Saudi Arabia Smart Factory Automation Market Size, Share, Trends and Forecast by Technology, Component, Deployment Mode, Industry Vertical, and Region, 2026-2034

Saudi Arabia Smart Factory Automation Market Overview:

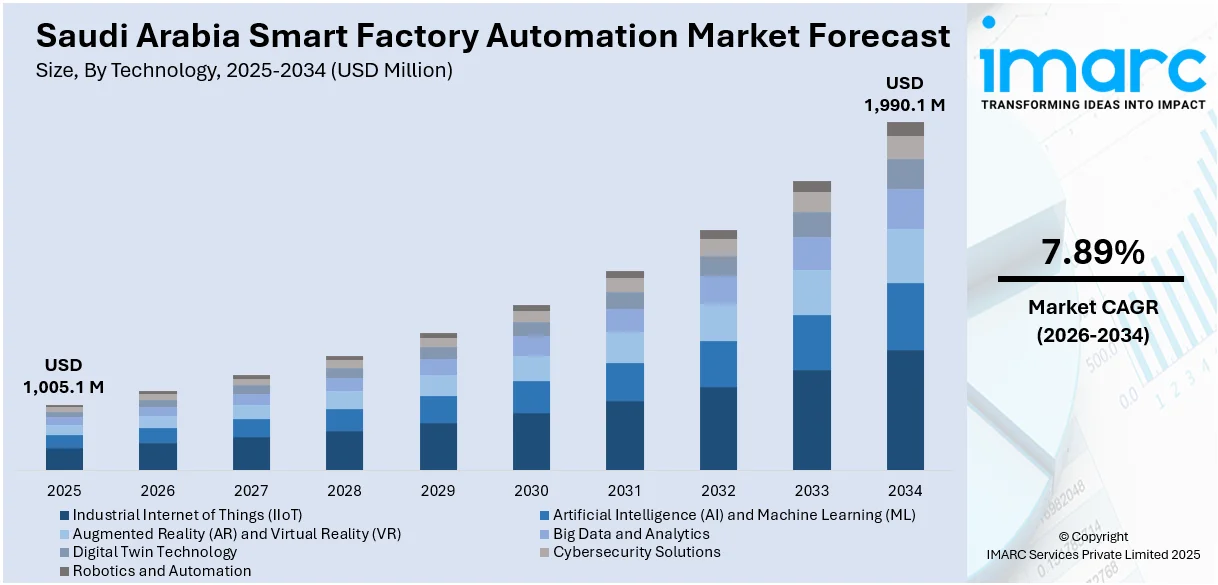

The Saudi Arabia smart factory automation market size reached USD 1,005.1 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,990.1 Million by 2034, exhibitingt a growth rate (CAGR) of 7.89% during 2026-2034. The industry is fueled by the emphasis on diversification of industries in Vision 2030, state-supported incentives, increased need for operational effectiveness, and rapid growth of digital infrastructure. Collaboration with international tech companies in strategic partnerships also underpins innovation and adoption of Industry 4.0 solutions and influences Saudi Arabia smart factory automation market share favorably.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,005.1 Million |

| Market Forecast in 2034 | USD 1,990.1 Million |

| Market Growth Rate 2026-2034 | 7.89% |

Saudi Arabia Smart Factory Automation Market Trends:

Government-Led Industrial Modernization

Saudi Arabia's Vision 2030 has spurred a wide-ranging overhaul of its industrial sector. The National Industrial Development and Logistics Program (NIDLP) and the Madar Smart City Program are central to this effort, providing financial incentives, regulatory assistance, and infrastructure investment to promote the use of smart manufacturing technologies. These efforts seek to diminish the Kingdom's reliance on oil exports by creating a diversified and technologically sophisticated industrial base. The development of smart cities and industrial zones further reinforces this vision as it creates favorable environments for Industry 4.0 solutions integration. Consequently, the use of automation, robotics, and data analysis by manufacturers to drive productivity and competitiveness in the global marketplace is gaining traction. For instance, the inaugural Industrial Transformation Saudi Arabia is a crucial event that it scheduled for December 2025 in Riyadh, led by Deutsche Messe AG, Riyadh Exhibitions Company, and the Saudi Ministry of Industry and Mineral Resources. Aligned with Vision 2030, the event will highlight smart manufacturing, Industry 4.0, and advanced industrial technologies. The event leverages HANNOVER MESSE’s global platform to boost Saudi Arabia’s industrial modernization and international collaboration.

