Saudi Arabia Stearic Acid Market Size, Share, Trends and Forecast by Type, End User, and Region, 2026-2034

Saudi Arabia Stearic Acid Market Summary:

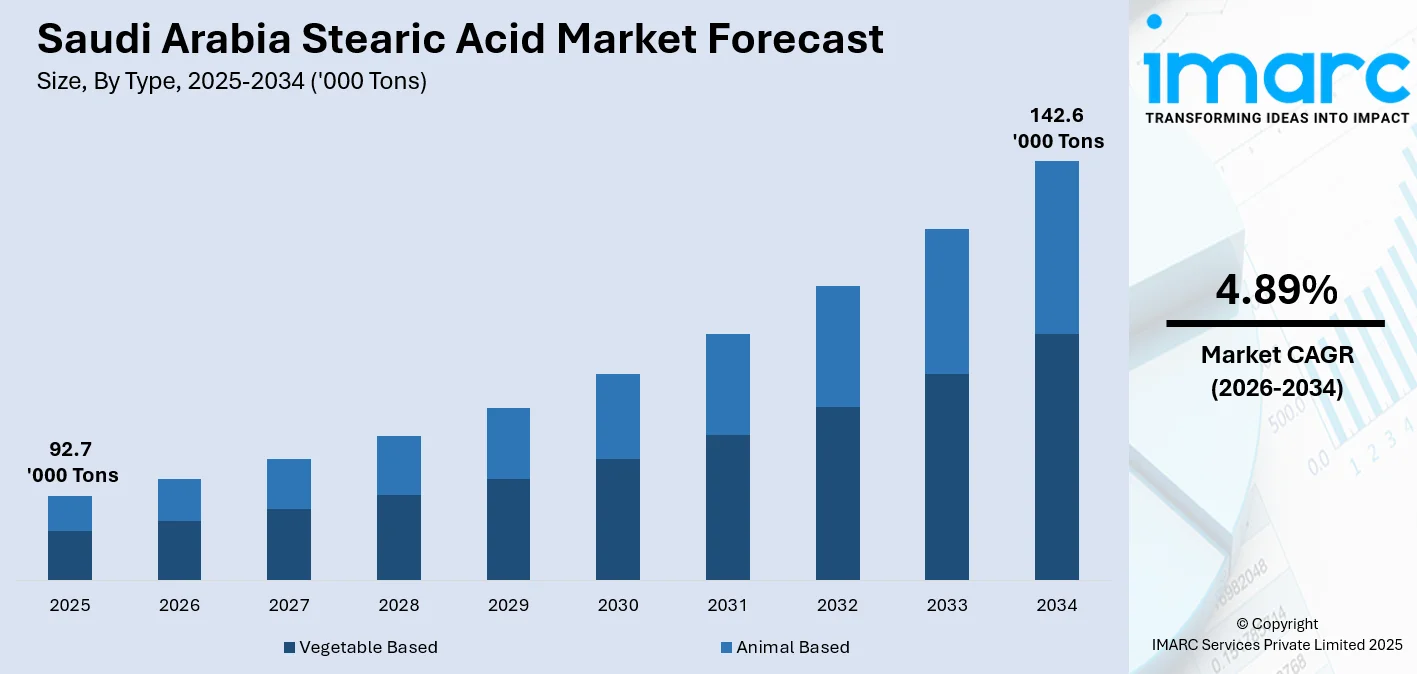

The Saudi Arabia stearic acid market size reached 92.7 Thousand Tons in 2025 and is projected to reach 142.6 Thousand Tons by 2034, growing at a compound annual growth rate of 4.89% from 2026-2034.

Saudi Arabia's market thrives on expanding industrial applications across personal care formulations, rubber manufacturing, and detergent production. Apart from this, growth stems from rising domestic consumption patterns, industrial diversification initiatives aligned with Vision 2030 objectives, and increasing demand for high quality acids from downstream manufacturing sectors seeking versatile fatty acid derivatives for multiple end-use applications, thereby expanding the Saudi Arabia stearic acid market share.

