Saudi Arabia Telemedicine Market Report by Component (Product, Services), Delivery Mode (Web/Mobile, Call Centers), Modality (Real-time, Store and Forward, and Others), Facility (Tele-Hospital, Tele-Home), Application (Teledermatology, Teleradiology, Telepsychiatry, Telepathology, Telecardiology, and Others), End User (Providers, Payers, Patients, and Others), and Region 2026-2034

Market Overview:

Saudi Arabia telemedicine market size reached USD 1,003.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 4,603.8 Million by 2034, exhibiting a growth rate (CAGR) of 18.45% during 2026-2034. The growing focus of government bodies to improve patient outcomes and enhance healthcare infrastructures is primarily driving the augmenting the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1,003.0 Million |

|

Market Forecast in 2034

|

USD 4,603.8 Million |

| Market Growth Rate 2026-2034 | 18.45% |

Telemedicine involves delivering medical services remotely through a telecommunication network. Various platforms, such as mobile health (mHealth) applications, video conferencing, and remote patient monitoring (RPM), facilitate the provision of these services. The objective of telemedicine is to improve clinical management, offer access to advanced healthcare services, and reduce discrepancies in diagnoses. Consequently, it finds application in numerous medical specialties, including radiology, psychiatry, cardiology, neurology, dermatology, and more.

Saudi Arabia Telemedicine Market Trends:

Government Support and Regulation

The Saudi Arabian government is strongly supporting the growth of telemedicine services through favorable regulations. The Ministry of Health is constantly enhancing the regulatory environment to stimulate digital healthcare solutions. Initiatives such as the National Health Information Center (NHIC) are promoting data exchange and integration between healthcare providers. Through the formulation of inclusive national strategies and funding programs, the government is driving the adoption of telemedicine platforms. These efforts are providing a formalized and safe environment for telehealth services, which is vital to their expansion and long-term success. Meanwhile, the government's Vision 2030 initiative is supporting the transition towards digital healthcare solutions, guaranteeing telemedicine's growing role in the healthcare system. Saudi Arabia will host the 8th Global Health Exhibition from October 27 to 30, 2025, at the Malham venue of the Riyadh Exhibition and Convention Center, featuring the motivating theme: “Invest in Health.” The occasion highlights the Kingdom’s dedication to enhancing its healthcare transformation and solidifying its status as a global center for health innovation and investment, in accordance with Vision 2030.

Growing Demand for Healthcare Services

Demand for Saudi Arabian healthcare services is continuously rising as a result of increased population and an upsurge in chronic conditions. Pressure is mounting on the healthcare sector to accommodate the demands of the population, and that makes telemedicine an important alternative solution. The ability to remotely receive consultations is filling the gap in healthcare professionals in some areas, especially rural or underserved areas. Telemedicine is also enhancing healthcare access for individuals with mobility limitations or time constraints. With virtual consultations, the healthcare system is increasing its capability to treat a greater number of patients without a reduction in quality. The government plans to privatize more than 290 hospitals and 2,300 healthcare facilities, raising private sector participation from 25% to 35% by 2030.

Technological Developments

Saudi Arabia is investing heavily in technological infrastructure to enhance healthcare services, which is driving the telemedicine market growth. The ubiquity of high-speed internet, combined with growing smartphone penetration, is making it possible for healthcare services to be provided remotely. Telehealth solutions such as video consultations, remote monitoring, and mobile health applications are increasingly being used by hospitals and clinics. Telemedicine is becoming more effective in diagnosis, treatment, and patient management through the integration of artificial intelligence (AI) and data analytics. Such technological improvements are making it possible for more prompt and precise consultations, hence the increasing attractiveness of telemedicine to both healthcare professionals and patients. In 2025, The HealthTech firm Doctorna launched in Saudi Arabia to offer its comprehensive CRM and telehealth solutions, customized for clinics, hospitals, and healthcare professionals adapting to a progressively digital environment.

