Saudi Arabia Security as a Service Market Size, Share, Trends and Forecast by Component, Organization Size, Application, Vertical, and Region, 2026-2034

Saudi Arabia Security as a Service Market Overview:

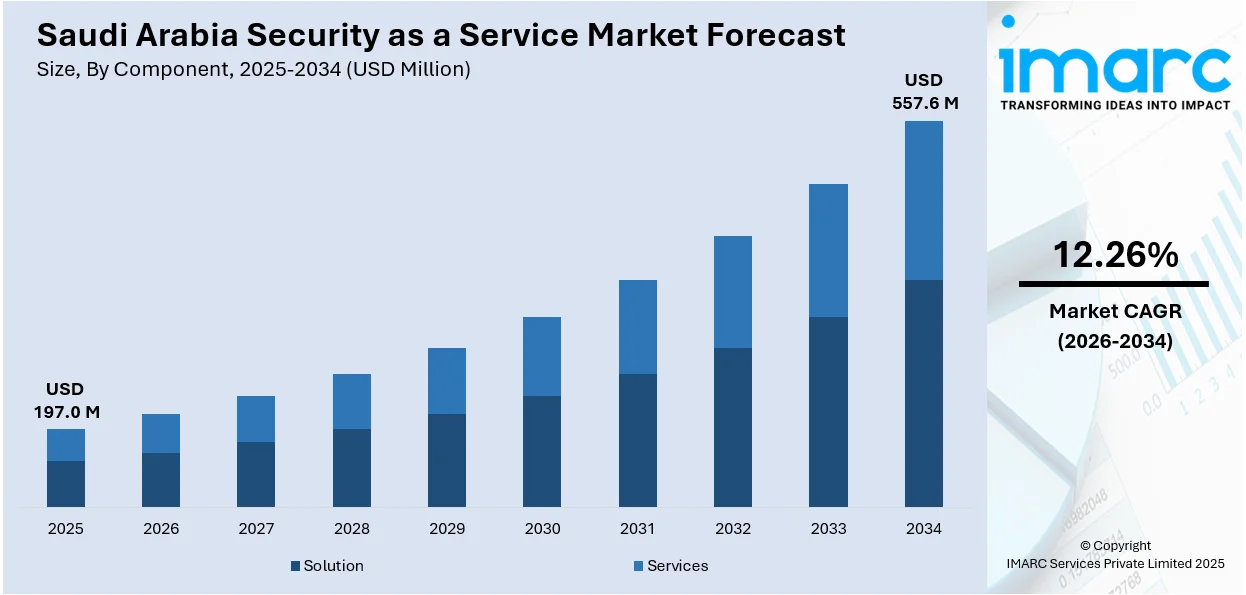

The Saudi Arabia security as a service market size reached USD 197.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 557.6 Million by 2034, exhibiting a growth rate (CAGR) of 12.26% during 2026-2034. The rising cyberattacks on energy, finance, and government sectors and the need for cost-effective, scalable security solutions are increasing the market demand. In addition to this, supportive regulatory frameworks, Vision 2030’s push for IT modernization, rising awareness of endpoint and network security, a shortage of in-house cybersecurity expertise, growing reliance on remote workforces, increased digitalization, and widespread cloud adoption are some of the major factors augmenting Saudi Arabia security as a service market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 197.0 Million |

| Market Forecast in 2034 | USD 557.6 Million |

| Market Growth Rate 2026-2034 | 12.26% |

Saudi Arabia Security as a Service Market Trends:

Accelerated Adoption of Cloud-Integrated Security Services by Large Enterprises

The increasing shift toward cloud infrastructure across Saudi Arabia’s banking, energy, and industrial sectors is increasing demand for scalable cloud-based security solutions. Large organizations are increasingly migrating critical applications to public, private, or hybrid cloud environments, which inherently require robust security layers for access control, threat detection, and data loss prevention. Recent industry reports indicate a 70% rise in commercial registrations for cloud computing services in the fourth quarter of 2024, underscoring the pace at which cloud adoption is expanding nationwide. This momentum is directly impacting the Saudi Arabia security as a service market growth, with vendors rolling out solutions that are not only cloud-native but also designed to meet the compliance requirements set forth by Saudi Arabia’s National Cybersecurity Authority (NCA). These services offer real-time threat visibility, centralized policy enforcement, and seamless integration with existing cloud infrastructure, making them increasingly attractive to enterprises seeking scalable, regulatory-aligned security models tailored to the market. Additionally, security orchestration and automation features are embedded into cloud security offerings to reduce incident response times. Furthermore, by leveraging artificial intelligence (AI) and machine learning (ML), these tools can detect anomalies in real time and help large enterprises secure cloud workloads without expanding internal security teams

To get more information on this market Request Sample.

SME Demand for Managed Detection and Response (MDR) Services

Saudi Arabia’s small and medium-sized enterprises (SMEs) are facing heightened exposure to cyber threats, primarily due to constrained internal resources and a shortage of dedicated cybersecurity personnel. As per the industry report, there was a 3.1% increase in the number of SMEs by the end of 2023, bringing the total to approximately 1.3 million enterprises. The SME segment now forms a significant portion of the Kingdom’s economic base. As digital adoption rises among SMEs, especially in retail, logistics, fintech, and professional services, the threat landscape is expanding, with phishing, ransomware, and supply chain intrusions becoming more common and disruptive. In response to these growing risks, SMEs across the country are increasingly adopting managed Security-as-a-Service solutions, with a strong emphasis on Managed Detection and Response (MDR). These offerings provide round-the-clock threat monitoring, endpoint protection, and incident response, all delivered remotely and without the need for internal security operations centers. Additionally, government support programs, such as Monsha’at’s cybersecurity awareness initiatives, are encouraging wider adoption of managed security services by SMEs. Vendors are capitalizing on this by developing region-specific threat intelligence capabilities and compliance frameworks aligned with the Kingdom’s cybersecurity policies. The affordability, minimal infrastructure requirement, and pay-as-you-go pricing make MDR appealing for SMEs needing enterprise-grade defense but lacking the capacity to build such capabilities independently.