Key Takeaways and Insights:

- By Type: Vegetable based dominates the market with a share of 60% in 2025, driven by sustainability preferences, halal certification requirements, and superior performance characteristics in cosmetic applications.

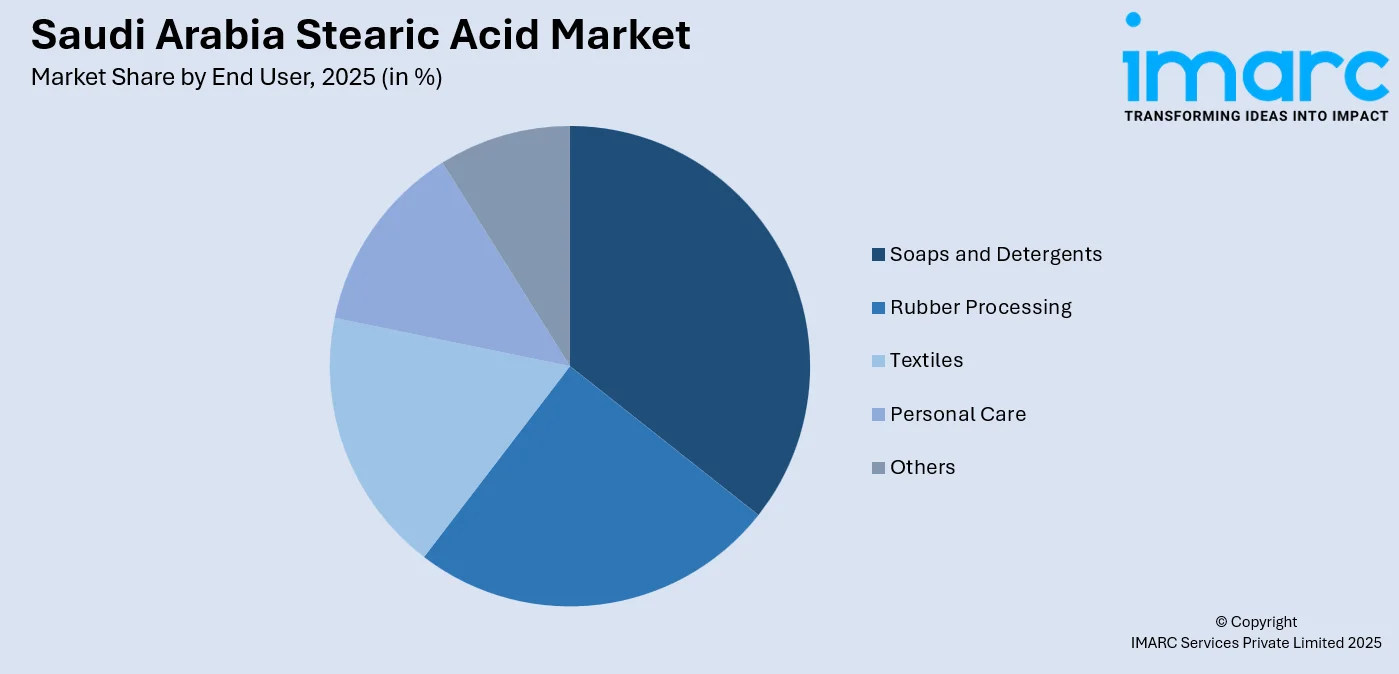

- By End User: Soaps and detergents lead the market with a share of 31% in 2025, supported by household consumption growth and expanding industrial cleaning applications.

- By Region: Eastern region represents the largest segment with a market share of 40% in 2025, propelled by petrochemical infrastructure concentration and proximity to manufacturing clusters.

- Key Players: The Saudi Arabia stearic acid market demonstrates moderate consolidation with international oleochemical manufacturers competing alongside regional producers. Competition intensifies across vegetable-based and animal-based formulations, with players differentiating through sustainable sourcing practices, halal certification standards, technical support capabilities, and integrated production facilities serving diverse industrial applications.

