Saudi Arabia Trade Finance Market Report by Finance Type (Structured Trade Finance, Supply Chain Finance, Traditional Trade Finance), Offering (Letters of Credit, Bill of Lading, Export Factoring, Insurance, and Others), Service Provider (Banks, Trade Finance Houses), End User (Small and Medium-sized Enterprises, Large Enterprises), and Region 2025-2033

Market Overview:

Saudi Arabia trade finance market size reached USD 514.0 Million in 2024. The market is projected to reach USD 693.7 Million by 2033, exhibiting a growth rate (CAGR) of 3.14% during 2025-2033. The growing demand for risk mitigation tools in an organization, increasing focus on sustainable and responsible trade practices in companies, and rising number of international trade activities represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 514.0 Million |

| Market Forecast in 2033 | USD 693.7 Million |

| Market Growth Rate (2025-2033) | 3.14% |

Trade finance encompasses a range of financial instruments and products, such as letters of credit, trade credit insurance, export and import financing, and documentary collections, designed to mitigate the inherent risks in international trade transactions. It is a vital component of international commerce, facilitating the exchange of goods and services across borders. It can help companies gain access to suppliers and individuals in distant markets, allowing them to source materials and sell products on a larger scale. It can be tailored as per the specific needs of individuals and companies. It serves to secure payment for exporters while providing importers with assurance regarding the quality and timely delivery of goods. It facilitates entry into new markets by providing financial tools to navigate different currencies and regulatory environments. It offers the necessary capital and guarantees to ensure the smooth flow of goods between buyers and sellers, particularly in cases involving different currencies, long distances, and varying legal and regulatory frameworks. It reduces the financial exposure of both buyers and sellers in international trade transactions. It enhances the processing of international transactions by automating document handling and payment processes. As it is beneficial in reducing dependence on any single market or partner, the demand for trade finance is rising in Saudi Arabia.

Saudi Arabia Trade Finance Market Trends:

Thriving non-oil sectors

The expansion of non-oil sectors is fueling the market growth in Saudi Arabia. According to the General Authority for Statistics, in April 2025, Saudi Arabia’s non-oil exports experienced a 24.6% yearly increase, totaling SR28.36 Billion (USD 7.56 Billion). As the country is moving towards economic diversification under Vision 2030, more businesses are engaging in cross-border trade, requiring instruments like letters of credit, export financing, and supply chain finance to manage transactions and reduce risk. New industries are generating greater import and export activity, creating opportunities for banks and financial institutions to offer tailored trade finance solutions. Small and medium-sized enterprises (SMEs) entering worldwide markets are creating the need for accessible and flexible financial tools. Government initiatives supporting non-oil sectors are further encouraging trade, while infrastructure investments assist in improving connectivity.

Improved trade infrastructure and logistics networks

Improved trade infrastructure and logistics networks are positively influencing the market in Saudi Arabia. The development of ports, transport corridors, and logistics hubs reduces transit times and operational costs, making trade more attractive for businesses. These advancements increase the volume of goods moving across borders, catalyzing the demand for trade finance instruments. Businesses are gaining more confidence in international transactions due to streamlined customs procedures and better cargo handling. Banks and financial institutions are responding by expanding their trade finance offerings to support the growing flow of goods. The broadening of e-commerce portals is creating new channels for cross-border trade. According to the IMARC Group, the Saudi Arabia e-commerce market size reached USD 222.9 Billion in 2024.

Increasing use of artificial intelligence (AI)

Rising AI adoption aids in improving the speed, accuracy, and security of financial transactions. AI-oriented systems automate document verification, risk assessment, and fraud detection, reducing manual errors and processing times. This enables banks and financial institutions to handle trade finance operations more efficiently and at a larger scale. Smart algorithms analyze transaction histories and credit profiles to offer better financing decisions and customized solutions. AI also enhances compliance by quickly scanning documents for regulatory issues and flagging potential red flags. These innovations build greater trust in the trade finance process, attracting more businesses to use these services. AI tools also support real-time tracking and management of trade flows, increasing transparency across supply chains. As digital transformation is accelerating in Saudi Arabia, AI is becoming a critical enabler of smarter, faster, and more secure trade finance systems that meet evolving business needs. As per industry reports, the AI market in the Kingdom of Saudi Arabia is set to attain USD 61,854.4 Million by 2033, with a CAGR of 46.6%.

