Saudi Arabia Telehealth Market Size, Share, Trends and Forecast by Component, Communication Technology, Hosting Type, Application, End User, and Region, 2026-2034

Saudi Arabia Telehealth Market Summary:

The Saudi Arabia telehealth market size was valued at USD 792.61 Million in 2025 and is projected to reach USD 4,212.13 Million by 2034, growing at a compound annual growth rate of 20.39% from 2026-2034.

The Saudi Arabia telehealth market is experiencing robust expansion driven by the Kingdom's strategic commitment to healthcare digitalization under Vision 2030. The government has prioritized telemedicine as a cornerstone of healthcare transformation, investing substantially in digital infrastructure and regulatory frameworks that support remote care delivery. Rising chronic disease prevalence, particularly diabetes affecting approximately 23.1% of the adult population according to the International Diabetes Federation, is accelerating demand for remote monitoring and virtual consultation services. The establishment of Seha Virtual Hospital, recognized as the world's largest virtual healthcare facility connecting 224 hospitals nationwide, demonstrates the Kingdom's leadership in telehealth innovation. Increasing smartphone penetration among the tech-savvy young population, coupled with expanding high-speed internet coverage, is enabling widespread adoption of mobile health applications and video-based consultations. Healthcare providers are increasingly integrating artificial intelligence and predictive analytics into telehealth platforms to enhance diagnostic accuracy and patient outcomes, further propelling market growth across the Saudi Arabia telehealth market share.

Key Takeaways and Insights:

- By Component: Software dominates the market with a share of 56.1% in 2025, owing to increasing adoption of electronic health records, AI-powered diagnostic tools, and integrated care management platforms. Rising demand for scalable cloud-based software solutions is enabling healthcare providers to deliver seamless virtual consultations and remote patient monitoring services.

- By Communication Technology: Video conferencing leads the market with a share of 43.04% in 2025, This dominance is driven by the preference for real-time visual consultations that replicate in-person interactions, enhanced patient-physician engagement, and widespread adoption across specialty care including telecardiology and telepsychiatry services.

- By Hosting Type: Cloud-based and web-based represents the biggest segment with a market share of 68.08% in 2025, reflecting strong healthcare provider preference for flexible, scalable infrastructure that enables seamless data access, reduced capital expenditure, and enhanced interoperability across healthcare networks throughout the Kingdom.

- By Application: Teleconsultation and telementoring holds the dominant 23.03% share in 2025, owing to growing demand for accessible specialist consultations, continued expansion of virtual primary care services, and increasing utilization for chronic disease management and follow-up appointments.

- By End User: Providers exhibit a clear dominance in the market with 43.05% share in 2025, reflecting strong adoption of telehealth platforms by hospitals and clinics seeking to expand service reach, optimize clinical workflows, and improve patient access to specialized care across urban and rural areas.

