Saudi Arabia Sauces and Seasonings Market Size, Share, Trends and Forecast by Product Type, Packaging Type, Distribution Channel, End User, and Region, 2026-2034

Saudi Arabia Sauces and Seasonings Market Overview:

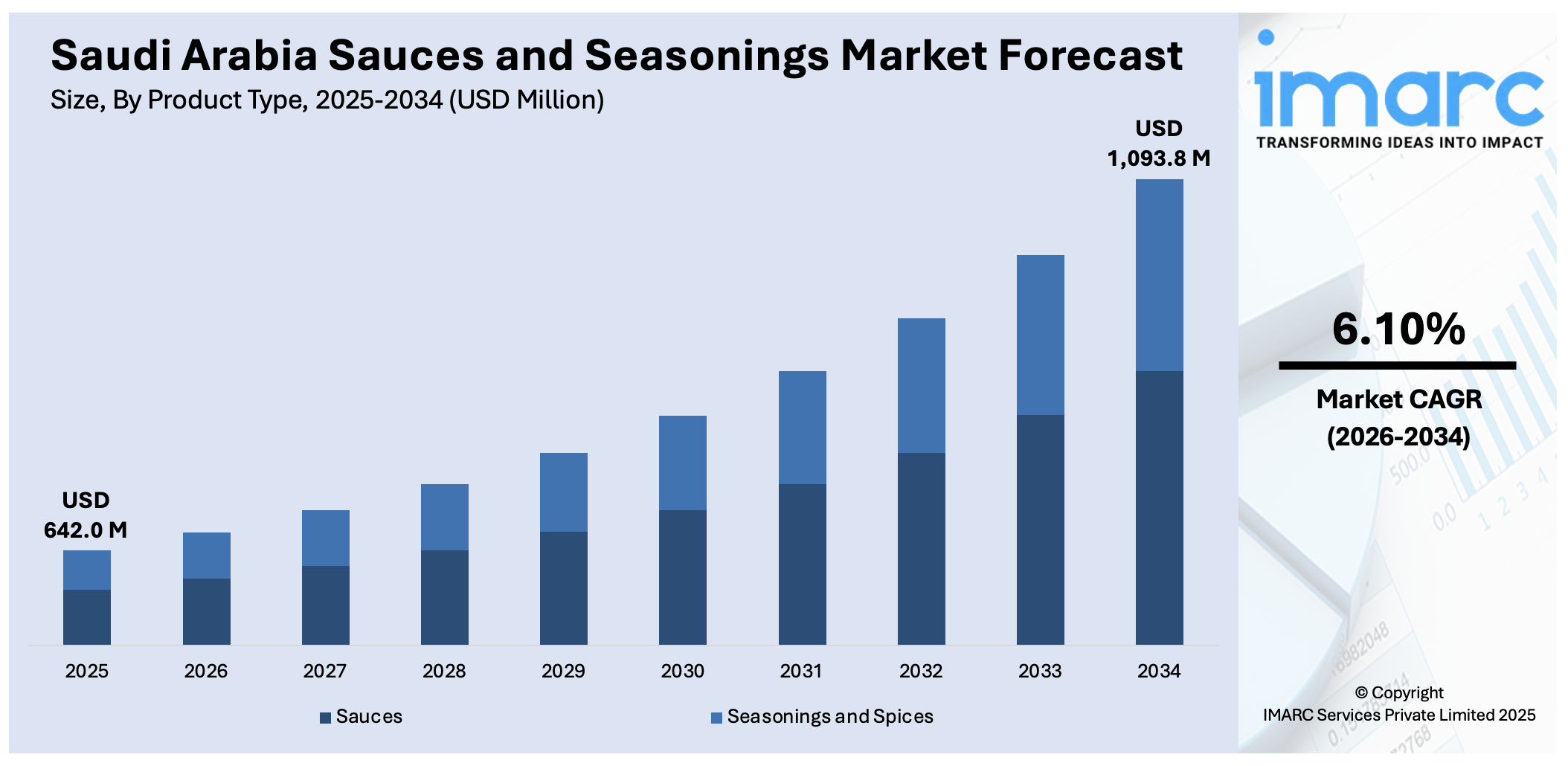

The Saudi Arabia sauces and seasonings market size reached USD 642.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,093.8 Million by 2034, exhibiting a growth rate (CAGR) of 6.10% during 2026-2034. The market is driven by rising health consciousness, and enhancing demand for organic and low-sodium products. Urbanization, busy lifestyles, and a growing foodservice sector fuel convenience-based purchases. Additionally, exposure to global cuisines and government health initiatives further stimulate market growth, encouraging innovation and product diversification.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 642.0 Million |

| Market Forecast in 2034 | USD 1,093.8 Million |

| Market Growth Rate 2026-2034 | 6.10% |

Saudi Arabia Sauces and Seasonings Market Trends:

Rising Demand for Healthy and Organic Sauces and Seasonings

The growing demand for healthier and organic products, driven by increasing health consciousness among consumers is majorly driving the Saudi Arabia sauces and seasonings market growth. A research report from the IMARC group indicates that the organic food market in Saudi Arabia was valued at USD 2.1 Billion in 2024. It is projected to grow to USD 5.1 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 9.4% from 2025 to 2033. As obesity and lifestyle diseases are growing, several consumers are choosing clean-label, low-sodium, and preservative-free foods. In response, companies are now launching organic sauces, gluten-free seasonings, and natural ingredient products. However, the trend is being driven even further by government support for healthier dietary habits, for instance, the nutritional labeling requirements of the Saudi Food and Drug Authority (SFDA). The demand for organic and natural conditioners is also fueled by the growing demand for international meals, such as Asian and Mediterranean meals, which normally use fresh herbs and spices. As a result, supermarkets and hypermarkets are expanding their organic product offerings, while e-commerce platforms are making these products more accessible, thus augmenting the Saudi Arabia sauces and seasonings market share.

To get more information on this market Request Sample

Growth of Convenience and Ready-to-Use Sauces

Another key trend in the market is the rising preference for convenience and ready-to-use products, driven by busy lifestyles and an increasing number of working professionals. In 2022, the number of employed individuals in Saudi Arabia rose to 11.16 million, up from 9.79 million in 2021, showing steady growth in the workforce and reaching near the 2016 peak of 11.64 million. This trend indicates an increased need for working professionals, creating new opportunities in the market for ready-to-use seasonings and sauces. With lifestyles becoming more hectic, the need for convenient cooking solutions is likely to increase across the Kingdom. With ready-to-use sauces, including pasta sauce, marinades, and dips on the rise, individuals are making cooking more convenient by preparing their food. The increasing need for easy-to-use sauces and seasonings to meet the expansion of the food service industry, particularly quick service restaurants (QSRs) and home delivery businesses, is one of the major reasons that are fueling the demand for ready-to-use sauces and seasonings. Demand for exotic and savory sauces such as peri-peri, sriracha, and teriyaki is fueled by international food trends, including fusion cuisine. To counter this, manufacturers are launching convenient packaging alternatives, including single-serve sachets and squeeze bottles, to enhance ease. With the growing young population and urbanization, this trend is creating a positive Saudi Arabia sauces and seasonings market outlook.

Saudi Arabia Sauces and Seasonings Market Growth Factors:

Growing Retail and E-Commerce Channels

As online shopping grows in popularity, consumers can now enjoy a vast selection of sauces and seasonings from their homes, motivated by the convenience, diversity, and simplicity of digital platforms. The rise of supermarkets, hypermarkets, and online grocery shops are making it easier for consumers to access a wider range of products. This transition is supported by promotional deals, subscription options, and tailored suggestions, which are improving individual involvement and expanding market access. E-commerce is also providing an avenue for international brands to enter the local market, introducing a greater variety of global flavors to consumers in Saudi Arabia. The International Trade Administration (ITA) indicated that by 2024, 33.6 million internet users in Saudi Arabia were projected to participate in e-commerce, emphasizing the increasing importance of online shopping in influencing consumer habits and broadening market prospects.

Innovation in Packaging and Product Variety

With consumer preferences leaning towards convenience and sustainability, manufacturers are focusing on easy-to-use, portable, and environment-friendly packaging options. For instance, single-use packets, squeezable containers, and resealable bags are becoming popular, especially for consumption while traveling. This trend not only improves convenience but also satisfies the desires of those looking for simple, clean usage. An important illustration of this trend is the partnership in 2024 between Alesayi Beverage Corporation and SIG. The collaboration, employing the SIG SureFill 42 Aseptic BIB filling system, intended to broaden their product range and launch bag-in-box packaging for drinks, beginning with water and later moving to juices and sauces in the HoReCa industry. This advancement demonstrated the continuous shift towards increased product diversity and improved packaging effectiveness. Additionally, the market is growing with the launch of various product choices, including organic, low-calorie, and spicy types, that address changing consumer preferences.

