Saudi Arabia Solar PV Inverter Market Size, Share, Trends and Forecast by Technology, Voltage, Application, and Region, 2026-2034

Saudi Arabia Solar PV Inverter Market Summary:

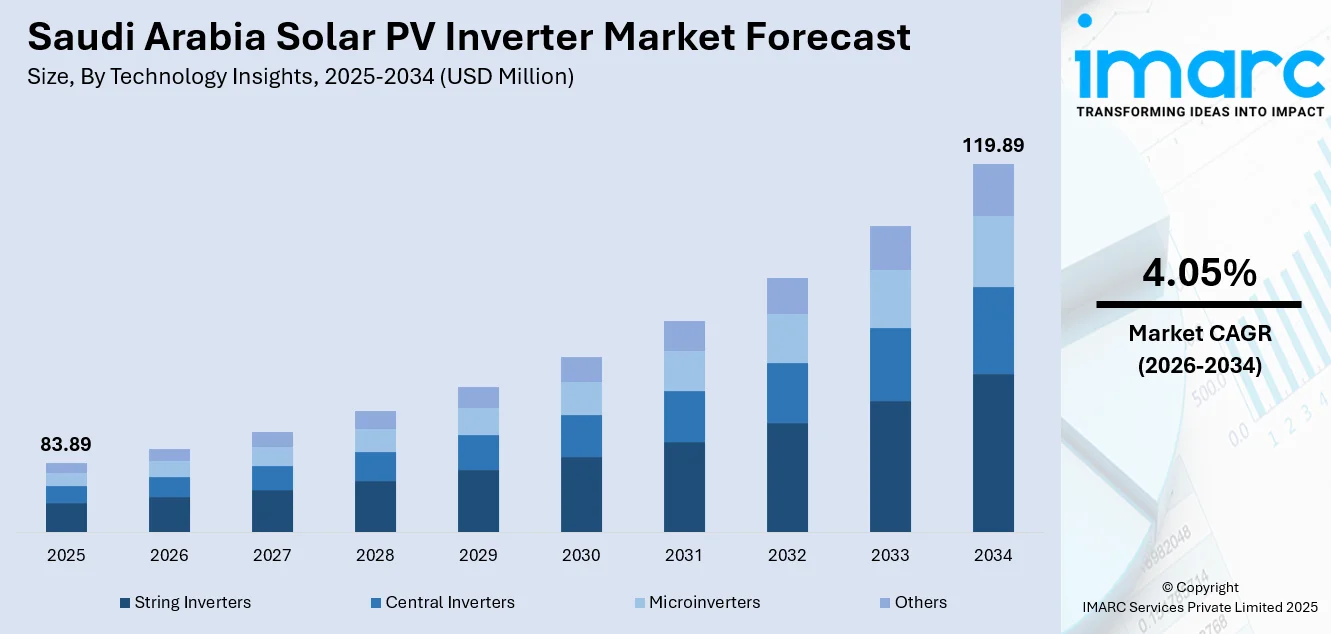

The Saudi Arabia solar PV inverter market size was valued at USD 83.89 Million in 2025 and is projected to reach USD 119.89 Million by 2034, growing at a compound annual growth rate of 4.05% from 2026-2034.

The Saudi Arabia solar PV inverter market is experiencing robust growth driven by the Kingdom's ambitious Vision 2030 renewable energy targets, which aim to source fifty percent of electricity from renewable sources by the end of the decade. Large-scale utility solar projects commissioned under the National Renewable Energy Programme are generating substantial demand for high-capacity inverter solutions capable of managing grid-scale energy production. Declining system costs combined with favorable solar irradiance conditions continue to enhance investment attractiveness, while growing energy storage integration requirements are creating additional demand for advanced inverter technologies. These factors collectively contribute to the expanding Saudi Arabia solar PV inverter market share.

Key Takeaways and Insights:

- By Technology: String inverters dominate the market with a share of 47% in 2025, owing to their modular design flexibility, cost-effectiveness for distributed installations, and compatibility with both commercial and utility-scale solar projects.

- By Voltage: 1,000 – 1,499 V leads the market with a share of 35% in 2025, driven by an optimal balance between system efficiency and equipment costs for medium to large-scale solar installations.

