Saudi Arabia Textile Dyes Market Size, Share, Trends and Forecast by Dye Type, Fiber Type, Application, and Region, 2026-2034

Saudi Arabia Textile Dyes Market Summary:

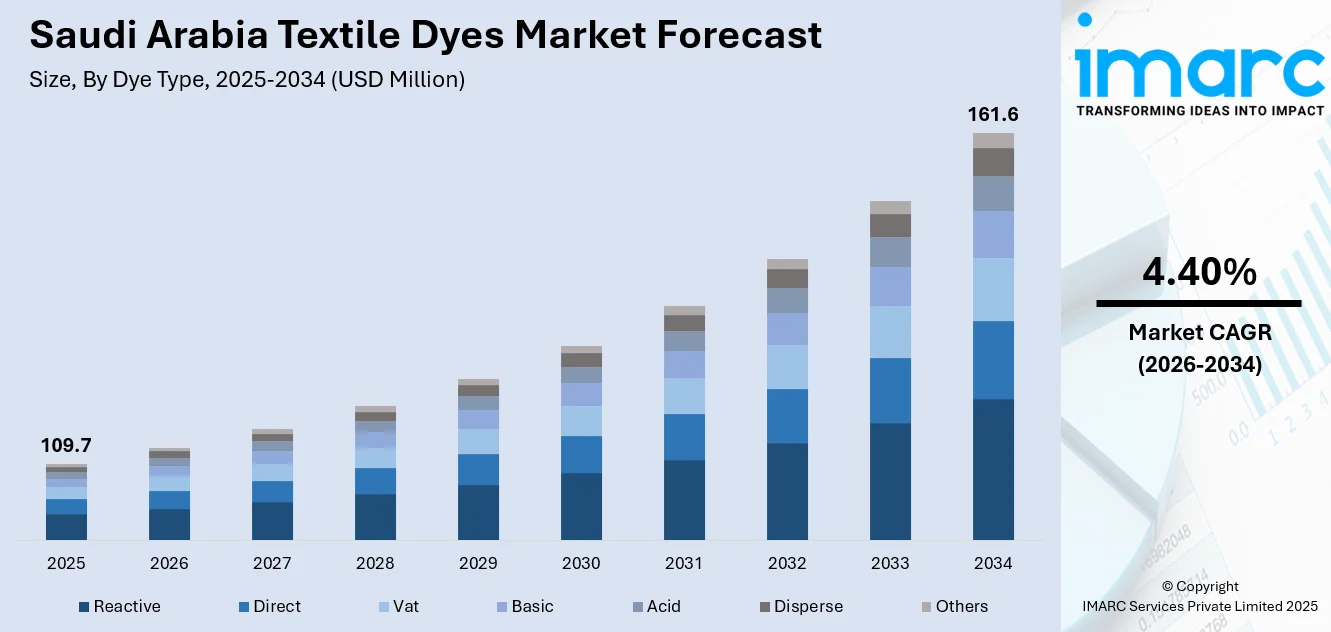

The Saudi Arabia textile dyes market size was valued at USD 109.7 Million in 2025 and is projected to reach USD 161.6 Million by 2034, growing at a compound annual growth rate of 4.40% from 2026-2034.

The market for textile dyes in Saudi Arabia is registering strong growth due to increase in local textile production units, automotive production, and growing demands for colorful and durable fabric in the textile, home textiles, and automotive industries. The Vision 2030 project led by the Kingdom of Saudi Arabia, focusing on economic diversification and industrialization of value chains, has been contributing immensely to investments in the textile value chain, marking an increase in dye usage.

Key Takeaways and Insights:

- By Dye Type: Reactive dominates the market with a share of 32% in 2025, owing to its superior colorfastness, versatility, and compatibility with cellulosic fibers like cotton.

- By Fiber Type: Cotton leads the market with a share of 35% in 2025, driven by the traditional preference for cotton-based garments and home textiles in the region.

