Saudi Arabia Textile Recycling Market Size, Share, Trends and Forecast by Product Type, Textile Waste, Distribution Channel, End Use, and Region, 2026-2034

Saudi Arabia Textile Recycling Market Overview:

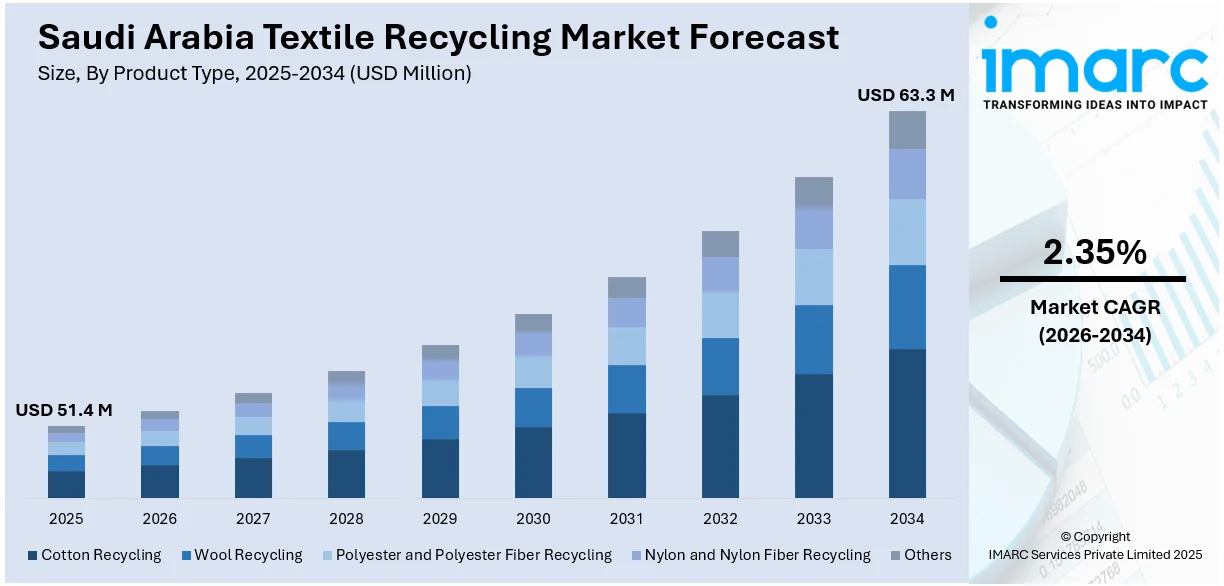

The Saudi Arabia textile recycling market size reached USD 51.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 63.3 Million by 2034, exhibiting a growth rate (CAGR) of 2.35% during 2026-2034. The rising environmental awareness, government initiatives promoting sustainability, increasing textile waste generation, the integration of circular economy principles, and the growing demand for recycled fibers across the fashion and industrial sectors are some of the key factors strengthening the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 51.4 Million |

| Market Forecast in 2034 | USD 63.3 Million |

| Market Growth Rate 2026-2034 | 2.35% |

Saudi Arabia Textile Recycling Market Trends:

Integration of Circular Fashion and Sustainable Manufacturing Practices

The expanding integration of circular fashion concepts into Saudi Arabia’s textile industry is a major trend boosting textile recycling efforts. Circular fashion emphasizes designing products with their end-of-life in mind, focusing on recyclability, reuse, and longer lifespans. This shift is being driven by both consumer demand and policy influence. In addition to this, with the Kingdom’s Vision 2030 pushing for sustainable development and resource efficiency, several local fashion brands and manufacturers are adopting eco-friendly sourcing and production. Textile recyclers are increasingly becoming key stakeholders in the value chain, processing post-consumer textile waste into reusable fibers. Furthermore, a rising number of Saudi-based companies use recycled polyester and cotton in apparel production, with brands partnering with recycling firms to ensure traceability and material recovery, which is further bolstering the market growth.

To get more information on this market Request Sample

Technological Advancements in Textile Waste Sorting and Fiber Recovery

A significant trend propelling the Saudi textile recycling market is the adoption of advanced technologies for sorting and fiber recovery. Traditional recycling methods struggle with the mixed-fiber content of modern garments, but new innovations are improving material separation and recovery efficiency. In line with this, Saudi Arabia is extensively investing in artificial intelligence (AI)-powered sorting systems and chemical recycling technologies that can break down complex fiber blends, such as polyester-cotton mixes. This enables higher recovery rates and a broader range of recyclables. Moreover, the Saudi Green Initiative 2024 roadmap outlined plans to support private sector innovation in recycling, offering subsidies and grants to textile recycling tech start-ups. These technologies are transforming textile recycling from a low-margin, manual operation to a high-efficiency industrial sector with potential for local and export-grade fiber production, further aligning with national sustainability goals.

