Saudi Arabia Television Market Size, Share, Trends and Forecast by Technology, Screen Size, Features, End User, and Region, 2026-2034

Saudi Arabia Television Market Summary:

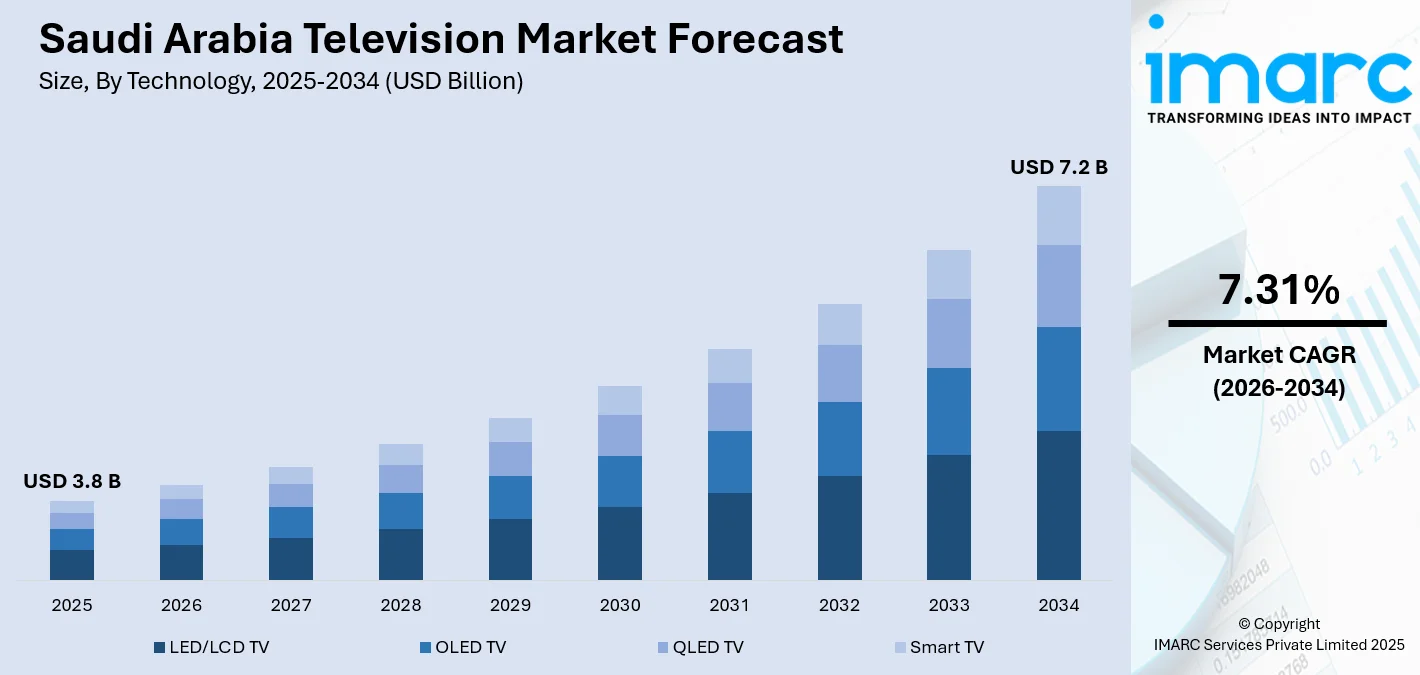

The Saudi Arabia television market size was valued at USD 3.8 Billion in 2025 and is projected to reach USD 7.2 Billion by 2034, growing at a compound annual growth rate of 7.31% from 2026-2034.

The Saudi Arabian market is experiencing robust expansion driven by rising disposable incomes, accelerating urbanization trends, and increasing consumer appetite for premium home entertainment systems. The market reflects a fundamental shift toward advanced display technologies and smart connectivity features as households prioritize immersive viewing experiences aligned with Vision 2030's digital transformation objectives. The market benefits from strong retail infrastructure and e-commerce platforms, while demographic advantages including a youthful, tech-savvy population with high digital engagement levels support sustained growth trajectories and expand the Saudi Arabian television market share.