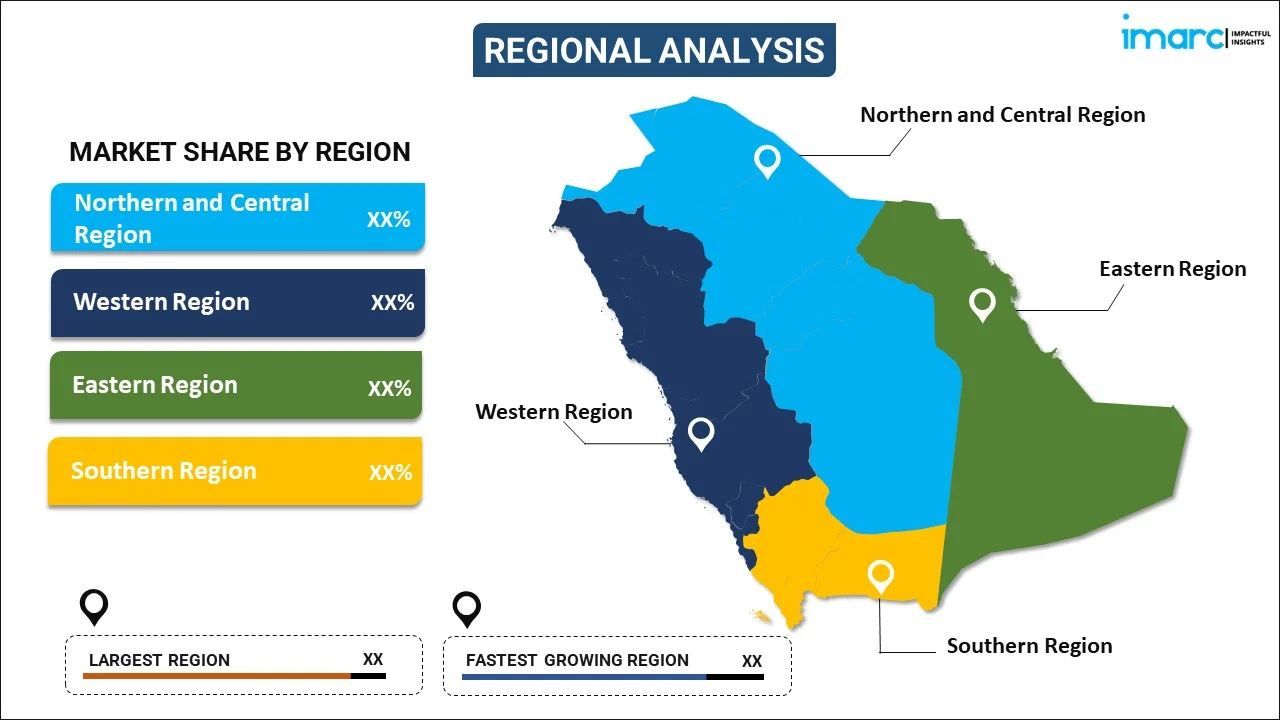

- By Region: Northern and Central Region is the largest region with 34% share in 2025, driven by the concentration of advanced healthcare infrastructure in Riyadh, presence of major medical cities, higher digital health adoption rates, and strategic government investments in telehealth technology.

- Key Players: Key players drive the Saudi Arabia telehealth market by investing in AI-powered diagnostic solutions, expanding virtual care platforms, and strengthening partnerships with healthcare providers. Their focus on user-friendly mobile applications, regulatory compliance, and integration with electronic health records is accelerating telehealth adoption across diverse healthcare settings. Some of the key players operating in the market include Altibbi FZ-LLC, Cura, International SOS (International SOS Pte Ltd) and Vezeeta.com.

Saudi Arabia Telehealth Market Trends:

Integration of Artificial Intelligence in Virtual Care Delivery

In Saudi Arabia, the use of artificial intelligence in telemedicine platforms is revolutionizing patient care and diagnostic capacities. In order to evaluate medical images, forecast health concerns, and tailor treatment suggestions during virtual consultations, healthcare providers are increasingly using machine learning algorithms. Chatbots and symptom checkers driven by AI are improving initial patient evaluations, facilitating more effective triage and cutting down on wait times for specialist consultations. During remote contacts, these intelligent solutions are increasing overall care quality, enabling evidence-based decision-making, and simplifying clinical workflows.

Expansion of Remote Patient Monitoring for Chronic Disease Management

As medical professionals look for creative ways to treat chronic illnesses that are common in the Saudi population, remote patient monitoring is becoming increasingly popular. Continuous monitoring of vital signs, blood sugar levels, and cardiac parameters is made possible by wearable technology coupled with telehealth platforms. This allows for preventative interventions and a decrease in hospital readmissions. Healthcare providers are adopting connected health technology to facilitate long-term patient engagement due to the increasing prevalence of lifestyle-related illnesses. With the help of these monitoring tools, patients can take an active role in their care and doctors can identify health decline early.

Growing Adoption of Mental Health Teleconsultation Services

Addressing previously unmet psychological healthcare requirements, mental health teleconsultation is a quickly expanding sector of the telehealth market. Digital platforms are lowering the stigma associated with seeking psychological care, removing cultural obstacles, and providing private access to certified mental health specialists. In order to provide complete patient support, healthcare providers are creating specialized telepsychiatry services that interact with primary care routines. More people are seeking timely psychological care and counseling services due to the privacy and ease of virtual mental health consultations.