Saudi Arabia Telemedicine Market Growth Drivers:

Increasing Healthcare Costs

The increasing cost of conventional healthcare is compelling both patients and healthcare professionals in Saudi Arabia to pursue cheaper alternatives. Telemedicine is diminishing these costs by avoiding physical visits, lowering the cost of transportation, and shortening hospital stays. To healthcare professionals, telemedicine is saving overhead expenses in terms of office facilities and administrative tasks. Through telehealth services, the necessity for face-to-face consultations, which come with long waiting times and greater operational costs, is being minimized. Therefore, telemedicine is viewed as an effective cost-reduction technique that can deliver quality healthcare while reducing the financial costs to both patients and healthcare systems.

Shift Toward Preventive Healthcare

The healthcare system of Saudi Arabia is moving away from reactive towards proactive, preventive care. Telemedicine is taking a key role in the transition by providing remote monitoring tools, health checks, and ongoing management of chronic conditions. Patients are now being urged to be more proactive in their health through wearable technology and mobile applications connecting them to healthcare professionals. This method is especially useful in the management of conditions such as diabetes, hypertension, and obesity, which are widespread in Saudi Arabia. By providing real-time sharing of data and individualized care plans, telemedicine is facilitating early detection and prevention, hence enhancing overall health outcomes.

Acceptance and Evolving Attitudes

Patient attitudes in Saudi Arabia are changing towards higher acceptance of telemedicine services. The increased exposure to digital services and tools in other industries is increasingly getting people used to employing telemedicine in healthcare. Saudi patients are thus gradually getting used to holding virtual consultations and enjoy the comfort and ease of access that telemedicine provides. Also, healthcare professionals are increasingly recognizing the necessity to incorporate telemedicine in their services, adding further momentum to the market's growth.

Saudi Arabia Telemedicine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on component, delivery mode, modality, facility, application, and end user.

Component Insights:

To get more information on this market, Request Sample

- Product

- Hardware

- Software

- Others

- Services

- Tele-Consulting

- Tele-Monitoring

- Tele-Education

The report has provided a detailed breakup and analysis of the market based on the component. This includes product (hardware, software, and others) and services (tele-consulting, tele-monitoring, and tele-education).

Delivery Mode Insights:

- Web/Mobile

- Audio/Text-based

- Visualized

- Call Centers

A detailed breakup and analysis of the market based on the delivery mode have also been provided in the report. This includes web/mobile (audio/text-based and visualized) and call centers.

Modality Insights:

- Real-Time

- Store and Forward

- Others

The report has provided a detailed breakup and analysis of the market based on the modality. This includes real-time, store and forward, and others.

Facility Insights:

- Tele-Hospital

- Tele-Home

A detailed breakup and analysis of the market based on the facility have also been provided in the report. This includes tele-hospital and tele-home.

Application Insights:

- Teledermatology

- Teleradiology

- Telepsychiatry

- Telepathology

- Telecardiology

- Others

The report has provided a detailed breakup and analysis of the market based on application. This includes teledermatology, teleradiology, telepsychiatry, telepathology, telecardiology, and others.

End User Insights:

- Providers

- Payers

- Patients

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes providers, payers, patients, and others.

