Saudi Arabia School Stationery Supplies Market Size, Share, Trends and Forecast by Product, Distribution Channel, End User, and Region, 2026-2034

Saudi Arabia School Stationery Supplies Market Overview:

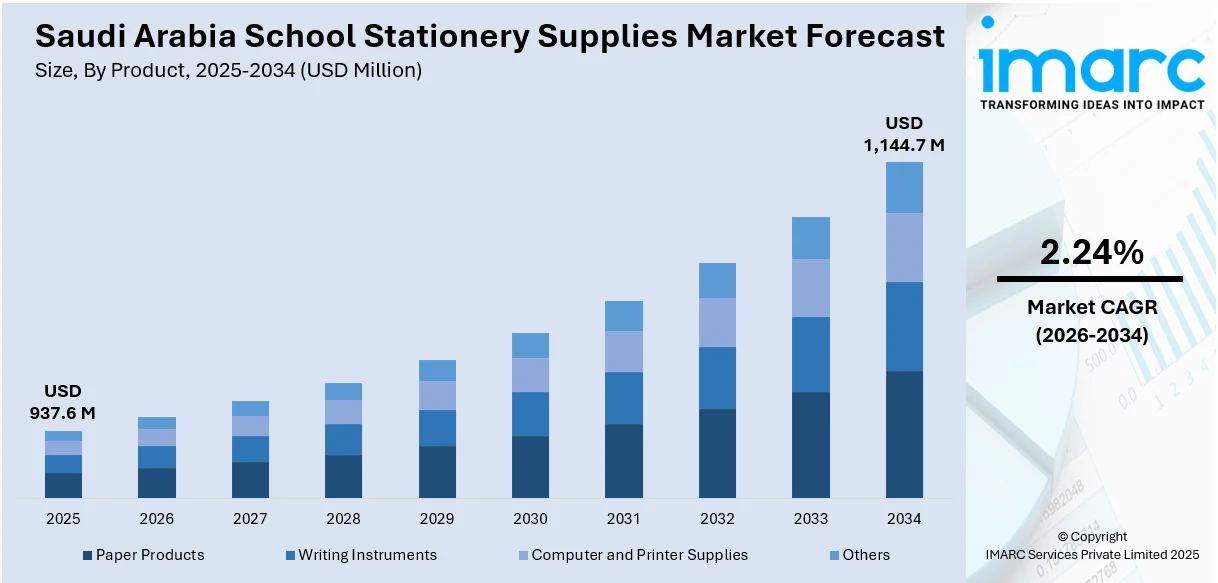

The Saudi Arabia school stationery supplies market size reached USD 937.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,144.7 Million by 2034, exhibiting a growth rate (CAGR) of 2.24% during 2026-2034. The market is growing steadily, driven by rising student enrollment, academic calendar-linked demand, and expanding local paper production. Seasonal purchasing cycles and efforts to reduce import reliance are shaping a more stable, responsive, and cost-effective supply environment across the Kingdom.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 937.6 Million |

| Market Forecast in 2034 | USD 1,144.7 Million |

| Market Growth Rate 2026-2034 | 2.24% |

Saudi Arabia School Stationery Supplies Market Trends:

Rising Domestic Production Securing Supply

Saudi Arabia’s school stationery supplies market is seeing a shift toward improved supply stability, driven by national efforts to increase local manufacturing capacity. With rising student enrollment and year-round academic activities, the country faces continuous pressure to maintain a steady, cost-effective supply of essential paper products. Local paper production is becoming central to easing dependency on imports, cutting costs, and ensuring faster delivery of goods across the educational supply chain. This shift was reinforced in March 2025, when MEPCO began constructing its fifth production line (PM5), which doubled its production capacity from 425,000 Tons to 875,000 Tons annually. The PM5 line introduced high-quality, low-basis weight paper while offering a cost-effective alternative to imported products, which previously made up nearly 30% of local consumption. This development helped meet increasing domestic demand, especially for notebooks, worksheets, and paper-based teaching aids used across schools in the Kingdom. It also created greater pricing control for local distributors and reduced the risk of stock disruptions. As more schools expand their intake and introduce digital-paper hybrid learning formats, the assurance of a reliable paper source becomes a long-term market driver. This trend strengthens Saudi Arabia’s positioning in the regional school stationery ecosystem by focusing on self-reliance and sustainability.