To get more information on this market Request Sample

Saudi Arabia's stearic acid market benefits from robust demand across manufacturing sectors requiring fatty acid derivatives for surfactant production, polymer processing, and specialty chemical applications. The kingdom's strategic position within global oleochemical supply chains, coupled with downstream industrial expansion in pharmaceuticals, cosmetics, and rubber processing, creates sustained consumption growth. Industrial clusters in the Eastern Region leverage petrochemical integration advantages while Western Region facilities serve consumer goods manufacturers. Moreover, the government is investing in the development of various ports which is further facilitating easy and seamless import of palm-based stearic acid derivatives, supplementing domestic production capabilities. Recent investments in sustainable oleochemical processing reflect alignment with circular economy principles and halal industry standards. In 2025, Saudi Arabia’s Ministry of Industry and Mineral Resources handled 524 chemical clearance service requests, highlighting the Kingdom’s initiatives to enhance industrial investment and simplify regulatory procedures. According to the ministry on social media platform X, the requests encompassed 510 permits for importing unrestricted chemical materials and 14 applications for importing restricted substances, while 838 export permit requests were also filed during that timeframe.

Saudi Arabia Stearic Acid Market Trends:

Shift Toward Plant-Derived Formulations in Industrial Applications

Manufacturers increasingly prioritize vegetable-based stearic acid for cosmetic emulsions, pharmaceutical excipients, and food-grade applications responding to consumer preferences for plant-derived ingredients. This transition reflects broader sustainability commitments, halal certification requirements, and performance advantages in temperature-sensitive formulations. Palm oil derivatives dominate supply chains, supported by established trade relationships with Southeast Asian producers and processing infrastructure capable of handling refined fatty acid fractions. The trend extends beyond personal care into rubber processing applications where vegetable sources offer consistent quality profiles. In 2026, BIKAR Expansion Joints consolidates its role in the country, now collaborating with a Saudi/Spanish joint venture tasked with designing and constructing a key project in the area. This transmission line spans 150 km and has a pumping capacity of 500,000 m³ per day. This project will link two key industrial zones situated north of Jeddah, facilitating the distribution of desalinated water to the Mecca and Medina areas. This project serves as a benchmark and is an essential element for the infrastructure advancement that SWPC is advocating across the Kingdom of Saudi Arabia.

Integration of Stearic Acid in Advanced Polymer Processing

Plastics manufacturers adopt stearic acid derivatives as processing aids for polyvinyl chloride extrusion, polyethylene compounding, and masterbatch production benefiting from lubrication properties and thermal stability characteristics. This application expansion supports growing packaging materials demand, construction plastics consumption, and automotive component manufacturing requiring specialized polymer formulations. Technical collaboration between fatty acid suppliers and polymer processors drives customized product development addressing specific processing temperature requirements, dispersion characteristics, and regulatory compliance standards for food-contact and medical-grade applications. In 2025, Songwon Industrial Co. Ltd., a polymer stabilizer manufacturer located in Ulsan, South Korea, announced at K 2025 in Düsseldorf that it will set up a One Pack Systems production facility in Saudi Arabia.

Emergence of Specialized Personal Care Formulations

Cosmetic manufacturers incorporate stearic acid into premium skincare products, haircare formulations, and color cosmetics leveraging emulsification properties, texture enhancement capabilities, and sensory profile improvements. Growing middle-class purchasing power fuels demand for international beauty brands and locally manufactured personal care products meeting Islamic cosmetic standards. Product innovation focuses on multifunctional ingredients combining emulsifying performance with skin-conditioning benefits, particularly in moisturizers, cleansers, and decorative cosmetics. The Kingdom's expanding halal cosmetics sector positions stearic acid as an essential ingredient meeting religious compliance requirements while delivering technical performance. IMARC Group predicts that the Saudi Arabia beauty and personal care market is projected to attain USD 6.4 Billion by 2033.

