Saudi Arabia Statin Market Size, Share, Trends and Forecast by Type, Therapeutic Area, Drug Class, Application, Distribution, and Region, 2026-2034

Saudi Arabia Statin Market Overview:

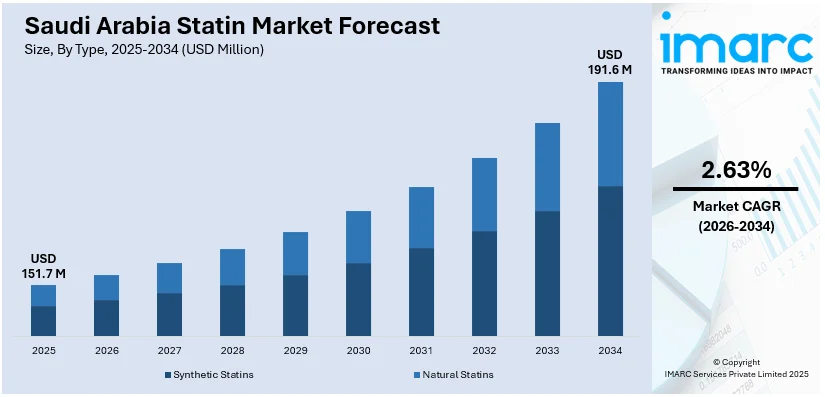

The Saudi Arabia statin market size reached USD 151.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 191.6 Million by 2034, exhibiting a growth rate (CAGR) of 2.63% during 2026-2034. The market is primarily driven by rising prevalence of cardiovascular diseases, increasing hypercholesterolemia cases, sedentary lifestyles, expanded screening programs, government-led healthcare investment, and improved local drug manufacturing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 151.7 Million |

| Market Forecast in 2034 | USD 191.6 Million |

| Market Growth Rate 2026-2034 | 2.63% |

Saudi Arabia Statin Market Trends:

Rising Prevalence of Cardiovascular Diseases and Hypercholesterolemia

A key factor influencing the statin market in Saudi Arabia is the increasing burden of cardiovascular diseases (CVDs), including coronary artery disease, myocardial infarction, and stroke. A combination of sedentary lifestyles, changing dietary habits, and rising obesity rates has led to a pronounced rise in cholesterol-related disorders. The prevalence of CVDs among the Saudi population aged 15 years and older was 1.6% in 2024, with higher rates observed in males (1.9%) compared to females (1.4%). Also, CVDs accounted for 37% of non-communicable disease (NCD) deaths in Saudi Arabia in 2024, making them the leading cause of NCD-related mortality in the country. Statins, as HMG-CoA reductase inhibitors, are the most prescribed pharmacological therapy for managing hypercholesterolemia and reducing cardiovascular risk, particularly among middle-aged and elderly populations. In recent years, urbanization and economic development have driven substantial shifts in daily routines and food consumption patterns. Processed food intake has increased, accompanied by a noticeable reduction in physical activity levels. Medical professionals across the country are responding by adopting international cardiovascular disease prevention guidelines, where statins remain the cornerstone therapy, thereby contributing to the Saudi Arabia statin market growth. Moreover, Saudi Arabia’s Vision 2030 initiative, which emphasizes enhancing healthcare infrastructure and expanding preventive health services, has indirectly facilitated increased diagnosis and long-term management of lipid-related conditions. This has encouraged regular cholesterol screening and expanded access to lipid-lowering agents. Local healthcare providers, including public and private clinics, have strengthened their protocols to identify at-risk individuals at earlier stages. The introduction of mandatory pre-employment and periodic medical check-ups in certain sectors, including oil and gas, also contributes to the growing pool of diagnosed patients requiring lipid management, and in turn, to the Saudi Arabia statin market share.

To get more information on this market Request Sample

Government-Led Healthcare Investment and Regulatory Support

Another crucial driver of the statin market in Saudi Arabia is the government's robust healthcare investment strategy and the improving pharmaceutical regulatory framework. With this level of systemic expansion, prescription drug utilization has increased, creating a favorable landscape for lipid-lowering therapies. The Ministry of Health has also strengthened its partnership with global and regional pharmaceutical firms to facilitate the local manufacturing of essential medicines, including statin. As per recent industry reports, Saudi Arabia's generic substitution policy has increased generic drug utilization from 30% to over 40% in recent years. Through public-private partnerships and the localization of drug production, the availability of statin has improved in both urban and semi-urban areas. This directly enhances the efficiency of pharmaceutical supply chains, reduces import reliance, and makes essential cardiovascular drugs more cost-effective. As the healthcare sector modernizes, the digitization of health services has emerged as a key enabler. Integrated electronic health records (EHR) systems allow for more streamlined patient monitoring and real-time decision-making by physicians. Furthermore, digital prescription systems enhance traceability, allowing better pharmaceutical inventory management and reduction of stockouts in both urban hospitals and peripheral clinics. The Saudi Arabia statin market outlook is also influenced by policies encouraging generic substitution and price regulation. The government has imposed cost-containment strategies to manage the national drug expenditure, which includes promoting the use of generics in the public healthcare system. Additionally, training programs for healthcare professionals now emphasize updated cardiovascular treatment algorithms, which include statin initiation as a routine preventive measure. These programs are often subsidized by the government or executed in collaboration with pharmaceutical firms under regulated compliance standards. The availability of such educational infrastructure ensures that physicians, particularly in remote regions, are well-equipped to recommend statin therapy in accordance with international treatment protocols.

