Saudi Arabia Smart Microgrids Market Size, Share, Trends and Forecast by Type, Component, Power Technology, Consumer Pattern, Application, and Region, 2026-2034

Saudi Arabia Smart Microgrids Market Overview:

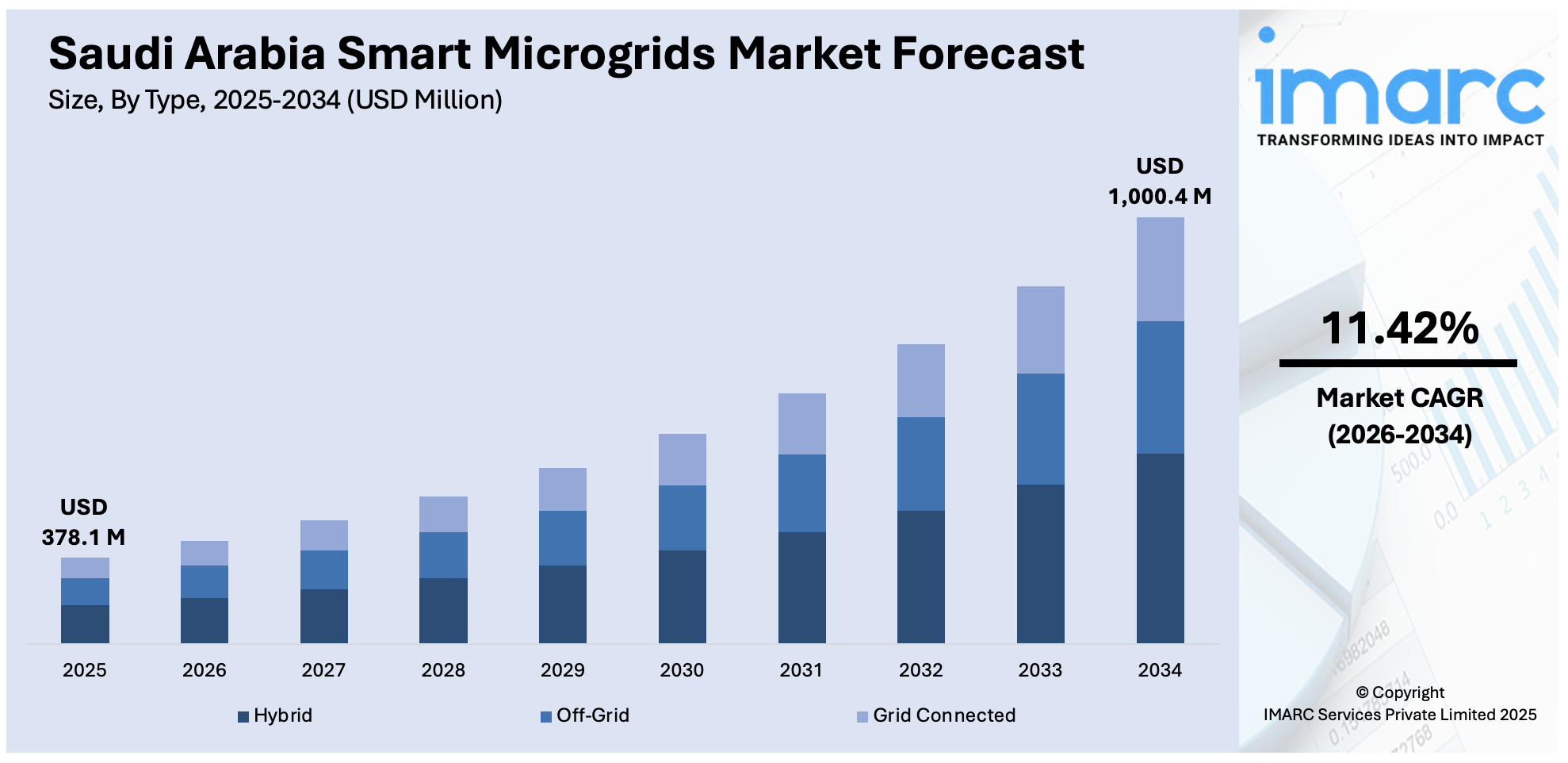

The Saudi Arabia smart microgrids market size reached USD 378.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,000.4 Million by 2034, exhibiting a growth rate (CAGR) of 11.42% during 2026-2034. The market is expanding with large-scale storage rollouts, off-grid renewable systems, and advanced grid-forming technologies. Government initiatives under Vision 2030 and increased investments in clean energy infrastructure continue to drive adoption, boosting Saudi Arabia smart microgrids market share across key urban and remote regions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 378.1 Million |

| Market Forecast in 2034 | USD 1,000.4 Million |

| Market Growth Rate 2026-2034 | 11.42% |

Saudi Arabia Smart Microgrids Market Trends:

Utility-Scale Storage Driving Grid Stability

Saudi Arabia is investing heavily in utility-scale battery energy storage systems (BESS) to support its growing renewable energy capacity. These systems play a vital role in balancing electricity supply and demand, ensuring that fluctuations in solar or wind output do not compromise grid stability. As renewable energy penetration rises, smart microgrids equipped with BESS offer flexible, decentralized control and the ability to operate independently or in coordination with the national grid. BESS allows for energy arbitrage, grid frequency regulation, and improved reserve margins, which are crucial for maintaining a stable electricity supply. In April 2025, Saudi Electricity Company launched Phase 2 of its BESS initiative with a total investment of SAR 6.73 Billion. The program included the development of 2.5 GW of storage across five strategic locations: Riyadh, Al-Qaisumah, Al-Jawf, Al-Dawadmi, and Rabigh. Each site is set to host 500 MW/2,000 MWh systems, developed by BYD and Alfanar. These large-scale deployments are aligned with the National Renewable Energy Program (NREP), aiming for 50% renewables in the national mix by 2030. This step significantly advanced Saudi Arabia’s smart microgrids market development by enhancing grid reliability, enabling demand-side management, and reducing reliance on conventional peaking power sources, all while supporting the broader energy transition.

To get more information on this market Request Sample

Off-Grid Solutions Powering Urban Expansion

Saudi Arabia is increasingly turning to smart microgrids as a solution for powering new urban developments and isolated zones with clean, reliable energy. These microgrids, designed to operate independently from the main grid, offer critical advantages in regions where grid extension is economically or logistically impractical. By using integrated solar power and energy storage, these systems ensure 24/7 availability of electricity and reduce dependency on diesel or fossil fuel-based generation. Off-grid smart microgrids are also instrumental in advancing Saudi Arabia’s carbon neutrality goals and improving energy security in new growth areas. In September 2024, Huawei completed a landmark 400 MW solar and 1.3 GWh battery storage microgrid in Red Sea New City. Fully off-grid, the system delivered over 1 TWh of renewable electricity within its first operational year, powering a key area of the Red Sea Project. With grid-forming technologies ensuring stable voltage, frequency, and load balancing, the project demonstrated how intelligent solar-storage systems can support large-scale infrastructure autonomously. It also proved the commercial and technical viability of deploying clean, self-sufficient power systems in Saudi Arabia’s mega-project zones. This success provided strong momentum for the Saudi Arabia smart microgrids market growth, positioning such solutions as central to the country’s urban sustainability and energy diversification strategies.

Saudi Arabia Smart Microgrids Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2026-2034. Our report has categorized the market based on type, component, power technology, consumer pattern, and application.

Type Insights:

- Hybrid

- Off-Grid

- Grid Connected

The report has provided a detailed breakup and analysis of the market based on the type. This includes hybrid, off-grid, and grid connected.

Component Insights:

- Storage

- Inverter

The report has provided a detailed breakup and analysis of the market based on the component. This includes storage and inverter.

Power Technology Insights:

- Fuel Cell

- CHP

A detailed breakup and analysis of the market based on the power technology have also been provided in the report. This includes fuel cell and CHP.

Consumer Pattern Insights:

- Urban

- Rural

A detailed breakup and analysis of the market based on the consumer pattern have also been provided in the report. This includes urban and rural.