Influence of Food Festivals and Culinary Events

Culinary events and food festivals in Saudi Arabia have experienced a notable surge in popularity, creating a dynamic platform that drives consumer interest and demand for a wide variety of sauces and seasonings. These events serve as dynamic platforms for both regional and international cuisines, bringing together a diverse array of flavors that captivate attendees. With each festival or culinary showcase, consumers are exposed to a rich assortment of unique sauces, spices, and seasonings, encouraging them to experiment with new ingredients in their cooking. The vibrant atmosphere and media excitement surrounding such events not only heighten public awareness but also create a rise in the demand for these featured products. As a result, both local and international brands are motivated to innovate, introducing novel varieties to meet consumer expectations. This expanding interest in flavor diversity nurtures a more sophisticated culinary culture, fostering a deeper connection to flavor exploration and, in turn, propelling growth of the sauces and seasonings market.

Saudi Arabia Sauces and Seasonings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, packaging type, distribution channel, and end user.

Product Type Insights:

- Sauces

- Hot Sauces

- Table Sauces

- Cooking Sauces

- Dips and Dressings

- Seasonings and Spices

- Powdered Seasonings

- Liquid Seasonings

- Herb and Spice Blends

The report has provided a detailed breakup and analysis of the market based on the product type. This includes sauces (hot sauces, table sauces, cooking sauces, and dips and dressings) and seasonings and spices (powdered seasonings, liquid seasonings, and herb and spice blends).

Packaging Type Insights:

- Bottles and Jars

- Pouches and Sachets

- Cans and Tins

- Spray and Squeeze Packs

A detailed breakup and analysis of the market based on the packaging type have also been provided in the report. This includes bottles and jars, pouches and sachets, cans and tins, and spray and squeeze packs.

