Saudi Arabia Sugar Substitutes Market Size, Share, Trends and Forecast by Product Type, Application, Origin, and Region, 2026-2034

Saudi Arabia Sugar Substitutes Market Overview:

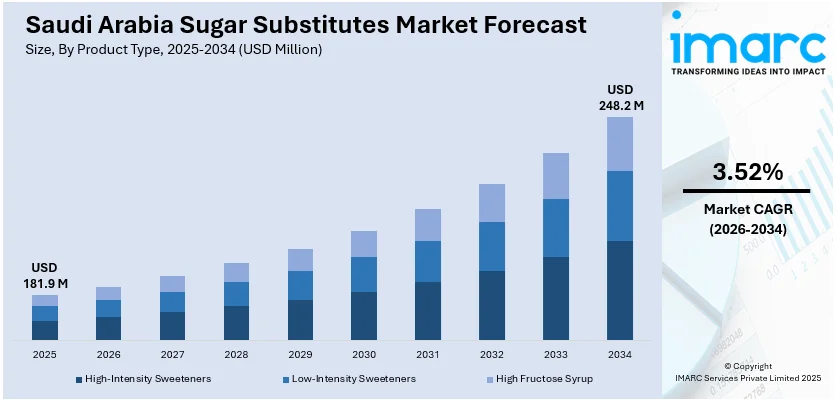

The Saudi Arabia sugar substitutes market size reached USD 181.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 248.2 Million by 2034, exhibiting a growth rate (CAGR) of 3.52% during 2026-2034. The market is driven by increasing health consciousness, government regulations limiting sugar in food and beverages, and rising prevalence of diabetes and obesity. Moreover, growing demand for low-calorie products and lifestyle shifts toward wellness and fitness further boost the adoption of sugar alternatives across various consumer segments and fuel the Saudi Arabia sugar substitutes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 181.9 Million |

| Market Forecast in 2034 | USD 248.2 Million |

| Market Growth Rate 2026-2034 | 3.52% |

Saudi Arabia Sugar Substitutes Market Trends:

Rising Health Awareness and Lifestyle Changes

Saudi Arabia is witnessing a growing shift toward health-conscious lifestyles, as consumers increasingly recognize the risks of high sugar intake, such as obesity and diabetes. Market demand for sugar substitutes rises because consumers have become more conscious about their wellness, so they search for healthier alternatives to regular sugar. A shift towards fitness-oriented lifestyles has emerged from the effects of increased living density coupled with growing purchasing abilities. The market demand for low-calorie, sugar-free natural sugar substitutes within food and beverages has experienced significant acceleration because of these conditioning factors. The younger generation is presently more disposed to adopt healthful dietary choices, which will preserve elevated consumption of sugar substitutes in the long term. The increased availability of these alternatives in the market further supports this health-driven trend.

To get more information on this market Request Sample

High Prevalence of Diabetes and Obesity

Saudi Arabia faces one of the highest obesity and diabetes rates globally, fueled by poor dietary habits, sedentary lifestyles, and urbanization. As reported by the World Health Organization (WHO), Saudi Arabia possesses the second-highest diabetes prevalence in the Middle East and is ranked seventh worldwide. Estimates suggest that about 7 million individuals are affected by diabetes, and nearly 3 million have pre-diabetes. People who are overweight make up 36.9% of the population. The rising prevalence of these chronic health conditions is a critical factor boosting the demand for sugar substitutes. Consumers with diabetes are actively seeking sugar-free alternatives to manage their blood sugar levels, while those with obesity are increasingly turning to low-calorie sweeteners as part of their weight loss strategies. Healthcare providers are also recommending sugar substitutes as part of the treatment for these conditions. As the need for dietary management grows, so does the demand for sugar substitutes, as these products help control caloric intake and blood sugar, contributing to the broader healthcare system’s fight against these lifestyle diseases.

Innovation and Availability of Diverse Sweeteners

Innovation in the sugar substitutes market is one of the key trends driving its growth in Saudi Arabia. The market has seen a significant diversification of available sweeteners, with consumers gaining access to a wider range of options, such as natural sweeteners like stevia, monk fruit, and erythritol, as well as artificial sweeteners such as aspartame, sucralose, and saccharin. Advances in food technology have enhanced the taste, functionality, and versatility of these substitutes, making them more appealing to consumers. This innovation has resulted in sugar substitutes becoming a viable option in a broad spectrum of food and beverage products. The increased availability of these alternatives, especially in mass-market products, ensures that consumers can easily incorporate them into their diets, driving continued Saudi Arabia sugar substitutes market growth.

Saudi Arabia Sugar Substitutes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, application, and origin.

Product Type Insights:

- High-Intensity Sweeteners

- Stevia

- Aspartame

- Cyclamate

- Sucralose

- Saccharin

- Others

- Low-Intensity Sweeteners

- D-Tagatose

- Sorbitol

- Maltitol

- Xylitol

- Mannitol

- Others

- High Fructose Syrup

The report has provided a detailed breakup and analysis of the market based on the product type. This includes high-intensity sweeteners (stevia, aspartame, cyclamate, sucralose, saccharin, and others), low-intensity sweeteners (d-tagatose, sorbitol, maltitol, xylitol, mannitol, and others), and high fructose syrup.

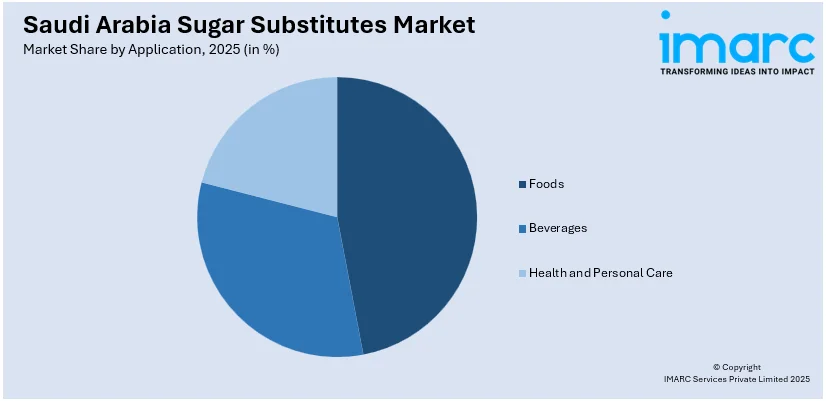

Application Insights:

Access the comprehensive market breakdown Request Sample

- Foods

- Beverages

- Health and Personal Care

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes foods, beverages, and health and personal care.

Origin Insights:

- Artificial

- Natural

A detailed breakup and analysis of the market based on the origin have also been provided in the report. This includes artificial and natural.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include the Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Sugar Substitutes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Foods, Beverages, Health and Personal Care |

| Origins Covered | Artificial, Natural |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia sugar substitutes market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia sugar substitutes market on the basis of product type?

- What is the breakup of the Saudi Arabia sugar substitutes market on the basis of application?

- What is the breakup of the Saudi Arabia sugar substitutes market on the basis of origin?

- What is the breakup of the Saudi Arabia sugar substitutes market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia sugar substitutes market?

- What are the key driving factors and challenges in the Saudi Arabia sugar substitutes market?

- What is the structure of the Saudi Arabia sugar substitutes market and who are the key players?

- What is the degree of competition in the Saudi Arabia sugar substitutes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia sugar substitutes market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia sugar substitutes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia sugar substitutes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)