Saudi Arabia Third-Party Logistics (3PL) Market Report by Service (Domestic Transportation Management, International Transportation Management, Value-added Warehousing and Distribution), End User (Automotive and Manufacturing, Oil and Gas, Chemical, Distributive Trade (Wholesale and Retail Trade, including E-commerce), Pharmaceutical and Healthcare, Construction, and Others), and Region 2026-2034

Market Overview:

Saudi Arabia third-party logistics (3PL) market size reached USD 14.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 24.9 Billion by 2034, exhibiting a growth rate (CAGR) of 6.20% during 2026-2034. The increasing innovations in technology, such as IoT (Internet of Things), blockchain, and advanced analytics, which have enhanced supply chain visibility and efficiency, are primarily driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 14.5 Billion |

| Market Forecast in 2034 | USD 24.9 Billion |

| Market Growth Rate 2026-2034 | 6.20% |

Third-party logistics (3PL) are referred to as outsourcing of supply chain management and logistics operations to specialized service providers. Companies enlist the services of 3PL providers to streamline and optimize their transportation, warehousing, distribution, and inventory management processes. These 3PL companies offer expertise, infrastructure, and technology to efficiently handle the complex aspects of moving goods from manufacturers to consumers. 3PL providers act as intermediaries between manufacturers and retailers, coordinating the movement of products and ensuring timely delivery. They offer benefits such as cost savings, scalability, and access to advanced logistics technologies. Additionally, 3PL providers help businesses focus on their core competencies while entrusting logistics operations to experts, ultimately improving overall efficiency and customer satisfaction. Services offered by 3PL providers can vary widely, from basic transportation and warehousing to more specialized solutions like order fulfillment, cross-docking, and reverse logistics. Overall, 3PL plays a crucial role in enhancing supply chain performance and allowing companies to adapt to the ever-changing demands of the market.

Saudi Arabia Third-Party Logistics (3PL) Market Trends:

High investments in transportation and port infrastructure

Increasing investments in transportation and port infrastructure are positively influencing the Saudi Arabia third-party logistics (3PL) market. In July 2024, Hassan Allam Holding, a prominent engineering and construction organization based in Saudi Arabia, revealed that one of its main subsidiaries, Hassan Allam Roads & Bridges, secured the contract for the roads and paving works at the Port of NEOM in Saudi Arabia's ambitious futuristic city. With the Kingdom developing modern highways, rail networks, and world-class ports, the efficiency of cargo handling, storage, and movement has significantly improved. These infrastructure upgrades reduce transit times and enhance connectivity between industrial hubs, airports, and seaports, making logistics services more reliable and cost-effective. For 3PL providers, this means greater opportunities to expand operations, offer integrated services, and handle higher volumes of goods efficiently. Additionally, state-of-the-art ports and logistics zones attract international trade and foreign investment, catalyzing the demand for 3PL solutions. This infrastructural transformation, aligned with Vision 2030, is positioning Saudi Arabia as a leading logistics hub in the region.

Increasing e-commerce penetration

The growing penetration of e-commerce outlets is offering a favorable market outlook. Online shopping is driving the demand for efficient warehousing, fulfillment, and last-mile delivery services. People increasingly expect fast, reliable, and cost-effective delivery, encouraging retailers to rely on specialized 3PL providers for logistics management. The surge in online sales during seasonal promotions, sales events, and festivals is further catalyzing the demand for scalable logistics solutions. Additionally, the growth of cross-border e-commerce is creating the need for customs clearance, reverse logistics, and integrated supply chain services. For 3PL providers, this represents an opportunity to expand networks, adopt digital platforms, and strengthen delivery fleets to meet e-commerce-oriented demand. As e-commerce continues to reshape user behavior in Saudi Arabia, 3PL players stand at the center of this transformation. As per the report by Agility Logistics, e-commerce revenue in Saudi Arabia is set to grow at 13.5% annually through 2027.

Rising use of IoT

Increasing use of the IoT is bolstering the market growth by enhancing supply chain visibility, efficiency, and security. As per the IMARC Group, the Saudi Arabia IoT market size reached USD 9,490.7 Million in 2024. IoT-enabled devices and sensors allow real-time tracking of shipments, monitoring of storage conditions, and predictive maintenance of logistics assets, ensuring reliable service delivery. For industries, such as pharmaceutical, food, and automotive, IoT supports temperature control, compliance, and safety across distribution networks. By leveraging connected devices, 3PL providers can optimize routes, reduce fuel utilization, and minimize delays, which lowers costs and improves customer satisfaction. Additionally, data generated from IoT systems helps in predictive analytics, allowing providers to anticipate disruptions and streamline inventory management. This technological shift is making logistics operations smarter and more transparent, thereby driving the broader adoption of 3PL solutions in Saudi Arabia.