Key Takeaways and Insights:

- By Technology: LED/LCD TV dominates the market with a share of 42% in 2025, benefiting from established manufacturing ecosystems, competitive pricing structures, and widespread consumer familiarity with proven display reliability.

- By Screen Size: Medium screen (32 to 50 inches) leads the market with a share of 45% in 2025, representing the optimal balance between viewing comfort for typical Saudi household spaces and affordability considerations.

- By Features: High-resolution displays represent the largest segment with a market share of 31% in 2025, reflecting consumer demand for enhanced picture clarity and future-proof entertainment investments.

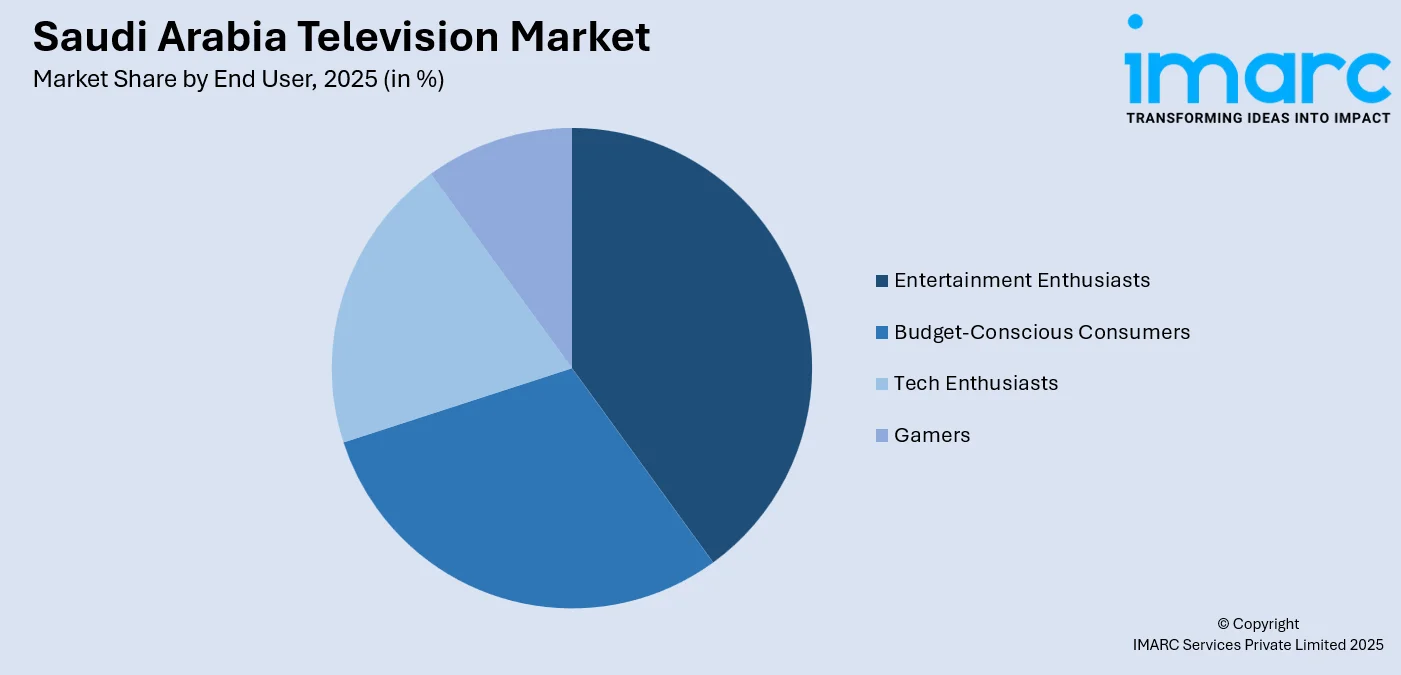

- By End User: Entertainment enthusiasts account for 30% market share in 2025, driven by the growing popularity of streaming platforms and premium content consumption habits.

- By Region: Northern and central region dominates with 35% market share in 2025, anchored by Riyadh's concentration of affluent households and strong retail infrastructure.

