Saudi Arabia School Market Size, Share, Trends and Forecast by Level of Education, Ownership, Board of Affiliation, Fee Structure, and Region, 2026-2034

Saudi Arabia School Market Overview:

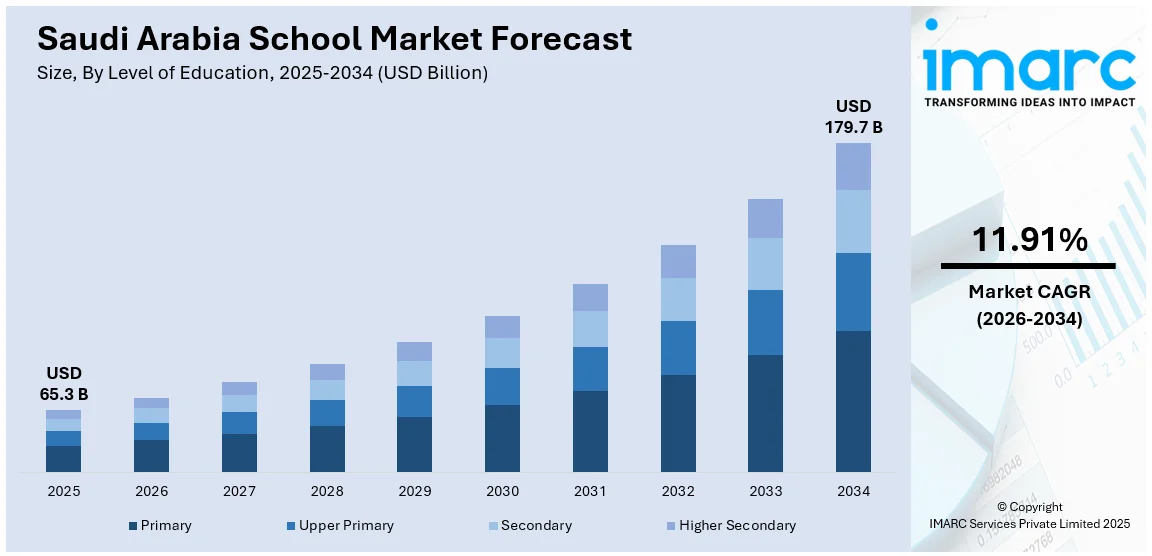

The Saudi Arabia school market size reached USD 65.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 179.7 Billion by 2034, exhibiting a growth rate (CAGR) of 11.91% during 2026-2034. The market in Saudi Arabia is growing because of the expanding digital learning adoption, rising demand for international curricula fueled by expat inflows and local aspirations, and regulatory reforms that improve transparency, streamline enrollment, and strengthen trust between schools and families.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 65.3 Billion |

| Market Forecast in 2034 | USD 179.7 Billion |

| Market Growth Rate 2026-2034 | 11.91% |

Saudi Arabia School Market Trends:

Growing Adoption of Digital Learning Tools

The acceleration of digital learning tools, both in classrooms and at home, is reshaping expectations around school delivery formats. Schools are integrating digital platforms for homework, parent-teacher communication, lesson planning, and assessment. This shift is attracting families who see value in technology-enhanced education that provides greater visibility and personalized learning. The governing body is also investing in digital infrastructure, making it easier for schools to adopt blended and remote learning capabilities. The use of artificial intelligence (AI)-powered tools, gamified content, and adaptive learning systems is influencing how schools differentiate themselves. Institutions that demonstrate readiness for digital innovation tend to attract higher enrolments and parent satisfaction. In 2025, Saudi Arabia launched the Mustaqbalhum app, allowing over two million parents to access real-time performance data for more than 22,000 schools. The initiative aims to improve educational quality, transparency, and accountability by offering insights into student performance, including national test results. It also seeks to empower families and foster healthier school competition, enhancing human capital.

To get more information on this market Request Sample

Inflow of Expat Families and International Curricula Demand

The relaxation of residency and employment regulations is resulting in a consistent rise in expatriate families relocating to Saudi Arabia, particularly in major business areas. This trend is increasing the need for schools that provide internationally recognized curricula. These families emphasize maintaining academic standards, language familiarity, and cultural adaptability, leading to an increase in interest in international education options. Local families are also opting for these institutions, viewing them as routes to improved international university placement and job opportunities. As a result, officials are proactively supporting the arrival of foreign entities and the growth of international programs within Saudi Arabia. In 2024, International Schools Services (ISS) was announced as the first American-based International School Operator (ISO) in Riyadh, Saudi Arabia. ISS planned to open its first school in the city in 2026, contributing to Saudi Arabia’s Vision 2030 by enhancing the quality of education. This move aligned with the Royal Commission for Riyadh City’s efforts to attract international schools to the capital.

Regulatory Reforms Enhancing Transparency and Access

Saudi Arabia's emphasis on regulatory reform is enhancing transparency and strengthening parental trust in the private education sector. By establishing more defined regulations for enrollment processes and formalizing the duties of schools and families, the system is becoming more organized and accessible. These modifications assist in avoiding conflicts, guarantee equitable treatment, and foster a more stable connection between institutions and parents. With processes becoming more standardized, schools experience improved operations and enhanced consistency in enrolment. This clear regulation not only promotes more effective school administration but also aligns with initiatives to foster an inclusive and reliable educational atmosphere. In 2024, Saudi Arabia launched a unified electronic contract for student enrollment in private schools. This initiative clarified the contractual relationship between schools and parents, ensuring transparency and protecting the rights of both parties. It also simplified the enrollment process and ensured that students were not denied education due to financial difficulties.

