Saudi Arabia Soda Ash Market Size, Share, Trends and Forecast by Application, and Region, 2026-2034

Saudi Arabia Soda Ash Market Overview:

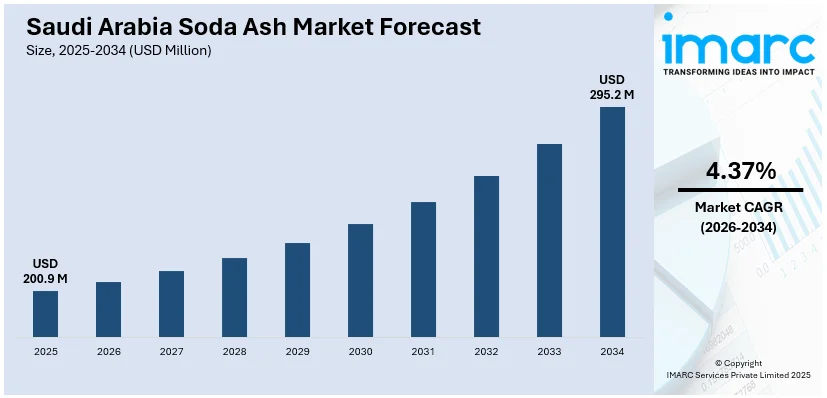

The Saudi Arabia soda ash market size reached USD 200.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 295.2 Million by 2034, exhibiting a growth rate (CAGR) of 4.37% during 2026-2034. The market share is expanding, driven by the rising investments in large-scale infrastructure projects and urban development activities, along with the increasing execution of government initiatives that promote domestic chemical production.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 200.9 Million |

| Market Forecast in 2034 | USD 295.2 Million |

| Market Growth Rate 2026-2034 | 4.37% |

Saudi Arabia Soda Ash Market Trends:

Increasing expenditure on construction activities

The rising investments in construction activities are offering a favorable Saudi Arabia soda ash market outlook. In March 2025, ACWA Power obtained USD 2.6 Billion in funding to advance three significant solar initiatives in Saudi Arabia. The financing structure included backing from key local and international financial institutions, with construction having been scheduled to commence later in 2025. This initiative is expected to create thousands of jobs during the construction phase. With the increasing development of residential structures, business complexes, and megaprojects under Vision 2030, the need for flat glass, tiles, and other building materials based on soda ash is rising. The glass industry, in particular, is experiencing increased output, as glass is widely used in modern building windows, facades, and interiors. Furthermore, soda ash is employed in the manufacturing of ceramic tiles, which are in high demand due to the growing preference for long-lasting and visually pleasing flooring options. The burgeoning cement industry, which supports the construction sector, also benefits from soda ash as an additive in certain formulations. Moreover, as Saudi Arabia focuses on sustainability and energy-efficient buildings, the utilization of high-quality insulating glass is increasing, further boosting soda ash adoption. Moreover, the government's efforts to promote tourism and entertainment hubs are positively influencing the market, driving the demand for soda ash. As infrastructure projects continue to expand, the market for soda ash in construction-related applications is broadening, solidifying its role as a crucial industrial ingredient in the sector.

To get more information on this market, Request Sample

Rising demand for chemicals

The increasing demand for chemicals is propelling the Saudi Arabia soda ash market growth. Soda ash is an important raw material in the manufacturing of numerous chemicals like detergents, soaps, and sodium-based compounds, all of which are experiencing high demand due to the rise in population and rapid urbanization. The chemical industry is also benefiting from the government's efforts to diversify the economy beyond oil, leading to greater investments in local production facilities that require soda ash. In line with this, the increasing chemical exports are positively influencing the market. According to industry reports, in December 2024, Saudi Arabia's chemical and related product exports surged 14% year-over-year (YoY), reaching almost SAR 7.63 Billion. In comparison to November 2024, chemical exports experienced a growth of 16%, equivalent to SAR 1.04 Billion. Additionally, the rise of water treatment initiatives in the country is creating the need for soda ash in pH regulation and softening processes. As industries, such as textiles, pulp and paper, and metallurgy continue to grow, soda ash is being widely employed in their chemical processes. The pharmaceutical industry also relies on soda ash for certain formulations, further contributing to market expansion. With Saudi Arabia focusing on strengthening its industrial base and chemical manufacturing capabilities, the demand for soda ash is increasing.

Saudi Arabia Soda Ash Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on application.

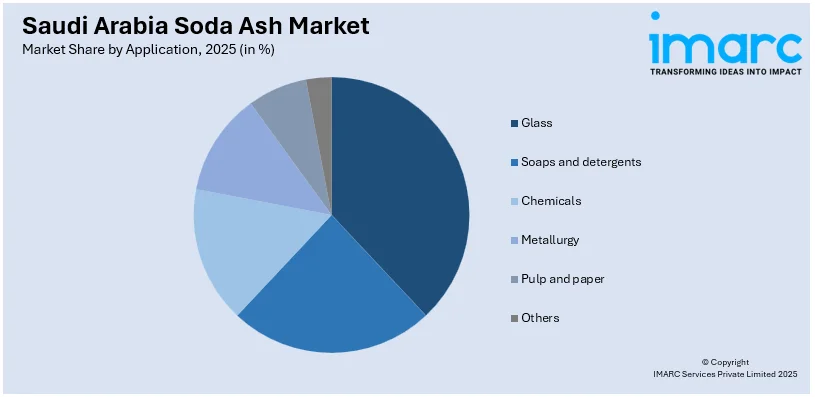

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Glass

- Soaps and detergents

- Chemicals

- Metallurgy

- Pulp and paper

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes glass, soaps and detergents, chemicals, metallurgy, pulp and paper, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Soda Ash Market News:

- In December 2023, Solvay teamed up with ENOWA, the energy and water firm of NEOM, to establish the inaugural carbon-neutral soda ash manufacturing plant in NEOM, Saudi Arabia. The collaborators intended to initiate a soda ash nameplate capacity of 500,000 Tons by 2030, which was set to progressively rise to 1.5 Million tons by 2035, with the possibility of including sodium bicarbonate production.

Saudi Arabia Soda Ash Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Glass, Soaps and detergents, Chemicals, Metallurgy, Pulp and paper, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia soda ash market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia soda ash market on the basis of application?

- What is the breakup of the Saudi Arabia soda ash market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia soda ash market?

- What are the key driving factors and challenges in the Saudi Arabia soda ash market?

- What is the structure of the Saudi Arabia soda ash market and who are the key players?

- What is the degree of competition in the Saudi Arabia soda ash market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia soda ash market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia soda ash market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia soda ash industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)