How Vision 2030 is Transforming the Saudi Arabia Telehealth Market

Vision 2030 serves as the cornerstone of Saudi Arabia's telehealth transformation, positioning healthcare digitalization as a strategic national priority. The government has allocated substantial investments for health information technology and telemedicine infrastructure, establishing robust regulatory frameworks that accelerate virtual care adoption. The Health Sector Transformation Program emphasizes expanding telehealth accessibility, with initiatives like Seha Virtual Hospital, now recognized as the world's largest virtual care platform connecting hospitals nationwide, demonstrating scalable implementation. In August 2024, the Ministry of Health launched the Regulatory Healthcare Sandbox, providing a secure environment for testing AI and digital health solutions. These coordinated efforts have significantly elevated telehealth adoption rates among healthcare providers, fundamentally reshaping care delivery across the Kingdom.

Market Outlook 2026-2034:

The Saudi Arabia telehealth market is poised for substantial expansion as digital health transformation accelerates under Vision 2030 initiatives. Healthcare infrastructure investments, regulatory modernization, and increasing consumer acceptance of virtual care are creating favorable conditions for sustained market development. The market generated a revenue of USD 792.61 Million in 2025 and is projected to reach a revenue of USD 4,212.13 Million by 2034, growing at a compound annual growth rate of 20.39% from 2026-2034. The Ministry of Health's continued emphasis on expanding virtual hospital networks and integrating telehealth into primary care settings is expected to broaden service accessibility across urban and remote regions. Strategic partnerships between technology companies and healthcare providers are fostering innovation in AI-driven diagnostics, cloud-based platforms, and interoperable health information systems that will define the next phase of telehealth evolution in the Kingdom.

Saudi Arabia Telehealth Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component | Software | 56.1% |

| Communication Technology | Video Conferencing | 43.04% |

| Hosting Type | Cloud-Based and Web-Based | 68.08% |

| Application | Teleconsultation and Telementoring | 23.03% |

| End User | Providers | 43.05% |

| Region | Northern and Central Region | 34% |

Component Insights:

To get detailed segment analysis of this market Request Sample

- Software

- Hardware

- Services

Software dominates with a market share of 56.1% of the total Saudi Arabia telehealth market in 2025.

The software segment is experiencing accelerated growth driven by increasing demand for comprehensive digital health platforms that integrate electronic health records, telemedicine capabilities, and clinical decision support systems. Healthcare providers across Saudi Arabia are prioritizing investments in scalable software solutions that enable seamless data exchange and interoperability between healthcare facilities. The Ministry of Health's National eHealth Strategy is fostering adoption of standardized health information systems, with hospitals increasingly utilizing electronic health records to support telehealth consultations and remote care coordination across the Kingdom's healthcare network. These integrated platforms are streamlining patient data management and enhancing continuity of care across multiple touchpoints.

The proliferation of AI-powered software applications is transforming diagnostic workflows and enhancing clinical accuracy during virtual consultations. Healthcare institutions are deploying machine learning algorithms embedded within telehealth platforms to analyze imaging data, predict disease progression, and recommend personalized treatment pathways. Cloud-native software architectures are enabling rapid deployment and updates, reducing operational complexity while ensuring compliance with healthcare data security regulations. The growing emphasis on user-friendly interfaces and mobile-responsive designs is further driving software adoption among both healthcare professionals and patients seeking convenient virtual care experiences.

Communication Technology Insights:

- Video Conferencing

- mHealth Solutions

- Others

Video conferencing leads with a share of 43.04% of the total Saudi Arabia telehealth market in 2025.