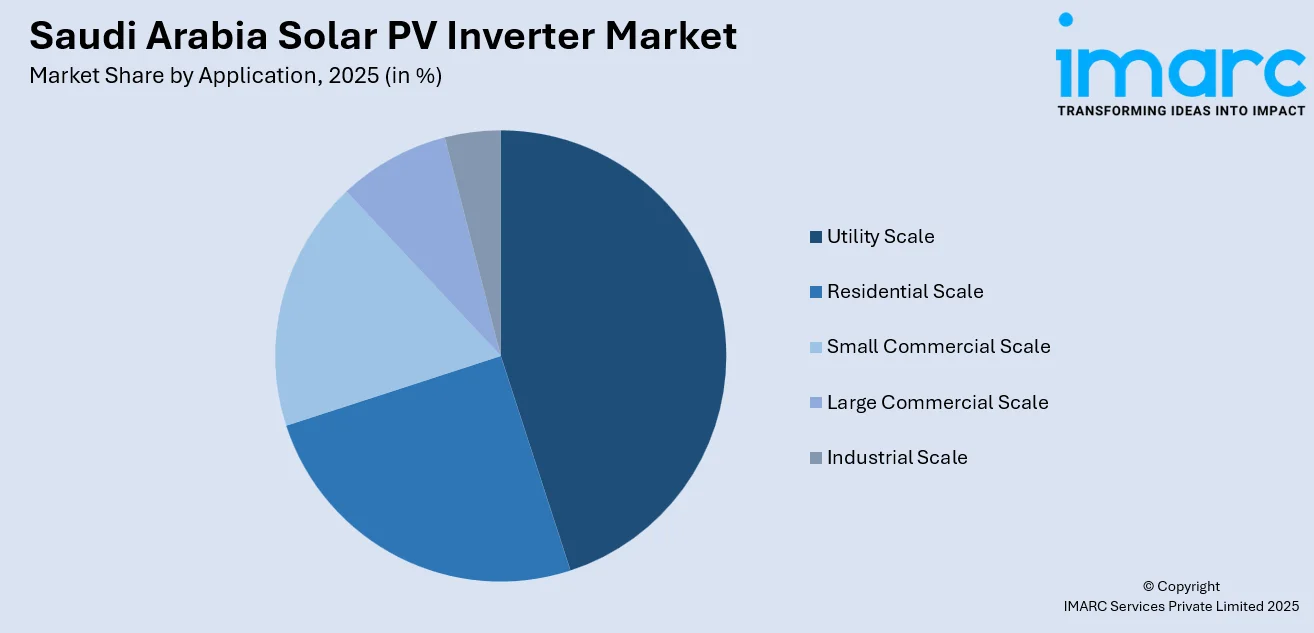

- By Application: Utility scale represents the largest segment with a market share of 41% in 2025, reflecting the Kingdom's strategic emphasis on large-scale solar farm development under the National Renewable Energy Programme.

- By Region: The Eastern region dominates the market with a share of 35% in 2025, supported by the concentration of major industrial zones, petrochemical facilities transitioning to renewable energy, and proximity to key infrastructure networks.

- Key Players: The Saudi Arabia solar PV inverter market is moderately competitive, with international and regional manufacturers vying for utility-scale and commercial project supply. Competition centers on technology performance, efficiency, and service support, as providers differentiate through advanced features, grid compliance, and local partnership strategies to capture rising renewable energy demand.

To get more information on this market Request Sample

The Saudi Arabia solar PV inverter market is undergoing a significant transformation as the Kingdom accelerates its renewable energy transition. Government initiatives, including the National Renewable Energy Programme and Power Purchase Agreement frameworks, provide stable offtake mechanisms that attract international investment. For instance, the Saudi Power Procurement Company completed power purchase agreements for three large-scale solar photovoltaic projects totaling 5.5 gigawatts in 2024, including the Haden, Muwayh, and Al Khushaybi facilities in Makkah and Qassim provinces, with contracts valued at approximately three point two eight billion US dollars. This procurement activity demonstrates sustained demand for inverter solutions across the project development pipeline. Furthermore, increasing integration of battery energy storage systems creates requirements for hybrid inverter configurations capable of managing bidirectional energy flows, positioning the market for continued expansion throughout the forecast period.

Saudi Arabia Solar PV Inverter Market Trends:

Vision 2030 Renewable Energy Acceleration

Saudi Arabia's Vision 2030 framework positions renewable energy as a cornerstone of economic diversification, targeting fifty percent electricity generation from clean sources by the end of the decade. This ambitious national strategy catalyzes substantial investment in solar infrastructure requiring advanced inverter technologies. The Renewable Energy Project Development Office conducts regular competitive tenders that establish benchmark pricing and technical standards. For instance, in June 2024, the Ministry of Energy commenced a comprehensive geographic survey deploying twelve hundred measurement stations across more than eight hundred fifty thousand square kilometers to identify optimal renewable project locations, demonstrating systematic planning approaches that support sustained inverter demand.

