Saudi Arabia Synthetic Rubber Market Size, Share, Trends and Forecast by Type, Form, Application, and Region, 2026-2034

Saudi Arabia Synthetic Rubber Market Overview:

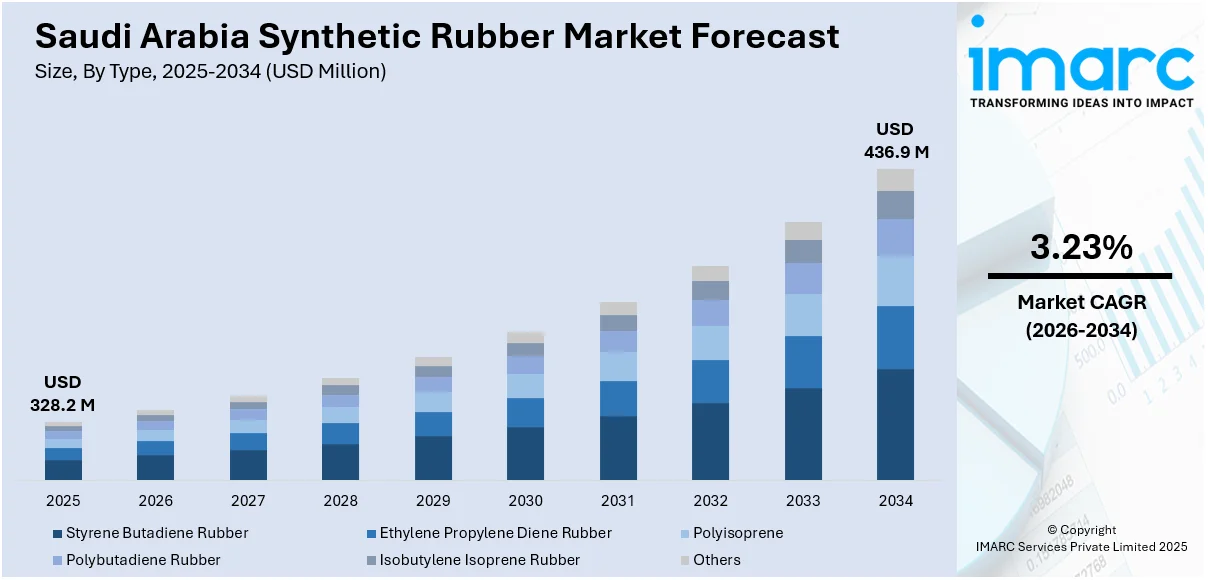

The Saudi Arabia synthetic rubber market size reached USD 328.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 436.9 Million by 2034, exhibiting a growth rate (CAGR) of 3.23% during 2026-2034. The market is witnessing consistent growth, led by growing demand from automotive, construction, and industrial applications. Growing infrastructure development and manufacturing operations are driving the demand for high-performance and long-lasting materials. Improvements in technology and sustainability considerations are also driving market trends. Major players are diversifying their product lines to address changing customer needs, improving their competitive positioning in the Saudi Arabia synthetic rubber share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 328.2 Million |

| Market Forecast in 2034 | USD 436.9 Million |

| Market Growth Rate 2026-2034 | 3.23% |

Saudi Arabia Synthetic Rubber Market Trends:

Expansion of Production Capacity

The synthetic rubber market in Saudi Arabia is experiencing significant growth due to expanded production capacity, driven by both local investments and strategic industrial development. Companies are increasingly investing in advanced manufacturing facilities to meet the rising demand for synthetic rubber, both domestically and internationally. Moreover, the market growth aligns with Saudi Arabia’s Vision 2030 initiative, which aims to diversify the economy and reduce reliance on oil exports. The government has already made substantial investments in the plastics and rubber industries, with over SAR 37.7 billion committed to supporting this sector. These efforts have also resulted in the creation of over 61,000 jobs. As a result, Saudi manufacturers are positioned to become major players in the Middle East and global synthetic rubber markets, particularly in industries like automotive, construction, and consumer goods.

To get more information on this market Request Sample

Technological Advancements and Innovation

Innovation is restructuring Saudi Arabia's synthetic rubber market, with a predominant focus on enhancing performance and sustainability. Companies are investing in advanced technologies and eco-friendly solutions to meet the evolving demands of industries such as automotive, construction, and manufacturing. This shift is expected to significantly shape Saudi Arabia synthetic rubber market growth, positioning it for a more resilient and competitive future. Firms are making substantial investments in research and development (R&D) toward producing bio-based and eco-friendly rubber substitutes with lesser dependence on conventional petroleum-derived feedstocks. The move takes direction from universal movements toward environmentally friendlier manufacturing and consumption patterns. Such institutions as KAUST are leading the way in developing technologies such as the conversion of ethanol to bio-butadiene, a renewable feedstock for rubber manufacturing. Concurrently, developments in manufacturing processes, facilitated by automation and intelligent technologies, are enhancing efficiency in production, quality of product, and waste minimization. Such innovations not only align with Saudi Arabia's Vision 2030 objectives but also make the country a leading center for high-performance and sustainable synthetic rubber in the international market.