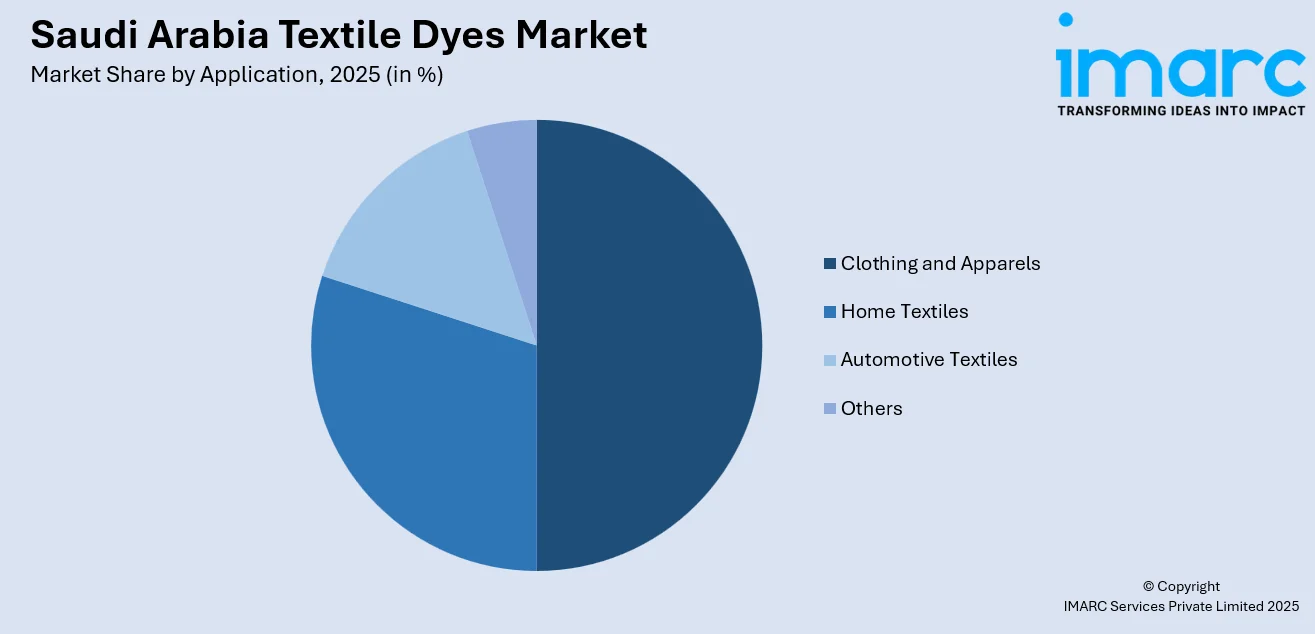

- By Application: Clothing and Apparels represents the largest segment with a market share of 50% in 2025, fueled by rising fashion consciousness and growing domestic apparel manufacturing.

- By Region: Western Region dominates the market with a share of 30% in 2025, driven by its concentration of textile manufacturing facilities in Jeddah and Makkah, well-established industrial infrastructure, and proximity to key Red Sea import-export ports facilitating raw material supply and distribution.

- Key Players: The competitive landscape of the Saudi Arabia textile dyes market comprises a mix of international chemical companies and regional suppliers. Key players focus on developing sustainable, eco-friendly dye formulations and expanding their product portfolios to meet the evolving requirements of domestic textile manufacturers.

To get more information on this market Request Sample

The Saudi Arabia textile dyes market is poised for sustained expansion as the Kingdom advances its industrial transformation agenda under Vision 2030. The textile sector has emerged as a strategic priority, with governing agencies actively encouraging investments in manufacturing infrastructure, automation technologies, and sustainable production practices. In November 2025, the Saudi Fashion Commission partnered with KAUST and textile firm PYRATEX to launch the Red Sea Seaweed Project, developing an innovative bio-textile from algae that underscores the nation’s push toward sustainable materials and advanced textile technologies, highlighting how local industry and research collaborations are driving next-generation textile solutions. The proliferation of new textile factories and the modernization of existing facilities are driving heightened demand for high-performance dyes that deliver durability, vibrancy, and environmental compliance. Additionally, the broadening of e-commerce platforms and the entry of international fashion brands are creating new channels for textile products, thereby stimulating dye consumption across multiple application segments.

Saudi Arabia Textile Dyes Market Trends:

Adoption of Sustainable and Eco-Friendly Dyeing Technologies

The textile dyes market in Saudi Arabia is witnessing a notable shift toward sustainable dyeing solutions as environmental regulations tighten and consumer awareness grows. Manufacturers are increasingly adopting waterless dyeing techniques, bio-based colorants, and low-liquor-ratio processes to minimize water consumption and chemical discharge. In 2025, the third Saudi Fashion and Textile Expo showcased over 550 exhibitors from 25 countries and highlighted sustainable fabrics, eco-friendly products, and modern textile technologies, underlining industry commitment to sustainability and innovation across the value chain. The integration of cold transfer dyeing and digital printing technologies is enabling more precise dye application while reducing waste. This trend aligns with the broader sustainability goals outlined in Vision 2030 and positions Saudi textile producers to meet the stringent environmental standards demanded by global brands.