Saudi Arabia Textile Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type, textile waste, distribution channel, and end use.

Product Type Insights:

- Cotton Recycling

- Wool Recycling

- Polyester and Polyester Fiber Recycling

- Nylon and Nylon Fiber Recycling

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes cotton recycling, wool recycling, polyester and polyester fiber recycling, nylon and nylon fiber recycling, and others.

Textile Waste Insights:

- Pre-consumer Textile

- Post-consumer Textile

A detailed breakup and analysis of the market based on textile waste have also been provided in the report. This includes pre-consumer and post-consumer textiles.

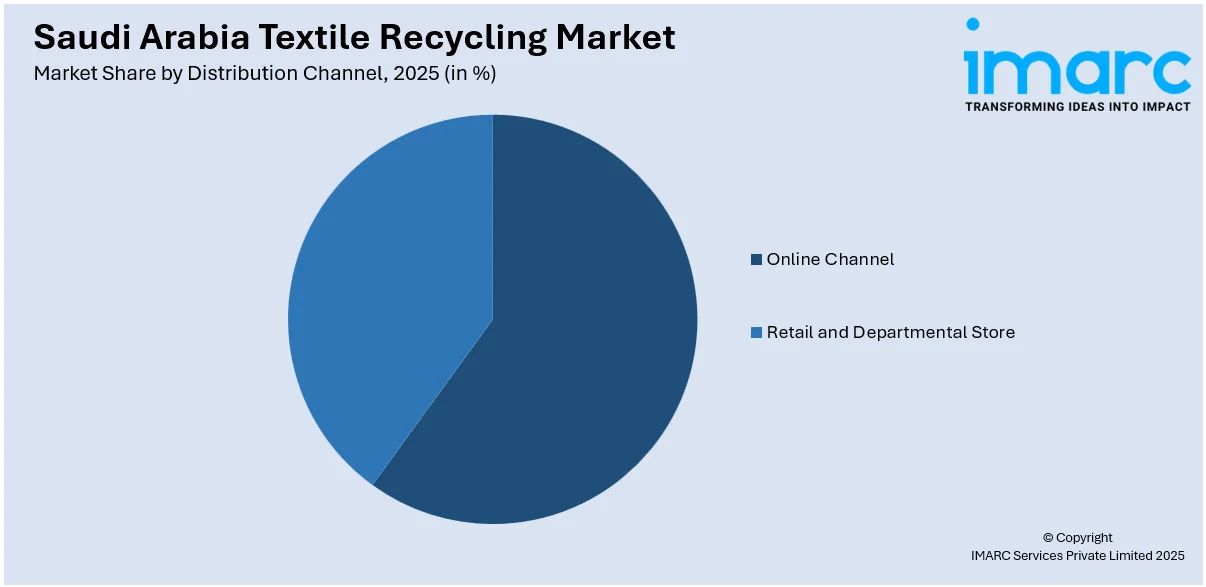

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online Channel

- Retail and Departmental Store

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online channel and retail and departmental store.

End Use Insights:

- Apparel

- Industrial

- Home Furnishings

- Non-woven

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes apparel, industrial, home furnishings, non-woven, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Textile Recycling Market News:

- March 2025: The Saudi Fashion Commission launched the Future of Sustainability Initiative, promoting fashion recycling throughout Saudi Arabia's retail venues. The campaign seeks to promote appropriate clothes recycling habits by strategically putting recycling bins in renowned malls.

- February 2025: The Fashion Commission under Saudi Arabia’s Ministry of Culture launched the Sustainable Ihram initiative, aimed at promoting the recycling of Ihram garments. The project involves collecting, sorting, and repurposing textile waste generated by pilgrims. It is being carried out in partnership with the Saudi Investment Recycling Company (SIRC), Tadweem, SANKO Textile, and RE&UP.

Saudi Arabia Textile Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Cotton Recycling, Wool Recycling, Polyester and Polyester Fiber Recycling, Nylon and Nylon Fiber Recycling, Others |

| Textile Wastes Covered | Pre-consumer Textile, Post-consumer Textile |

| Distribution Channels Covered | Online Channel, Retail and Departmental Store |

| End Uses Covered | Apparel, Industrial, Home Furnishings, Non-woven, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia textile recycling market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia textile recycling market on the basis of product type?

- What is the breakup of the Saudi Arabia textile recycling market on the basis of textile waste?

- What is the breakup of the Saudi Arabia textile recycling market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia textile recycling market on the basis of end use?

- What is the breakup of the Saudi Arabia textile recycling market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia textile recycling market?

- What are the key driving factors and challenges in the Saudi Arabia textile recycling market?

- What is the structure of the Saudi Arabia textile recycling market and who are the key players?

- What is the degree of competition in the Saudi Arabia textile recycling market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia textile recycling market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia textile recycling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia textile recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)