Saudi Arabia Tablet Market Report by Product (Detachable, Slate), Operating System (Android, iOS, Windows), Screen Size (8’’, 8’’ and Above), End User (Consumer, Commercial), Distribution Channel (Online, Offline), and Region 2025-2033

Market Overview:

Saudi Arabia tablet market size reached USD 785 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 841 Million by 2033. The increasing trend of remote work and the need for portable productivity solutions, which have boosted the demand for tablets, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 785 Million |

| Market Forecast in 2033 | USD 841 Million |

Tablets have become indispensable devices, seamlessly blending portability with powerful functionality. These sleek, touchscreen devices have transformed the consumption of information, work, and entertainment. With compact designs and vibrant displays, tablets offer a versatile platform for a myriad of tasks, from browsing the web and checking emails to creating digital art and watching videos. Their intuitive interfaces and user-friendly applications make them accessible to users of all ages. Tablets also serve as efficient educational tools, providing interactive learning experiences for students. Moreover, the convenience of on-the-go productivity, thanks to the myriad of productivity apps available, has made tablets an essential companion for professionals. As technology continues to evolve, tablets remain at the forefront, evolving to meet the demands of an increasingly digital world, making them an integral part of daily lives.

Saudi Arabia Tablet Market Trends:

Increasing Digital Transformation in Sectors

The Saudi Arabia market is growing as the country is experiencing large-scale digital transformation efforts across sectors. Led by Vision 2030, the government is encouraging large-scale use of digital technologies in education, healthcare, retail, and banking. A 2024 report from the Saudi Ministry of Investment indicates that investments in digital transformation in the Kingdom are projected to hit $13.3 billion by 2025, with a yearly growth rate of 17.2%. Organizations are increasingly adopting tablets to be used in everyday operations for communication, data management, and service delivery. The education industry is banking on tablets for e-learning sites, online testing, and interactive study aids, whereas health care organizations are implementing them for patient tracking, telemedicine, and electronic medical records. Retail and banking industries are also using tablets for point-of-sale and customer service software. This steady move toward digitalization is boosting productivity, enhancing customer interaction, and streamlining operational effectiveness. With more institutions embracing tablets as part of their digital platform, demand for these devices is gradually growing, cementing their position as a vital tool in Saudi Arabia's changing digital landscape.

Increasing Demand for Remote Learning and Online Education

Uptake of tablets in Saudi Arabia is rising with remote learning and online education continuing to gain traction. Educational institutions are increasingly adding digital devices to classrooms to facilitate interactive learning and digital coursework. In the wake of the pandemic, the Ministry of Education is focusing on hybrid and e-learning solutions, encouraging schools and universities to invest in tablets as key learning devices. Parents are also giving top priority to tablets for their kids because they are portable, more affordable compared to laptops, and compatible with different learning applications. Additionally, international publishers and edtech firms are joining hands with Saudi schools to deliver tailored digital learning platforms designed for use on tablets. This is developing a high demand for tablets against conventional computing devices. With the younger generation getting used to technology-facilitated learning, tablets are becoming an essential part of the education industry, guaranteeing constant demand from both public and private sector institutions throughout the Kingdom. IMARC Group predicts that that Saudi Arabia online education market is projected to attain USD 4,359.82 Million by 2033.

Growing Demand for Mobile Entertainment and Streaming Services

The Saudi Arabian tablet market share is expanding as people increasingly turn to tablets for entertainment and streaming. With platforms gaining popularity, the need for handheld devices with larger screens, higher resolution, and longer battery life is driving demand. Younger generations, especially Gen Z and millennials, are spending more time watching digital content, driving the demand for tablets as a substitute for regular TVs or laptops. The addition of premium audio-visual capabilities, gaming support, and smooth app functionality is making tablets a desirable option for entertainment use. Also, the deployment of high-speed 5G networks in Saudi Arabia is enabling buffer-free video streaming, improving the experience. With rising disposable incomes and more digitally inclined lifestyles among the masses, the position of tablets as a mainstream device for entertainment and multimedia consumption is further consolidating in the Kingdom. Moreover, this is encouraging numerous OTT platforms to expand their footprint in the country. For instance, in 2025, Qvest and ARABSAT established a Memorandum of Understanding at FOMEX 2025 in Riyadh to initiate a quick, dependable, and user-friendly OTT streaming platform. The strategic collaboration will allow ARABSAT to broaden its direct-to-consumer offerings and supply white-label solutions for broadcasters and content creators.

