Saudi Arabia Soft Tissue Repair Market Size, Share, Trends and Forecast by Product, Application, End Use, and Region, 2026-2034

Saudi Arabia Soft Tissue Repair Market Summary:

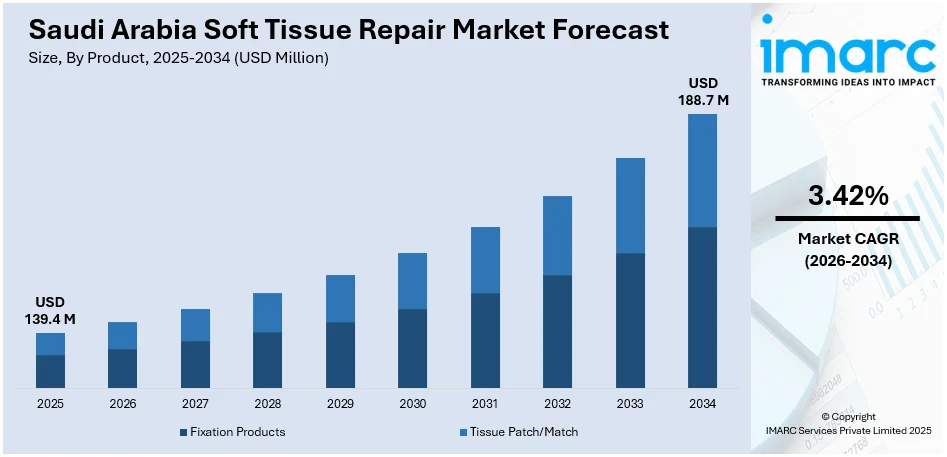

The Saudi Arabia soft tissue repair market size was valued at USD 139.4 Million in 2025 and is projected to reach USD 188.7 Million by 2034, growing at a compound annual growth rate of 3.42% from 2026-2034.

The Saudi Arabia soft tissue repair market is experiencing significant growth, driven by expanding healthcare infrastructure, increasing surgical procedure volumes, and rising adoption of advanced fixation technologies. The market benefits from substantial government investments in healthcare modernization under Vision 2030 initiatives, growing elderly population requiring orthopedic interventions, and increasing prevalence of sports-related injuries necessitating sophisticated tissue repair solutions.

Key Takeaways and Insights:

- By Product: Fixation products dominate the market with a share of 56% in 2025, owing to widespread adoption in orthopedic and reconstructive surgeries, superior mechanical stability, and technological advancements in suture anchor designs. Increasing minimally invasive surgical procedures are further propelling segment expansion.

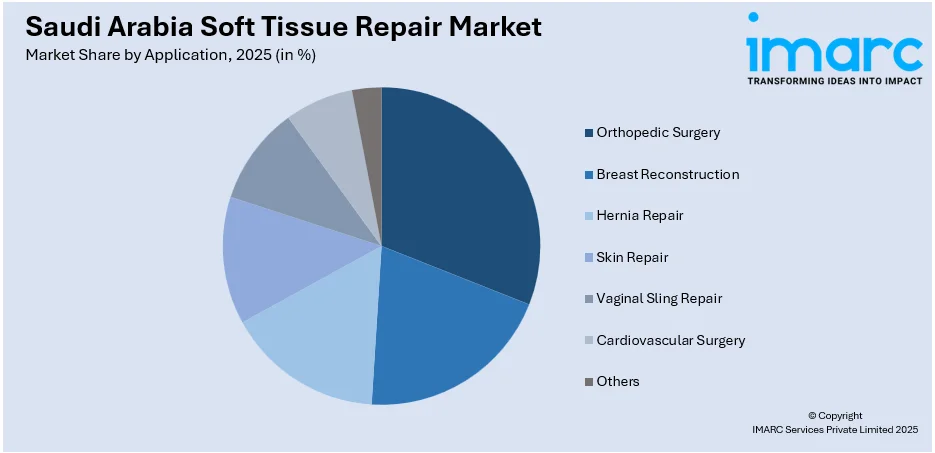

- By Application: Orthopedic surgery leads the market with a share of 25% in 2025. This dominance is driven by rising incidence of musculoskeletal disorders, growing sports injury cases, and expanding robotic-assisted surgical capabilities enhancing precision outcomes.