- Key Players: The market demonstrates significant competitive intensity with multinational electronics manufacturers competing alongside regional distributors across multiple price segments. Major players leverage brand recognition, after-sales service networks, and strategic retail partnerships to maintain market positioning while emerging brands capture price-sensitive segments through aggressive promotional strategies.

To get more information on this market Request Sample

The Saudi television market is undergoing a transformative phase as consumer preferences shift toward larger screens with advanced features. Households increasingly view televisions as central entertainment hubs rather than passive viewing devices, with integration capabilities for gaming consoles, streaming services, and smart home ecosystems becoming standard expectations. The market benefits from strong retail distribution networks spanning hypermarkets, specialized electronics outlets, and expanding e-commerce platforms that provide consumers with diverse purchasing options and competitive pricing transparency. Various network providers are also launching new shows and programs for people to enjoy with their peers and family. For instance, in 2025, the Russian news channel, RT Arabic, debuted a new analytical show, “Studio Riyadh,” from the capital next month in celebration of the centennial of diplomatic ties between Moscow and Saudi Arabia. The show will be led by experienced Saudi journalist Mohammed Al-Rashed and aired bi-monthly, beginning in February 2026. It will offer thorough examination of domestic and global events, highlighting key political and media personalities.

Saudi Arabia Television Market Trends:

Accelerating Smart TV Adoption Across Consumer Segments

Smart television penetration is expanding rapidly beyond premium consumer segments as manufacturers introduce competitively priced models with built-in streaming capabilities and voice control features. Industry data indicates that smart TV sales increased in the Saudi market during 2024, reflecting the Kingdom's internet penetration rate exceeding and growing subscription bases for regional and international streaming platforms. The General Authority for Statistics (GASTAT) published the findings of the 2025 ICT Access and Usage by Households and Individuals survey, indicating that internet usage in Saudi Arabia continues to be remarkably elevated. In total, 99.0% of people aged 15–74 indicated they used the internet, with usage rates of 99.0% for males and 98.9% for females. Leading electronics brands introduced Arabic-language voice assistants specifically optimized for Saudi dialects in their 2024 product launches, enhancing user experience and driving adoption among consumers who previously found voice control features less accessible. This democratization of smart technology creates an ecosystem where connectivity features transition from luxury additions to baseline consumer expectations across urban and suburban markets.

Premium Display Technology Migration Patterns

Consumer interest in OLED and QLED technologies is intensifying among affluent households seeking superior picture quality, with these premium segments experiencing accelerated adoption despite higher price points. Market tracking data reveals that OLED television sales grew in the Saudi market during 2024, while QLED segment registrations increased the same period, significantly outpacing the overall market growth rate. Major brands launched 8K OLED televisions in sizes ranging from 65 to 88 inches during the second half of 2024, with flagship models priced between SAR 15,000 and SAR 45,000 targeting ultra-premium consumer segments. This trend mirrors global patterns where early technology adopters drive initial market establishment before pricing corrections enable broader market penetration, supported by marketing emphasis on enhanced contrast ratios achieving infinite black levels in OLED technology, quantum dot color accuracy improvements, and energy efficiency benefits that resonate with quality-conscious consumers. In 2025, TCL Electronics launched its flagship TCL X11K QD-Mini LED TC in Saudi Arabia. The TV is created for premium home entertainment with redefined picture quality, sound effects, and modern design.

Large Format Display Preference Emergence

Household preferences are shifting toward screens exceeding 50 inches as residential spaces accommodate larger entertainment installations and consumers seek cinema-like viewing experiences. Manufacturers responded by launching new television models in the 65-inch category and models in the 75-inch and above category during 2024, with several brands introducing 85-inch and 98-inch variants priced competitively to stimulate premium large-format adoption. This sizing trend is reinforced by declining per-inch pricing for large-format displays, architectural preferences for open-plan living spaces that can accommodate substantial screens, and cultural entertainment patterns that favor shared family viewing experiences over individual device consumption. In 2024, Hisense, a worldwide frontrunner in consumer electronics and home appliances, opened its flagship store on King Abdulaziz Road in Riyadh. This advanced space transcends a typical retail destination, it serves as an innovation center, aimed at providing Saudi consumers engaging experiences with the newest smart home and entertainment technologies. Central to the launch is the introduction of the Hisense 110-Inch ULED X Mini LED TV, establishing a new standard for home entertainment.

