Saudi Arabia Vegan Food Market Size, Share, Trends and Forecast by Product, Source, Distribution Channel, and Region, 2026-2034

Saudi Arabia Vegan Food Market Overview:

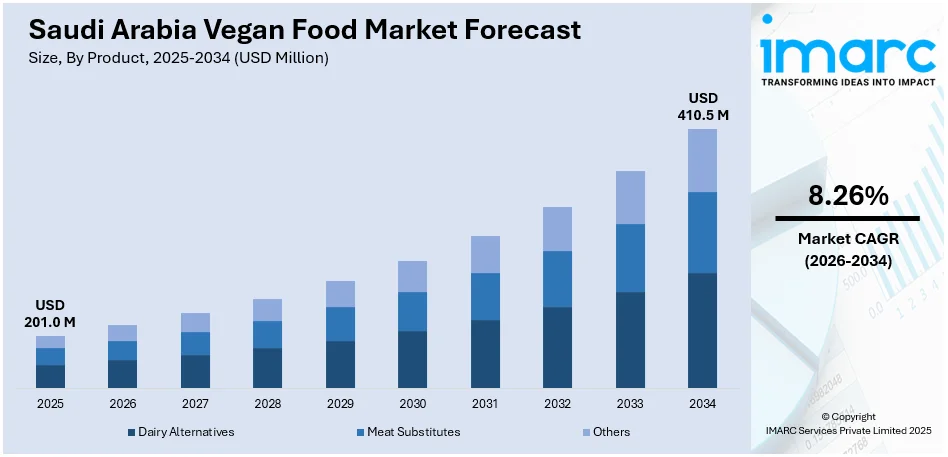

The Saudi Arabia vegan food market size reached USD 201.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 410.5 Million by 2034, exhibiting a growth rate (CAGR) of 8.26% during 2026-2034. The market is being driven by increasing health consciousness, rising lactose intolerance rates, growing awareness about the importance of environmental sustainability, expanding urbanization levels, a youthful population embracing global food trends, and supportive government initiatives promoting healthy lifestyles.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 201.0 Million |

| Market Forecast in 2034 | USD 410.5 Million |

| Market Growth Rate 2026-2034 | 8.26% |

Saudi Arabia Vegan Food Market Trends:

Rising Health Consciousness and Flexitarianism

A major factor propelling the growth of the vegan food market in Saudi Arabia is the rising health consciousness among consumers. An increasing number of individuals are turning to plant-based diets to reduce the health risks linked to excessive consumption of animal products, such as obesity and cardiovascular diseases. Plant-based diets are widely recognized for their benefits, including lower cholesterol levels and improved digestion. About 74% of consumers in the GCC region, including Saudi Arabia, cite escalating health concerns as the prime reason for cutting back on meat consumption. Supporting this shift, around 75% of Saudi consumers believe that plant-based foods contribute to overall health improvement. Reflecting this growing inclination towards healthier food choices, the plant-based food market in Saudi Arabia is projected to reach USD 0.29 billion by 2033, exhibiting a growth rate (CAGR) of 11.28% during 2025-2033. This trend is further fueled by the increasing availability of plant-based products in supermarkets and restaurants, enhancing consumer access and convenience. Another related driver is the advent of flexitarianism, which is a dietary approach that focuses on eating mostly plant-based foods while allowing for occasional consumption of animal products like meat. This makes it easier for consumers to transition to vegan lifestyles.

To get more information on this market Request Sample

Government Initiatives and Environmental Sustainability

The Saudi government is increasingly championing plant-based diets as part of its broader agenda to promote sustainability and ensure long-term food security. Through initiatives like the Saudi Green Initiative, the nation is working to enhance sustainable agriculture, align with global food trends, and support healthier dietary habits. A notable step in this direction came in 2023 when the Ministry of Environment, Water, and Agriculture signed agreements with companies such as Ayla’s Choice to produce high-quality, locally made vegan and vegetarian alternatives. These efforts are complemented by the development of large-scale sustainable farms, including the 3.2 million square meter farm in Asir’s Wadi bin Hashba, which has been recognized by Guinness World Records for its scale and innovation as the largest sustainable farm in the world. These government-backed initiatives not only address pressing environmental challenges but also aim to diversify food sources and encourage healthier eating habits among Saudi citizens, reflecting a strong national commitment to a more sustainable and health-conscious future.

