Saudi Arabia Surgical Sutures Market Size, Share, Trends and Forecast by Type, Material, Application, End User, and Region, 2026-2034

Saudi Arabia Surgical Sutures Market Overview:

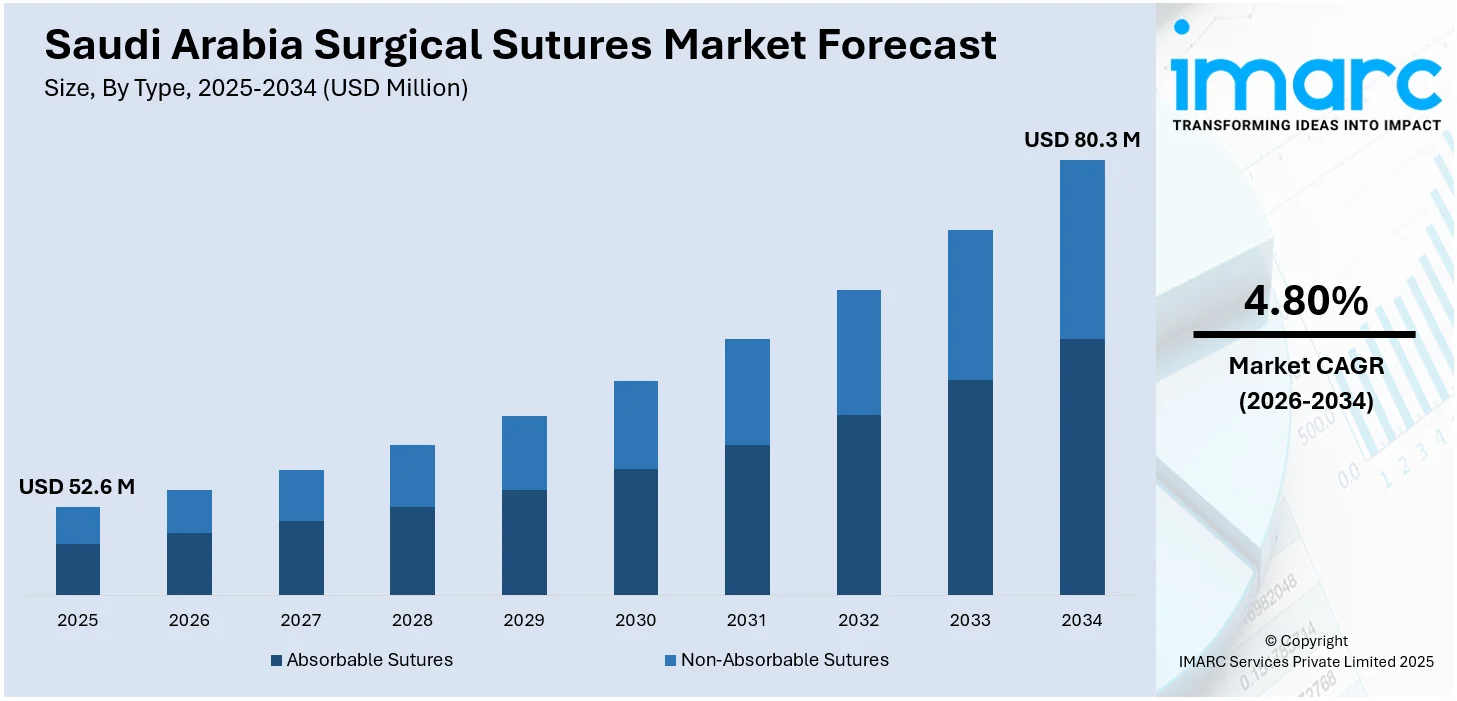

The Saudi Arabia surgical sutures market size reached USD 52.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 80.3 Million by 2034, exhibiting a growth rate (CAGR) of 4.80% during 2026-2034. The market share is driven by increasing investments in upgrading hospitals, clinics, and specialized healthcare centers to meet international standards. This, along with the rising incidences of chronic diseases, is stimulating the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 52.6 Million |

| Market Forecast in 2034 | USD 80.3 Million |

| Market Growth Rate 2026-2034 | 4.80% |

Saudi Arabia Surgical Sutures Market Trends:

Rising medical tourism activities

Increasing medical tourism activities are positively influencing the market. Saudi Arabia is becoming a popular healthcare destination in the Middle East, drawing international patients who are seeking affordable and premium medical services. They frequently require operations, which is driving the demand for surgical sutures used for wound closure and tissue restoration. The government is investing in hospitals, clinics, and specialized institutions to meet international standards and improve the healthcare system's ability to handle sophisticated surgical suturing procedures. With an increasing number of patients arriving for cosmetic, orthopedic, cardiac, and general surgeries, the need for reliable and high-performance sutures is rising. Medical tourism is also encouraging the adoption of modern surgical techniques, incorporating robotic-assisted and minimally invasive surgeries, which require specialized suturing materials. As competition is growing among hospitals to entice medical tourists, the emphasis on successful surgical outcomes is further promoting the usage of high-quality sutures. According to the IMARC Group, the Saudi Arabia medical tourism market is set to attain USD 7,918.6 Million by 2033, exhibiting a growth rate (CAGR) of 21.80% during 2025-2033.

To get more information on this market Request Sample

Growing incidence of chronic illnesses and accidents

Rising incidence of chronic illnesses and accidents is offering a favorable Saudi Arabia surgical sutures market outlook. As people are suffering from health conditions like cardiovascular diseases, diabetes, and cancer, the number of surgeries required for treatment and management of these illnesses is increasing. As per industry reports, as of July 2024, the incidence of all cancers except non-melanoma skin cancer was estimated at 17,522 cases (8,296 men and 9,226 women) in Saudi Arabia. These medical procedures, whether minor or major, rely heavily on surgical sutures for effective wound closure and healing. Additionally, road accidents and workplace injuries in the country are contributing to a high number of emergency surgeries, further boosting the utilization of sutures. Hospitals and clinics are experiencing an increasing need for both absorbable and non-absorbable sutures to handle various types of surgeries. As healthcare facilities are expanding their surgical departments to manage the growing patient load, the procurement of suturing materials is increasing.

Advancements in technology

Technological advancements are fueling the Saudi Arabia surgical sutures market growth. Newer sutures use materials that are more biocompatible, absorbable, and resistant to infections, making them highly preferred in hospitals and clinics. Innovations like barbed sutures and antimicrobial coatings enhance surgical precision and reduce the risk of complications. These innovations cater to a wide range of surgeries, ranging from general to specialized fields like cosmetic procedures. The rising geriatric population in Saudi Arabia is further driving the demand, as older individuals often undergo surgeries due to age-related health issues and require advanced care. As hospitals are aiming for better patient outcomes and shorter recovery times, they are employing modern suture technologies.

Saudi Arabia Surgical Sutures Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2026-2034. Our report has categorized the market based on type, material, application, and end user.

Type Insights:

- Absorbable Sutures

- Non-Absorbable Sutures

The report has provided a detailed breakup and analysis of the market based on the type. This includes absorbable sutures and non-absorbable sutures.

Material Insights:

- Monofilament

- Multifilament

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes monofilament and multifilament.

