Saudi Arabia Tooling Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2025-2033

Saudi Arabia Tooling Market Overview:

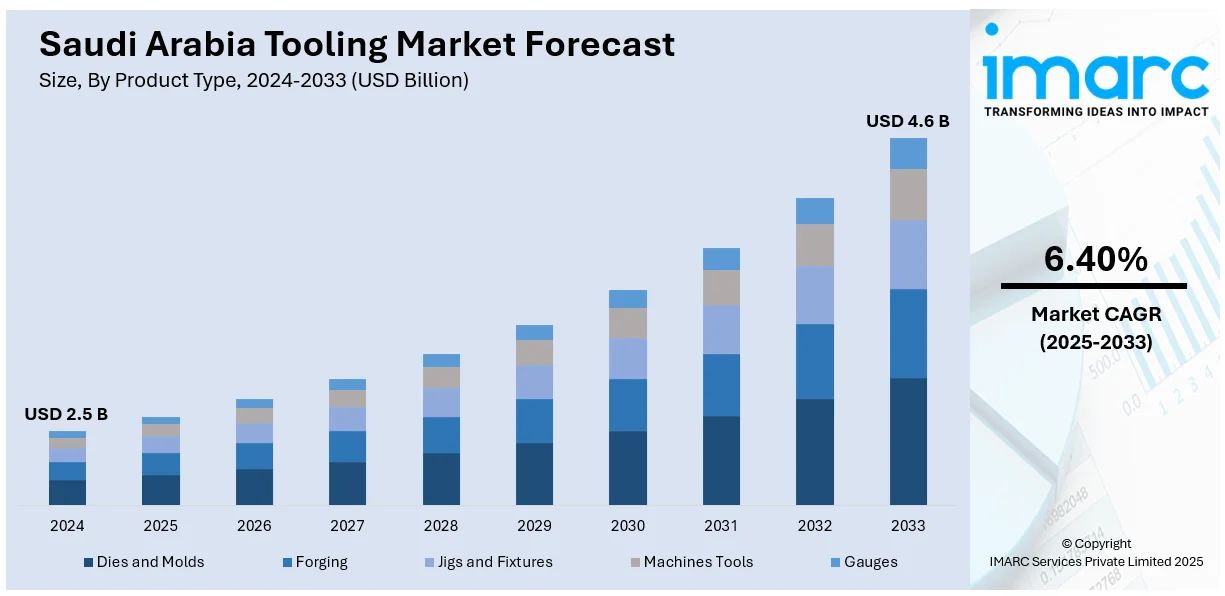

The Saudi Arabia tooling market size reached USD 2.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.6 Billion by 2033, exhibiting a growth rate (CAGR) of 6.40% during 2025-2033. The market is expanding due to the rise in industrial automation, increased investment in manufacturing infrastructure, and ongoing diversification under Vision 2030. Demand for precision tools is also increasing across aerospace, automotive, and energy sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.6 Billion |

| Market Growth Rate 2025-2033 | 6.40% |

Saudi Arabia Tooling Market Trends:

Growing Focus on Local Manufacturing

The tooling market in Saudi Arabia is witnessing consistent growth, driven by the government’s strategic push to boost domestic manufacturing. As part of Vision 2030, there is a national effort to reduce dependence on imports and expand local production capabilities. This shift is raising the need for advanced tooling systems across various sectors. The automotive, aerospace, and industrial components sectors are investing in efficient, high-precision tools to improve output and meet international standards. Moreover, manufacturers are leaning towards automation, which requires accurate and durable tooling setups. Machine tools, dies, jigs, and fixtures are seeing increasing demand due to rising local production targets. In recent months, there has been a noticeable expansion in facilities producing automotive parts, which has directly increased procurement of tool and die systems. Additionally, partnerships between Saudi firms and international tooling companies are emerging, aimed at technology transfer and local capacity building. Tooling service providers are also upgrading their offerings with digital solutions to support local industries aiming for global competitiveness. As the country strengthens its non-oil sectors, tooling requirements are becoming more sophisticated and integrated into broader industrial strategies.

Rise in Oil and Gas Investments

Saudi Arabia’s continued investment in its oil and gas sector is supporting tooling demand for heavy-duty equipment and maintenance operations. Despite the move toward diversification, the energy industry remains a cornerstone of the economy, and high-specification tooling solutions are essential for both upstream and downstream activities. Projects related to drilling, pipeline construction, and refining depend heavily on specialized tools that can withstand harsh conditions and deliver accurate results over extended usage cycles. The tooling industry is adapting by offering more durable, corrosion-resistant, and maintenance-efficient options tailored for oilfield use. In the past year, large-scale projects such as refinery upgrades and offshore platform expansions have led to increased orders for machining tools and custom dies. International vendors are collaborating with local firms to supply application-specific tooling systems, enhancing supply reliability. These developments are also creating demand for skilled labor capable of handling precision tools in challenging environments. As energy infrastructure projects expand, particularly those involving petrochemicals and LNG terminals, the requirement for high-performance tooling continues to grow steadily, reinforcing its critical role in industrial progress across the Kingdom.