Saudi Arabia Trade Finance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on finance type, offering, service provider, and end user.

Finance Type Insights:

- Structured Trade Finance

- Supply Chain Finance

- Traditional Trade Finance

The report has provided a detailed breakup and analysis of the market based on the finance type. This includes structured trade finance, supply chain finance, and traditional trade finance.

Offering Insights:

- Letters of Credit

- Bill of Lading

- Export Factoring

- Insurance

- Others

A detailed breakup and analysis of the market based on the offering have also been provided in the report. This includes letters of credit, bill of lading, export factoring, insurance, and others.

Service Provider Insights:

- Banks

- Trade Finance Houses

The report has provided a detailed breakup and analysis of the market based on the service provider. This includes banks and trade finance houses.

End User Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes small and medium-sized enterprises and large enterprises.

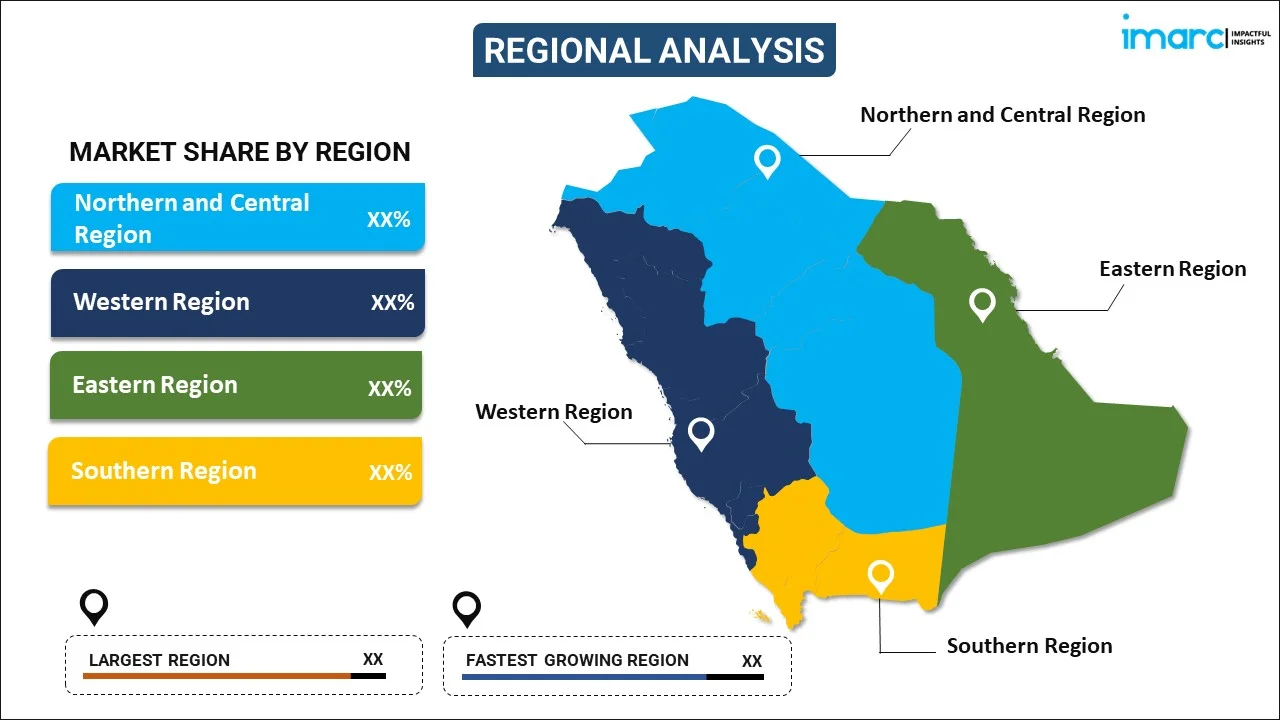

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Trade Finance Market News:

- May 2025: GTR KSA was set to return to Riyadh on May 13, 2025. With over 400 industry leaders taking part in 2024, the upcoming edition promised another highly anticipated chance to interact with essential stakeholders and connect with various companies within the Saudi trade and export finance sector. The exhibition space offered a unique venue for networking and building relationships with industry leaders, colleagues, and prospective clients in the Saudi Arabian trade and export field.

- March 2025: The Board of Directors of the International Islamic Trade Finance Corporation (ITFC), which served as the international trade finance branch of the Islamic Development Bank (IsDB) Group, announced the selection of Eng. Adeeb Y Al Aama as the new CEO. His extensive background would be crucial in advancing ITFC’s goal to promote trade and economic development in its member nations, including Saudi Arabia. He served as Saudi Arabia’s OPEC Governor and Deputy Minister for Kingdom Affairs in OPEC and Global Oil Markets, where he significantly influenced energy policies and enhanced economic collaboration.

- February 2025: Oman and Saudi Arabia established three agreements regarding trade, legal services, and manufacturing to enhance economic cooperation and collaboration in the private sector. The event included working papers from both nations, with Oman presenting strategic initiatives and investment prospects, while Saudi Arabia detailed its investment framework and sectors contributing to economic diversification. Key focus areas included oil and gas, finance, insurance, and food security.

- January 2025: First Abu Dhabi Bank (FAB), the prominent financial leader, enhanced its trade product line by launching the Supply Chain Finance (SCF) program in KSA, broadening its presence in the region. According to Anirudha Panse, Head of GTB Trade Finance Product Innovation at FAB, the firm aimed to provide enhanced solutions to all the regional clients. With the assimilation of the automated SCF solution, clients would enjoy a smooth and cohesive experience.

- November 2024: The 12th Annual Saudi Trade Finance (STF) Summit was held in Riyadh on November 6-7, 2024. It gathered the Kingdom’s top experts and industry leaders in trade finance, treasury, and economic development for two days of engaging discussions, networking, and collaboration. Featuring a varied group of speakers, attendees, and exhibitors, the summit tackled urgent topics in trade finance, technology integration, and the changing financial landscape.

- October 2024: The Saudi Export-Import Bank entered into a USD 25 Million credit deal with South Africa's Standard Bank Group Ltd., the trade finance institution, to promote trade between the kingdom and the continent's largest economy. The two nations decided to merge their lists of trade and investment prospects in the coming weeks and would develop an action plan to be implemented over the next two years.

Saudi Arabia Trade Finance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Finance Types Covered | Structured Trade Finance, Supply Chain Finance, Traditional Trade Finance |

| Offerings Covered | Letters of Credit, Bill of Lading, Export Factoring, Insurance, Others |

| Service Providers Covered | Banks, Trade Finance Houses |

| End Users Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia trade finance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia trade finance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia trade finance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Trade finance refers to the financial instruments and services used to support international and domestic trade transactions. It helps importers and exporters manage the risks, costs, and logistics involved in buying and selling goods across borders. Common tools inculcate export credit, invoice financing, and guarantees. Trade finance ensures that suppliers get paid promptly and buyers receive their goods as agreed, improving cash flow and trust between parties.

The trade finance market in Saudi Arabia was valued at USD 514.0 Million in 2024.

The Saudi Arabia trade finance market is projected to exhibit a CAGR of 3.14% during 2025-2033, reaching a value of USD 693.7 Million by 2033.

The growing participation of SMEs in international trade activities is creating the need for accessible and flexible financial instruments. Additionally, advancements in digital banking and financial technologies are enhancing the speed, transparency, and efficiency of trade transactions. Supportive government policies and investments in trade infrastructure are also encouraging financial institutions to strengthen trade finance services.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)