Saudi Arabia Tablet Market Growth Drivers:

Growing E-Government and Smart City Projects

Tablets market in Saudi Arabia is picking up pace with growing e-government initiatives and smart city projects across the country. Government institutions are increasingly adopting digital platforms that need efficient and easy-to-use devices by both citizens and employees. Tablets are being rolled out in administrative offices, public service centers, and digital kiosks to support e-payments, licensing, and other service delivery processes. As Saudi Arabia invests in smart city projects like NEOM and The Line, tablets are being utilized in urban planning, project monitoring, and real-time data gathering. The policy of the government to increase transparency, accessibility, and efficiency in the delivery of services is propelling the demand for tablets as key digital devices. This transformation not only enhances citizen participation but also generates a mounting demand within public sector agencies. Growing dependence on tablets for using digital government services is playing a key role in the sustained growth of the market.

Rising Use of Tablets in Healthcare Services

The Saudi healthcare industry is embracing tablets to enhance patient care, telemedicine, and hospital management systems. Tablets are being incorporated by healthcare professionals into clinical practice flows for electronic medical records, digital prescriptions, and diagnostic assistance. Patients are making more use of tablets to access telehealth consultations, medical advice, and appointment booking services, particularly in rural areas where access is limited to physical healthcare organizations. Physicians and nurses are using tablets to remotely monitor patients, access drug data, and receive clinical decision support in real-time, enhancing healthcare outcomes and operational effectiveness. Through Vision 2030, the Saudi government is focusing investments on digital healthcare infrastructure, urging hospitals and clinics to go for smart devices. Pharmaceutical firms and health startups are also using tablets for awareness drives, mobile apps, and virtual consultations. This widespread adoption of tablets in the healthcare sector is making them a vital tool within the Kingdom's healthcare environment.

Increasing Youth Population and Increased Digital Consumption

The Saudi market for tablets is experiencing rapid growth owing to the increasing youth population and their increased use of digital content. With over half the population aged under 30, the demand for lightweight and all-purpose devices is rising exponentially. Young individuals are employing tablets for social media, online gaming, streaming, e-learning, and creative purposes like digital art and content creation. Tablets are more favored than laptops and desktops because they are affordable, portable, and touch-oriented. International brands are catering to this age group by introducing affordable and feature-packed tablets designed for students and young professionals. Additionally, with social media influencers and online content creators increasingly prominent in Saudi Arabia, tablets are being used intensively to create and edit content. This robust digitalized lifestyle culture among youth is facilitating steady tablet adoption, making this cohort one of the most significant growth drivers in the Kingdom's tablet market.

Saudi Arabia Tablet Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, operating system, screen size, end user, and distribution channel.

Product Insights:

To get more information on this market, Request Sample

- Detachable

- Slate

The report has provided a detailed breakup and analysis of the market based on the product. This includes detachable and slate.

Operating System Insights:

- Android

- iOS

- Windows

A detailed breakup and analysis of the market based on the operating system have also been provided in the report. This includes android, iOS, and windows.

Screen Size Insights:

- 8’’

- 8’’ and Above

The report has provided a detailed breakup and analysis of the market based on the screen size. This includes 8’’ and 8’’ and above.

End User Insights:

- Consumer

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes consumer and commercial.