How Vision 2030 is Transforming the Saudi Arabia Television Market:

Vision 2030 is reshaping the Saudi Arabia television market by accelerating digital adoption, lifestyle changes, and household spending on entertainment. The program’s focus on economic diversification and quality of life has supported large-scale housing projects, urban development, and smart city initiatives, all of which increase demand for modern home electronics. Rising broadband coverage and faster internet services have strengthened the appeal of smart televisions, enabling wider use of streaming platforms and on-demand content. Vision 2030 has also encouraged growth in the local media and entertainment sector, expanding Arabic content libraries and driving higher daily screen usage. Higher employment opportunities and income stability in urban centers have improved consumer confidence, leading to upgrades toward larger screens and higher resolution models. Together, these changes are shifting televisions from basic appliances to central home entertainment systems, reinforcing steady market growth across the country.

Market Outlook 2026-2034:

The Saudi Arabian television market is positioned for sustained expansion as economic diversification initiatives strengthen consumer purchasing power and digital infrastructure investments support advanced connectivity features. The market trajectory reflects underlying demographic advantages including a young, tech-savvy population with high digital engagement levels and urbanization patterns that concentrate purchasing power in metropolitan centers with developed retail ecosystems. The market generated a revenue of USD 3.8 Billion in 2025 and is projected to reach a revenue of USD 7.2 Billion by 2034, growing at a compound annual growth rate of 7.31% from 2026-2034. Market growth will be further supported by continued technological innovation introducing enhanced display capabilities, artificial intelligence (AI) integration for personalized viewing experiences, and ecosystem connectivity features that position televisions as central command centers for smart home management.

Saudi Arabia Television Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Technology |

LED/LCD TV |

42% |

|

Screen Size |

Medium Screen (32 to 50 inches) |

45% |

|

Features |

High-Resolution Displays |

31% |

|

End User |

Entertainment Enthusiasts |

30% |

|

Region |

Northern and Central Region |

35% |

Technology Insights:

- LED/LCD TV

- OLED TV

- QLED TV

- Smart TV

The LED/LCD TV dominates with a market share of 42% of the total Saudi Arabia television market in 2025.

LED/LCD technology maintains commanding market leadership through its optimal convergence of performance reliability, manufacturing maturity, and pricing accessibility that appeals to broad consumer demographics. The segment benefits from decades of technological refinement that have delivered consistent improvements in energy efficiency, panel longevity, and picture quality while maintaining production cost structures that enable competitive retail pricing across multiple screen size categories. The technology's market dominance is further reinforced by extensive service networks comprising authorized service centers across Saudi Arabia, readily available replacement components with average lead times under 48 hours in major cities, and consumer familiarity factors that reduce perceived purchase risk compared to newer display technologies.

Manufacturers continue investing in LED/LCD innovation including mini-LED backlighting systems with up to 1,000 dimming zones in premium models launched in 2024, quantum dot enhancement layers achieving 95% DCI-P3 color gamut coverage, and high refresh rate capabilities reaching 120Hz and beyond that extend the technology's competitive relevance against emerging alternatives. Recent product launches in the LED/LCD category introduced new models specifically optimized for Saudi market preferences, incorporating features such as dual-tuner capabilities for simultaneous recording, enhanced Arabic user interfaces, and Middle East broadcast standard compatibility that strengthen the segment's relevance.

Screen Size Insights:

- Small Screen (Below 32 inches)

- Medium Screen (32 to 50 inches)

- Large Screen (Above 50 inches)

Medium screen (32 to 50 inches) leads with a share of 45% of the total Saudi Arabia television market in 2025.

Medium-sized televisions represent the market's core segment by addressing the dimensional requirements of typical Saudi residential spaces including apartments, villas, and family rooms where viewing distances align with optimal screen size recommendations. This category achieves market leadership through its versatility across multiple room applications, from primary living area installations to secondary bedroom placements, while maintaining price points accessible to middle-income households that constitute the market's largest demographic segment. The 32 to 50-inch category generated huge revenue during 2024, representing its commanding market share position.

