Saudi Arabia Thermal Processing Equipment Market Size, Share, Trends and Forecast by Equipment Type, Process Type, Heating Source, Automation Level, End Use Industry, and Region, 2026-2034

Saudi Arabia Thermal Processing Equipment Market Overview:

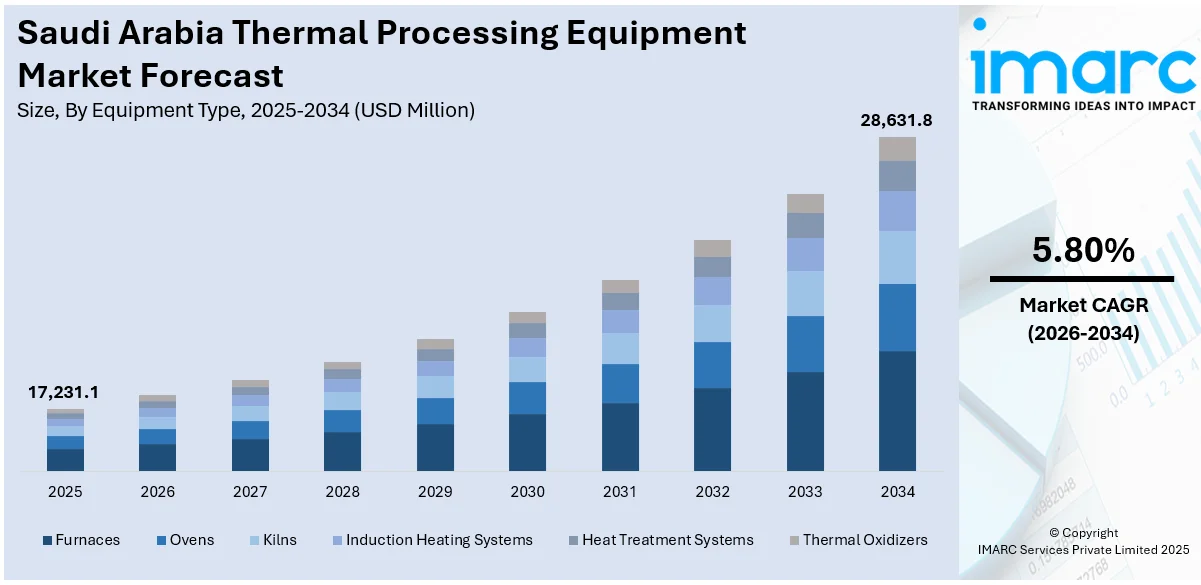

The Saudi Arabia thermal processing equipment market size reached USD 17,231.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 28,631.8 Million by 2034, exhibiting a growth rate (CAGR) of 5.80% during 2026-2034. The market is driven by Vision 2030’s industrial expansion, escalating demand in oil and gas, petrochemicals, and food processing sectors. Energy-efficient solutions are gaining traction due to sustainability goals and cost-saving needs. Additionally, large-scale infrastructure projects and growing manufacturing activities are accelerating equipment adoption. Government incentives and technological advancements are further expanding the Saudi thermal processing equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 17,231.1 Million |

| Market Forecast in 2034 | USD 28,631.8 Million |

| Market Growth Rate 2026-2034 | 5.80% |

Saudi Arabia Thermal Processing Equipment Market Trends:

Increasing Demand for Energy-Efficient Thermal Processing Equipment

The market is witnessing a growing demand for energy-efficient solutions, driven by environmental regulations and cost-saving initiatives. A 2023 industry report shows that Riyadh contributed 28.1% of the country's electricity consumption, with air conditioners running for a weekly average of 51.5 hours, highlighting the rising energy consumption in Saudi homes. This represents great growth potential for the thermal processing equipment sector, especially against the background of the Kingdom's drive towards sustainability and energy efficiency. With the Kingdom’s Vision 2030 emphasizing sustainability, industries such as oil and gas, petrochemicals, and food processing are adopting advanced thermal systems that reduce energy consumption. Manufacturers are introducing innovative technologies, such as waste heat recovery systems and high-efficiency burners, to minimize carbon emissions and operational costs. Additionally, government incentives for green industrial practices are encouraging businesses to upgrade their equipment. The shift toward energy-efficient thermal processing aligns with global trends, as companies seek to enhance productivity while meeting stringent environmental standards. As a result, suppliers focusing on eco-friendly and energy-saving designs are gaining a competitive edge in the Saudi market, further accelerating the adoption of sustainable thermal processing solutions.