Video conferencing has emerged as the preferred communication modality for telehealth consultations, enabling face-to-face interactions between patients and healthcare providers regardless of geographic location. The technology facilitates comprehensive clinical assessments through visual examination, patient observation, and real-time dialogue that closely replicate in-person consultations. Saudi Arabia's advanced telecommunications infrastructure, including widespread high-speed internet coverage in major urban centers, supports high-quality video streaming essential for diagnostic accuracy and patient satisfaction during virtual care encounters. The ability to observe non-verbal cues and conduct visual assessments enhances clinical decision-making during remote consultations.

Healthcare facilities are increasingly integrating video conferencing with peripheral diagnostic devices to enhance clinical capabilities during remote consultations. Specialty services including telecardiology, teledermatology, and telepsychiatry rely heavily on video-based interactions to deliver quality care remotely. The Seha Virtual Hospital utilizes advanced video conferencing technology to connect hospitals nationwide, offering specialized consultations, remote ICU services, and AI-enhanced diagnostics. This infrastructure has significantly improved access to care in rural and underserved regions, enabling patients to receive expert consultations without traveling long distances and reducing burden on tertiary healthcare facilities.

Hosting Type Insights:

- Cloud-Based and Web-Based

- On-Premises

Cloud-based and web-based exhibits a clear dominance with a 68.08% share of the total Saudi Arabia telehealth market in 2025.

Cloud-based telehealth solutions are gaining substantial traction as healthcare organizations prioritize flexibility, scalability, and reduced infrastructure costs in their digital transformation strategies. These platforms enable secure access to patient data and telehealth applications from any location, facilitating seamless care delivery across distributed healthcare networks. The Saudi government's emphasis on digital infrastructure development has enhanced cloud computing capabilities, with major healthcare facilities migrating to cloud-hosted solutions that support real-time data access and improved collaboration.

The adoption of cloud-based hosting is accelerating due to advantages including lower capital expenditure requirements, automatic software updates, and enhanced disaster recovery capabilities. Healthcare providers benefit from the ability to rapidly scale telehealth services during demand surges without significant infrastructure investments. Saudi Arabia is considerably investing in in digital health technologies including cloud platforms and telemedicine infrastructure, establishing a robust foundation for widespread cloud-based telehealth adoption. Integration with national health information exchange platforms further drives preference for cloud-hosted solutions that ensure interoperability across the healthcare ecosystem.

Application Insights:

- Teleconsultation and Telementoring

- Medical Education and Training

- Teleradiology

- Telecardiology

- Tele-ICU

- Tele-Psychiatry

- Tele-Dermatology

- Others

Teleconsultation and telementoring represents the leading segment with a 23.03% share of the total Saudi Arabia telehealth market in 2025.

Teleconsultation services are experiencing robust demand as patients increasingly prefer the convenience and accessibility of virtual healthcare encounters. The segment encompasses both primary care consultations and specialist referrals conducted through digital platforms, reducing wait times and eliminating geographic barriers to care access. Healthcare facilities are expanding teleconsultation offerings to address growing patient expectations for on-demand healthcare services that fit contemporary lifestyles while maintaining clinical quality standards. The ability to consult with healthcare professionals from home or workplace settings is particularly appealing to working professionals and individuals with mobility limitations.

Telementoring applications are transforming medical education and clinical skill development by connecting experienced specialists with practitioners in remote or underserved areas. This approach enables real-time guidance during complex procedures, enhances training opportunities, and improves healthcare outcomes in facilities with limited specialist access. The Seha Virtual Hospital, recognized as the largest virtual healthcare hospital in the world, exemplifies the transformative impact of virtual consultation services. Stroke management and other critical care services delivered through teleconsultation have expanded dramatically, demonstrating how telementoring capabilities are revolutionizing specialist care delivery across the Kingdom's healthcare network.

End User Insights:

- Providers

- Patients

- Payers

- Others

Providers dominate the market with a share of 43.05% of the total Saudi Arabia telehealth market in 2025.

Healthcare providers including hospitals, clinics, and ambulatory care centers are the primary adopters of telehealth technologies, investing in platforms that enhance service delivery capabilities and operational efficiency. These institutions leverage telehealth to extend specialist services beyond physical facility boundaries, optimize resource utilization, and improve patient access to care. The Ministry of Health's strategic initiatives encouraging private sector participation in digital health are driving increased provider investments in telehealth infrastructure and capabilities. This institutional commitment is creating a robust foundation for sustainable telehealth growth across the healthcare ecosystem.