Saudi Arabia Vegan Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product, source, and distribution channel.

Product Insights:

- Dairy Alternatives

- Cheese

- Desserts

- Snacks

- Others

- Meat Substitutes

- Tofu

- Texturized Vegetable Protein (TVP)

- Seiten

- Quorn

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes dairy alternatives (cheese, desserts, snacks, and others), meat substitutes (tofu, texturized vegetable protein (TVP), seiten, Quorn, and others), and others.

Source Insights:

- Almond

- Soy

- Oats

- Wheat

- Others

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes almond, soy, oats, wheat, and others.

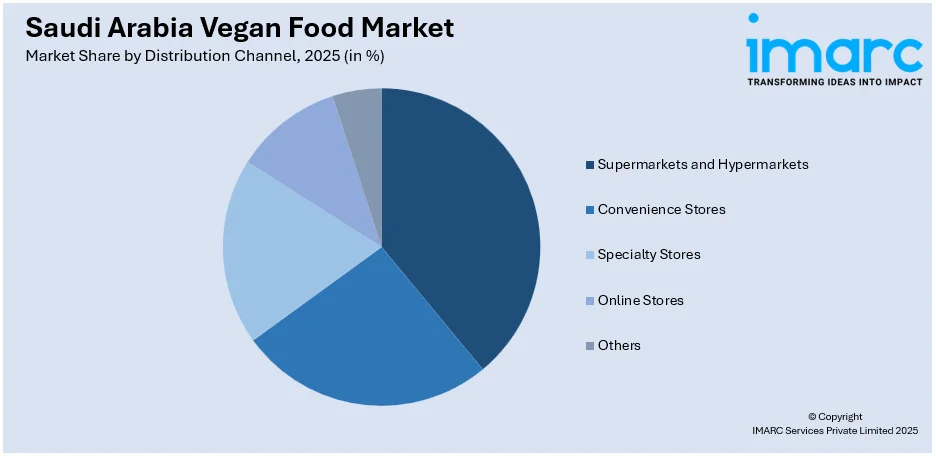

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Vegan Food Market News:

- February 2025: Ola Kayal launched Nabati Eatery in Jeddah, offering a vegan food experience that was plant-based, gluten-free, and organic. The restaurant features creative dishes and focus on sustainability with locally sourced ingredients and eco-friendly practices.

- November 2024: The Ministry of Environment, Water, and Agriculture in Saudi Arabia launched Organic Food Day 2024, aiming to promote the benefits of organic products for healthier diets. The campaign focuses on raising awareness about organic food, including plant-based and vegan options, to encourage innovation and improve product quality.

- August 2023: French vegan fast-food chain Furahaa entered the Saudi market via the HungerStation app, marking its first Middle East expansion. Offering a fully plant-based menu - including vegan burgers, chick’n nuggets, and dairy-free cheese - the brand caters to the Kingdom’s growing demand for sustainable, ethical dining options.

Saudi Arabia Vegan Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report` |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Sources Covered | Almond, Soy, Oats, Wheat, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia vegan food market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia vegan food market on the basis of product?

- What is the breakup of the Saudi Arabia vegan food market on the basis of source?

- What is the breakup of the Saudi Arabia vegan food market on the basis of distribution channel?

- What are the various stages in the value chain of the Saudi Arabia vegan food market?

- What are the key driving factors and challenges in the Saudi Arabia vegan food market?

- What is the structure of the Saudi Arabia vegan food market and who are the key players?

- What is the degree of competition in the Saudi Arabia vegan food market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia vegan food market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia vegan food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia vegan food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)