Distribution Channel Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

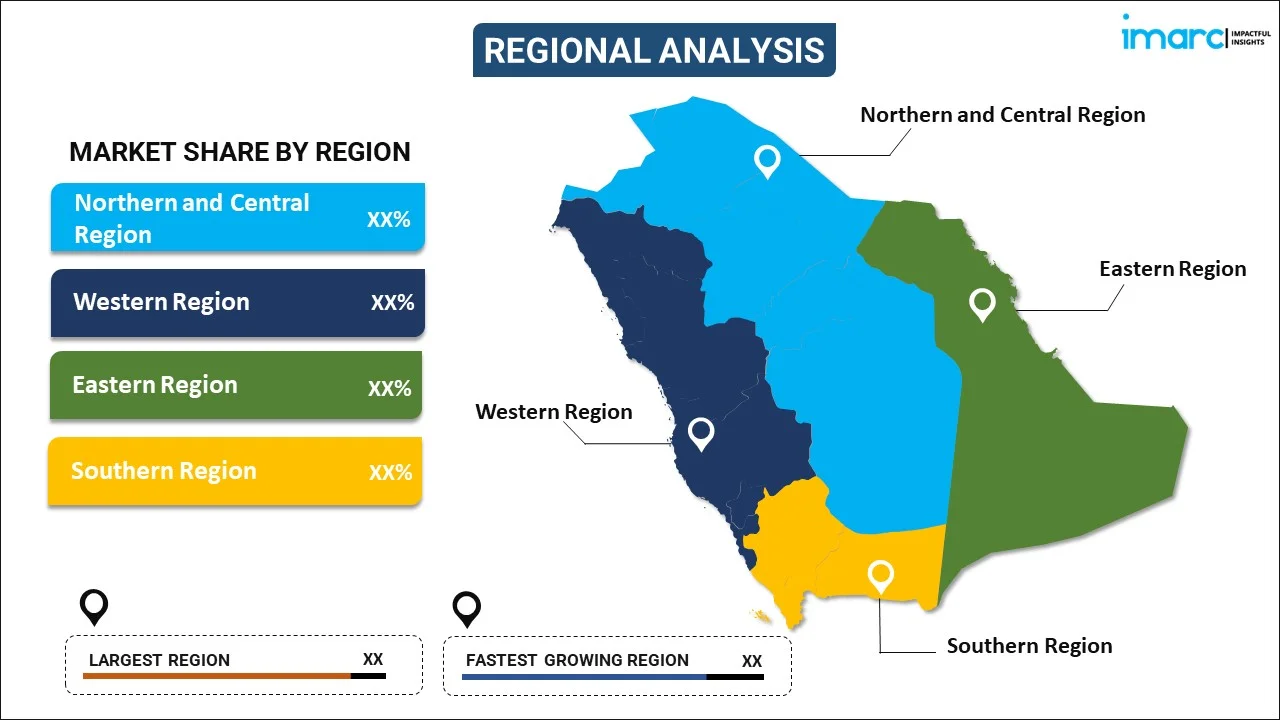

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Tablet Market News:

- August 2025: China's Lenovo Group announced its plans to establish a regional headquarters in Saudi Arabia, intending to enhance its presence in the Middle East. The Chinese PC manufacturer announced in a statement that it has designated Lenovo veteran Lawrence Yu as the leader of its new headquarters in Saudi Arabia. Giovanni Di Filippo was also named general manager of Lenovo Saudi Arabia, while Zoran Radumilo was appointed as the chief technology officer.

Saudi Arabia Tablet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Detachable, Slate |

| Operating Systems Covered | Android, iOS, Windows |

| Screen Sizes Covered | 8’’, 8’’ and Above |

| End Users Covered | Consumer, Commercial |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia tablet market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia tablet market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia tablet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The tablet market in Saudi Arabia was valued at USD 785 Million in 2024.

The Saudi Arabia tablet market is projected to reach a value of USD 841 Million by 2033.

Growth in e-learning and remote work, increasing disposable income, rising digital literacy, widespread internet and 5G expansion, and strong customer demand are key drivers of the tablet market in Saudi Arabia. Government support for digital transformation also fuels growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)