Saudi Arabia Testing and Commissioning Market Size, Share, Trends and Forecast by Service Type, Commissioning Type, Sourcing Type, End Use Sector, and Region, 2026-2034

Saudi Arabia Testing and Commissioning Market Overview:

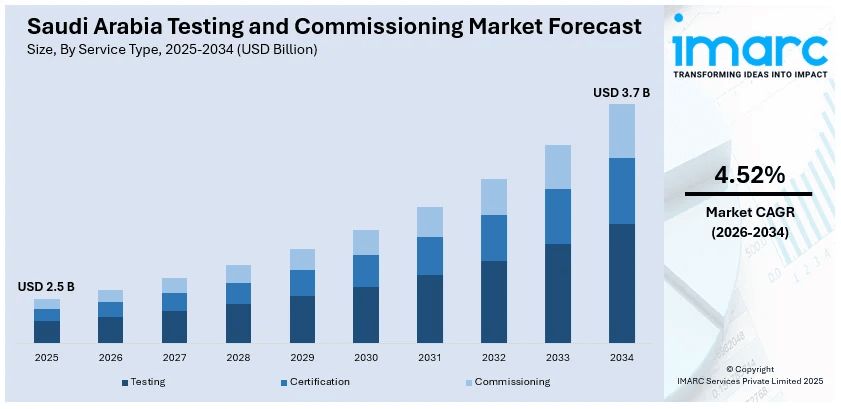

The Saudi Arabia testing and commissioning market size reached USD 2.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 3.7 Billion by 2034, exhibiting a growth rate (CAGR) of 4.52% during 2026-2034. The market is being driven by rapid infrastructure development, particularly under Vision 2030, the increasing complexity of energy and transportation projects, advancements in automation and digital testing technologies, and the escalating need for quality assurance to ensure safety, reliability, and compliance in large-scale projects.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.5 Billion |

| Market Forecast in 2034 | USD 3.7 Billion |

| Market Growth Rate 2026-2034 | 4.52% |

Saudi Arabia Testing and Commissioning Market Trends:

Increasing Demand for Infrastructure Development

One of the key market drivers is the infrastructural expansion across the country. The government's Vision 2030 plan to diversify the economy away from oil has led to massive investments in the construction, transportation, energy, and urban development sectors. This has created an upsurge in mega infrastructure projects, such as the construction of new airports, railroads, residential estates, and commercial structures. As such, there is an escalating need for quality and efficient testing and commissioning (T&C) services. T&C services are crucial for ensuring that the infrastructure is constructed in accordance with specifications and functional to the fullest before they are transferred to clients or the general public. These services assist in detecting and correcting any defects or discrepancies at the construction stage, ensuring safety, quality, and performance. Additionally, as projects become more complex, especially in industries such as transportation (e.g., high-speed rail) and energy (e.g., smart grids), demand for specialized testing and commissioning services will increase, driving the market.

To get more information on this market Request Sample

Technological Advancements in Diagnostic Testing

Another driver in Saudi Arabia's T&C market is the incorporation of state-of-the-art testing technologies. The testing and commissioning landscape is evolving with advancements in automation, digitalization, and artificial intelligence (AI). For instance, the use of advanced diagnostic equipment, IoT sensors, drone inspections, and AI-based predictive maintenance has significantly improved the efficiency and accuracy of testing activities. These technologies enable real-time system monitoring and facilitate more accurate assessment of sophisticated infrastructure. These technologies are very useful, as they avoid human error, restrict downtime, and increase the overall cost-effectiveness of testing. AI-aided analytics also can predict probable system failure, allowing proactive maintenance and ensuring long-term system reliability. As the sophistication of infrastructure escalates, especially in smart cities and renewable energy, the demand for such advanced testing solutions will grow. This is driving the market for testing and commissioning services in Saudi Arabia, as companies seek to install the most recent technologies to enhance the performance and safety of their infrastructure.

Saudi Arabia Testing and Commissioning Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on service type, commissioning type, sourcing type, and end use sector.

Service Type Insights:

- Testing

- Certification

- Commissioning

The report has provided a detailed breakup and analysis of the market based on the service type. This includes testing, certification, and commissioning.