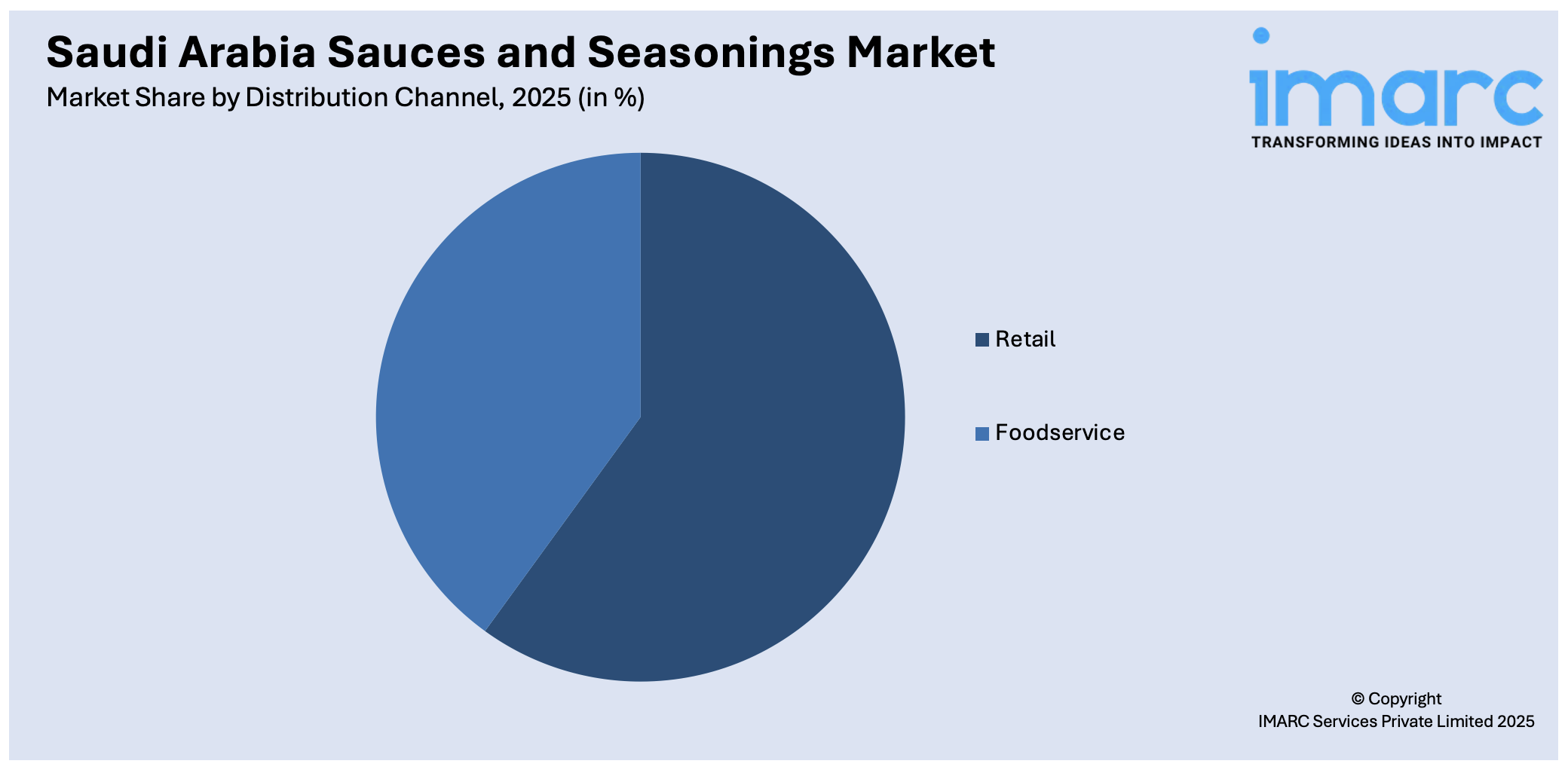

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Retail

- Foodservice

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes retail and foodservice.

End User Insights:

- Household/Consumer

- Food Manufacturers

- HoReCa (Hotels, Restaurants, Cafés)

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes household/consumer, food manufacturers, and HoReCa (hotels, restaurants, cafés).

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Sauces and Seasonings Market News:

- February 2025: Dubai's popular burger brand, Pickl, is launching its first outlet in Riyadh, Saudi Arabia, bringing its high-quality, no-nonsense burgers to the city. Set to open at Al Nakheel Mall, the menu features both classic and plant-based options with their fresh, house-made sauces and custom spice blends.

- December 2024: SCG International launched Siam Signature, a premium Thai food and beverage brand, at Tamimi Markets in Riyadh. The brand included ready-made sauces from Thai Aree, along with products like Doi Kham and Raimaijon, offering authentic Thai flavors to Saudi consumers. The event highlighted the strengthening cultural and economic ties between Thailand and Saudi Arabia.

- August 2024: ID Fresh Foods announced plans to establish a production base in Saudi Arabia by the end of the year as part of its global expansion strategy. The company also launched new spices, including blended and wet spices, by September 2024.

- August 2024: Heinz launched the "Hum Hum" robotic snack dipper at the Esports World Cup in Saudi Arabia. The device allowed gamers to dip their snacks into Heinz sauces without pausing their game, addressing the 75% of gamers who want to snack while playing.

- March 6, 2025: Tanmiah Food Company signed a Memorandum of Understanding with Griffith Foods for working together on creating halal-targeted sauces, seasonings, and ingredient solutions in Saudi Arabia. It reflects the objectives of Vision 2030 related to increasing food security and pursuing sustainability. Plans include setting up an advanced research and development hub as well as the Kingdom's first facility with all its capacity entirely focused on halal ingredients. This partnership supports the growing market for seasonings and sauces in Saudi Arabia by providing innovations that are locally adapted and globally inspired.

Saudi Arabia Sauces and Seasonings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Packaging Types Covered | Bottles and Jars, Pouches and Sachets, Cans and Tins, Spray and Squeeze Packs |

| Distribution Channels Covered | Retail, Foodservice |

| End Users Covered | Household/Consumer, Food Manufacturers, HoReCa (Hotels, Restaurants, Cafés) |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia sauces and seasonings market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia sauces and seasonings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia sauces and seasonings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The sauces and seasonings market in Saudi Arabia was valued at USD 642.0 Million in 2025.

The Saudi Arabia sauces and seasonings market is projected to exhibit a CAGR of 6.10% during 2026-2034, reaching a value of USD 1,093.8 Million by 2034.

The Saudi Arabia sauces and seasonings market is driven by increasing consumer demand for diverse flavors, the growing popularity of international cuisines, and rising disposable incomes. Additionally, changing eating habits, the rising number of fast food chains, and a younger population seeking convenience contribute to the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)