Saudi Arabia Smart Safety Helmets Market Size, Share, Trends and Forecast by Technology Type, Connectivity Type, Material Type, Safety Features, End Use Industry, and Region, 2026-2034

Saudi Arabia Smart Safety Helmets Market Overview:

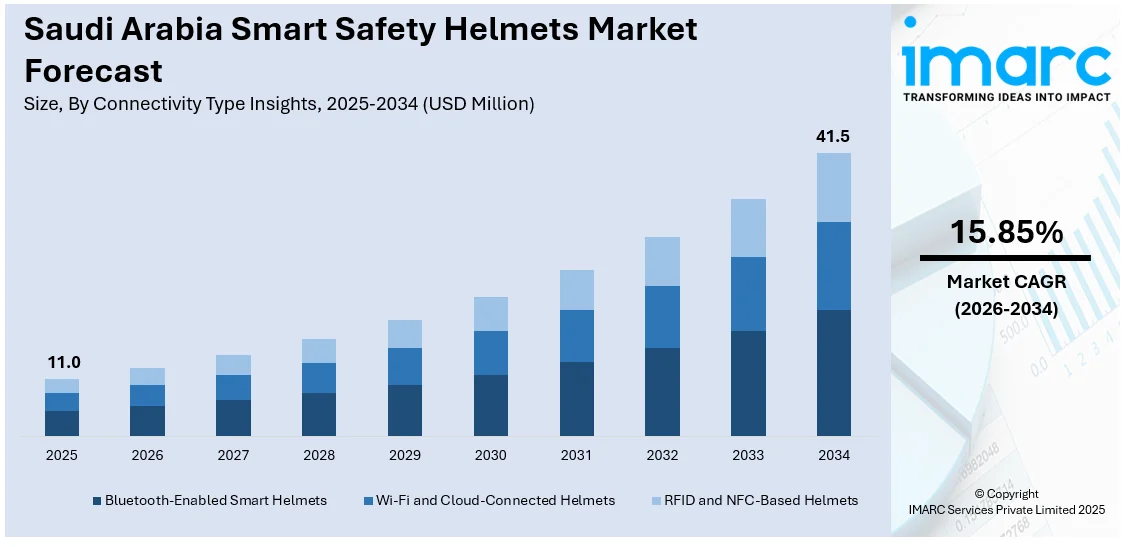

The Saudi Arabia smart safety helmets market size reached USD 11.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 41.5 Million by 2034, exhibiting a growth rate (CAGR) of 15.85% during 2026-2034. The market is gaining traction with growing adoption across construction, oil and gas, and logistics sectors, due to workplace safety regulations and industrial modernization under Vision 2030. The integration of real-time monitoring, GPS, and sensor-based alerts is also enhancing operational efficiency and worker protection. Increasing demand for smart PPE is further expected to significantly boost the Saudi Arabia smart safety helmets market share over the coming years.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 11.0 Million |

| Market Forecast in 2034 | USD 41.5 Million |

| Market Growth Rate 2026-2034 | 15.85% |

Saudi Arabia Smart Safety Helmets Market Trends:

Rising Demand from Industrial and Construction Sectors

The Saudi Arabian smart safety helmets market is witnessing strong growth due to heightened demand from the industrial and construction sectors. This surge is backed by major policy and funding commitments aimed at transforming the country’s economic landscape. Construction sites, in particular, are adopting smart helmets equipped with GPS tracking, real-time hazard alerts, and communication tools to monitor on-site activity and reduce accident risks. Industrial plants, including those in petrochemicals and logistics, are also turning to smart helmets to ensure compliance with stricter safety protocols. These sectors are under growing pressure to enhance workplace safety performance, especially for remote or high-risk operations. As a result, companies are investing in smart PPE to meet both safety goals and productivity benchmarks across projects of national importance.