Saudi Arabia School Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on level of education, ownership, board of affiliation, and fee structure.

Level of Education Insights:

- Primary

- Upper Primary

- Secondary

- Higher Secondary

The report has provided a detailed breakup and analysis of the market based on the level of education. This includes primary, upper primary, secondary, and higher secondary.

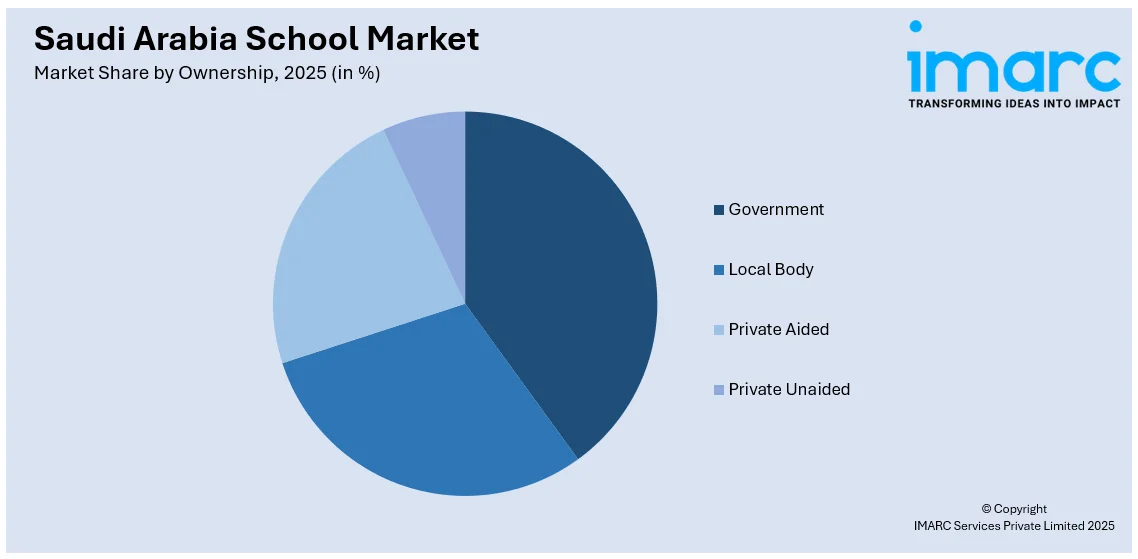

Ownership Insights:

Access the comprehensive market breakdown Request Sample

- Government

- Local Body

- Private Aided

- Private Unaided

A detailed breakup and analysis of the market based on the ownership have also been provided in the report. This includes government, local body, private aided, and private unaided.

Board of Affiliation Insights:

- Central Board of Secondary Education (CBSE)

- Council for the Indian School Certificate Examinations (CISCE)

- State Government Boards

- Others

The report has provided a detailed breakup and analysis of the market based on the board of affiliation. This includes central board of secondary education (CBSE), council for the Indian school certificate examinations (CISCE), state government boards, and others.

Fee Structure Insights:

- Low-Income

- Medium-Income

- High-Income

A detailed breakup and analysis of the market based on the fee structure have also been provided in the report. This includes low-income, medium-income, and high-income.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia School Market News:

- In April 2025, Saudi Arabia launched an AI course for 12th-grade students, aiming to equip over 50,000 learners with essential digital skills. Introduced by SDAIA and the Ministry of Education, the course is part of the Vision 2030 strategy to build a knowledge-based economy. It blends theory with hands-on projects via a digital platform to prepare students for future tech-driven careers.

- In January 2025, Saudi Arabia’s Ministry of Education issued a directive requiring secondary school students in public and private schools to wear the national dress, including the thobe and ghutra or shemagh. This policy aims to strengthen national identity and pride in Saudi heritage. It does not apply to students at foreign schools and includes awareness programs for smooth implementation.

Saudi Arabia School Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Level of Educations Covered | Primary, Upper Primary, Secondary, Higher Secondary |

| Ownerships Covered | Government, Local Body, Private Aided, Private Unaided |

| Board of Affiliations Covered | Central Board of Secondary Education (CBSE), Council for the Indian School Certificate Examinations (CISCE), State Government Boards, Others |

| Fee Structures Covered | Low-Income, Medium-Income, High-Income |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia school market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia school market on the basis of level of education?

- What is the breakup of the Saudi Arabia school market on the basis of ownership?

- What is the breakup of the Saudi Arabia school market on the basis of board of affiliation?

- What is the breakup of the Saudi Arabia school market on the basis of fee structure?

- What is the breakup of the Saudi Arabia school market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia school market?

- What are the key driving factors and challenges in the Saudi Arabia school market?

- What is the structure of the Saudi Arabia school market and who are the key players?

- What is the degree of competition in the Saudi Arabia school market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia school market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia school market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia school industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)