Key Growth Drivers of Saudi Arabia Third-Party Logistics (3PL) Market:

Strong government support

Strong government support is a pivotal factor fueling the growth of the market. As part of Vision 2030, the Kingdom has prioritized transforming its logistics sector into a global hub, supported by policies that encourage private sector participation and international partnerships. Initiatives, such as the establishment of free economic zones, customs digitization, and tax incentives, are creating a business-friendly environment for logistics providers. The government’s investment in mega projects and industrial zones is also driving the demand for reliable and scalable supply chain solutions. Moreover, state-backed funding for digital technologies in logistics enhances innovation and efficiency. This robust policy framework and continuous support provide 3PL providers with the stability, infrastructure, and regulatory clarity needed to expand services and meet the growing market demands.

Increasing collaborations with global logistics providers

Rising collaborations with global logistics providers are bolstering the market growth in Saudi Arabia. International players are bringing advanced expertise, digital platforms, and best practices that enhance efficiency, scalability, and service quality across the Kingdom’s logistics ecosystem. These partnerships also facilitate technology integration and training for local providers, elevating operational standards. By teaming up with established global firms, Saudi companies are gaining access to international trade networks, enabling smoother cross-border logistics and expanding the market reach. Such alliances are also strengthening customer confidence in service reliability, particularly in industries requiring complex logistics, such as pharmaceuticals, automotive, and e-commerce. As the Kingdom is aspiring to become a regional logistics hub under Vision 2030, these strategic collaborations are instrumental in accelerating the growth and competitiveness of the 3PL market.

Innovations in logistics services

Innovations in logistics services are propelling the market growth, as companies are seeking smarter, faster, and more efficient supply chain solutions. The integration of technologies, such as automation, robotics, artificial intelligence (AI)-based route optimization, and real-time tracking platforms, aids in enhancing operational accuracy and reducing delivery times. Value-added services like predictive analytics, digital freight platforms, and flexible warehousing solutions also provide clients with greater transparency and scalability. For e-commerce, retail, and manufacturing sectors, these innovations directly translate into improved customer satisfaction and cost savings. Additionally, green logistics practices, such as electric delivery fleets and optimized fuel usage, align with sustainability goals under Vision 2030. By adopting cutting-edge solutions, 3PL providers are transforming logistics into a competitive advantage, fueling the market growth across Saudi Arabia.

Saudi Arabia Third-Party Logistics (3PL) Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Saudi Arabia third-party logistics (3PL) market report, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on service and end user.

Service Insights:

To get more information on this market, Request Sample

- Domestic Transportation Management

- International Transportation Management

- Value-added Warehousing and Distribution

The report has provided a detailed breakup and analysis of the market based on the service. This includes domestic transportation management, international transportation management, and value-added warehousing and distribution.

End User Insights:

- Automotive and Manufacturing

- Oil and Gas

- Chemical

- Distributive Trade (Wholesale and Retail Trade, including E-commerce)

- Pharmaceutical and Healthcare

- Construction

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes automotive and manufacturing, oil and gas, chemical, distributive trade (wholesale and retail trade, including e-commerce), pharmaceutical and healthcare, construction, and others.