Saudi Arabia Statin Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, therapeutic area, drug class, application, and distribution.

Type Insights:

- Synthetic Statins

- Natural Statins

The report has provided a detailed breakup and analysis of the market based on the type. This includes synthetic statins and natural statins.

Therapeutic Area Insights:

- Cardiovascular Disorders

- Obesity

- Inflammatory Disorders

- Others

The report has provided a detailed breakup and analysis of the market based on the therapeutic area. This includes cardiovascular disorders, obesity, inflammatory disorders, and others.

Drug Class Insights:

- Atorvastatin

- Fluvastatin

- Lovastatin

- Pravastatin

- Simvastatin

- Others

The report has provided a detailed breakup and analysis of the market based on the drug class. This includes atorvastatin, fluvastatin, lovastatin, pravastatin, simvastatin, and others.

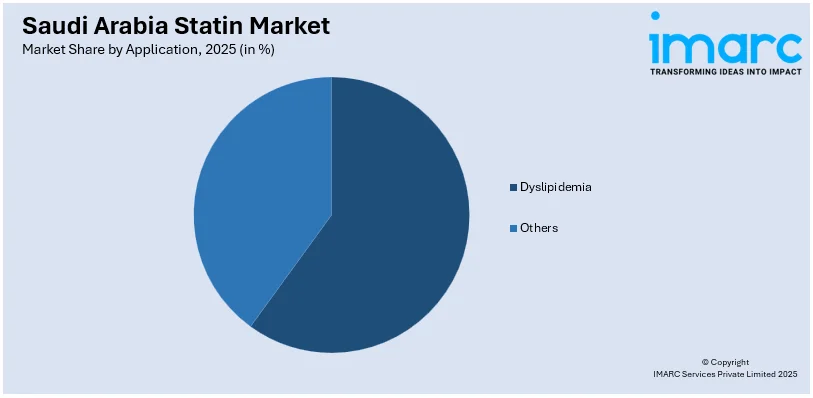

Application Insights:

Access the comprehensive market breakdown Request Sample

- Dyslipidemia

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes dyslipidemia and others.

Distribution Insights:

- Hospitals

- Clinics

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution. This includes hospitals, clinics, and others.

Region Insights

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has provided a detailed breakup and analysis of the market based on the region. This includes Northern and Central region, Western region, Eastern region and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Statin Market News:

- On June 21, 2023, the Saudi Food and Drug Authority (SFDA) approved Vascepa® (icosapent ethyl) as an adjunct to statin therapy for adults with elevated triglyceride levels (≥150 mg/dL) who are at high risk of cardiovascular events due to established cardiovascular disease or diabetes mellitus with at least one additional risk factor. This approval, based on the REDUCE-IT trial, positions Vascepa as the first and only medication in Saudi Arabia approved to reduce cardiovascular risk beyond cholesterol-lowering therapy in high-risk statin-treated patients with elevated triglycerides.

Saudi Arabia Statin Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Synthetic Statins, Natural Statins |

| Therapeutic Areas Covered | Cardiovascular Disorders, Obesity, Inflammatory Disorders, Others |

| Drug Classes Covered: | Atorvastatin, Fluvastatin, Lovastatin, Pravastatin, Simvastatin, Others |

| Applications Covered: | Dyslipidemia, Others |

| Distributions Covered: | Hospitals, Clinics, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia statin market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia statin market on the basis of type?

- What is the breakup of the Saudi Arabia statin market on the basis of therapeutic area?

- What is the breakup of the Saudi Arabia statin market on the basis of drug class?

- What is the breakup of the Saudi Arabia statin market on the basis of application?

- What is the breakup of the Saudi Arabia statin market on the basis of distribution?

- What is the breakup of the Saudi Arabia statin market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia statin market?

- What are the key driving factors and challenges in the Saudi Arabia statin market?

- What is the structure of the Saudi Arabia statin market and who are the key players?

- What is the degree of competition in the Saudi Arabia statin market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia statin market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia statin market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia statin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)