Strategic Government Initiatives

Saudi Arabia’s Vision 2030 is driving growth in the synthetic rubber market through government-led initiatives focused on economic diversification. To reduce reliance on oil, the Kingdom is investing heavily in alternative industries, particularly manufacturing and construction, which has significantly increased demand for synthetic rubber used in tyres, industrial components, and infrastructure. A key indicator of this shift is the government’s investment of over SAR 37.7 billion in the plastics and rubber products industry, leading to the creation of more than 61,000 jobs. This investment represents 62% of total industrial sector funding, with rubber and plastic plants accounting for 12% of all industrial facilities in the country. These strategic moves are positioning Saudi Arabia as a major player in the global synthetic rubber market, attracting both domestic and foreign investment.

Saudi Arabia Synthetic Rubber Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional for 2026-2034. Our report has categorized the market based on type, form, and application.

Type Insights:

- Styrene Butadiene Rubber

- Ethylene Propylene Diene Rubber

- Polyisoprene

- Polybutadiene Rubber

- Isobutylene Isoprene Rubber

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes styrene butadiene rubber, ethylene propylene diene rubber, polyisoprene, polybutadiene rubber, isobutylene isoprene rubber, and others.

Form Insights:

- Liquid Synthetic Rubber

- Solid Synthetic Rubber

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes liquid synthetic rubber and solid synthetic rubber.

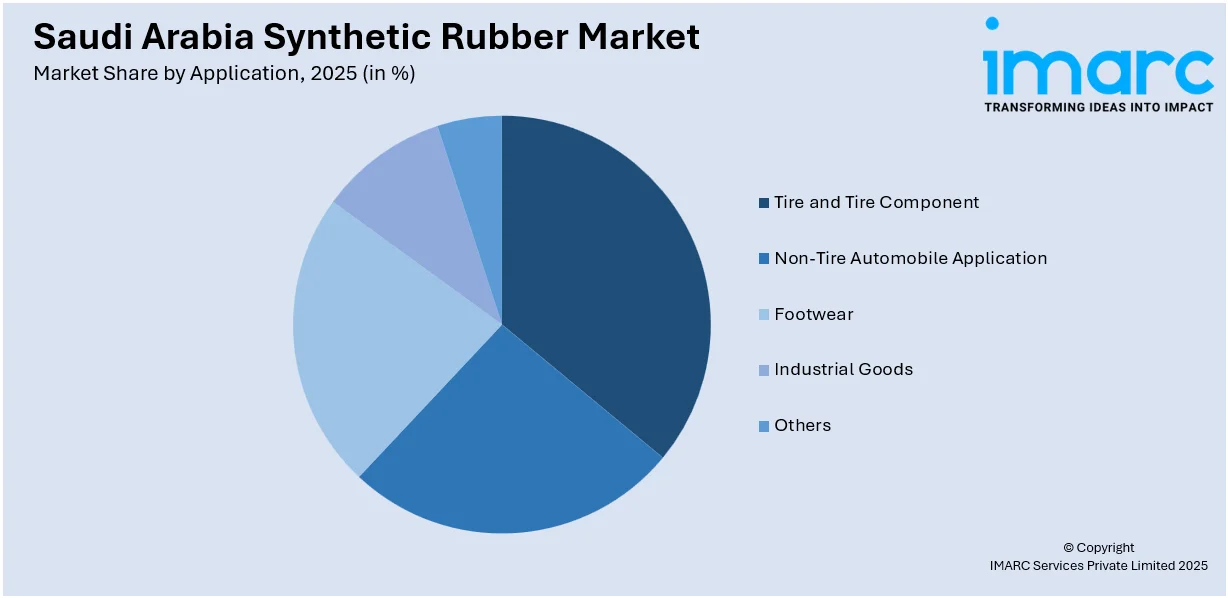

Application Insights:

Access the comprehensive market breakdown Request Sample

- Tire and Tire Component

- Non-Tire Automobile Application

- Footwear

- Industrial Goods

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes tire and tire component, non-tire automobile application, footwear, industrial goods, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central, Western, Eastern, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Synthetic Rubber Market News:

- In June 2023, Arlanxeo announced plans to establish a 140 ktpa synthetic rubber plant in Jubail, Saudi Arabia, following a joint investment decision by Aramco and TotalEnergies. The facility will produce Ultra High cis Polybutadiene (NdBR) for tyre treads and Lithium Butadiene Rubber (LiBR) for plastics. Construction will begin in 2024, with commercial operations set for 2027. This expansion supports Arlanxeo's growth strategy and strengthens its position in the high-performance rubber market.

Saudi Arabia Synthetic Rubber Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Styrene Butadiene Rubber, Ethylene Propylene Diene Rubber, Polyisoprene, Polybutadiene Rubber, Isobutylene Isoprene Rubber, Others |

| Forms Covered | Liquid Synthetic Rubber, Solid Synthetic Rubber |

| Applications Covered | Tire and Tire Component, Non-Tire Automobile Application, Footwear, Industrial Goods, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia synthetic rubber market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia synthetic rubber market on the basis of type?

- What is the breakup of the Saudi Arabia synthetic rubber market on the basis of form?

- What is the breakup of the Saudi Arabia synthetic rubber market on the basis of application?

- What is the breakup of the Saudi Arabia synthetic rubber market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia synthetic rubber market?

- What are the key driving factors and challenges in the Saudi Arabia synthetic rubber market?

- What is the structure of the Saudi Arabia synthetic rubber market and who are the key players?

- What is the degree of competition in the Saudi Arabia synthetic rubber market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia synthetic rubber market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia synthetic rubber market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia synthetic rubber industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)