The segment's sustained dominance reflects architectural realities of Saudi housing stock where room dimensions favor screens between thirty-two and fifty inches for comfortable viewing without overwhelming available wall space or furniture arrangements. Average Saudi living rooms measure between 4.5 and 6.5 meters in length, creating optimal viewing distances of 2.5 to 3.5 meters that align perfectly with 43 to 50-inch screen recommendations based on industry standards for 4K resolution viewing. Manufacturers prioritize this size range with diverse model offerings spanning entry-level to premium feature sets, with distinct models available in the Saudi market across the 32-50 inch range during 2024, ensuring consumers find suitable options regardless of budget constraints or feature preferences.

Features Insights:

- High-Resolution Displays

- 4K

- 8K

- HDR (High Dynamic Range)

- Audio Enhancement

- Dolby Atmos

- DTS X

- Connectivity Options

- Bluetooth

- Wi-Fi

- HDMI

- Voice Control and AI Integration

High-resolution displays exhibit a clear dominance with a 31% share of the total Saudi Arabia television market in 2025.

High-resolution displays form the strongest feature segment in the Saudi Arabia television market, driven mainly by rising consumer expectations for picture clarity and screen size. Demand for 4K televisions dominates sales volumes, supported by falling prices, wider brand availability, and strong promotion through electronics retailers across major cities. Large households and a preference for spacious living rooms make bigger screens more appealing, and 4K resolution delivers visible improvements even at everyday viewing distances. Content availability has played a major role as well. Streaming platforms widely used in Saudi Arabia, including Netflix, Shahid, and YouTube, offer extensive 4K libraries, while satellite broadcasters continue upgrading transmission quality. Sports viewing, especially football and motorsports, further supports adoption, as higher resolution enhances motion detail and viewing comfort. For many buyers, 4K has shifted from a premium option to a default expectation, making it the backbone of television sales rather than a niche upgrade.

8K televisions occupy a smaller but growing space within the high-resolution segment, largely tied to affluent consumers and early adopters. While native 8K content remains limited, manufacturers position these models as long-term investments, emphasizing advanced upscaling technologies and future readiness. In Saudi Arabia, strong disposable incomes in urban centers like Riyadh and Jeddah support interest in such high-end models, particularly within luxury housing and premium retail channels. Retail strategies often bundle 8K televisions with flagship features such as HDR, advanced audio formats, and AI-based picture processing, reinforcing their aspirational appeal. Government-backed digital infrastructure development and high internet penetration also support the narrative of future-focused home entertainment. Even though 8K volumes remain modest, their presence elevates the overall high-resolution category and strengthens brand positioning. Together, 4K’s mass adoption and 8K’s premium pull explain why high-resolution displays account for the largest share of the Saudi Arabia television market, shaping product launches, pricing strategies, and consumer expectations across all major brands.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Entertainment Enthusiasts

- Budget-Conscious Consumers

- Tech Enthusiasts

- Gamers

Entertainment enthusiasts lead with a share of 30% of the total Saudi Arabia television market in 2025.

Entertainment enthusiasts form the largest end-user segment in the Saudi Arabia television market, reflecting the country’s strong home-centric leisure culture and high media consumption levels. Television remains a central fixture in Saudi households, not just for casual viewing but as a primary source of daily entertainment. Families often spend extended hours watching a mix of satellite channels, streaming platforms, sports broadcasts, and regional content, making screen quality, size, and performance key purchase drivers. The rapid growth of Arabic and international streaming services has significantly influenced viewing habits, encouraging upgrades to larger and more advanced televisions. Major sporting events, especially football leagues and international tournaments, draw collective viewing, reinforcing demand for immersive displays with high resolution and smooth motion handling. Cultural preferences for social gatherings at home also support this segment, as televisions serve as a shared entertainment hub during weekends, festivals, and family occasions.

