Saudi Arabia Solar Panel Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2026-2034

Saudi Arabia Solar Panel Market Overview:

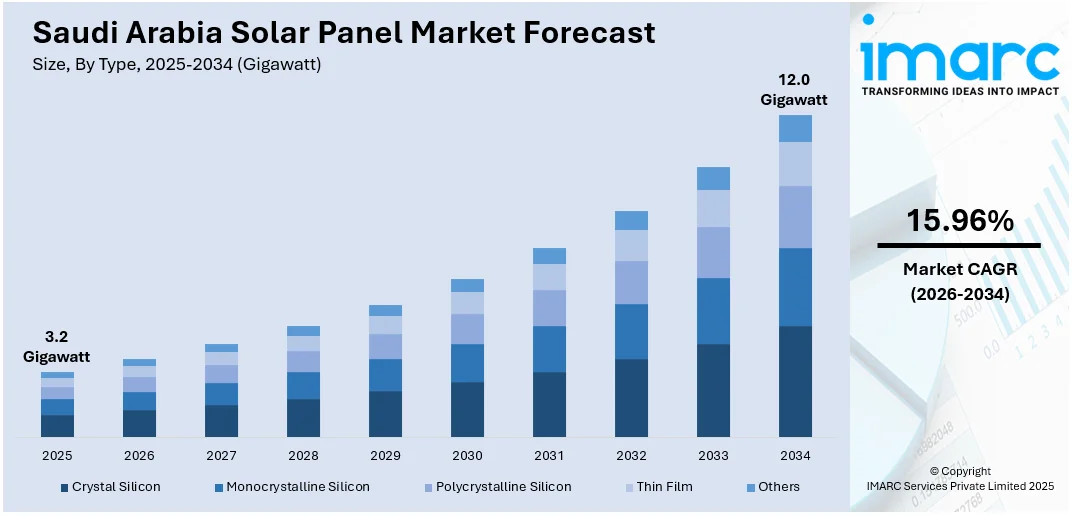

The Saudi Arabia solar panel market size reached 3.2 Gigawatt in 2025. Looking forward, IMARC Group expects the market to reach 12.0 Gigawatt by 2034, exhibiting a growth rate (CAGR) of 15.96% during 2026-2034. The solar panel market in Saudi Arabia is advancing through industrial decarbonization efforts, regulatory support for clean energy in manufacturing zones, and the growing use of climate-resilient solar technologies designed to maintain high performance under harsh environmental conditions while supporting long-term energy security and sustainability goals.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 3.2 Gigawatt |

| Market Forecast in 2034 | 12.0 Gigawatt |

| Market Growth Rate 2026-2034 | 15.96% |

Saudi Arabia Solar Panel Market Trends:

Industrial Sector Decarbonization Initiatives

The solar panel market in Saudi Arabia is gaining momentum due to the decarbonization initiatives in industrial areas and manufacturing hubs. As the pressure to meet sustainability goals increases, industrial companies are adopting on-site solar setups to lower their carbon emissions and energy expenses. Programs supported by the governing body, such as green industrial policies and clean energy requirements in specific areas, are speeding up this transition. Industrial estates are evolving into central hubs for renewable integration, as solar systems are progressively incorporated into facility design and infrastructure enhancements. These efforts not only aid in reducing emissions but also enhance energy security by decreasing reliance on grid electricity. As regulatory systems develop to promote clean energy use in various sectors, the installation of solar panels is turning into an effective means of ensuring compliance and enhancing operational efficiency. The blending of environmental accountability and economic benefit is encouraging industrial players to integrate solar energy as a standard component of their energy portfolio, rather than just an optional choice. In 2025, SIG and Yellow Door Energy launched a 2 MW solar project in Riyadh under MODON’s Green Initiative. The installation, featuring over 3,200 panels, will cut 1,300 metric tons of CO₂ annually and power an industrial facility. This project supports Saudi Arabia’s Net Zero 2060 goal and Vision 2030.

