Saudi Arabia Smart Display Market Size, Share, Trends and Forecast by Type, Display Size, Resolution, End User, and Region, 2026-2034

Saudi Arabia Smart Display Market Overview:

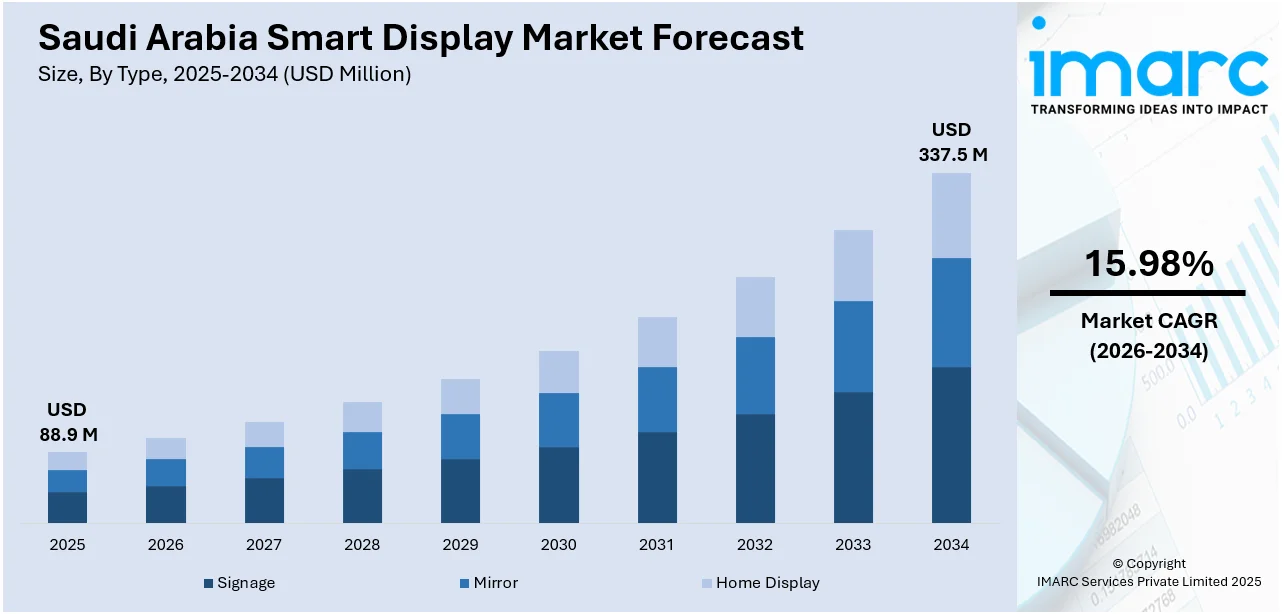

The Saudi Arabia smart display market size reached USD 88.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 337.5 Million by 2034, exhibiting a growth rate (CAGR) of 15.98% during 2026-2034. The market is witnessing rapid growth, led by display technologies like OLED and QLED which have improved the visuals and functionality of smart displays, thereby increasing their appeal to consumers. Moreover, the growing demand for smart devices and home automation solutions and government agendas such as Vision 2030 also focus on driving digital transformation and advancements in technology, are further fueling the Saudi Arabia smart display market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 88.9 Million |

| Market Forecast in 2034 | USD 337.5 Million |

| Market Growth Rate 2026-2034 | 15.98% |

Saudi Arabia Smart Display Market Trends:

Blending with Smart Homes and IoT Environments

In Saudi Arabia, the uptake of smart displays is becoming increasingly enmeshed within the overall smart home and Internet of Things (IoT) environments. Consumers today are looking for easy integration of their devices to create smart homes and living spaces. Smart displays hence act as focal points where users can manage lighting, climate, security systems, and entertainment choices by voice or touch interfaces. The integration enhances user convenience and adds to energy efficiency, which works in sync with the Kingdom's sustainability ambitions. The various government-backed programs, like that of the Smart Cities Program and the National Transformation Program, also drive the implementation of smart technologies, such as smart displays, in homes and offices. Consequently, the market for smart displays that provide support for multiple IoT devices and platforms is undergoing rapid expansion, in turn fueling innovation and competition.

To get more information on this market Request Sample

Evolution of Display Technologies

The Saudi Arabia smart display market growth is being fueled by the rapid evolution in display technologies, with increased demand for ultra-high-definition (UHD) and organic light-emitting diode (OLED) displays. These technologies provide better image quality, rich colors, and power efficiency, which make them extremely desirable to consumers looking for high-end viewing experiences. With features such as HDR support and AI-driven image processing, these displays improve the overall experience of viewing. Moreover, the growing availability of 4K and 8K content, combined with the expansion of streaming services, contributes to the demand for high-resolution displays. Manufacturers are hence countering this by launching smart displays with advanced features to satisfy the changing needs of Saudi consumers.