To get more information on this market Request Sample

Government-Led Safety Regulations

The enforcement of stringent occupational safety regulations in Saudi Arabia is a major catalyst for the adoption of advanced personal protective equipment (PPE), including smart safety helmets. Regulatory bodies are emphasizing worker protection in high-risk sectors such as construction, oil and gas, and heavy manufacturing. Employers are now required to implement proactive safety measures and digital monitoring tools that align with national labor and safety codes. Smart helmets with built-in sensors, real-time communication systems, and environmental alerts are becoming essential for regulatory compliance. These devices not only help reduce workplace incidents but also support documentation and audit readiness. Additionally, government-backed safety campaigns and inspections are increasing awareness and compliance rates across public and private projects. The regulatory push, combined with the need for modernization, is significantly contributing to Saudi Arabia smart safety helmets market growth across various industrial domains.

Integration of IoT and Real-Time Monitoring

The growing emphasis on workplace safety in Saudi Arabia has accelerated the adoption of smart helmets integrated with Internet of Things (IoT) capabilities and real-time monitoring features. These helmets are equipped with GPS, motion sensors, biometric scanners, and environmental detectors that continuously track workers’ location, body temperature, fatigue levels, and exposure to hazardous conditions such as toxic gases or extreme heat. The real-time data is transmitted to centralized dashboards, enabling supervisors to respond promptly to risks and ensure compliance with safety protocols. This level of visibility is particularly valuable on large-scale construction sites and in oil & gas operations where manual oversight is limited. The combination of IoT and data analytics is also being used to generate predictive insights that help prevent accidents before they occur, contributing to a more proactive safety culture and supporting the expansion of Saudi Arabia’s industrial safety ecosystem.

Saudi Arabia Smart Safety Helmets Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on technology type, connectivity type, material type, safety features, and end use industry.

Technology Type Insights:

- IoT-Enabled Smart Helmets

- Augmented Reality (AR) and Heads-Up Display (HUD) Helmets

- AI-Powered Safety Helmets

- Sensor-Based Smart Helmets

- GPS-Enabled Helmets

- Communication-Integrated Helmets

The report has provided a detailed breakup and analysis of the market based on the technology type. This includes IoT-enabled smart helmets, augmented reality (AR) and heads-up display (HUD) helmets, AI-powered safety helmets, sensor-based smart helmets, GPS-enabled helmets, and communication-integrated helmets.

Connectivity Type Insights:

- Bluetooth-Enabled Smart Helmets

- Wi-Fi and Cloud-Connected Helmets

- RFID and NFC-Based Helmets

A detailed breakup and analysis of the market based on the connectivity have also been provided in the report. This includes Bluetooth-enabled smart helmets, Wi-Fi and cloud-connected helmets, and RFID and NFC-based helmets.

Material Type Insights:

- Polycarbonate Helmets

- Fiberglass and Composite Helmets

- ABS Plastic Helmets

- Carbon Fiber Helmets

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes polycarbonate helmets, fiberglass and composite helmets, ABS plastic helmets, and carbon fiber helmets.

Safety Features Insights:

- Real-Time Health Monitoring

- Fall and Impact Detection

- Noise Cancellation and Communication Enhancement

- Fire and Hazard Detection

- Environmental Monitoring

- Smart Lighting and Alerts

A detailed breakup and analysis of the market based on the safety features have also been provided in the report. This includes real-time health monitoring, fall and impact detection, noise cancellation and communication enhancement, fire and hazard detection, environmental monitoring, and smart lighting and alerts.