How Vision 2030 is Transforming the Saudi Arabia Stearic Acid Market:

Saudi Vision 2030 is quietly reshaping the stearic acid market by changing how chemicals are produced, consumed, and sourced inside the Kingdom. The push to reduce oil dependence has led to steady investment in downstream petrochemicals, oleochemicals, and specialty chemicals used in plastics, rubber, cosmetics, detergents, and personal care. Stearic acid benefits directly from this shift, as local manufacturers expand capacity to serve domestic industries instead of relying on imports. Industrial zones like Jubail and Yanbu are attracting chemical producers through incentives, infrastructure upgrades, and easier foreign participation. At the same time, Vision 2030’s focus on local manufacturing in FMCG, automotive, construction materials, and packaging is lifting demand for stabilizers, surfactants, and processing aids where stearic acid plays a role. Sustainability goals are also nudging producers toward bio-based and palm-derived alternatives, opening space for higher-grade and specialty variants. Overall, the market is moving from import-led supply toward localized production tied closely to industrial growth targets.

Market Outlook 2026-2034:

Saudi Arabia's stearic acid market trajectory reflects sustained industrial diversification, expanding manufacturing capabilities across petrochemical value chains, and growing domestic consumption from personal care and household products sectors. Infrastructure investments supporting oleochemical processing, downstream product development in specialty chemicals, and alignment with sustainable sourcing practices position the market for consistent expansion. The market size was estimated at 92.7 Thousand Tons in 2025 and is expected to reach 142.6 Thousand Tons by 2034, reflecting a compound annual growth rate of 4.89% over the forecast period 2026-2034. Additionally, growing female workforce participation and rising beauty consciousness among younger demographics fuel premium personal care consumption, creating opportunities for specialized cosmetic-grade stearic acid formulations.

Saudi Arabia Stearic Acid Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Vegetable Based |

60% |

|

End User |

Soaps and Detergents |

31% |

|

Region |

Eastern Region |

40% |

Type Insights:

- Vegetable Based

- Animal Based

Vegetable based dominates with a market share of 60% of the total Saudi Arabia stearic acid market in 2025.

Vegetable-based stearic acid commands market leadership through alignment with halal certification standards, sustainability preferences among multinational manufacturers, and consistent quality profiles derived from palm oil fractionation processes. Palm stearin and palm kernel oil serve as primary feedstocks, processed through established Southeast Asian supply chains and domestic refining facilities capable of producing pharmaceutical-grade and cosmetic-grade specifications. Environmental considerations drive corporate procurement policies favoring RSPO-certified sustainable palm derivatives over tallow-based alternatives, particularly among personal care brands serving conscious consumer segments.

Technical performance advantages in emulsion stability, melting point consistency, and regulatory acceptance across food-contact applications reinforce vegetable-based dominance. Manufacturers leverage established palm oil trade infrastructure connecting Saudi markets with Malaysian and Indonesian production hubs, ensuring reliable supply despite seasonal variations. Growing investments in domestic oleochemical processing capabilities support vertical integration strategies, enabling local producers to compete on quality specifications while reducing import dependency. The segment benefits from technological advancements in fractionation processes yielding higher purity grades suitable for specialized pharmaceutical excipients and premium cosmetic formulations.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Soaps and Detergents

- Rubber Processing

- Textiles

- Personal Care

- Others

Soaps and detergents lead with a share of 31% of the total Saudi Arabia stearic acid market in 2025.

Soaps and detergents represent the largest consumption segment driven by household cleaning product demand, industrial detergent applications, and expanding hospitality sector requirements. Moreover, stearic acid functions as a critical raw material for soap base production, providing hardness characteristics, lathering properties, and stability in traditional bar soap formulations prevalent in Saudi households. Apart from this, detergent manufacturers utilize stearic acid derivatives in fabric softeners, liquid detergents, and specialty cleaning formulations benefiting from surfactant properties and biodegradability profiles meeting environmental regulations.