To get more information on this market Request Sample

Expansion of Industrial Sectors

The rapid growth of key industrial sectors, including construction, automotive, and food production, is also propelling the Saudi Arabia thermal processing equipment market growth. The government’s push for economic diversification under Vision 2030 has led to increased investments in manufacturing and infrastructure projects, escalating the need for heat treatment, drying, and curing systems. Saudi Arabia's drive for economic diversification under Vision 2030 witnessed non-oil exports account for 38% of all exports in 2024, and revenue from tourism overtaking petrochemical revenue at USD 41 billion. In spite of a USD 6 billion current account deficit due to reduced oil revenue and higher imports, non-oil GDP is now 51% of the total output, reflecting increased private sector activity. For the construction and manufacturing industry of thermal processing equipment, such growth in manufacturing and construction, especially in logistics and machinery, is an indicator of domestic demand and possible exports. Furthermore, the rising demand for processed foods and automotive components is fueling the adoption of advanced thermal technologies. Local and international manufacturers are establishing production facilities in the Kingdom, further driving equipment sales. With ongoing industrial developments and large-scale projects such as NEOM and the Red Sea Initiative, the demand for reliable and high-performance thermal processing equipment is expected to grow steadily, presenting significant opportunities for market players.

Saudi Arabia Thermal Processing Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on equipment type, process type, heating source, automation level, and end use industry.

Equipment Type Insights:

- Furnaces

- Ovens

- Kilns

- Induction Heating Systems

- Heat Treatment Systems

- Thermal Oxidizers

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes furnaces, ovens, kilns, induction heating systems, heat treatment systems, and thermal oxidizers.

Process Type Insights:

- Heat Treatment

- Annealing

- Hardening and Tempering

- Sintering

- Drying and Curing

- Calcination

A detailed breakup and analysis of the market based on the process type have also been provided in the report. This includes heat treatment, annealing, hardening and tempering, sintering, drying and curing, and calcination.

Heating Source Insights:

- Electric Thermal Processing

- Gas-Fired Systems

- Infrared and Microwave Heating

- Induction Heating

The report has provided a detailed breakup and analysis of the market based on the heating source. This includes electric thermal processing, gas-fired systems, infrared and microwave heating, and induction heating.

Automation Level Insights:

- Manual Thermal Processing Equipment

- Semi-Automated Systems

- Fully Automated Systems

A detailed breakup and analysis of the market based on the automation level have also been provided in the report. This includes manual thermal processing equipment, semi-automated systems, and fully automated systems.

