Saudi Arabia Solar Inverter Market Size, Share, Trends and Forecast by Inverter Type, Application, and Region, 2026-2034

Saudi Arabia Solar Inverter Market Overview:

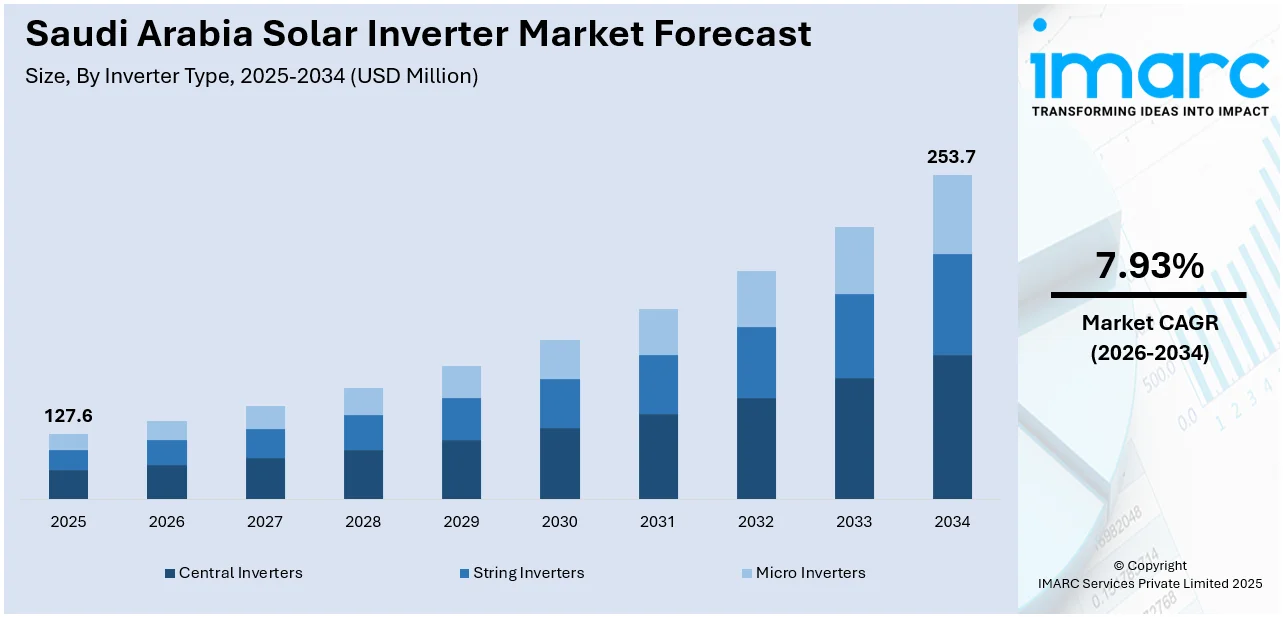

The Saudi Arabia solar inverter market size reached USD 127.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 253.7 Million by 2034, exhibiting a growth rate (CAGR) of 7.93% during 2026-2034. The market drivers include government incentives for renewable energy, Saudi Vision 2030 sustainability initiative, increasing investment in solar energy programs, and demand for clean energy options. Increasing environmental consciousness and technology development also drive Saudi Arabia solar inverter market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 127.6 Million |

| Market Forecast in 2034 | USD 253.7 Million |

| Market Growth Rate 2026-2034 | 7.93% |

Saudi Arabia Solar Inverter Market Trends:

Government Initiatives and Vision 2030

Saudi Arabia’s Vision 2030 plan, which emphasizes economic diversification and renewable energy adoption, plays a crucial role in the growth of the solar inverter market. The government's commitment to generating 50% of its power from renewable sources by 2030 has led to substantial investments in solar projects. For instance, in December 2024, Saudi Arabia's Power Procurement Company (SPPC) signed power purchase agreements for three solar projects totaling 1.7 GW as part of the National Renewable Energy Program (NREP). The projects—Al-Masaa (1 GW), Al-Henakiyah 2 (400 MW), and Rabigh 2 (300 MW)—were awarded to international and local consortiums with competitive tariffs. This aligns with Saudi Arabia's goal of producing 50% of its electricity from renewable sources by 2030. An additional 3.7 GW capacity has been shortlisted for future rounds of the NREP. Solar inverters, a key component in these systems, are seeing an increase in demand due to government-driven subsidies and regulations. Additionally, the Saudi government has implemented programs that reduce the cost of solar installations, encouraging both businesses and residential consumers to adopt solar solutions. These measures not only promote solar inverter usage but also ensure the long-term sustainability of the sector in the country.

To get more information on this market Request Sample

Increasing Commercial and Industrial Adoption of Solar Power

There is an increasing trend towards the industrial and commercial use of solar power in Saudi Arabia, fueling the need for solar inverters. Most big companies and industries are seeking to lower their carbon footprint and energy expenses by switching to renewable energy sources. Solar power provides a feasible solution, and with the advent of net metering policies, companies can balance out their energy bills while supplying power to the national grid. Solar inverters play a crucial role in such systems, converting DC power from solar panels into usable power in the form of AC power. This transition to industrial and commercial solar installations is likely to propel the Saudi Arabia solar inverter market growth significantly, especially as companies work to maintain pace with the kingdom's sustainability objectives. For instance, in October 2024, Arctech secured a 2.3 GW solar project in Saudi Arabia, marking a significant milestone in the MEA region. The project, part of the PIF4-Haden initiative, utilizes Arctech's SkyLine II solar trackers to optimize efficiency and reduce costs. These trackers, designed to withstand harsh desert conditions, improve energy production and ensure long-term stability. The project supports Saudi Arabia's Vision 2030, aiming to diversify its energy mix with renewable sources. It is expected to reduce CO2 emissions by 147 million tons over 25 years, contributing to the Kingdom's renewable energy goals.