Market leadership reflects established consumption patterns across residential and commercial cleaning applications, with growing hotel construction, healthcare facility expansion, and food service sector growth driving institutional detergent demand. Manufacturers develop customized formulations addressing regional water hardness characteristics, temperature variations affecting cleaning efficiency, and cultural preferences for specific product formats. The segment demonstrates resilience through essential product classification, consistent repurchase cycles, and expanding middle-class household formation creating sustained baseline demand independent of economic fluctuations.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Eastern region exhibits a clear dominance with a 40% share of the total Saudi Arabia stearic acid market in 2025.

The Eastern Region's market leadership stems from concentrated petrochemical infrastructure in Jubail and Dammam industrial cities, providing strategic advantages for oleochemical processing, derivative manufacturing, and integrated production facilities serving multiple industrial applications. Proximity to major ports facilitates efficient import of palm oil feedstocks and export of processed stearic acid derivatives to regional markets. Established industrial clusters housing rubber manufacturers, plastics processors, and chemical companies create dense demand networks reducing logistics costs and enabling just-in-time delivery capabilities.

Regional dominance reflects historical industrial development patterns prioritizing petrochemical value chain integration, with stearic acid production complementing fatty alcohol manufacturing, glycerin processing, and surfactant synthesis operations. The region benefits from skilled technical workforce concentrations, research collaboration with King Fahd University of Petroleum and Minerals, and government incentives supporting downstream chemical manufacturing. Growing investments in specialty oleochemicals, expanding rubber processing capacity for automotive applications, and development of halal cosmetic manufacturing clusters reinforce the Eastern Region's position as the Kingdom's primary stearic acid consumption and production hub.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Stearic Acid Market Growing?

Expanding Personal Care and Cosmetics Manufacturing Sector

Saudi Arabia's personal care industry experiences robust growth driven by rising disposable incomes, increasing beauty consciousness among younger demographics, and expansion of international cosmetic brands establishing local manufacturing presence. Stearic acid serves as an essential ingredient in moisturizers, lotions, creams, and color cosmetics providing emulsification, texture enhancement, and stability properties. The Kingdom's halal cosmetics sector attracts regional investment as manufacturers develop Shariah-compliant beauty products for domestic consumption and export to Gulf Cooperation Council markets. Government initiatives supporting local manufacturing under industrial development programs incentivize cosmetic production facilities requiring consistent stearic acid supplies. In 2025, The Halal Products Development Company (HPDC), owned by PIF, entered into a binding agreement to invest in Believe, a firm focused on halal cosmetics and personal care items. The agreement intends to move Believe’s headquarters from Singapore to Saudi Arabia, establishing it as a central hub for exporting the company’s products to numerous countries worldwide. It intended to establish a factory in Saudi Arabia to localize manufacturing and provide contract manufacturing services for local brands, with plans to expand to international brands later.

Industrial Diversification Under Vision 2030 Initiatives

The Kingdom's economic transformation agenda prioritizes manufacturing sector development, reducing petroleum dependency through downstream chemical industries, and building competitive advantages in specialty materials production. Stearic acid derivatives support expanding plastics processing, rubber manufacturing, and textile industries aligned with diversification objectives. Government incentives for foreign investment in oleochemical facilities, development of industrial cities with integrated infrastructure, and technical training programs building chemical industry workforce capabilities create favorable conditions for stearic acid market expansion. In 2024, India and Saudi Arabia have decided to strengthen cooperation in the chemicals and petrochemicals industry after a bilateral discussion between the Department of Chemicals & Petrochemicals, Ministry of Chemicals and Fertilizers, Government of India, and the Ministry of Industry and Minerals, Kingdom of Saudi Arabia. Moreover, strategic initiatives promoting pharmaceutical manufacturing and specialty chemical production generate additional demand from high-value applications.

Growing Rubber Processing and Automotive Component Manufacturing

Saudi Arabia's automotive sector expansion drives rubber processing demand for tire manufacturing, automotive seals, and vibration dampening components utilizing stearic acid as a critical processing aid and vulcanization activator. Stearic acid improves rubber compound dispersion, enhances processing efficiency, and contributes to final product performance characteristics. Increasing vehicle ownership rates, expanding public transportation infrastructure requiring specialized rubber components, and growth in maintenance and replacement parts markets sustain rubber industry expansion. Regional automotive assembly operations and component localization initiatives under local content requirements further strengthen stearic acid consumption from rubber processing applications. IMARC Group predicts that the Saudi Arabia rubber market is projected to attain USD 624.2 Million by 2034.