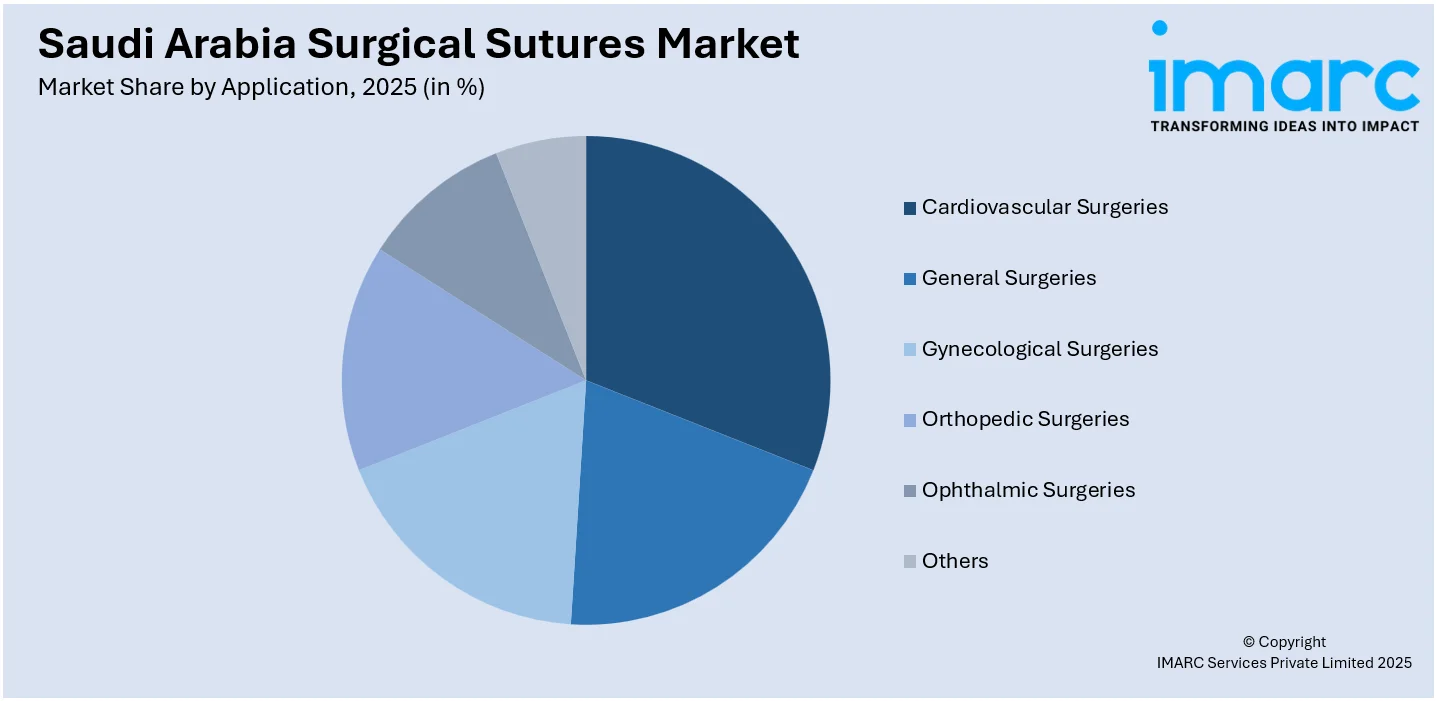

Application Insights:

Access the comprehensive market breakdown Request Sample

- Cardiovascular Surgeries

- General Surgeries

- Gynecological Surgeries

- Orthopedic Surgeries

- Ophthalmic Surgeries

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes cardiovascular surgeries, general surgeries, gynecological surgeries, orthopedic surgeries, ophthalmic surgeries, and others.

End User Insights:

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, ambulatory surgical centers, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Surgical Sutures Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Absorbable Sutures, Non-Absorbable Sutures |

| Materials Covered | Monofilament, Multifilament |

| Applications Covered | Cardiovascular Surgeries, General Surgeries, Gynecological Surgeries, Orthopedic Surgeries, Ophthalmic Surgeries, Others |

| End Users Covered | Hospitals and Clinics, Ambulatory Surgical Centers, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia surgical sutures market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia surgical sutures market on the basis of type?

- What is the breakup of the Saudi Arabia surgical sutures market on the basis of material?

- What is the breakup of the Saudi Arabia surgical sutures market on the basis of application?

- What is the breakup of the Saudi Arabia surgical sutures market on the basis of end user?

- What is the breakup of the Saudi Arabia surgical sutures market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia surgical sutures market?

- What are the key driving factors and challenges in the Saudi Arabia surgical sutures market?

- What is the structure of the Saudi Arabia surgical sutures market and who are the key players?

- What is the degree of competition in the Saudi Arabia surgical sutures market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, the Saudi Arabia surgical sutures market forecast, and dynamics from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia surgical sutures market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia surgical sutures industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)