The provider segment benefits from economies of scale in telehealth implementation, with large healthcare networks deploying integrated platforms across multiple facilities. Hospitals are incorporating telehealth into standard clinical workflows, enabling seamless transitions between in-person and virtual care modalities. Telehealth adoption among healthcare providers has grown substantially, with a significant proportion of physicians now utilizing AI-powered tools to facilitate diagnoses during virtual consultations. The establishment of health clusters including the Riyadh First and Second Health Clusters is further accelerating coordinated telehealth deployment across integrated provider networks, fostering collaboration and standardization in virtual care delivery.

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region holds the largest share with 34% of the total Saudi Arabia telehealth market in 2025.

The Northern and Central Region, anchored by the capital city of Riyadh, commands the largest telehealth market share due to its concentration of advanced healthcare infrastructure and technology-forward medical institutions. The region benefits from superior digital infrastructure including widespread high-speed internet connectivity and extensive network coverage that enables seamless delivery of bandwidth-intensive telehealth services. Major medical cities including King Fahd Medical City serve as innovation hubs, pioneering telehealth applications that are subsequently scaled across the Kingdom.

The region's demographic profile, characterized by a densely populated urban center with a high concentration of tech-savvy residents, drives strong demand for convenient digital healthcare solutions. Healthcare providers in Riyadh have established comprehensive telehealth programs that integrate with national digital health platforms, facilitating seamless patient engagement and care coordination. The Northern and Central Region leads in private sector healthcare investments, with the majority of private health institutions concentrated in the capital city, creating a robust ecosystem for telehealth innovation and adoption that sets benchmarks for other regions to follow.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Telehealth Market Growing?

Technological Advancements and Integration of Artificial Intelligence in Healthcare

Rapid technological innovation is fundamentally reshaping telehealth capabilities across Saudi Arabia, enabling sophisticated remote care delivery that rivals in-person consultations. The proliferation of artificial intelligence and machine learning applications is enhancing diagnostic accuracy, automating clinical workflows, and personalizing patient care during virtual encounters. Healthcare providers are deploying AI-powered tools that analyze medical imaging, predict disease progression, and recommend treatment pathways in real-time during teleconsultations. Advanced video conferencing technologies supported by widespread 5G network coverage ensure high-quality visual interactions essential for clinical assessments across specialty care domains. The integration of wearable devices and connected health monitors with telehealth platforms enables continuous vital sign tracking and proactive health management for patients with chronic conditions. Natural language processing capabilities are streamlining clinical documentation and enabling intelligent symptom assessment through conversational interfaces.

Rising Prevalence of Chronic Diseases Requiring Continuous Monitoring

Saudi Arabia faces a significant chronic disease burden that is driving demand for remote monitoring and ongoing patient management solutions. Lifestyle-related conditions including diabetes, cardiovascular disease, and obesity have reached epidemic proportions, straining traditional healthcare delivery models and necessitating innovative care approaches. Telehealth platforms enable continuous patient engagement, medication adherence monitoring, and timely clinical interventions that improve outcomes for chronic disease patients. Remote patient monitoring reduces the need for frequent hospital visits while maintaining quality oversight of patient health status. The growing elderly population requiring regular medical supervision further amplifies demand for telehealth solutions that provide care convenience without compromising quality.

Expanding Digital Infrastructure and Technology Adoption

Robust digital infrastructure development across Saudi Arabia is creating the technical foundation for widespread telehealth adoption. High-speed internet penetration has expanded significantly, with major urban centers benefiting from advanced 5G networks that support bandwidth-intensive video consultations and real-time data transmission. Smartphone penetration enables mobile health application adoption and facilitates patient engagement with telehealth services. Healthcare facilities are upgrading technical capabilities to support integrated telehealth platforms that connect with national health information systems. The proliferation of connected medical devices and wearable health monitors expands possibilities for remote patient monitoring and continuous data collection.