Government Initiatives and Infrastructure Development

The Vision 2030 program of the Saudi government is one of the significant drivers, shaping the market for smart displays through digital transformation and infrastructure development. Investments across industries like retail, hospitality, and entertainment are fueling demand for cutting-edge display solutions. Smart screens are being used in a wide range of applications, ranging from digital signage in shopping malls, interactive kiosks in museums to large-format screens in entertainment facilities and sports events. While these screens increase consumer interaction, they also help to modernize public spaces. Moreover, the government's focus on energy efficiency promotes the use of green display technology, further accelerating the market for smart screens within the Kingdom.

Saudi Arabia Smart Display Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, display size, resolution, and end user.

Type Insights:

- Signage

- Mirror

- Home Display

The report has provided a detailed breakup and analysis of the market based on the type. This includes signage, mirror, and home display.

Display Size Insights:

- Below 32 Inch

- Between 32 and 52 Inch

- Above 52 Inch

The report has provided a detailed breakup and analysis of the market based on the display size. This includes below 32 inch, between 32 and 52 inch, and above 52 inch.

Resolution Insights:

- UHD

- FHD

- HD

The report has provided a detailed breakup and analysis of the market based on the resolution. This includes UHD, FHD, and HD.

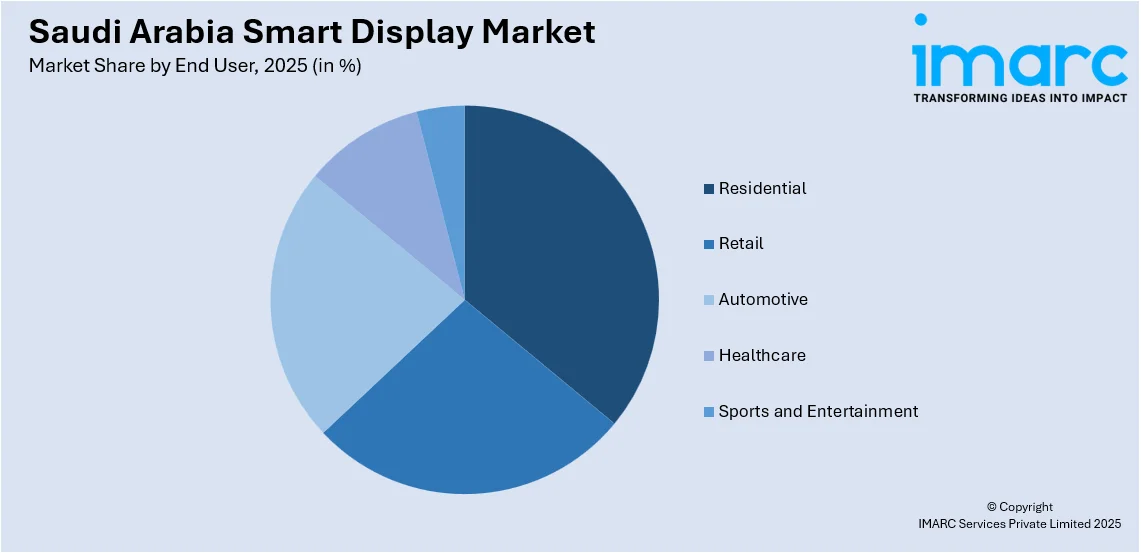

End User Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Retail

- Automotive

- Healthcare

- Sports and Entertainment

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, retail, automotive, healthcare, and sports and entertainment.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Smart Display Market News:

- In November 2024, Mohammed bin Salman Nonprofit City, referred to as Misk City, executed a memorandum of understanding with the technology leader Samsung Electronics to collaborate in the areas of smart city technology, sustainability, and youth empowerment. David Henry, the CEO of Misk City, signed the memorandum alongside Hendrick Lee, the President of Samsung Electronics Saudi Arabia, during the Misk Global Forum in Riyadh.

Saudi Arabia Smart Display Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Signage, Mirror, Home Display |

| Display Sizes Covered | Below 32 Inch, Between 32 and 52 Inch, Above 52 Inch |

| Resolutions Covered | UHD, FHD, HD |

| End Users Covered | Residential, Retail, Automotive, Healthcare, Sports and Entertainment |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia smart display market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia smart display market on the basis of type?

- What is the breakup of the Saudi Arabia smart display market on the basis of display size?

- What is the breakup of the Saudi Arabia smart display market on the basis of resolution?

- What is the breakup of the Saudi Arabia smart display market on the basis of end user?

- What is the breakup of the Saudi Arabia smart display market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia smart display market?

- What are the key driving factors and challenges in the Saudi Arabia smart display market?

- What is the structure of the Saudi Arabia smart display market and who are the key players?

- What is the degree of competition in the Saudi Arabia smart display market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia smart display market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia smart display market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia smart display industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)