Saudi Arabia Solar Power Equipment Market Size, Share, Trends and Forecast by Equipment, Application, and Region, 2025-2033

Saudi Arabia Solar Power Equipment Market Overview:

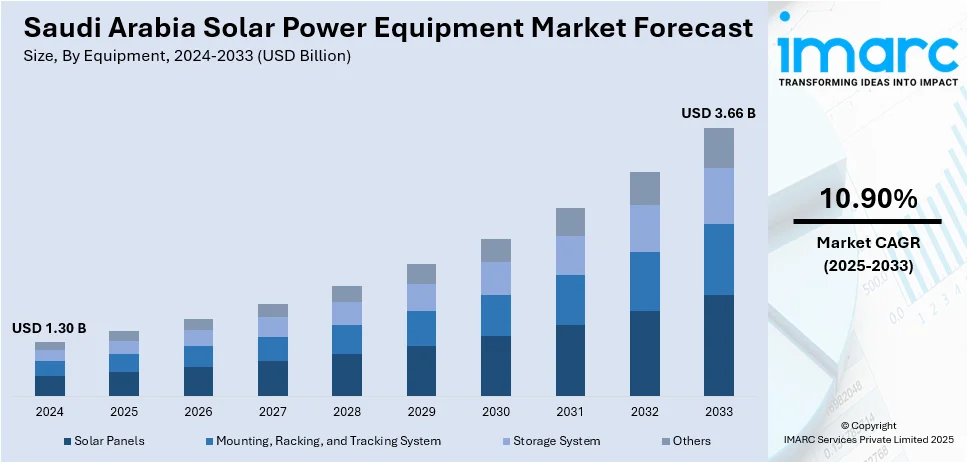

The Saudi Arabia solar power equipment market size reached USD 1.30 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.66 Billion by 2033, exhibiting a growth rate (CAGR) of 10.90% during 2025-2033. Government solar tenders, grid upgrades, and national clean energy targets are driving renewable adoption. Localized manufacturing, adaptive photovoltaic technology, and joint ventures with international OEMs are transforming equipment availability. In addition to this, risk mitigation strategies, research grants, and smart monitoring systems are some of the major factors augmenting the Saudi Arabia solar power equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.30 Billion |

| Market Forecast in 2033 | USD 3.66 Billion |

| Market Growth Rate 2025-2033 | 10.90% |

Saudi Arabia Solar Power Equipment Market Trends:

Government-Led Renewable Energy Initiatives and Utility-Scale Deployment

Saudi Arabia’s national strategy for sustainable energy development is directly shaping demand for photovoltaic technologies and associated components. The Kingdom’s Vision 2030 policy, coupled with the National Renewable Energy Program (NREP), targets significant non-fossil fuel generation capacity over the next decade. This direction is reinforced by structured auctions and power purchase agreements managed by the Saudi Power Procurement Company. Favorable solar irradiance, particularly in regions such as Riyadh, Makkah, and the Eastern Province, enhances the commercial viability of large-scale solar farms. On December 3, 2024, TotalEnergies and Aljomaih Energy & Water Company signed a 25-year Power Purchase Agreement (PPA) for a 300 MW solar power project in Saudi Arabia, known as Rabigh 2. This project is part of the National Renewable Energy Program (NREP) and aligns with Saudi Arabia’s Vision 2030 to achieve an optimal energy mix. The solar plant, which is set to connect to the grid by 2026, marks a significant step in TotalEnergies’ commitment to supporting the Kingdom’s renewable energy transition. The government’s financial and regulatory commitment has resulted in the awarding of multi-gigawatt contracts to both international and local developers. To support this infrastructure expansion, there is increasing demand for high-performance modules, inverters, and balance-of-system technologies. The broader supply chain—from transmission integration to operations and maintenance—is also seeing consistent investment. These structural enablers are directly influencing Saudi Arabia solar power equipment market growth, as the Kingdom focuses on developing grid-connected, utility-scale projects to reduce carbon intensity and increase energy security.