Saudi Arabia Security as a Service Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component, organization size, application, and vertical.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Organization Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium-sized enterprises and large enterprises.

Application Insights:

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes network security, endpoint security, application security, cloud security, and others.

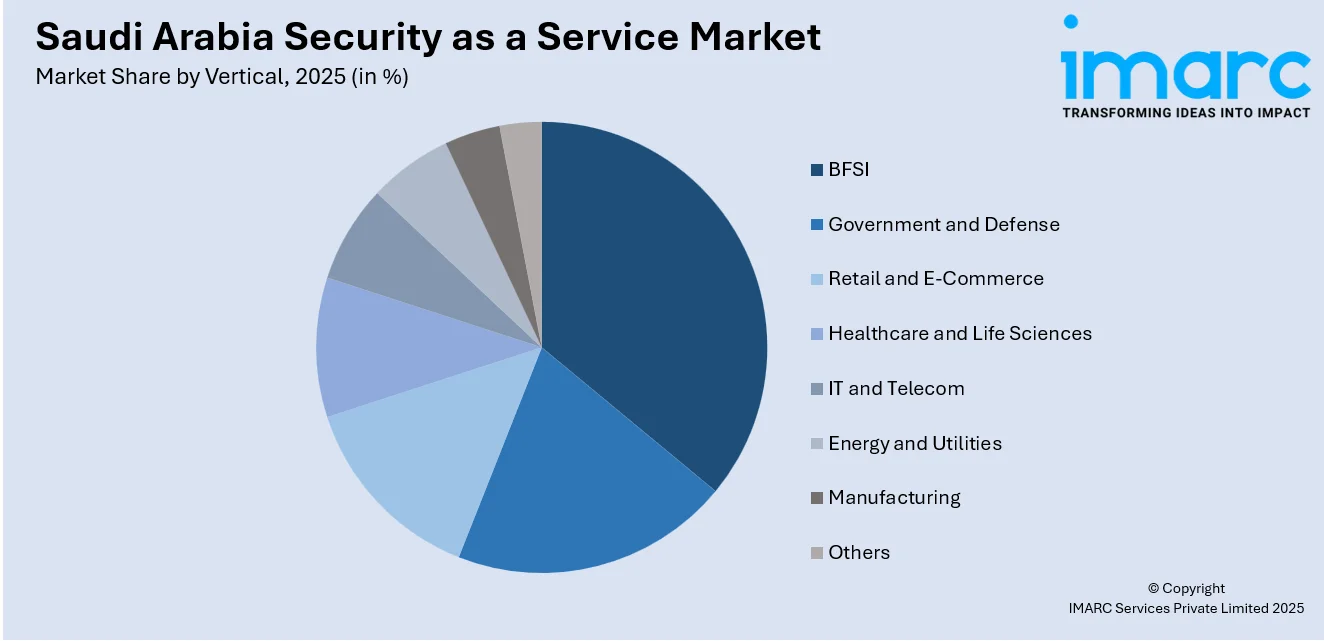

Vertical Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- Government and Defense

- Retail and E-Commerce

- Healthcare and Life Sciences

- IT and Telecom

- Energy and Utilities

- Manufacturing

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes BFSI, government and defense, retail and e-commerce, healthcare and life sciences, IT and telecom, energy and utilities, manufacturing, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Security as a Service Market News:

- On April 1, 2024, a joint venture (JV) agreement was formed by AhnLab Inc. and Saudi Arabian Information Technology Company (SITE). SITE is a national company that specializes in cloud services and security, and it is entirely funded by the Saudi Arabian Public Investment Fund (PIF). The goal of this collaboration is to provide improved security services and solutions to Saudi Arabian public institutions and businesses.

- On November 27, 2024, a strategic partnership was formed between Security Matterz and Cofense, the industry leader in email security awareness training (SAT) and advanced phishing detection and response (PDR) solutions. By integrating Cofense's cutting-edge technologies into its product range, Security Matterz will enhance and broaden its email security offering across Saudi Arabia and the larger Gulf.

Saudi Arabia Security as a Service Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Applications Covered | Network Security, Endpoint Security, Application Security, Cloud Security, Others |

| Verticals Covered | BFSI, Government and Defense, Retail and E-Commerce, Healthcare and Life Sciences, IT and Telecom, Energy and Utilities, Manufacturing, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia security as a service market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia security as a service market on the basis of component?

- What is the breakup of the Saudi Arabia security as a service market on the basis of organization size?

- What is the breakup of the Saudi Arabia security as a service market on the basis of application?

- What is the breakup of the Saudi Arabia security as a service market on the basis of vertical?

- What is the breakup of the Saudi Arabia security as a service market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia security as a service market?

- What are the key driving factors and challenges in the Saudi Arabia security as a service market?

- What is the structure of the Saudi Arabia security as a service market and who are the key players?

- What is the degree of competition in the Saudi Arabia security as a service market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia security as a service market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia security as a service market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia security as a service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)