Energy Storage System Integration

The growing deployment of battery energy storage systems alongside solar photovoltaic installations is reshaping inverter requirements in the Saudi market. Hybrid and storage-compatible inverters capable of managing bidirectional energy flows are becoming increasingly important for grid stability and renewable integration. For instance, Sungrow signed a landmark agreement with Algihaz Holding in December 2025 for three energy storage projects with a combined capacity of 7.8 gigawatt-hours, representing one of the largest battery storage deployments globally. This trend toward integrated solar-plus-storage configurations drives demand for sophisticated inverter solutions with advanced grid support functionalities.

Manufacturing Localization Initiatives

Saudi Arabia is advancing the localization of solar equipment manufacturing to strengthen supply chain resilience and build domestic industrial capacity. Increasing local content requirements in renewable energy projects are encouraging manufacturers to establish local operations, support technology transfer, and develop a more self-sufficient solar energy ecosystem aligned with national industrial and energy transition goals. For instance, in July 2024, the Public Investment Fund signed joint venture agreements with JinkoSolar and TCL Zhonghuan Renewable Energy to establish thirty gigawatts of solar photovoltaic manufacturing capacity spanning ingots to modules. TCL Zhonghuan commenced construction of a two point eight billion US dollar integrated manufacturing complex in the Eastern Province featuring twenty gigawatt wafer production capacity, establishing domestic supply capabilities that may eventually extend to inverter assembly.

How Vision 2030 is Transforming the Saudi Arabia Solar PV Inverter Market:

Vision 2030 is transforming Saudi Arabia’s solar PV inverter market by accelerating large-scale renewable energy deployment and strengthening the local clean energy ecosystem. Government-led programs promote utility-scale and distributed solar projects, driving sustained demand for advanced, high-efficiency inverters. Localization initiatives encourage international manufacturers to establish regional operations, supporting technology transfer and supply chain development. The combination of solar energy with advanced energy storage and smart grid systems is driving greater use of high-tech inverter solutions, equipped with digital monitoring capabilities and features that support grid stability. Regulatory clarity, long-term power procurement frameworks, and strong government backing are positioning Saudi Arabia as a key growth market for solar PV inverter technologies in the Middle East.

Market Outlook 2026-2034:

The Saudi Arabia solar PV inverter market outlook remains positive as the Kingdom maintains aggressive renewable energy deployment targets supported by robust project pipelines and institutional procurement mechanisms. Continued expansion of utility-scale solar capacity combined with emerging distributed generation segments, will sustain inverter demand across technology categories. Energy storage integration requirements and grid modernization initiatives are expected to create additional growth opportunities for advanced inverter solutions with enhanced functionality. The market generated a revenue of USD 83.89 Million in 2025 and is projected to reach a revenue of USD 119.89 Million by 2034, growing at a compound annual growth rate of 4.05% from 2026-2034.

Saudi Arabia Solar PV Inverter Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Technology | String Inverters | 47% |

| Voltage | 1,000 – 1,499 V | 35% |

| Application | Utility Scale | 41% |

| Region | Eastern Region | 35% |

Technology Insights:

- Central Inverters

- String Inverters

- Microinverters

- Others

String inverters dominates with a market share of 47% of the total Saudi Arabia solar PV inverter market in 2025.

String inverters maintain market leadership due to their versatile deployment characteristics and favorable economics for medium-scale installations. These inverters offer modular configurations that accommodate varying array sizes while providing individual string-level monitoring and maximum power point tracking. The technology's scalability makes it suitable for commercial rooftop installations and distributed generation applications alongside utility-scale deployments.

Project developers are increasingly adopting string inverter architectures due to their ease of maintenance, modular design, and greater system flexibility. Large-scale solar projects continue to favor string-based solutions, reflecting strong institutional confidence in the technology. Their compatibility with bifacial solar modules and single-axis tracking systems, widely used in Saudi Arabia’s desert conditions, further strengthens their appeal, enabling improved performance, easier scalability, and efficient operation in utility-scale installations.

Voltage Insights:

- < 1,000 V

- 1,000 – 1,499 V

- > 1,500 V

1,000 – 1,499 V leads with a share of 35% of the total Saudi Arabia solar PV inverter market in 2025.