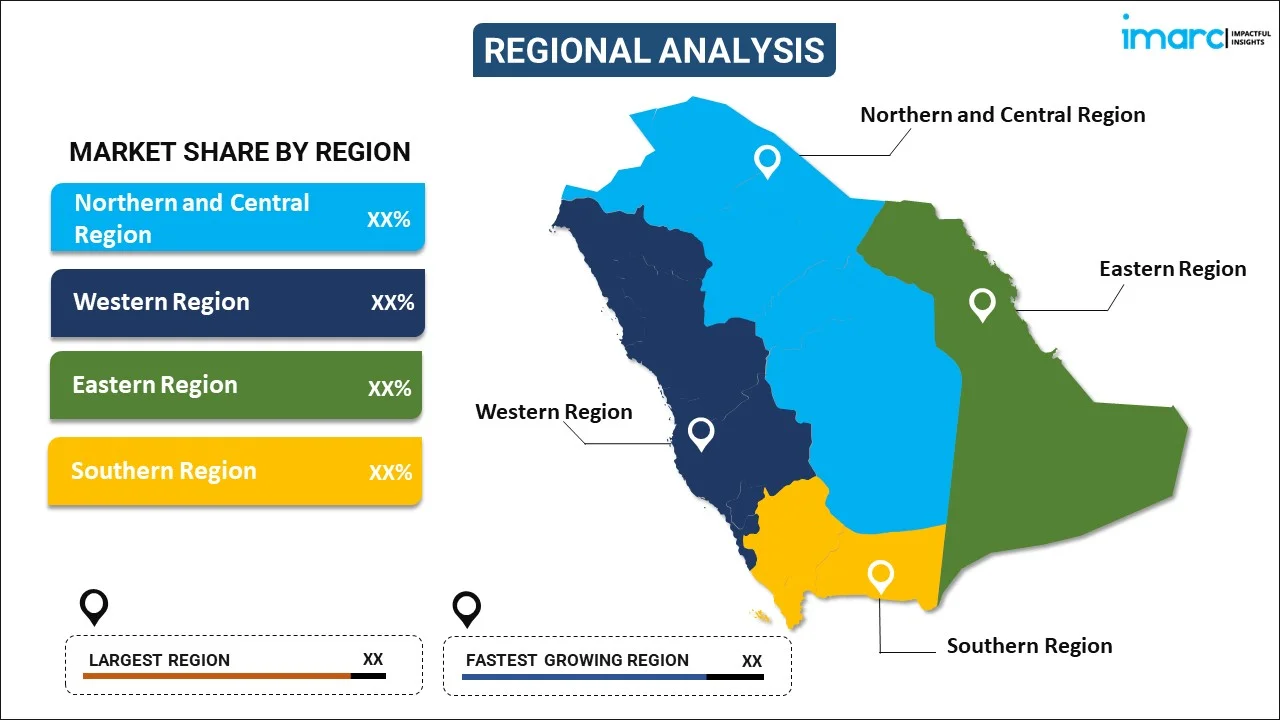

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Third-Party Logistics (3PL) Market News:

- February 2025: Saudi Arabia's National Unified Procurement Co. (NUPCO) obtained three major financing deals worth SR2.5 Billion (USD 666.6 Million) at the PIF Private Sector Forum to enhance supply chain financing for healthcare providers. On the second day of the PIF Forum, the firm entered into an MoU with MODON to improve logistics services, localize content, and bolster pharmaceutical supply chains in the Kingdom. The agreement sought to provide logistics solutions from third-party providers to pharmaceutical manufacturers and companies in industrial areas.

- October 2024: CEVA Logistics, a worldwide leader in 3PL, and Almajdouie Logistics, a prominent end-to-end logistics solutions provider in the Middle East, finalized an agreement to form a joint venture in Saudi Arabia. The newly formed joint venture, ‘CEVA Almajdouie Logistics’ would utilize the strengths of both firms to address the increasing demand for integrated logistics solutions in Saudi Arabia, supporting the Kingdom’s expanding logistics sector and overall economy.

Saudi Arabia Third-Party Logistics (3PL) Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Services Covered | Domestic Transportation Management, International Transportation Management, Value-added Warehousing and Distribution |

| End Users Covered | Automotive and Manufacturing, Oil and Gas, Chemical, Distributive Trade (Wholesale and Retail Trade, including E-commerce), Pharmaceutical and Healthcare, Construction, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia third-party logistics (3PL) market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia third-party logistics (3PL) market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia third-party logistics (3PL) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The third-party logistics (3PL) market in Saudi Arabia was valued at USD 14.5 Billion in 2025.

The market is expanding due to the government’s efforts to transform the Kingdom into a regional logistics hub under Vision 2030. The growing e-commerce penetration, coupled with rising demand for cost-effective supply chain management, has amplified the role of 3PL providers. The increasing outsourcing of warehousing, distribution, and last-mile delivery by retailers and manufacturers is further accelerating the market growth, supported by digitalization and advanced logistics technologies.

The Saudi Arabia third-party logistics (3PL) market is projected to exhibit a CAGR of 6.20% during 2026-2034, reaching a value of USD 24.9 Billion by 2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)