Saudi Arabia Solar Inverter Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2026-2034. Our report has categorized the market based on inverter type and application.

Inverter Type Insights:

- Central Inverters

- String Inverters

- Micro Inverters

The report has provided a detailed breakup and analysis of the market based on the inverter type. This includes central inverters, string inverters, and micro inverters.

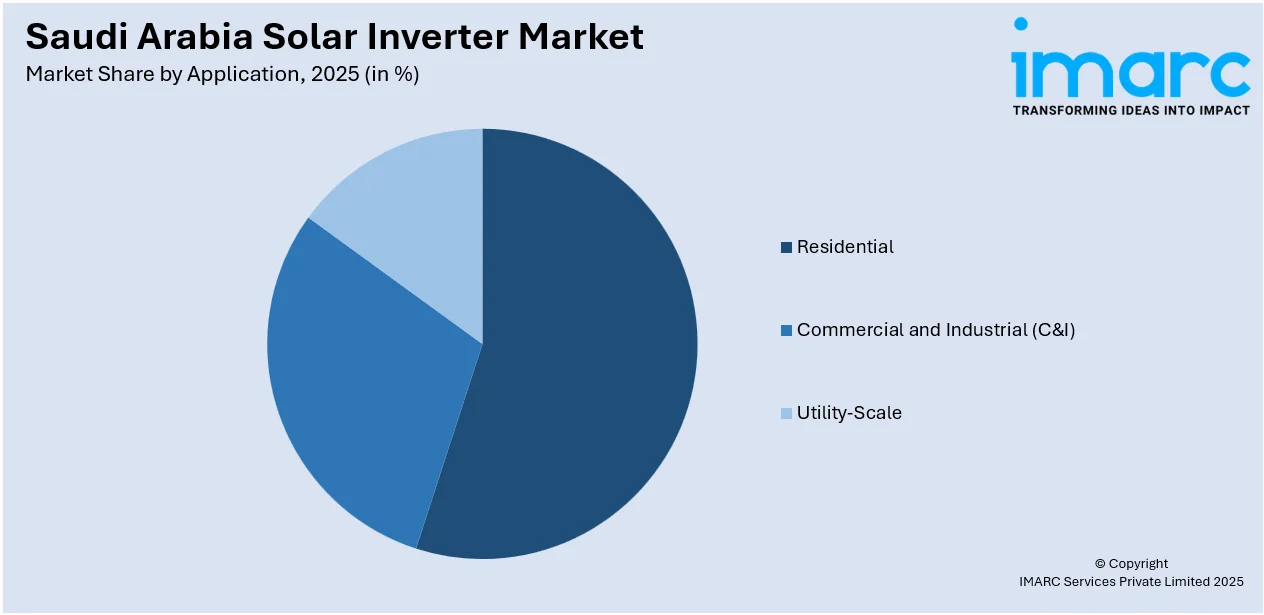

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial and Industrial (C&I)

- Utility-Scale

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial and industrial (C&I), and utility-scale.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Solar Inverter Market News:

- In April 2025, Sungrow, a well-known manufacturer of solar inverters, and BYD made significant progress on large-scale battery energy storage systems (BESS) projects in Saudi Arabia and Chile, with a combined capacity of 16GWh. Sungrow, in partnership with Saudi EPC firm Algihaz Holding, has already manufactured 7.8GWh for Saudi projects in just 58 days. These projects are pivotal for enhancing energy storage capabilities in the respective regions, driving the shift towards more reliable, sustainable energy solutions, especially in renewable energy-driven markets like Saudi Arabia and Chile.

- In November 2024, Sineng Electric secured a 2.6GW PV inverter supply contract for the PIF4 solar project in Saudi Arabia, marking a significant step in the country's renewable energy initiatives aligned with Vision 2030. The project includes two sub-projects: the Haden and Al Khushaybi solar power plants. Sineng will supply advanced 8.8MW MV turnkey stations, offering high power output, flexibility, and efficiency under extreme conditions. This contract enhances Sineng's presence in the Middle East, supporting Saudi Arabia’s goal of achieving a 50% renewable energy mix by the decade's end.

Saudi Arabia Solar Inverter Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Inverters Type Covered | Central Inverters, String Inverters, Micro Inverters |

| Applications Covered | Residential, Commercial and Industrial (C&I), Utility-Scale |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia solar inverter market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia solar inverter market on the basis of inverter type?

- What is the breakup of the Saudi Arabia solar inverter market on the basis of application?

- What is the breakup of the Saudi Arabia solar inverter market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia solar inverter market?

- What are the key driving factors and challenges in the Saudi Arabia solar inverter market?

- What is the structure of the Saudi Arabia solar inverter market and who are the key players?

- What is the degree of competition in the Saudi Arabia solar inverter market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia solar inverter market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia solar inverter market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia solar inverter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)