The intermediate voltage segment represents the dominant configuration for solar PV installations in Saudi Arabia, balancing system efficiency with equipment cost considerations. This voltage range enables optimized string lengths that maximize energy harvest while maintaining compatibility with established electrical infrastructure and safety standards. Commercial and industrial applications particularly favor this configuration for its practical implementation characteristics.

The segment benefits from mature technology ecosystems with extensive equipment availability and established installation practices. Higher voltage systems exceeding fifteen hundred volts are gaining traction for utility-scale projects where their efficiency advantages justify additional equipment requirements, though the intermediate segment continues to capture the largest market share across diverse application categories.

Application Insights:

To get detailed segment analysis of this market Request Sample

- Utility Scale

- Residential Scale

- Small Commercial Scale

- Large Commercial Scale

- Industrial Scale

Utility scale exhibits clear dominance with a 41% share of the total Saudi Arabia solar PV inverter market in 2025.

Utility-scale applications represent the primary demand driver for solar PV inverters in Saudi Arabia, reflecting the Kingdom's strategic emphasis on large-scale renewable energy deployment. The National Renewable Energy Programme has successfully tendered gigawatt-scale projects that require substantial inverter procurement volumes. Projects such as the 2.6 gigawatt Al Shuaibah solar photovoltaic facility developed by ACWA Power and partners exemplify the scale of utility installations driving market growth.

This segment is supported by standardized procurement frameworks and long-term power purchase agreements that offer stable and predictable revenue for developers. While central inverters have traditionally been preferred for utility-scale projects, string inverters are gaining traction due to easier maintenance and enhanced monitoring capabilities. Ongoing investments in large ground-mounted solar facilities continue to drive demand for high-capacity inverter solutions, reinforcing the importance of reliable and scalable technologies in utility-scale solar deployment.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Eastern region represents the highest revenue share of 35% of the total Saudi Arabia solar PV inverter market in 2025.

The Eastern region maintains market leadership driven by its concentration of industrial infrastructure and strategic renewable energy projects. The region hosts major petrochemical facilities, manufacturing zones, and desalination plants that are increasingly integrating solar power systems to reduce operational carbon footprints and energy costs. The Al Sadawi Independent Power Producer solar project, with a capacity of 2,000 megawatts in the Eastern Province, stands as one of the Kingdom’s largest planned solar installations.

Strong industrial demand for dependable power, along with ample land availability, positions the Eastern Region as a key area for ongoing solar energy development. The expansion of integrated solar manufacturing facilities in the region is reinforcing the local renewable energy ecosystem and supporting supply chain development. Existing large-scale solar parks and operational facilities further highlight the region’s established capabilities, strengthening its leadership role in Saudi Arabia’s solar power and related equipment markets.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Solar PV Inverter Market Growing?

Expansion of Utility-Scale Solar Projects

The rapid commissioning of utility-scale solar projects is a key growth driver for Saudi Arabia’s solar PV inverter market. The Kingdom’s ambitious renewable energy pipeline continues to generate strong demand for high-capacity inverter solutions. Large-scale developments require robust technology capable of managing substantial energy output, ensuring grid stability, and meeting regulatory standards. Early projects established deployment benchmarks, while ongoing expansions and tender rounds are further increasing market opportunities. As solar capacity grows, reliable and efficient inverters remain critical to supporting the performance, scalability, and operational resilience of Saudi Arabia’s utility-scale solar installations.

Declining Solar PV System Costs

The sustained reduction in solar photovoltaic system costs across Saudi Arabia significantly influences the inverter market by expanding the addressable project base. Declining module prices combined with competitive tender outcomes have substantially reduced the levelized cost of electricity from solar sources, improving investment returns across utility and distributed generation segments. The Shuaibah 1 solar project achieved the lowest levelized cost of energy in Saudi Arabia at approximately 0.039 Saudi Riyals per kilowatt-hour when commissioned in November 2024. This cost competitiveness enhances project viability across commercial, industrial, and residential segments, increasing total inverter demand. As system costs continue to decline, project developers demonstrate willingness to invest in higher-quality inverters offering improved efficiency, remote monitoring capabilities, and advanced grid-support features that maximize lifetime energy production and investment returns.