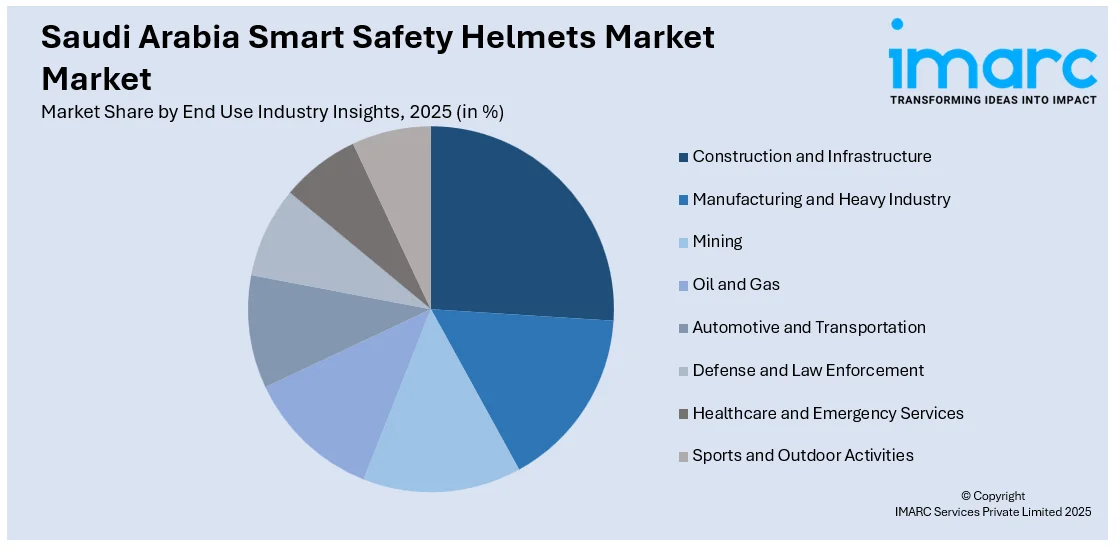

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Construction and Infrastructure

- Manufacturing and Heavy Industry

- Mining, Oil and Gas

- Automotive and Transportation

- Defense and Law Enforcement

- Healthcare and Emergency Services

- Sports and Outdoor Activities

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes construction and infrastructure, manufacturing and heavy industry, mining, oil and gas, automotive and transportation, defense and law enforcement, healthcare and emergency services, and sports and outdoor activities.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Smart Safety Helmets Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technology Types Covered | IoT-Enabled Smart Helmets, Augmented Reality (AR) and Heads-Up Display (HUD) Helmets, AI-Powered Safety Helmets, Sensor-Based Smart Helmets, GPS-Enabled Helmets, Communication-Integrated Helmets |

| Connectivity Types Covered | Bluetooth-Enabled Smart Helmets, Wi-Fi and Cloud-Connected Helmets, RFID and NFC-Based Helmets |

| Material Types Covered | Polycarbonate Helmets, Fiberglass and Composite Helmets, ABS Plastic Helmets, Carbon Fiber Helmets |

| Safety Features Covered | Real-Time Health Monitoring, Fall and Impact Detection, Noise Cancellation and Communication Enhancement, Fire and Hazard Detection, Environmental Monitoring, Smart Lighting and Alerts |

| End Use Industries Covered | Construction and Infrastructure, Manufacturing and Heavy Industry, Mining, Oil and Gas, Automotive and Transportation, Defense and Law Enforcement, Healthcare and Emergency Services, Sports and Outdoor Activities |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia smart safety helmets market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia smart safety helmets market on the basis of technology type?

- What is the breakup of the Saudi Arabia smart safety helmets market on the basis of connectivity type?

- What is the breakup of the Saudi Arabia smart safety helmets market on the basis of material type?

- What is the breakup of the Saudi Arabia smart safety helmets market on the basis of safety features?

- What is the breakup of the Saudi Arabia smart safety helmets market on the basis of end use industry?

- What is the breakup of the Saudi Arabia smart safety helmets market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia smart safety helmets market?

- What are the key driving factors and challenges in the Saudi Arabia smart safety helmets?

- What is the structure of the Saudi Arabia smart safety helmets market and who are the key players?

- What is the degree of competition in the Saudi Arabia smart safety helmets market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia smart safety helmets market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia smart safety helmets market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia smart safety helmets industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)