- By End Use: Hospitals and clinics exhibit a clear dominance in the market with 70% share in 2025, reflecting concentrated surgical infrastructure, specialized orthopedic departments, and comprehensive patient care facilities across major metropolitan centers.

- By Region: Northern and Central Region comprises the largest region with 30% share in 2025, driven by concentration of advanced healthcare facilities in Riyadh, higher healthcare expenditure, and presence of specialized orthopedic centers.

- Key Players: Key players drive the Saudi Arabia soft tissue repair market by expanding product portfolios, introducing innovative fixation technologies, and strengthening distribution networks. Their investments in clinical partnerships, regulatory approvals, and training programs boost market penetration, accelerate adoption of advanced surgical solutions, and ensure consistent product availability across diverse healthcare segments.

To get more information on this market Request Sample

The Saudi Arabia soft tissue repair market is witnessing transformative growth, as the Kingdom advances its healthcare modernization agenda under Vision 2030. The market benefits from increasing adoption of minimally invasive surgical techniques, with leading institutions pioneering robotic-assisted procedures that enhance precision in tissue reconstruction. Rising prevalence of chronic conditions, particularly osteoarthritis, drives sustained demand for orthopedic soft tissue interventions. The growing elderly population further accelerates market expansion as age-related musculoskeletal disorders necessitate specialized repair solutions. The Elderly Survey 2025 indicated that individuals aged 60 and older in the Kingdom of Saudi Arabia totaled around 1.7 Million in 2025, representing 4.8% of the overall population. Additionally, increasing sports participation and road traffic incidents contribute to higher trauma cases requiring sophisticated fixation products. Healthcare privatization initiatives are attracting significant foreign investment, enhancing access to international-standard surgical technologies across the Kingdom.

Saudi Arabia Soft Tissue Repair Market Trends:

Adoption of Minimally Invasive Surgical Techniques

The Saudi Arabia soft tissue repair market is experiencing a significant shift towards minimally invasive surgical approaches. As per IMARC Group, the Saudi Arabia minimally invasive surgery market size reached USD 550.4 Million in 2025. Healthcare facilities across the Kingdom are increasingly incorporating arthroscopic and laparoscopic techniques for tissue repair procedures. This transition is driven by patient preference for reduced recovery times, smaller incisions, and lower complication rates. Advanced visualization technologies and specialized instrumentation are enabling surgeons to perform complex soft tissue reconstructions with enhanced precision, promoting faster healing and improved functional outcomes while reducing hospital stays.

Integration of Regenerative Medicine Technologies

Regenerative medicine approaches are gaining prominence in the Saudi Arabia soft tissue repair landscape. Healthcare providers are increasingly exploring biologic scaffolds, tissue engineering solutions, and advanced biomaterials that promote natural healing processes. These innovative technologies offer enhanced biocompatibility and support cellular integration at repair sites. Research institutions across the Kingdom are collaborating with international partners to develop next-generation tissue patches that combine mechanical strength with regenerative properties, addressing complex reconstruction challenges in orthopedic and reconstructive surgery applications.

Expansion of Specialized Orthopedic Centers

Saudi Arabia is witnessing rapid expansion of dedicated orthopedic and sports medicine facilities across major urban centers. In January 2026, AC Milan and Al Hammadi Holding declared the initiation of a long-term alliance that, for the first time in the Club's history, centered the MilanLab model within an international partnership. The goal is to enhance innovation in sports medicine in Saudi Arabia and support the aims of Saudi Vision 2030 in health, wellness, and skill advancement. These specialized institutions are equipped with advanced surgical suites, rehabilitation services, and comprehensive diagnostic capabilities. The establishment of health clusters under healthcare transformation programs is concentrating expertise and resources to deliver world-class musculoskeletal care. This infrastructure development supports increased procedure volumes, facilitates technology adoption, and attracts skilled practitioners, ultimately driving demand for sophisticated soft tissue repair products.