Spending patterns among entertainment enthusiasts in Saudi Arabia show a willingness to invest in premium features that enhance the viewing experience. Consumers in this group prioritize large screen sizes, 4K resolution, HDR support, and advanced audio formats to recreate a cinema-like setup at home. Sound quality is particularly important, leading many buyers to favor televisions compatible with Dolby Atmos or external sound systems. Smart TV functionality plays a decisive role, as seamless access to apps, voice control, and personalized recommendations align well with heavy usage. This segment is also less sensitive to price fluctuations compared to budget-focused buyers, especially in middle- to high-income households. Strong retail presence, frequent promotional campaigns, and installment-based payment options further encourage upgrades and repeat purchases. As a result, entertainment enthusiasts heavily influence market trends, pushing brands to focus on immersive performance, content integration, and premium design. Their sustained demand explains why this group represents the largest share of television end users in Saudi Arabia, shaping product development and marketing strategies across the industry.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and central region exhibits a clear dominance with a 35% share of the total Saudi Arabia television market in 2025.

The Northern and Central region represents the largest share of the Saudi Arabia television market, mainly due to its population concentration, urban development, and higher purchasing power. This region includes Riyadh and surrounding cities, which together account for a significant portion of the country’s households. Rapid urban expansion, large residential projects, and a high rate of home ownership have created steady demand for televisions across both new and replacement purchases. Residents in this region tend to favor larger screen sizes and advanced features, supported by higher disposable incomes and greater exposure to global consumer electronics trends. Retail infrastructure is also more developed here, with a strong presence of organized electronics chains, brand-exclusive stores, and large-format malls. Easy access to physical retail, along with well-established e-commerce networks, ensures broad product availability and frequent promotional activity, further strengthening sales volumes.

Lifestyle and consumption patterns in the Northern and Central region strongly support television demand as a core household product. Home entertainment plays a major role in daily life, particularly in urban settings where indoor leisure is preferred for much of the year. High internet penetration and widespread use of streaming platforms encourage households to upgrade to smart televisions with better resolution and connectivity. Sports viewership is especially influential in this region, with football matches and international tournaments driving demand for high-performance screens and smooth motion handling. Government investment in digital infrastructure and housing development also supports long-term market growth, as newly built homes are typically equipped with modern entertainment systems from the outset. Consumers here are relatively open to premium offerings, including 4K and high-end smart TVs, and are more likely to adopt new technologies earlier than those in other regions. These factors together explain why the Northern and Central region holds the largest share of the Saudi Arabia television market, shaping national sales trends and influencing how brands plan distribution, pricing, and feature positioning across the country.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Television Market Growing?

Rising Household Disposable Income and Economic Diversification

Economic transformation initiatives under Vision 2030 are expanding employment opportunities across private sector industries, strengthening household purchasing power and enabling discretionary spending on home entertainment upgrades. Saudi Arabia's per capita GDP reached increased 1.3% in 2024. Regarding quarterly projections, the real GDP experienced a growth of 4.5% in the fourth quarter of 2024 relative to the same quarter in the prior year. This income growth is particularly pronounced among young professional demographics entering peak earning years, creating expanded consumer bases for mid-range and premium television segments. The diversification away from oil-dependent economic structures is fostering salary stability and career advancement opportunities that translate into confidence for durable goods purchases including televisions as households invest in quality living environments aligned with aspirational lifestyle standards.

Expanding Digital Content Ecosystem and Streaming Platform Proliferation

The rapid expansion of Arabic-language content production combined with increasing availability of international streaming services is creating compelling consumption incentives that drive television upgrades to support enhanced viewing experiences. Regional streaming platforms invested massive amounts in original Arabic content production during 2024, representing an increase from previous levels, while international streaming services expanded their Arabic subtitle libraries and dubbing catalogs. In 2025, the MBC Group has revealed a collaboration with Netflix that unites two prominent streaming services into one subscription offering, a first for the area. This signifies that MBCNOW, the newly launched content aggregation platform by the Saudi media giant, will offer seamless access to the complete Netflix catalogue in addition to Shahid, a top Arabic streaming service, along with MBC’s acclaimed linear TV channels. This collaboration marks a first for Netflix in the Middle East and North Africa, aiming to address various viewing preferences throughout Saudi Arabia and the broader Arab region.