To get more information on this market Request Sample

Adoption of Climate-Resilient Solar Technologies

The rising development of climate-adaptive technologies designed specifically for the harsh environmental conditions of Saudi Arabia is bolstering the market growth. Elevated temperatures, strong sunlight, and regular dust buildup create operational difficulties that can diminish performance and raise maintenance needs. To address this, manufacturers and researchers are focusing on innovative module types that preserve efficiency during thermal stress and provide greater yields in dry regions. Attributes like bifacial cell design, elevated temperature coefficients, and anti-soiling coatings are being emphasized in utility-scale as well as distributed solar initiatives. These innovations focus not only on performance but also align with long-term environmental goals by reducing heat effects and promoting sustainable land use. The increasing need for solutions that provide reliable energy performance in challenging conditions is encouraging suppliers to stand out through their technical expertise. This trend is transforming procurement approaches and promoting enduring collaborations between developers and technology suppliers. As solar energy becomes a fundamental part of national energy policy, the capacity of panels to endure and prosper in desert environments is becoming a crucial aspect of project development. In 2025, JinkoSolar secured a deal to supply 1.75 GW of N-type TOPCon bifacial modules for EDF-SPIC’s solar projects in Medina and Hail. These projects support Saudi Arabia’s Vision 2030 and are designed to perform in harsh desert conditions. The modules enhance energy yield and offer ecological benefits like reduced surface temperatures and improved soil moisture.

Saudi Arabia Solar Panel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on type and end use.

Type Insights:

- Crystal Silicon

- Monocrystalline Silicon

- Polycrystalline Silicon

- Thin Film

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes crystal silicon, monocrystalline silicon, polycrystalline silicon, thin film, and others.

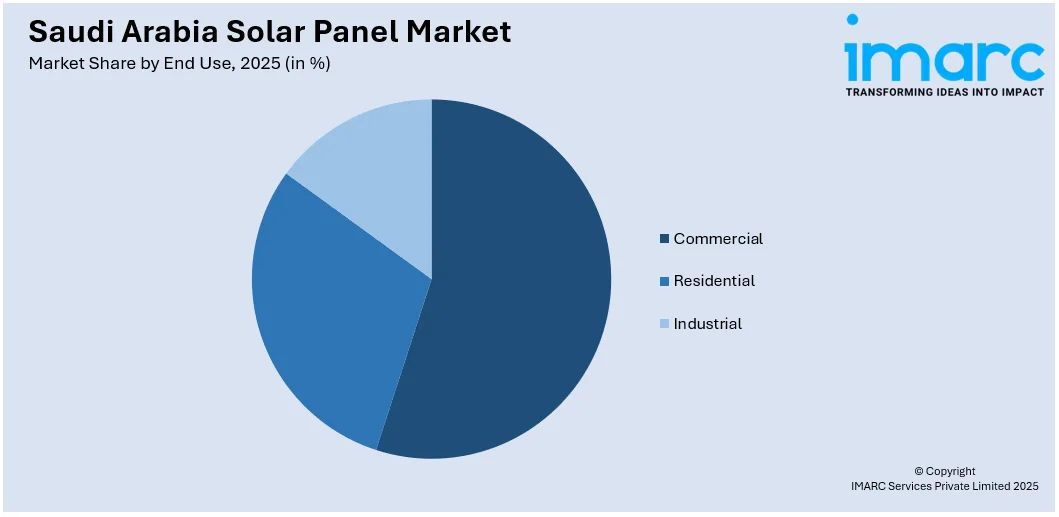

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Commercial

- Residential

- Industrial

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes commercial, residential, and industrial.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Solar Panel Market News:

- In November 2024, Desert Technologies announced plans to build a 5 GW solar manufacturing complex in Jeddah, in partnership with Modon. The SAR 750 million facility was designed to produce solar panels and cells, supporting Saudi Arabia's Vision 2030 renewable energy goals. The project aimed to localize production, strengthen the supply chain, and create jobs.

- In July 2024, JinkoSolar, a solar panel producer, announced plans to open the world's largest N-type solar cell plant in Saudi Arabia by early 2026. The USD 1 billion facility will have an annual production capacity of 10 GW and boost both local and global solar manufacturing. The move aligns with Saudi Arabia's growing role in renewable energy and supports JinkoSolar's global expansion strategy.

Saudi Arabia Solar Panel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Gigawatt |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Crystal Silicon, Monocrystalline Silicon, Polycrystalline Silicon, Thin Film, Others |

| End Uses Covered | Commercial, Residential, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia solar panel market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia solar panel market on the basis of type?

- What is the breakup of the Saudi Arabia solar panel market on the basis of end use?

- What is the breakup of the Saudi Arabia solar panel market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia solar panel market?

- What are the key driving factors and challenges in the Saudi Arabia solar panel?

- What is the structure of the Saudi Arabia solar panel market and who are the key players?

- What is the degree of competition in the Saudi Arabia solar panel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia solar panel market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia solar panel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia solar panel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)