How Vision 2030 is Transforming the Saudi Arabia Soft Tissue Repair Market:

Vision 2030 is significantly transforming the Saudi Arabia soft tissue repair market by accelerating healthcare modernization, expanding domestic medical manufacturing, and increasing access to advanced surgical care. Government investments in hospital infrastructure, specialized surgical centers, and digital health systems are improving procedural capacity for orthopedic, hernia, sports medicine, and reconstructive surgeries. The program’s strong focus on localization is encouraging the development and adoption of locally produced medical devices, reducing import dependence and improving supply reliability. Rising private sector participation and public–private partnerships (PPPs) are also supporting faster technology adoption, including biologics, meshes, and minimally invasive repair solutions.

Market Outlook 2026-2034:

The Saudi Arabia soft tissue repair market demonstrates promising growth prospects through the forecast period, supported by comprehensive healthcare transformation initiatives and increasing surgical procedure volumes. The market generated a revenue of USD 139.4 Million in 2025 and is projected to reach a revenue of USD 188.7 Million by 2034, growing at a compound annual growth rate of 3.42% from 2026-2034. Market expansion is driven by aging demographics, rising chronic disease prevalence, and government investments in healthcare infrastructure. Privatization efforts are enhancing access to advanced surgical technologies, while medical tourism initiatives position the Kingdom as a regional healthcare destination. Continued adoption of robotic-assisted surgery, bioresorbable fixation devices, and regenerative tissue solutions will sustain market momentum throughout the forecast period.

Saudi Arabia Soft Tissue Repair Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Fixation Products |

56% |

|

Application |

Orthopedic Surgery |

25% |

|

End Use |

Hospitals and Clinics |

70% |

|

Region |

Northern and Central Region |

30% |

Product Insights:

- Fixation Products

- Suture

- Suture Anchors

- Tissue Patch/Mesh

- Biological

- Synthetic

Fixation products dominate with a market share of 56% of the total Saudi Arabia soft tissue repair market in 2025.

Fixation products maintain dominant market positioning, due to their essential role in securing soft tissue during surgical repair procedures. These devices, including sutures and suture anchors, provide mechanical stability required for proper healing in orthopedic, reconstructive, and hernia repair applications. Saudi Arabian healthcare facilities are increasingly adopting advanced all-suture anchors that offer equivalent clinical performance to solid anchors while reducing bone loss risks. Rising procedure volumes across public and private hospitals further reinforce the sustained demand for reliable and clinically proven fixation products.

Technological advancements are driving fixation product innovations across the Kingdom. Modern suture anchors incorporate biocomposite materials that provide greater yield load and energy compared to traditional designs. Healthcare facilities are transitioning towards knotless fixation systems that simplify surgical techniques and reduce procedure times. The proliferation of minimally invasive surgical approaches accelerates demand for specialized fixation products designed for arthroscopic applications and enhanced tissue integration capabilities. These innovations are also aligning with surgeon preferences for standardized, efficient, and reproducible surgical outcomes.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Orthopedic Surgery

- Breast Reconstruction

- Hernia Repair

- Skin Repair

- Vaginal Sling Repair

- Cardiovascular Surgery

- Others

Orthopedic surgery leads with a share of 25% of the total Saudi Arabia soft tissue repair market in 2025.

Orthopedic surgery dominates the Saudi Arabia soft tissue repair market, due to the high prevalence of musculoskeletal injuries and degenerative conditions across Saudi Arabia. Rotator cuff repairs, ligament reconstructions, and meniscal repairs represent primary procedure categories driving product demand. Advanced arthroscopic techniques enable precise soft tissue reconstruction with minimized trauma, promoting faster patient recovery and improved functional outcomes. The strong availability of specialized orthopedic surgeons and well-equipped tertiary care hospitals further supports the dominance of this segment.

Rising sports participation and road traffic incidents contribute significantly to orthopedic soft tissue repair demand in Saudi Arabia. Road Transport Statistics for 2024 indicated that serious traffic accidents reached over 17.2 Thousand, with urban accidents making up 60.3% of the overall total. Healthcare facilities across Riyadh, Jeddah, and Dammam are expanding orthopedic departments with robotic-assisted surgical capabilities, enhancing precision in complex tissue reconstructions. The growing elderly population and increasing osteoarthritis prevalence further sustain demand for joint-related soft tissue interventions, including knee and hip repair procedures requiring sophisticated fixation solutions.

End Use Insights:

- Hospitals and Clinics

- Research and Academic Institutes

- Others

Hospitals and clinics exhibit a clear dominance with a 70% share of the total Saudi Arabia soft tissue repair market in 2025.