Expansion of Automotive Textile Applications

The automotive sector is emerging as a significant growth driver for the textile dyes market in Saudi Arabia. With the Kingdom experiencing robust growth in vehicle production and sales, there is increasing demand for dyed textiles used in car interiors, including seats, carpets, door panels, and headliners. In February 2025, Saudi Arabia launched the King Salman Automotive Cluster in King Abdullah Economic City, a major initiative under Vision 2030 aimed at boosting local vehicle manufacturing and innovation by hosting companies such as Ceer, Lucid Motors, and joint ventures with global automakers like Hyundai. Automotive manufacturers require dyes that offer exceptional colorfastness, UV resistance, and compatibility with synthetic and blended fabrics. The trend toward customized and luxurious vehicle interiors is further promoting the employment of premium, high-performance dye solutions tailored for automotive applications.

Digital Transformation and Automation in Dye Application

Advancements in textile machinery and automation are reshaping dye application processes across Saudi Arabia. Digital printing technologies are gaining traction as they enable faster production cycles, reduced material waste, and greater design flexibility compared to conventional dyeing methods. In November 2025, the Saudi Stitch & Tex 2025 expo in Riyadh highlighted the adoption of state-of-the-art digital printing and fabric machinery by local manufacturers, showcasing automated solutions that streamline production and support sustainable practices in textile processing. Smart manufacturing systems equipped with AI-powered quality inspection are enhancing production efficiency and ensuring consistent color accuracy. These technological innovations are enabling textile manufacturers to respond more rapidly to changing fashion trends while maintaining stringent quality standards.

How Vision 2030 is Transforming the Saudi Arabia Textile Dyes Market

The Vision 2030 project initiated by Saudi Arabia is substantially transforming the market for textile dyes as there is a strong emphasis on industrialization and less reliance on oil resources. The policy promotes heavy investments in the country’s textile manufacturing infrastructure and lays the foundation for favorable industrial clusters and state-of-the-art manufacturing plants and outlets for dyes. The surrounding incentives for localizing these manufacturing sectors are pulling both local and global investors to increase their presence in the Kingdom. The stress on M&S practices is pushing favorable and eco-friendly dye manufacturing techniques and water-friendly processes faster than ever before. Other factors such as policy and technological regimes are upgrading manufacturing sectors and paving the way for innovation and an emerging hub for manufacturing textiles and employing dyes marketed from Saudi Arabia.

Market Outlook 2026-2034:

The Saudi Arabia textile dyes market outlook remains favorable as the Kingdom continues to invest in industrial diversification and manufacturing localization. The expanding textile production base, coupled with increasing applications in apparel, home furnishings, and automotive textiles, is expected to sustain steady demand for dyes throughout the forecast period. Government initiatives supporting the textile sector, combined with growing consumer preference for high-quality and vibrant fabrics, will further propel market growth. The market generated a revenue of USD 109.7 Million in 2025 and is projected to reach a revenue of USD 161.6 Million by 2034, growing at a compound annual growth rate of 4.40% from 2026-2034.

Saudi Arabia Textile Dyes Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Dye Type | Reactive | 32% |

| Fiber Type | Cotton | 35% |

| Application | Clothing and Apparels | 50% |

| Region | Western Region | 30% |

Dye Type Insights:

- Direct

- Reactive

- Vat

- Basic

- Acid

- Disperse

- Others

The reactive dominates with a market share of 32% of the total Saudi Arabia textile dyes market in 2025.

Reactive dyes are the most widely used dye type in Saudi Arabia’s textile industry due to their excellent colorfastness and ability to form covalent bonds with cellulosic fibers. These dyes are particularly favored for dyeing cotton and other natural fibers, which constitute a significant portion of the regional textile production. The versatility of reactive dyes in producing a broad spectrum of vibrant colors makes them indispensable for apparel and home textile applications.

The demand for reactive dyes is further bolstered by ongoing innovations in dye chemistry that enhance environmental performance. Manufacturers are actively developing low-salt and cold-reactive dye formulations that significantly reduce water and energy consumption during the dyeing process. These technological advancements align seamlessly with the sustainability objectives of Saudi textile producers and support compliance with evolving environmental regulations, thereby positioning reactive dyes for continued market leadership throughout the forecast period.