Saudi Arabia Tooling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Dies and Molds

- Forging

- Jigs and Fixtures

- Machines Tools

- Gauges

The report has provided a detailed breakup and analysis of the market based on the product type. This includes dies and molds, forging, jigs and fixtures, machines tools, and gauges.

Material Type Insights:

- Stainless Steel

- Iron

- Aluminum

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes stainless steel, iron, aluminum, and others.

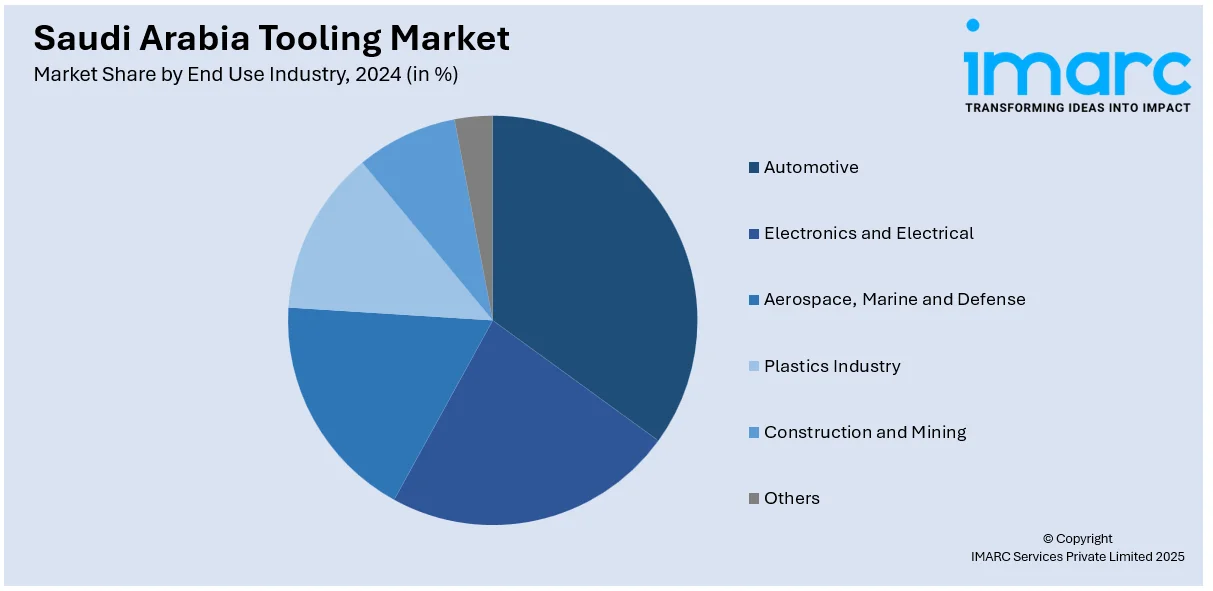

End Use Industry Insights:

- Automotive

- Electronics and Electrical

- Aerospace, Marine and Defense

- Plastics Industry

- Construction and Mining

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive, electronics and electrical, aerospace, marine and defense, plastics industry, construction and mining, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central region, Western region, Eastern region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Tooling Market News:

- January 2025, Welspun partnered with Saudi Aramco to build an LSAW line pipe facility in Dammam with 350,000 MT annual capacity. The project boosted demand for advanced tooling systems, supporting precision manufacturing for oil, gas, hydrogen, and CCUS pipelines, enhancing local industrial capabilities.

- November 2024, Rival Downhole Tools partnered with GOtech in Saudi Arabia to expand access to its advanced drilling tools, including STORM, AXE, and TORX motors. This strengthened local tooling capabilities, supported energy sector demand, and enhanced service delivery across Saudi Arabia’s drilling operations.

Saudi Arabia Tooling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Dies and Molds, Forging, Jigs and Fixtures, Machines Tools, Gauges |

| Material Types Covered | Stainless Steel, Iron, Aluminum, Others |

| End Use Industries Covered | Automotive, Electronics and Electrical, Aerospace, Marine and Defense, Plastics Industry, Construction and Mining, Others |

| Distribution Channels Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia tooling market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia tooling market on the basis of the product type?

- What is the breakup of the Saudi Arabia tooling market on the basis of material type?

- What is the breakup of the Saudi Arabia tooling market on the basis of end use industry?

- What are the various stages in the value chain of the Saudi Arabia tooling market?

- What are the key driving factors and challenges in the Saudi Arabia tooling?

- What is the structure of the Saudi Arabia tooling market and who are the key players?

- What is the degree of competition in the Saudi Arabia tooling market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia tooling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia tooling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia tooling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)