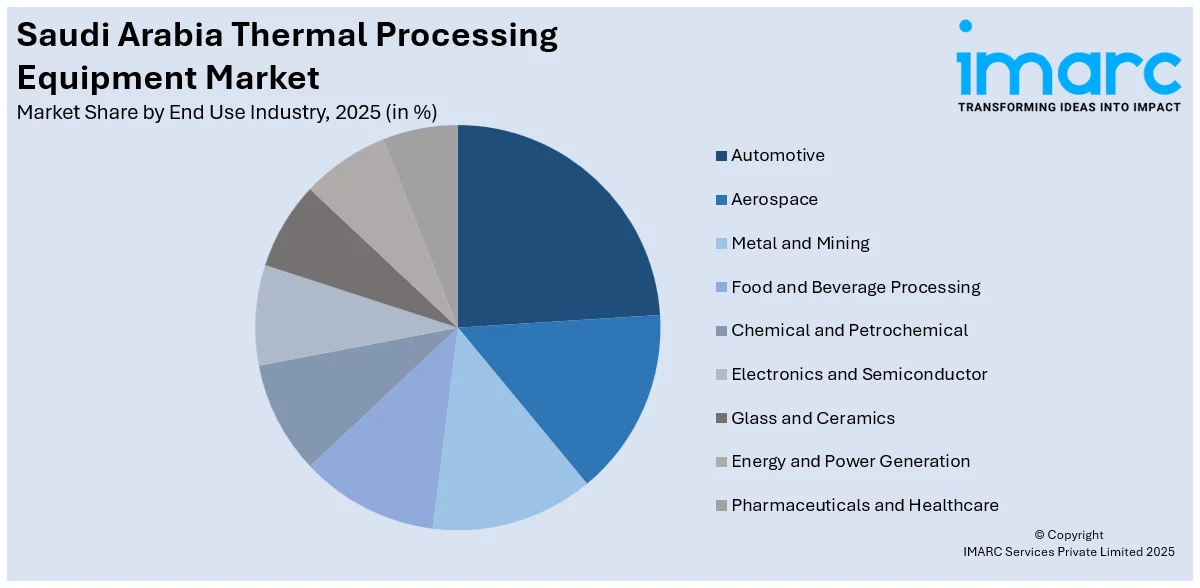

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Aerospace

- Metal and Mining

- Food and Beverage Processing

- Chemical and Petrochemical

- Electronics and Semiconductor

- Glass and Ceramics

- Energy and Power Generation

- Pharmaceuticals and Healthcare

The report has provided a detailed breakup and analysis of the market based on the end use. This includes automotive, aerospace, metal and mining, food and beverage processing, chemical and petrochemical, electronics and semiconductor, glass and ceramics, energy and power generation, and pharmaceuticals and healthcare.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Thermal Processing Equipment Market News:

- December 23, 2024: GlassPoint, together with Saudi Arabia's Ministry of Investment, has started the demonstration phase of its USD 1.5 billion Ma'aden I solar thermal project that seeks to lower carbon emissions during aluminum processing via the implementation of cutting-edge thermal processing technology. This project utilizes cutting-edge niobium mirrors, liquid salt heat transfer loops, and polymer membrane technology for a 30% decrease in the cost of the solar field and a 50% reduction in storage costs. A local manufacturing facility for solar will also be created, contributing to improving Saudi Arabia's supply chain for thermal equipment and abilities within the renewable sectors.

- October 17, 2024: Hithium launched a battery energy storage system (BESS) tailored for desert climate conditions, with superior sandstorm and temperature resilience, to enable long-duration energy storage in the Middle East. As part of its expansion plan, the firm is to build a factory for the production of battery storage with an annual capacity of 5 GWh in Saudi Arabia, in partnership with MANAT, led by former Saudi Aramco engineer Nabilah Al-Tunisi. The project is in line with Vision 2030 and offers new prospects for thermal processing equipment demand necessary for the production of large-scale battery components.

Saudi Arabia Thermal Processing Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Furnaces, Ovens, Kilns, Induction Heating Systems, Heat Treatment Systems, Thermal Oxidizers |

| Process Types Covered | Heat Treatment, Annealing, Hardening and Tempering, Sintering, Drying and Curing, Calcination |

| Heating Sources Covered | Electric Thermal Processing, Gas-Fired Systems, Infrared and Microwave Heating, Induction Heating |

| Automation Levels Covered | Manual Thermal Processing Equipment, Semi-Automated Systems, Fully Automated Systems |

| End Use Industries Covered | Automotive, Aerospace, Metal and Mining, Food and Beverage Processing, Chemical and Petrochemical, Electronics and Semiconductor, Glass and Ceramics, Energy and Power Generation, Pharmaceuticals and Healthcare |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia thermal processing equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia thermal processing equipment market on the basis of equipment type?

- What is the breakup of the Saudi Arabia thermal processing equipment market on the basis of process type?

- What is the breakup of the Saudi Arabia thermal processing equipment market on the basis of heating source?

- What is the breakup of the Saudi Arabia thermal processing equipment market on the basis of automation level?

- What is the breakup of the Saudi Arabia thermal processing equipment market on the basis of end use industry?

- What is the breakup of the Saudi Arabia thermal processing equipment market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia thermal processing equipment market?

- What are the key driving factors and challenges in the Saudi Arabia thermal processing equipment market?

- What is the structure of the Saudi Arabia thermal processing equipment market and who are the key players?

- What is the degree of competition in the Saudi Arabia thermal processing equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia thermal processing equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia thermal processing equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia thermal processing equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)