Fiber Type Insights:

- Wool

- Nylon

- Cotton

- Viscose

- Polyester

- Others

The cotton leads with a share of 35% of the total Saudi Arabia textile dyes market in 2025.

Cotton remains the predominant fiber type in Saudi Arabia’s textile sector, driven by cultural preferences and the comfort properties of cotton-based garments in the region’s climate. The widespread use of cotton in traditional attire, casual wear, and home textiles generates substantial demand for dyes compatible with cellulosic fibers. Reactive and direct dyes are primarily employed for cotton dyeing applications. In March 2025, the Saudi Fashion Commission launched the Sustainable Ihram Initiative, which repurposes used cotton Ihram garments from Hajj into new eco-friendly textile products as part of broader efforts to promote circularity and sustainability in the Kingdom’s textile ecosystem

The cotton segment benefits from the expansion of domestic spinning and weaving facilities that process both imported and locally sourced cotton fibers. As textile manufacturers scale up production to meet rising domestic demand and explore export opportunities, the requirement for high-quality cotton dyes continues to grow. Sustainability considerations are also influencing the shift toward organic cotton processing, which necessitates eco-friendly dyeing solutions.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Clothing and Apparels

- Home Textiles

- Automotive Textiles

- Others

The clothing and apparels dominate with a market share of 50% of the total Saudi Arabia textile dyes market in 2025.

The clothing and apparels segment represents the primary end-use application for textile dyes in Saudi Arabia, driven by the Kingdom’s young and fashion-conscious population. Rising disposable incomes and the influence of international fashion trends are fueling demand for diverse and vibrant apparel products. The growth of e-commerce platforms and the entry of global fashion brands are expanding the retail landscape, creating additional demand for dyed fabrics.

The apparel manufacturing sector is undergoing significant expansion as part of Vision 2030’s industrial localization efforts. New garment factories are being established across the Kingdom, increasing the domestic production of clothing items and generating sustained demand for textile dyes. The trend toward fast fashion and frequent style changes further stimulates dye consumption as manufacturers seek to rapidly produce new collections with varied color palettes.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Western Region exhibits a clear dominance with a 30% share of the total Saudi Arabia textile dyes market in 2025.

The Western Region, anchored by the major commercial centers of Jeddah and Makkah, leads the Saudi Arabia textile dyes market due to its concentration of textile manufacturing facilities and proximity to key import-export ports. The region benefits from well-established industrial infrastructure and serves as a gateway for both raw material imports and finished product distribution. The presence of major industrial cities and free zones facilitates textile production activities.

The Western Region's dominance is further reinforced by ongoing mega-projects along the Red Sea coast, including large-scale tourism and hospitality developments that generate substantial demand for textiles used in hotels, resorts, and entertainment venues. The expansion of retail and wholesale markets in Jeddah creates additional distribution channels for textile products, while the region's robust logistics infrastructure supports efficient supply chain operations, sustaining its position as the largest consumer of textile dyes.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Textile Dyes Market Growing?

Expansion of Textile Manufacturing Infrastructure

The expansion of textile manufacturing infrastructure across Saudi Arabia is a primary driver of the textile dyes market. As new textile factories open and existing facilities undergo modernization, the consumption of dyes rises proportionally to meet the growing production of fabrics. In 2023, the Saudi Authority for Industrial Cities and Technology Zones (MODON) revealed that it had invested over SAR 4.1 billion in textile and fabric industry projects across 19 industrial cities, spread over more than one million square meters of industrial land, illustrating substantial government-led industrial expansion. The Saudi Authority for Industrial Cities and Technology Zones has made substantial investments in textile and fabric industries, fostering the development of industrial clusters dedicated to textile production. This manufacturing expansion enables local producers to reduce import dependence and capture a larger share of domestic demand, while also exploring export opportunities to neighboring GCC countries.

Rising Automotive Sector and Vehicle Production

The thriving automotive sector in Saudi Arabia represents a significant growth catalyst for the textile dyes market. With robust growth in vehicle sales and increasing local production initiatives, highlighted by Saudi Arabia exploring local vehicle manufacturing with global automaker Stellantis and Petromin Corporation to establish a manufacturing facility under a memorandum of understanding signed in 2025, the demand for automotive components is strengthening across the value chain. Automotive manufacturers require substantial quantities of dyed textiles for vehicle interiors. Car seats, carpets, door panels, and headliners all necessitate durable, UV‑resistant, and aesthetically appealing dye solutions. The trend toward premium and customized vehicle interiors is promoting the employment of specialized dyes that meet stringent automotive performance standards, thereby driving incremental demand in this high‑value application segment.