Government Policy Support and Vision 2030 Implementation

Government policy frameworks are providing strong support for the growth of Saudi Arabia’s solar PV inverter market. Vision 2030 positions renewable energy as a strategic priority, promoting capacity expansion and economic diversification. Competitive tender processes establish clear technical standards, transparent pricing, and revenue certainty through long-term power purchase agreements. Local content requirements encourage supply chain development and technology transfer, while investments in domestic solar manufacturing strengthen the local industry. Policy support also extends to complementary technologies, such as battery energy storage systems, enabling more efficient integration of renewable energy and enhancing the overall resilience and performance of the solar sector.

Market Restraints:

What Challenges the Saudi Arabia Solar PV Inverter Market is Facing?

Grid Infrastructure Integration Challenges

The existing transmission and distribution infrastructure presents integration challenges for rapidly expanding solar capacity in Saudi Arabia. Legacy grid networks designed around centralized fossil fuel generation require substantial upgrades to accommodate variable renewable energy sources distributed across new geographic areas. Transmission line construction timelines extending up to five years may outpace solar project development schedules, creating temporary interconnection constraints that could moderate market growth in certain regions.

Reliance on Imported Equipment and Technology

Key solar equipment including inverters and energy storage systems, currently depends heavily on imports, exposing the Saudi market to supply chain vulnerabilities and currency fluctuations. While localization initiatives are progressing, domestic manufacturing capabilities for advanced power electronics remain limited. This import dependency may affect equipment availability, pricing stability, and project implementation timelines, particularly during periods of global supply chain disruption or geopolitical uncertainty.

Harsh Environmental Operating Conditions

Saudi Arabia's extreme desert environment, characterized by high temperatures, frequent sandstorms, and significant diurnal temperature variations, imposes demanding operational requirements on solar PV inverters. Equipment must maintain reliable performance under thermal stress while managing dust accumulation that affects cooling system efficiency. These conditions necessitate customized technology solutions and enhanced maintenance protocols that may increase total system costs and complexity compared to more temperate deployment environments.

Competitive Landscape:

The Saudi Arabia solar PV inverter market exhibits moderately concentrated competitive dynamics characterized by participation from established international technology providers alongside regional system integrators and distributors. Global manufacturers maintain strong market positions through direct project supply agreements with major developers and strategic partnerships with local engineering procurement and construction firms. Competition centers on technical performance specifications, grid compliance certifications, service support capabilities, and total cost of ownership considerations. Leading international suppliers have secured significant contract awards for utility-scale projects while also developing channel partnerships to address commercial and industrial market segments. The market environment rewards suppliers capable of meeting demanding technical requirements for harsh environmental conditions while providing responsive local support for installation and maintenance activities.

Recent Developments:

- November 2024: Sineng Electric secured a 2.6 gigawatt PV inverter supply contract for the PIF4 solar project, covering the Haden (1 gigawatt) and Al Khushaybi (1.6 gigawatt) solar power plants, through agreements with China Energy Engineering Group for Haden and Larsen & Toubro for Al Khushaybi.

- September 2024: Huawei Digital Energy completed construction of the world's largest photovoltaic-energy storage microgrid for Saudi Arabia's Red Sea Project, integrating a 400 megawatt solar PV system with a 1.3 gigawatt-hour energy storage system to provide complete renewable energy supply to the luxury tourism development.

Saudi Arabia Solar PV Inverter Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Central Inverters, String Inverters, Microinverters, Others |

| Voltages Covered | < 1,000 V, 1,000 – 1,499 V, > 1,500 V |

| Applications Covered | Utility Scale, Residential Scale, Small Commercial Scale, Large Commercial Scale, Industrial Scale |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia solar PV inverter market size was valued at USD 83.89 Million in 2025.

The Saudi Arabia solar PV inverter market is expected to grow at a compound annual growth rate of 4.05% from 2026-2034 to reach USD 119.89 Million by 2034.

String inverters dominated the market with a 47% share in 2025, driven by their modular design flexibility, cost-effectiveness for distributed installations, and compatibility with both commercial and utility-scale solar projects deployed across the Kingdom.

Key factors driving the Saudi Arabia solar PV inverter market include expanding utility-scale solar projects under the National Renewable Energy Programme, declining solar system costs improving investment viability, government policy support through Vision 2030 renewable energy targets, and growing energy storage integration requirements.

Major challenges include grid infrastructure integration constraints requiring substantial transmission network upgrades, reliance on imported key equipment affecting supply chain stability, harsh environmental operating conditions demanding customized technology solutions, and evolving regulatory requirements for grid compliance and local content thresholds.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)