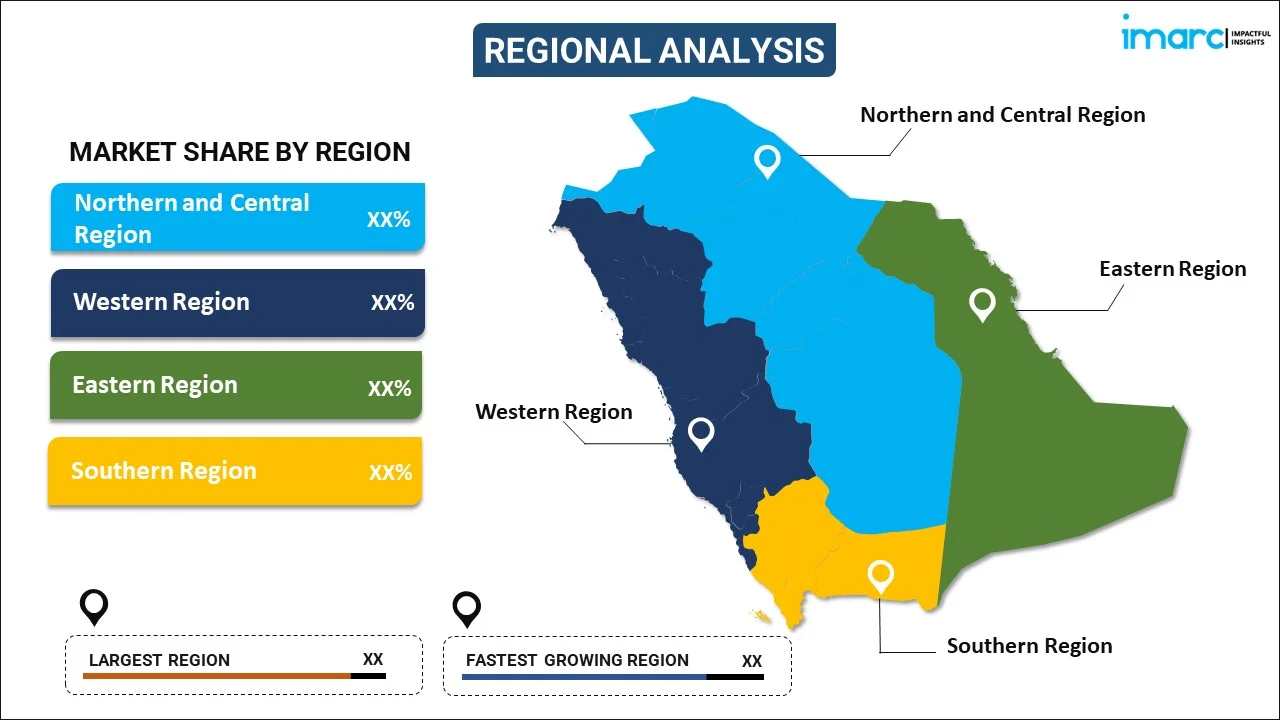

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Telemedicine Market News:

- August 2025: The Ministry of Health has declared that school fitness screening will be offered for newly registered first-grade students for the 2025/2026 school year, in collaboration with the Ministry of Education. The program seeks to guarantee students' health preparedness for school, encourage early identification, and enhance preventive healthcare in educational settings. Parents can schedule appointments online via the “Sehhaty” app, enabling them to choose the most suitable time and healthcare facility. The assessment includes confirmation of vaccination records for school-aged children, an evaluation of the student’s health history, BMI calculation, vision and hearing tests, speech and dental assessments, along with a comprehensive clinical evaluation.

- June 2025: The Seha Virtual Hospital of Saudi Arabia’s Ministry of Health has initiated virtual medical consultation facilities for pilgrims during the Hajj season of 1446 AH. The hospital provides 24/7 consultations through the centralized call center, the Sehhaty app, and the X platform. Services are offered in seven languages, specifically Arabic, English, French, Turkish, Persian, Urdu, and Indonesian.

Saudi Arabia Telemedicine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered |

|

| Delivery Modes Covered |

|

| Modalities Covered | Real-time, Store and Forward, Others |

| Facilities Covered | Tele-hospital, Tele-home |

| Applications Covered | Teledermatology, Teleradiology, Telepsychiatry, Telepathology, Telecardiology, Others |

| End Users Covered | Providers, Payers, Patients, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia telemedicine market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia telemedicine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia telemedicine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The telemedicine market in Saudi Arabia was valued at USD 1,003.0 Million in 2025.

The Saudi Arabia telemedicine market is projected to exhibit a CAGR of 18.45% during 2026-2034, reaching a value of USD 4,603.8 Million by 2034.

Key factors driving the Saudi Arabia telemedicine market include government support and regulations, technological advancements, rising healthcare demand, increasing healthcare costs, the shift toward preventive care, and growing acceptance. These factors are collectively enhancing the accessibility, affordability, and efficiency of healthcare services across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)