Market Restraints:

What Challenges the Saudi Arabia Telehealth Market is Facing?

Digital Literacy Gaps and Technology Adoption Barriers

Disparities in digital literacy across demographic groups present challenges to universal telehealth adoption, particularly among elderly populations and residents in remote areas who may lack familiarity with digital health tools. Some patients experience difficulties navigating telehealth platforms and utilizing connected medical devices effectively, limiting their ability to benefit from virtual care services. Healthcare providers also require training to integrate telehealth into clinical workflows and maintain care quality during remote consultations.

Infrastructure Limitations in Rural and Remote Regions

While urban centers benefit from advanced telecommunications infrastructure, connectivity challenges persist in some rural and remote regions of Saudi Arabia. Inconsistent internet coverage and bandwidth limitations in these areas can impair video consultation quality and disrupt real-time remote monitoring capabilities. Healthcare facilities in underserved regions may lack the technical infrastructure necessary to fully implement telehealth services, creating disparities in virtual care accessibility.

Data Privacy and Security Concerns

Patient concerns regarding the privacy and security of personal health information transmitted through telehealth platforms can inhibit adoption. Healthcare organizations must implement robust cybersecurity measures to protect sensitive medical data from unauthorized access and potential breaches. Compliance with evolving data protection regulations requires ongoing investments in security infrastructure and protocols, adding complexity and cost to telehealth implementations. Building patient trust through transparent data handling practices remains essential for widespread telehealth acceptance across the Kingdom.

Competitive Landscape:

The Saudi Arabia telehealth market features a dynamic competitive landscape characterized by a mix of established global technology providers, regional healthcare systems, and emerging digital health startups. Market participants are competing on platform functionality, integration capabilities, user experience, and service breadth to capture market share. Strategic partnerships between technology companies and healthcare institutions are accelerating innovation and expanding service offerings across the Kingdom. Key players are investing in artificial intelligence, cloud computing, and mobile health applications to differentiate their telehealth platforms. The market is witnessing increased consolidation as larger players acquire specialized technology providers to enhance capabilities.

Some of the key players include:

- Altibbi FZ-LLC

- Cura

- International SOS (International SOS Pte Ltd)

- Vezeeta.com

Recent Developments:

- In January 2025, Redesign Health partnered with Sanabil Investments, a wholly owned company by the Public Investment Fund, to establish the Sanabil Venture Studio in Saudi Arabia. The partnership aims to jointly develop and launch at least 20 healthcare companies in the Kingdom, aligning with Vision 2030 objectives for healthcare transformation and digital innovation.

Saudi Arabia Telehealth Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Software, Hardware, Services |

| Communication Technologies Covered | Video Conferencing, mHealth Solutions, Others |

| Hosting Types Covered | Cloud-Based and Web-based, On-Premises |

| Applications Covered | Teleconsultation and Telementoring, Medical Education and Training, Teleradiology, Telecardiology, Tele-ICU, Tele-Psychiatry, Tele-Dermatology, Others |

| End Users Covered | Providers, Patients, Payers, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Companies Covered | Altibbi FZ-LLC, Cura, International SOS (International SOS Pte Ltd), Vezeeta.com, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia telehealth market size was valued at USD 792.61 Million in 2025.

The Saudi Arabia telehealth market is expected to grow at a compound annual growth rate of 20.39% from 2026-2034 to reach USD 4,212.13 Million by 2034.

Software dominated the market with a share of 56.1%, driven by increasing adoption of electronic health records, AI-powered diagnostic tools, and integrated telemedicine platforms across healthcare facilities.

Key factors driving the Saudi Arabia telehealth market include government-led digital health transformation under Vision 2030, rising chronic disease prevalence requiring continuous monitoring, expanding digital infrastructure, and growing adoption of AI-powered healthcare solutions.

Major challenges include digital literacy gaps among elderly and rural populations, infrastructure limitations in remote regions, data privacy and security concerns, interoperability issues between healthcare systems, and the need for enhanced regulatory frameworks governing cross-border telehealth services.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)