To get more information on this market Request Sample

Academic Reopening’s Driving Seasonal Demand

The Saudi school stationery supplies market continues to experience cyclical demand peaks aligned with the academic calendar, particularly around the start of the school year. These seasonal surges drive strong retail activity in educational merchandise, including notebooks, writing materials, bags, bottles, and classroom accessories. Families preparing for term openings tend to increase their purchases in a short window, creating a concentrated yet predictable demand pattern. In August 2024, IPS (International Programs School) announced the beginning of its 2024–2025 academic year, with classes starting on the 25th of August and a Parent-Student Orientation Day held on the 22nd of August. The announcement encouraged families to prepare students with labeled water bottles, lunch containers, and school supplies to meet classroom requirements. This directly contributed to a boost in demand for stationery and school gear across retail outlets in Saudi Arabia. Suppliers typically align their inventory buildup and marketing efforts with these school announcements, using them to optimize sales. Retailers and brands also use this window to launch themed collections and offer bundled deals targeting specific grade levels. These short-term surges, tied closely to academic events, are an important recurring driver for the stationery market, supporting both local production and retail distribution throughout the Kingdom.

Saudi Arabia School Stationery Supplies Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product, distribution channel, and end user.

Product Insights:

- Paper Products

- Writing Instruments

- Computer and Printer Supplies

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes paper products, writing instruments, computer and printer supplies, and others.

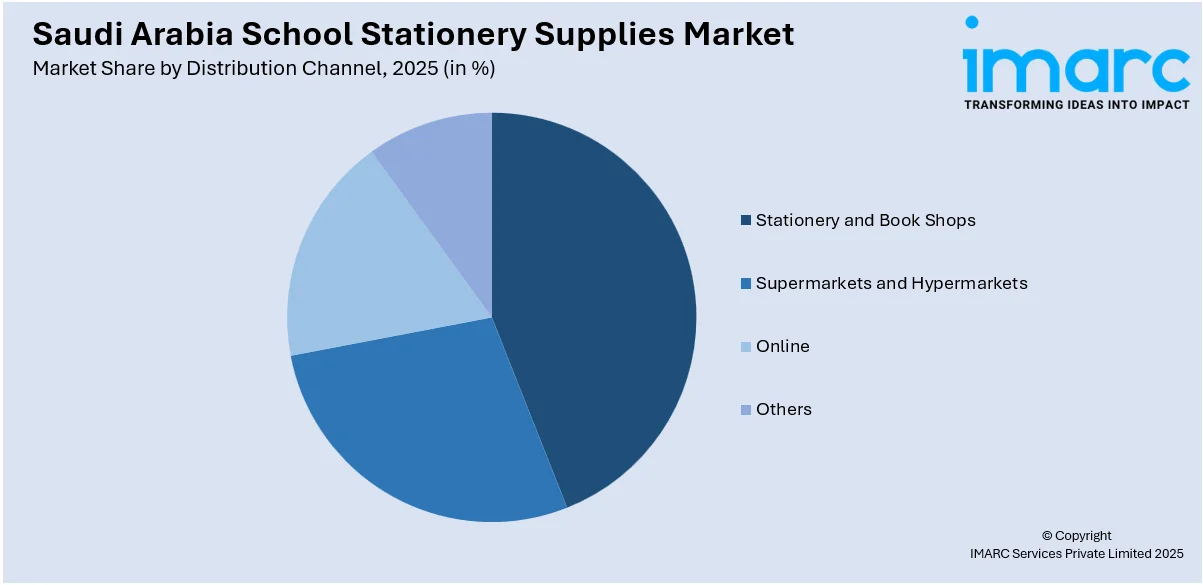

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Stationery and Book Shops

- Supermarkets and Hypermarkets

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes stationery and book shops, supermarkets and hypermarkets, online, and others.

End User Insights:

- K-12

- Higher Education

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes K-12 and higher education.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central region, Western region, Eastern region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia School Stationery Supplies Market News:

- August 2024: R&B, under Apparel Group, launched its Back-to-School collection across the UAE, offering character-themed trolley sets, backpacks, and stationery. This rollout supported regional demand, boosting Saudi Arabia’s school stationery supplies market through cross-border brand influence and accessible, trend-driven educational products.

- August 2024: IPS announced the start of the 2024–2025 academic year and hosted a Parent-Student Orientation Day. This event boosted demand for school stationery supplies in Saudi Arabia, as students prepared with lunch gear, labeled bottles, and classroom materials ahead of reopening.

Saudi Arabia School Stationery Supplies Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Paper Products, Writing Instruments, Computer and Printer Supplies, Others |

| Distribution Channels Covered | Stationery and Book Shops, Supermarkets and Hypermarkets, Online, Others |

| End Users Covered | K-12, Higher Education |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia school stationery supplies market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia school stationery supplies market on the basis of the product?

- What is the breakup of the Saudi Arabia school stationery supplies market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia school stationery supplies market on the basis of end user?

- What is the breakup of the Saudi Arabia school stationery supplies market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia school stationery supplies market?

- What are the key driving factors and challenges in the Saudi Arabia school stationery supplies market?

- What is the structure of the Saudi Arabia school stationery supplies market and who are the key players?

- What is the degree of competition in the Saudi Arabia school stationery supplies market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia school stationery supplies market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia school stationery supplies market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia school stationery supplies industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)