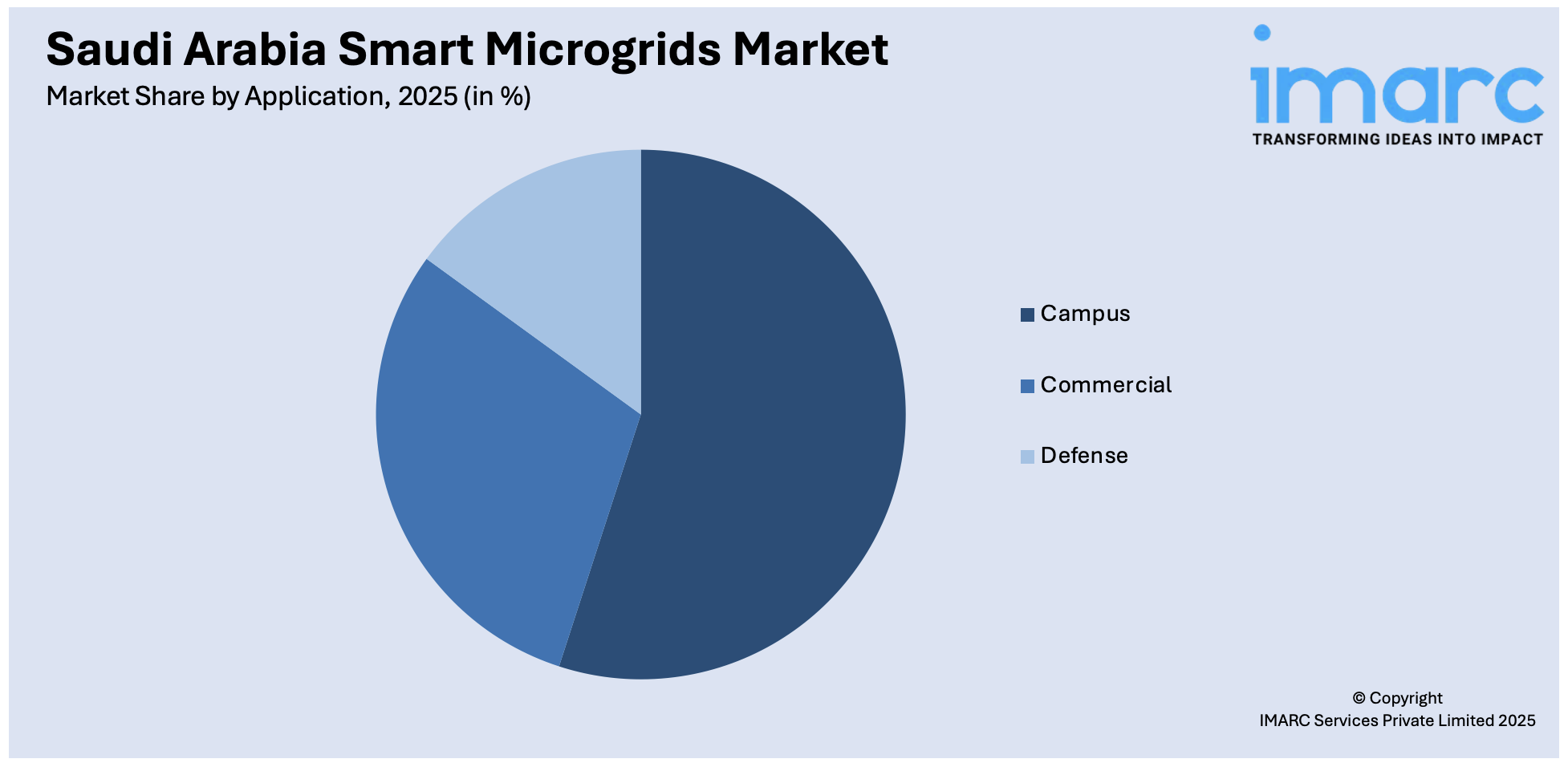

Application Insights:

Access the comprehensive market breakdown Request Sample

- Campus

- Commercial

- Defense

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes campus, commercial, and defense.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central region, Western region, Eastern region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Smart Microgrids Market News:

- April 2025: Saudi Electricity Company launched Phase 2 of its BESS program, investing SAR 6.73 Billion for 2.5 GW storage across five sites. This large-scale deployment enhanced grid reliability, flexibility, and demand response, significantly advancing Saudi Arabia’s smart microgrids market development and energy transition goals.

- January 2025: NEOM’s subsidiary ENOWA advanced Saudi Arabia’s smart microgrids market by implementing a high-voltage “grid of microgrids” powered by 100% renewables. Integrating IoT and AI, the system improved energy efficiency, reduced infrastructure costs, and strengthened large-scale sustainability across the NEOM development zone.

Saudi Arabia Smart Microgrids Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hybrid, Off-Grid, Grid Connected |

| Components Covered | Storage, Inverter |

| Power Technologies Covered | Fuel Cell, CHP |

| Consumer Patterns Covered | Urban, Rural |

| Applications Covered | Campus, Commercial, Defense |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia smart microgrids market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia smart microgrids market on the basis of type?

- What is the breakup of the Saudi Arabia smart microgrids market on the basis of component?

- What is the breakup of the Saudi Arabia smart microgrids market on the basis of power technology?

- What is the breakup of the Saudi Arabia smart microgrids market on the basis of consumer pattern?

- What is the breakup of the Saudi Arabia smart microgrids market on the basis of application?

- What is the breakup of the Saudi Arabia smart microgrids market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia smart microgrids market?

- What are the key driving factors and challenges in the Saudi Arabia smart microgrids market?

- What is the structure of the Saudi Arabia smart microgrids market and who are the key players?

- What is the degree of competition in the Saudi Arabia smart microgrids market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia smart microgrids market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia smart microgrids market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia smart microgrids industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)