Industrial Localization, Technology Transfer, and Manufacturing Incentives

Saudi Arabia is actively cultivating a domestic ecosystem to support the manufacturing and assembly of solar energy technologies. In alignment with national industrial policies, the government has introduced localization mandates that encourage the sourcing of components such as photovoltaic panels, mounting systems, and electrical infrastructure from within the country. This push is supported by incentives for foreign firms to establish local production facilities through joint ventures, licensing agreements, and technology transfer partnerships. On October 30, 2024, Desert Technologies announced a partnership with the Saudi Authority for Industrial Cities and Technology Zones (Modon) to establish one of the largest solar panel and cell factories in Saudi Arabia. The facility, located in Jeddah’s third industrial city, will have an annual production capacity of 5 GW and is set to help meet the growing local demand for solar energy solutions. With an investment of SAR 750 Million (about USD 200 Million), this project will strengthen the Kingdom’s renewable energy sector and contribute to Saudi Vision 2030 by enhancing local manufacturing capabilities and increasing the country’s presence in global non-oil export markets. The aim is to reduce import dependency, retain economic value domestically, and build long-term industrial resilience. Additionally, economic zones such as NEOM and the King Salman Energy Park are serving as hubs for clean energy innovation and advanced manufacturing. Workforce development programs are also playing a critical role in training technicians and engineers in solar system design, installation, and quality assurance. As these efforts mature, they are contributing materially to the market demand by reducing cost barriers, strengthening supply reliability, and encouraging vertically integrated project delivery across the renewable sector.

Saudi Arabia Solar Power Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on equipment and application.

Equipment Insights:

- Solar Panels

- Mounting, Racking, and Tracking System

- Storage System

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment. This includes solar panels, mounting, racking, and tracking system, storage system, and others.

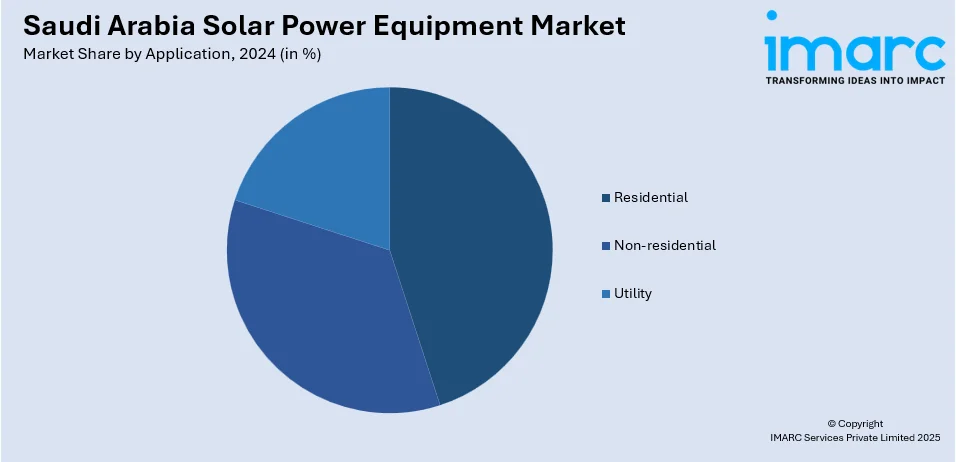

Application Insights:

- Residential

- Non-residential

- Utility

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, non-residential, and utility.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Solar Power Equipment Market News:

- On February 19, 2025, TrinaTracker, a subsidiary of Trinasolar, opened a 3 GW manufacturing facility in Saudi Arabia, aiming to strengthen regional renewable energy goals. Located in Jeddah's 3rd Industrial City, the factory will produce solar trackers and smart control systems, supporting Saudi Arabia’s ambitious Vision 2030 and the country’s growing solar market, projected to reach USD 125.2 billion by 2033. This move underscores TrinaTracker's commitment to localization, sustainability, and innovation, contributing to the energy transition in Saudi Arabia and the broader region.

- On March 11, 2025, Yellow Door Energy and SIG launched a 2-MWp solar project in Riyadh, Saudi Arabia, under the patronage of the Saudi Authority for Industrial Cities and Technology Zones (MODON). The solar plant, covering 8,000 square meters and featuring over 3,200 solar panels, will reduce carbon emissions by 1,300 metric tons annually. This initiative is part of SIG’s sustainability strategy and contributes to Saudi Arabia's Net Zero Emissions goal by 2060, supporting the broader Saudi Green Initiative and Vision 2030.

Saudi Arabia Solar Power Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipments Covered | Solar Panels, Mounting, Racking, and Tracking System, Storage System, Others |

| Applications Covered | Residential, Non-residential, Utility |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia solar power equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia solar power equipment market on the basis of equipment?

- What is the breakup of the Saudi Arabia solar power equipment market on the basis of application?

- What is the breakup of the Saudi Arabia solar power equipment market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia solar power equipment market?

- What are the key driving factors and challenges in the Saudi Arabia solar power equipment?

- What is the structure of the Saudi Arabia solar power equipment market and who are the key players?

- What is the degree of competition in the Saudi Arabia solar power equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia solar power equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia solar power equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia solar power equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)