the structure of the Saudi Arabia rooftop solar market and who are the key players?

- What is the degree of competition in the Saudi Arabia rooftop solar market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia rooftop solar market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia rooftop solar market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia rooftop solar industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)