Urbanization Trends and Modern Housing Development Patterns

Continued urban population growth concentrated in major metropolitan areas is generating sustained demand for household electronics including televisions as new residents establish living spaces and existing households relocate to modern developments. Saudi Arabia's urban population reached 29,812,993 in 2024 as per World Bank, with new residential units completed across major cities during the year, each representing potential television purchase opportunities. Contemporary residential construction incorporates open-plan living areas specifically designed to accommodate large entertainment installations, featuring dedicated entertainment walls optimized for larger televisions. These urbanization dynamics are complemented by improving retail accessibility in expanding suburban developments where electronics chains establish new outlets, reducing geographic barriers and exposing broader consumer segments to latest display technologies and smart features through experiential retail environments.

Market Restraints:

What Challenges the Saudi Arabia Television Market is Facing?

Lengthening Product Replacement Cycles

Modern televisions demonstrate exceptional longevity with operational lifespans extending beyond seven years, significantly delaying replacement purchases as consumers perceive minimal functional degradation that would justify premature upgrades. This durability, while beneficial for consumer value, suppresses market turnover rates as households only replace units following complete failure rather than incremental feature improvements, limiting potential market expansion from existing owner bases.

Economic Sensitivity to Oil Price Volatility

Despite diversification efforts, Saudi household incomes remain indirectly exposed to petroleum sector performance through government employment levels and private sector confidence that influence discretionary spending patterns. Economic uncertainty triggered by oil market fluctuations can prompt consumers to defer non-essential purchases including television upgrades, creating demand volatility that complicates manufacturer inventory planning and retail forecasting across economic cycles.

Intensifying Competition from Alternative Entertainment Devices

Proliferation of tablets, smartphones, and personal computers with high-resolution displays is fragmenting viewing time, particularly among younger demographics who consume content on portable devices rather than shared household televisions. This behavioral shift reduces the perceived necessity of television ownership or upgrades for certain household segments, potentially constraining long-term market growth as individual device consumption patterns displace traditional family viewing habits centered on television sets.

Competitive Landscape:

The Saudi Arabian television market demonstrates robust competitive intensity characterized by established multinational electronics manufacturers competing across premium, mid-range, and value segments while regional distributors leverage localized market knowledge and pricing flexibility. Competition manifests through aggressive promotional campaigns during religious holidays and seasonal shopping periods, extensive retail partnerships spanning hypermarkets and specialized electronics chains, and differentiated positioning strategies emphasizing brand heritage, technological innovation, or value propositions. Market participants invest heavily in after-sales service networks and warranty programs to build consumer trust while navigating import dynamics, retail margin pressures, and rapidly evolving consumer preferences for smart features and display technologies that require continuous product portfolio refreshes.

Saudi Arabia Television Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | LED/LCD TV, OLED TV, QLED TV, Smart TV |

| Screen Sizes Covered | Small Screen (Below 32 inches), Medium Screen (32 to 50 inches), Large Screen (Above 50 inches) |

| Features Covered |

|

| End Users Covered | Entertainment Enthusiasts, Budget-Conscious Consumers, Tech Enthusiasts, Gamers |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia television market size was valued at USD 3.8 Billion in 2025.

The Saudi Arabia television market is expected to grow at a compound annual growth rate of 7.31% from 2026-2034 to reach USD 7.2 Billion by 2034.

LED/LCD TV technology dominated the market with a 42% share in 2025, driven by its optimal balance of performance reliability, competitive pricing, and widespread consumer acceptance across diverse household segments seeking proven display technology.

Key factors driving the Saudi Arabia television market include rising household disposable incomes from economic diversification initiatives, expanding digital content ecosystems with proliferating streaming platforms offering Arabic and international programming, and sustained urbanization trends creating demand in modern housing developments.

Major challenges include lengthening product replacement cycles as modern televisions demonstrate exceptional durability extending beyond seven years, economic sensitivity to oil price volatility affecting discretionary spending patterns, and intensifying competition from alternative entertainment devices fragmenting traditional viewing habits.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)