Hospitals and clinics maintain overwhelming market dominance as primary venues for soft tissue repair procedures requiring specialized surgical infrastructure and multidisciplinary care teams. Government healthcare spending reached SAR 214 Billion (USD 57 Billion) allocated to health and social development in 2024, supporting substantial capacity expansion across public and private hospital networks. Major medical facilities are equipped with advanced operating theaters, imaging capabilities, and rehabilitation services essential for comprehensive soft tissue repair management from diagnosis through postoperative recovery phases.

Healthcare privatization initiatives are transforming the hospital landscape across Saudi Arabia. These developments expand surgical capacity, introduce cutting-edge technologies, and enhance access to sophisticated soft tissue repair procedures across metropolitan and regional healthcare networks throughout the Kingdom. Private hospital groups are increasingly investing in specialized orthopedic and sports medicine centers to differentiate service offerings. PPPs are also improving operational efficiency and accelerating technology transfer within hospital systems. Together, these shifts are strengthening the role of hospitals and clinics as the central hub for advanced soft tissue repair delivery nationwide.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region represents the leading region with a 30% share of the total Saudi Arabia soft tissue repair market in 2025.

Northern and Central Region commands market leadership due to concentration of advanced healthcare infrastructure in Riyadh, the national capital. King Faisal Specialist Hospital and Research Centre, established in Riyadh, serves as a flagship institution, having completed over 400 robotic cardiac surgeries, as of July 2024, demonstrating regional expertise in advanced surgical procedures. The capital attracts significant healthcare investments and houses specialized orthopedic centers offering comprehensive soft tissue repair services.

The Northern and Central Region also benefits from a high concentration of skilled surgeons, medical universities, and research institutions that support continuous adoption of advanced surgical techniques. Strong patient inflow from surrounding regions further strengthens procedure volumes in Riyadh-based hospitals. In addition, the presence of insurance providers, corporate healthcare programs, and government-backed referral systems improves access to complex soft tissue repair procedures. Ongoing hospital expansions, digitization initiatives, and integration of minimally invasive technologies continue to reinforce the region’s leadership position in the Saudi Arabia soft tissue repair market.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Soft Tissue Repair Market Growing?

Expanding Healthcare Infrastructure Under Vision 2030

The Saudi Arabia soft tissue repair market is experiencing substantial growth driven by unprecedented healthcare infrastructure expansion under Vision 2030 initiatives. The Kingdom has committed significant financial resources to modernize and expand its healthcare system, creating new hospitals, medical cities, and specialized treatment centers across all regions. These developments include establishment of health clusters designed to provide comprehensive care within integrated networks, enhancing access to advanced surgical services, including soft tissue repair procedures. PPPs are accelerating infrastructure development, with major healthcare groups investing billions of dollars in new facilities equipped with state-of-the-art surgical technologies. The Ministry of Health is driving initiatives to increase private sector participation in healthcare delivery, creating opportunities for international medical technology companies to establish presence in the Kingdom. In April 2023, Dr. Sulaiman Al Habib Medical Group (HMG) revealed a USD 1.73 Billion (SAR6.489 Billion) expansion, which included the building of six new hospitals expected to start operations within coming years: two in 2023, three in 2024, and one in 2025. The most significant of the forthcoming developments was the Shamal Al Riyadh (North Riyadh) hospital, estimated at USD 586.5 Million (SAR2.2 Billion), featuring a capacity of 500 beds and expected to be finished in 2023.

Rising Prevalence of Chronic Diseases and Musculoskeletal Disorders

Increasing prevalence of chronic conditions and musculoskeletal disorders represents a primary growth driver for the Saudi Arabia soft tissue repair market. The Kingdom faces elevated rates of diabetes, obesity, and cardiovascular conditions that contribute to tissue degeneration and surgical intervention requirements. Osteoarthritis and related joint disorders are becoming increasingly common among the adult population, driving demand for orthopedic soft tissue repair procedures, including ligament reconstruction and cartilage repair. The aging population is expanding rapidly, with elderly individuals particularly susceptible to degenerative musculoskeletal conditions requiring surgical management. Lifestyle factors, including sedentary behaviors and dietary patterns, contribute to musculoskeletal health challenges across demographic groups. Research institutions are advancing understanding of chronic disease impacts on tissue health, informing development of targeted repair solutions.