Market Restraints:

What Challenges the Saudi Arabia Stearic Acid Market is Facing?

Price Volatility in Palm Oil Feedstock Markets

Stearic acid production costs fluctuate with palm oil price movements influenced by Southeast Asian weather patterns, biodiesel policy changes, and global vegetable oil supply dynamics. Manufacturers face margin pressures during periods of elevated feedstock costs, particularly when downstream customers resist price adjustments. Limited domestic palm cultivation restricts local sourcing options, creating dependency on imported refined palm products subject to currency fluctuations and international trade dynamics.

Competition from Synthetic Alternatives in Industrial Applications

Petroleum-based synthetic fatty acids and alternative processing aids challenge stearic acid in certain industrial applications where performance specifications permit substitution. Synthetic options sometimes offer price advantages during periods of elevated natural fatty acid costs, particularly in commodity-grade applications with less stringent purity requirements. Manufacturers developing bio-based alternatives derived from different vegetable sources introduce competitive pressure, though halal certification requirements and established formulations limit substitution in many Saudi market segments.

Regulatory Compliance and Quality Standardization Requirements

Pharmaceutical-grade and food-grade stearic acid applications demand rigorous quality control, consistent purity specifications, and comprehensive documentation meeting international standards. Compliance costs burden smaller producers lacking sophisticated analytical capabilities and quality management systems. Evolving cosmetic regulations, particularly for halal certification standards and ingredient transparency requirements, necessitate continuous process improvements and supply chain auditing programs. Import regulations governing fatty acid derivatives require extensive product testing and certification procedures affecting market entry timing for international suppliers.

Competitive Landscape:

The Saudi Arabia stearic acid market exhibits moderate competitive intensity with established international oleochemical producers maintaining significant market presence alongside regional manufacturers serving specialized applications. Competition centers on product quality consistency, halal certification credentials, technical support capabilities, and integrated production facilities offering derivative products. Major players differentiate through sustainable sourcing commitments, particularly RSPO-certified palm derivatives, and vertical integration strategies spanning fatty acid production to downstream specialty chemicals. Market dynamics reflect growing emphasis on plant-based formulations, increasing demand from personal care applications requiring pharmaceutical-grade specifications, and expansion of domestic manufacturing capabilities reducing import dependency. Regional producers leverage proximity advantages and cultural understanding while international suppliers compete through technological expertise and global quality standards.

Saudi Arabia Stearic Acid Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Vegetable Based, Animal Based |

| End Users Covered | Soaps and Detergents, Rubber Processing, Textiles, Personal Care, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia stearic acid market reached a volume of 92.7 Thousand Tons in 2025.

The Saudi Arabia stearic acid market is expected to grow at a compound annual growth rate of 4.89% from 2026-2034 to reach 142.6 Thousand Tons by 2034.

Vegetable-based commanded the largest market share of 60%, driven by halal certification alignment, sustainability preferences among international manufacturers, and superior performance characteristics in personal care and pharmaceutical applications. Palm oil derivatives dominate supply chains, benefiting from established Southeast Asian trade relationships and processing infrastructure capable of producing high-purity grades meeting stringent quality specifications.

Key factors driving the Saudi Arabia stearic acid market include expanding personal care and cosmetics manufacturing aligned with beauty consciousness trends, industrial diversification under Vision 2030 initiatives supporting downstream chemical production, and growing rubber processing demand from automotive sector expansion requiring specialized processing aids.

Major challenges include price volatility in palm oil feedstock markets affecting production costs and profit margins, competition from synthetic alternatives in industrial applications offering occasional price advantages, and regulatory compliance requirements for pharmaceutical-grade and food-grade specifications demanding rigorous quality control systems and comprehensive documentation standards.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)