Government Support under Vision 2030

Government initiatives under the Vision 2030 framework are providing substantial impetus to the textile dyes market. The Kingdom's economic diversification agenda prioritizes the development of local manufacturing capabilities and the creation of employment opportunities in non-oil sectors. In January 2025, Saudi Arabia launched the Standard Incentives Program for the industrial sector, allocating SR10 billion to support projects that localize manufacturing, attract investment, and boost competitiveness, with incentives covering up to 35% of initial project costs. Technical regulations and industry standards introduced by governing agencies ensure product quality and safety while encouraging investments in the textile value chain. Incentives for industrial localization and technology transfer are attracting both domestic and international investment, accelerating the growth of textile dye consumption.

Market Restraints:

What Challenges the Saudi Arabia Textile Dyes Market is Facing?

Environmental Compliance and Water Scarcity Concerns

The textile dyes market in Saudi Arabia faces challenges related to environmental compliance and water scarcity. Dyeing processes are traditionally water-intensive, and the Kingdom's reliance on desalination raises operational costs for textile manufacturers. Stricter effluent treatment requirements and zero-liquid-discharge mandates necessitate significant capital investment in environmental management systems, posing financial burdens for smaller manufacturers.

Dependence on Imported Raw Materials

Saudi Arabia's textile dyes market is constrained by its reliance on imported raw materials, including dye intermediates and specialty chemicals. Fluctuations in global commodity prices and logistics disruptions can impact supply chain stability and production costs. This import dependence exposes local manufacturers to currency exchange risks, potential supply shortages, and vulnerability to international trade disruptions.

Competition from Low-Cost Imports

The influx of low-cost textile dyes from manufacturing hubs in Asia presents competitive pressure for domestic and regional suppliers. Price-sensitive market segments often opt for imported products, limiting market share capture potential for locally produced or premium-grade dyes. Balancing cost competitiveness with quality and sustainability requirements remains a persistent challenge for regional manufacturers.

Competitive Landscape:

The competitive scenario of the Saudi Arabia textile dyes market represents a good balance of multinational chemical conglomerates, regional players, and specialized dye suppliers. The large international companies utilize the richness of their product portfolios, technical prowess, and wide-reaching distribution networks to supply their products to the Saudi market. These regional players compete on price, local customer service, and formulation customization to win market share. However, the competitive landscape is increasingly shifting, in which sustainability is emerging as one of the decisive differentiators wherein leading players invest in bio-based dyeing technologies, water-efficient processes, and eco-compliant production facilities to meet the increasing demand for eco-friendly textile solutions.

Recent Developments:

- In September 2025, Saudi Arabia is witnessing a revival of traditional natural textile dyeing as local artists reintroduce heritage colour-craft techniques under the Year of Handicrafts initiative. Using eco-friendly dyes derived from natural sources, the movement blends cultural preservation with sustainable fashion, highlighting renewed interest in low-impact textile coloration across the Kingdom.

Saudi Arabia Textile Dyes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Dye Types Covered | Direct, Reactive, Vat, Basic, Acid, Disperse, Others |

| Fiber Types Covered | Wool, Nylon, Cotton, Viscose, Polyester, Others |

| Applications Covered | Clothing and Apparels, Home Textiles, Automotive Textiles, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia textile dyes market size was valued at USD 109.7 Million in 2025.

The Saudi Arabia textile dyes market is expected to grow at a compound annual growth rate of 4.40% from 2026-2034 to reach USD 161.6 Million by 2034.

Reactive held the largest market share at 32%, driven by their excellent colorfastness properties and widespread use in cotton and cellulosic fiber applications that dominate the regional textile industry.

Key factors driving the Saudi Arabia textile dyes market include the expansion of textile manufacturing facilities under Vision 2030, rising automotive production requiring interior textiles, growing demand for apparel driven by young demographics, and increasing adoption of sustainable dyeing technologies.

Major challenges include environmental compliance requirements related to water scarcity and effluent treatment, dependence on imported raw materials exposing manufacturers to supply chain risks, and competition from low-cost textile dyes imported from Asian manufacturing hubs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)