Adoption of Advanced Surgical Technologies and Minimally Invasive Techniques

Rapid adoption of advanced surgical technologies is propelling the growth of the Saudi Arabia soft tissue repair market. Healthcare facilities are increasingly implementing robotic-assisted surgical systems that enhance precision, reduce complications, and improve patient outcomes in tissue repair procedures. Minimally invasive surgical approaches have gained widespread acceptance among both surgeons and patients, driving demand for specialized instruments and fixation devices designed for arthroscopic and laparoscopic applications. Training programs are expanding surgeon capabilities in advanced techniques, enabling complex procedures previously unavailable within the Kingdom. Digital health technologies, including surgical navigation systems and real-time imaging, enhance intraoperative decision-making and procedure accuracy. Telemedicine platforms facilitate specialist consultations and postoperative monitoring, improving overall care quality. As per IMARC Group, the Saudi Arabia telemedicine market size reached USD 1,003.0 Million in 2025. Medical device innovations, including bioresorbable fixation products and regenerative tissue scaffolds, offer enhanced treatment options for complex cases.

Market Restraints:

High Cost of Advanced Surgical Products and Technologies

The Saudi Arabia soft tissue repair market faces challenges from high costs associated with advanced surgical products and technologies. Premium fixation devices, biologic tissue patches, and robotic surgical systems require significant capital investments that may limit adoption among smaller healthcare facilities. Reimbursement limitations for certain advanced procedures can restrict patient access, while import dependency for specialized medical devices contributes to elevated product pricing across the market.

Shortage of Specialized Healthcare Professionals

Limited availability of specialized surgeons and healthcare professionals constrains market growth potential. Despite workforce expansion initiatives, demand for orthopedic surgeons and tissue repair specialists continues to exceed supply in certain regions. Training programs require extended timeframes to develop competencies in advanced surgical techniques. Geographic distribution challenges concentrate expertise in major urban centers, limiting access to sophisticated tissue repair procedures in peripheral and rural healthcare facilities.

Regulatory Approval and Compliance Requirements

Stringent regulatory requirements for medical device approvals create market entry barriers and potentially delay introduction of innovative products. The Saudi Food and Drug Authority mandates comprehensive safety and efficacy documentation for soft tissue repair devices. Compliance with evolving regulatory frameworks requires substantial resources and expertise. International manufacturers must navigate local registration processes, while clinical evidence requirements may extend product development timelines before market availability.

Competitive Landscape:

The Saudi Arabia soft tissue repair market exhibits a competitive landscape, characterized by presence of established international medical device manufacturers alongside emerging regional players. Market participants compete through product innovations, clinical education initiatives, and strategic partnerships with healthcare providers. Leading companies focus on expanding product portfolios, encompassing fixation devices, tissue patches, and complementary surgical instruments. Distribution network development remains critical for market penetration, with manufacturers establishing relationships with major hospital groups and specialized distributors. Clinical training programs support surgeon adoption of advanced techniques and products. Localization strategies, including regional warehousing and technical support services, enhance competitive positioning.

Saudi Arabia Soft Tissue Repair Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered | Orthopedic Surgery, Breast Reconstruction, Hernia Repair, Skin Repair, Vaginal Sling Repair, Cardiovascular Surgery, Others |

| End Uses Covered | Hospitals and Clinics, Research and Academic Institutes, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia soft tissue repair market size was valued at USD 139.4 Million in 2025.

The Saudi Arabia soft tissue repair market is expected to grow at a compound annual growth rate of 3.42% from 2026-2034 to reach USD 188.7 Million by 2034.

Fixation products dominated the market with a share of 56%, driven by widespread adoption in orthopedic and reconstructive surgeries, superior mechanical stability, and increasing minimally invasive procedure volumes.

Key factors driving the Saudi Arabia soft tissue repair market include expanding healthcare infrastructure under Vision 2030, rising prevalence of musculoskeletal disorders, adoption of advanced surgical technologies, and increasing elderly population requiring orthopedic interventions.

Major challenges include high costs of advanced surgical products and technologies, shortage of specialized healthcare professionals, stringent regulatory approval requirements, import dependency for sophisticated medical devices, and geographic distribution limitations concentrating expertise in urban centers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)