Commissioning Type Insights:

- Initial Commissioning

- Retro Commissioning

- Monitor-Based Commissioning

A detailed breakup and analysis of the market based on the commissioning type have also been provided in the report. This includes initial commissioning, retro commissioning, and monitor-based commissioning.

Sourcing Type Insights:

- Inhouse

- Outsourced

The report has provided a detailed breakup and analysis of the market based on the sourcing type. This includes inhouse and outsourced.

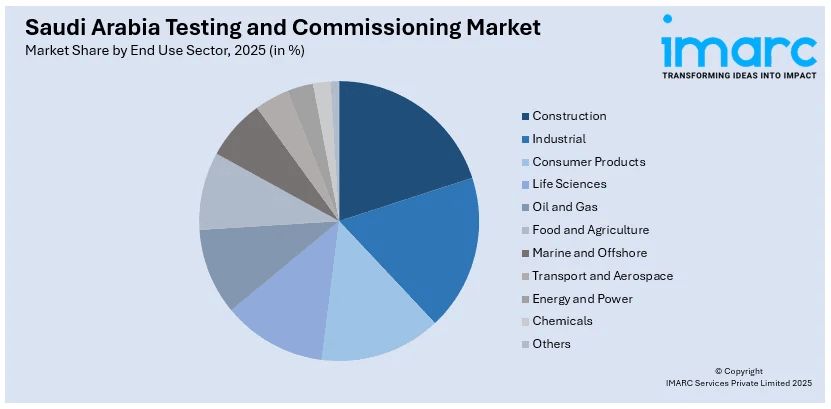

End Use Sector Insights:

Access the comprehensive market breakdown Request Sample

- Construction

- Industrial

- Consumer Products

- Life Sciences

- Oil and Gas

- Food and Agriculture

- Marine and Offshore

- Transport and Aerospace

- Energy and Power

- Chemicals

- Others

A detailed breakup and analysis of the market based on the end use sector have also been provided in the report. This includes construction, industrial, consumer products, life sciences, oil and gas, food and agriculture, marine and offshore, transport and aerospace, energy and power, chemicals, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Testing and Commissioning Market News:

- April 2025: Japanese startup Terra Drone signed a memorandum of understanding with Saudi Aramco to enhance inspection operations of oil and gas facilities using drone technology. Test runs are reportedly scheduled to commence later this year, with full-scale operations expected by 2027. This initiative aimed to improve inspection efficiency and safety, reducing the need for traditional scaffolding-based methods.

- March 2025: Larsen & Toubro (L&T) signed an agreement with ACWA Power to construct a major seawater reverse osmosis desalination plant in Jubail, Saudi Arabia. The project involved design, procurement, construction, testing, and commissioning of the facility, which aimed to produce 600,000 cubic meters of water per day.

- July 2024: NEOM awarded a USD 84.3 million EPC contract to a joint venture between Tawzea and Spain’s Lantania for the Al Badaa Water Recycling Plant enhancements. The project encompassed engineering, procurement, construction, testing, and commissioning of the upgraded facility, including an interim biosolids treatment plant, innovation center, and demonstration center.

Saudi Arabia Testing and Commissioning Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Testing, Certification, Commissioning |

| Commissioning Types Covered | Initial Commissioning, Retro Commissioning, Monitor-Based Commissioning |

| Sourcing Types Covered | Inhouse, Outsourced |

| End Use Sectors Covered | Construction, Industrial, Consumer Products, Life Sciences, Oil and Gas, Food and Agriculture, Marine and Offshore, Transport and Aerospace, Energy and Power, Chemicals, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia testing and commissioning market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia testing and commissioning market on the basis of service type?

- What is the breakup of the Saudi Arabia testing and commissioning market on the basis of commissioning type?

- What is the breakup of the Saudi Arabia testing and commissioning market on the basis of sourcing type?

- What is the breakup of the Saudi Arabia testing and commissioning market on the basis of end use sector?

- What are the various stages in the value chain of the Saudi Arabia testing and commissioning market?

- What are the key driving factors and challenges in the Saudi Arabia testing and commissioning market?

- What is the structure of the Saudi Arabia testing and commissioning market and who are the key players?

- What is the degree of competition in the Saudi Arabia testing and commissioning market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia testing and commissioning market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia testing and commissioning market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia testing and commissioning industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)