To get more information on this market Request Sample

Integration of IoT and AI for Operational Efficiency

The convergence of Internet of Things (IoT) and Artificial Intelligence (AI) is aiding the Saudi Arabia smart factory automation market growth. IoT sensors and devices gather live data from machines and equipment and are analyzed using AI algorithms for the purpose of optimizing production effectiveness, anticipating maintenance requirements, and enhancing overall operation performance. It helps manufacturers maximize productivity levels, minimize downtime, and sustain competitiveness. Petrochemicals, manufacturing, and logistics sectors are heavily relying on such technologies to support their operational competencies. The increase in IoT devices and the increasing relevance of data analytics are also driving market growth, as businesses look to streamline processes and save costs. For instance, a 2024 Rockwell Automation study revealed that 87% of companies in Saudi Arabia and the UAE are investing in AI and machine learning, with 86% focusing on generative AI. Key AI applications include quality control (50%) and cybersecurity (47%). Workforce skill gaps (46%) remain a major challenge. Notably, 75% of firms allocate over 20% of operating budgets to tech. Climate change (37%) and supply chain planning ROI (17%) were standout concerns.

Strategic Investments in Digital Infrastructure

Saudi Arabia's commitment to digital transformation is evident in its substantial investments in digital infrastructure. The development of optical fiber networks and wireless connectivity in industrial cities has facilitated the adoption of modern technologies such as 5G and IoT. These advancements enable the creation of connected factories, where continuous data exchange and real-time insights into equipment performance are possible. Such connectivity allows for proactive maintenance and optimized operational efficiency. Moreover, the integration of AI and machine learning models further enhances predictive capabilities, enabling manufacturers to anticipate equipment failures and optimize production schedules. These developments are pivotal in transforming Saudi Arabia's manufacturing sector into a more efficient and innovative ecosystem. For instance, in February 2024, SoftBank and Saudi Arabia’s Alat partnered to invest up to $150 Million in building an industrial robot manufacturing hub in Riyadh by December 2024. The project, part of Saudi Vision 2030, aims to transform manufacturing with next-gen automation and contribute $1 Billion to GDP by 2025. Robots will be developed using SoftBank's IP and powered by green energy, aligning with Alat’s $100 Billion mandate for sustainable, smart manufacturing.

Saudi Arabia Smart Factory Automation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on technology, component, deployment mode, and industry vertical.

Technology Insights:

- Industrial Internet of Things (IIoT)

- Artificial Intelligence (AI) and Machine Learning (ML)

- Augmented Reality (AR) and Virtual Reality (VR)

- Big Data and Analytics

- Digital Twin Technology

- Cybersecurity Solutions

- Robotics and Automation

The report has provided a detailed breakup and analysis of the market based on the technology. This includes Industrial Internet of Things (IIoT), artificial intelligence (AI) and machine learning (ML), augmented reality (AR) and virtual reality (VR), big data and analytics, digital twin technology, cybersecurity solutions, and robotics and automation.

Component Insights:

- Sensors and Actuators

- Industrial Robots

- Human-Machine Interface (HMI)

- Industrial Control Systems

- SCADA

- PLC

- DCS

- Networking and Communication Systems

- Software and Cloud Solutions

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes sensors and actuators, industrial robots, human-machine interface (HMI), industrial control systems (SCADA, PLC, and DCS), networking and communication systems, and software and cloud solutions.

Deployment Mode Insights:

- On-Premises

- Cloud-Based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

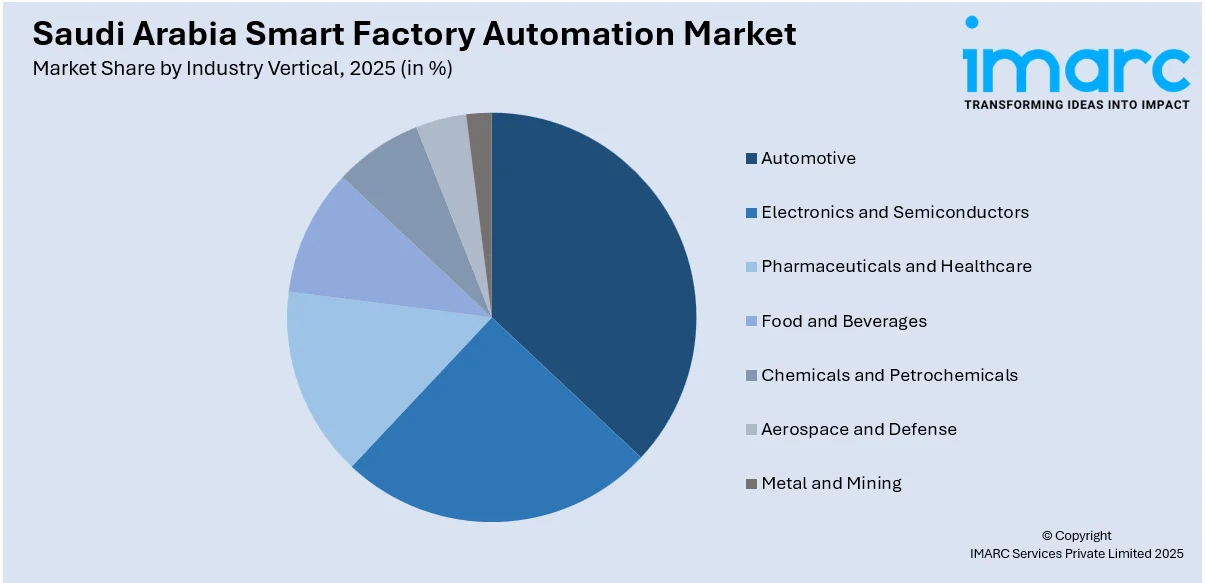

Industry Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Electronics and Semiconductors

- Pharmaceuticals and Healthcare

- Food and Beverages

- Chemicals and Petrochemicals

- Aerospace and Defense

- Metal and Mining

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes automotive, electronics and semiconductors, pharmaceuticals and healthcare, food and beverages, chemicals and petrochemicals, aerospace and defense, and metal and mining.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Smart Factory Automation Market News:

- In October 2024, Emerson inaugurated a new 140,000-square-foot manufacturing and innovation hub at King Salman Energy Park (SPARK) in Saudi Arabia, reinforcing its commitment to local growth and Vision 2030. The facility will produce advanced automation technologies, reduce reliance on imports, and support sustainability goals with energy-efficient systems. It aims to localize supply chains, foster Saudi talent, and expand Emerson’s regional presence while advancing industrial self-sufficiency in the Kingdom.

- In May 2024, Honeywell inaugurated its first building automation assembly line in Dhahran, Saudi Arabia, to produce fire alarm and building management solutions. This facility supports Honeywell’s localization strategy and enhances its capacity to meet regional demand. The initiative aligns with Saudi Arabia’s Vision 2030 and Honeywell’s focus on automation, energy transition, and sustainable infrastructure. Serving both local and Middle Eastern markets, the facility will ensure faster delivery of safety and automation products.

- In April 2024, Dematic expanded its presence in the Middle East with the opening of a new office in Riyadh, Saudi Arabia. Dematic aims to address growing demand for automation in sectors such as food, retail, pharmaceuticals, and automotive by providing tailored solutions like automated storage systems and software. The Riyadh office will enhance local service, project management, and customer support to help drive logistics automation in the region.

- In February 2024, Alat, a Saudi PIF-backed firm, announced four global partnerships with Softbank, Carrier, Dahua Technology, and Tahakom to boost sustainable technology manufacturing in Saudi Arabia. It will invest USD 100 billion by 2030, focusing on clean energy and Industry 4.0. Key initiatives include a USD 150M robotics plant with Softbank and a $200M surveillance tech joint venture with Dahua.

Saudi Arabia Smart Factory Automation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Industrial Internet of Things (IIoT), Artificial Intelligence (AI) and Machine Learning (ML), Augmented Reality (AR) and Virtual Reality (VR), Big Data and Analytics, Digital Twin Technology, Cybersecurity Solutions, Robotics and Automation |

| Components Covered |

|

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Industry Verticals Covered | Automotive, Electronics and Semiconductors, Pharmaceuticals and Healthcare, Food and Beverages, Chemicals and Petrochemicals, Aerospace and Defense, Metal and Mining |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia smart factory automation market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia smart factory automation market on the basis of technology?

- What is the breakup of the Saudi Arabia smart factory automation market on the basis of component?

- What is the breakup of the Saudi Arabia smart factory automation market on the basis of deployment mode?

- What is the breakup of the Saudi Arabia smart factory automation market on the basis of industry vertical?

- What is the breakup of the Saudi Arabia smart factory automation market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia smart factory automation market?

- What are the key driving factors and challenges in the Saudi Arabia smart factory automation market?

- What is the structure of the Saudi Arabia smart factory automation market and who are the key players?

- What is the degree of competition in the Saudi Arabia smart factory automation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia smart factory automation market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia smart factory automation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia smart factory automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)